ETF Sales Pressure: Taiwan Regulator Launches Investigation Into Employee Practices

Table of Contents

The FSC Investigation: Scope and Concerns

The FSC's investigation into ETF sales pressure is a comprehensive undertaking aimed at uncovering and addressing potentially unethical sales practices employed by brokerage firms and ETF providers. The trigger for the investigation remains undisclosed, but it's likely spurred by a confluence of complaints, market observations, and a growing awareness of aggressive sales tactics impacting the Taiwanese ETF market. The objectives include identifying instances of misconduct, determining the extent of the problem, and ultimately, preventing future occurrences.

- Specific allegations: Reports suggest allegations include misrepresentation of ETF products, the omission of crucial risk information, and the use of high-pressure tactics to coerce investors into unsuitable investments. Specific brokerage firms and ETF providers implicated have yet to be publicly named.

- Unethical sales practices: The investigation focuses on a range of unethical sales practices, including misselling of ETFs (selling unsuitable products to investors), aggressive and high-pressure sales tactics (coercing clients into purchases against their better judgment), and the undisclosed charging of excessive fees.

- Potential penalties: Firms found in violation could face severe penalties, ranging from hefty fines and suspension of licenses to criminal prosecution, depending on the severity of the misconduct. The FSC is clearly demonstrating its commitment to strong regulatory enforcement in this area.

- Investor protection: The FSC has underscored its dedication to protecting investors from harm caused by unethical sales practices. This investigation demonstrates a proactive approach to safeguarding the interests of retail investors and maintaining the integrity of the Taiwanese ETF market.

The Impact of ETF Sales Pressure on Employees

The pressure to meet ambitious sales targets significantly impacts employees within the Taiwanese ETF sales sector. This pressure manifests in several ways, creating a challenging and ethically fraught working environment.

- Aggressive sales targets and quotas: Employees often face unrealistic and consistently increasing sales quotas, forcing them to prioritize volume over client suitability.

- Consequences of underperformance: Failure to meet targets can result in serious repercussions, including demotion, reduced compensation, or even termination of employment. This creates a climate of fear and compromises ethical decision-making.

- Impact on employee morale and well-being: The relentless pressure contributes to high stress levels, burnout, and diminished job satisfaction among employees. This can lead to high employee turnover within the sector.

- Ethical dilemmas: Employees regularly face difficult ethical dilemmas, often forced to choose between meeting their sales targets and acting in the best interests of their clients.

Implications for the Taiwanese ETF Market

The FSC's investigation into ETF sales pressure has significant implications for the Taiwanese ETF market as a whole. The consequences are likely to be multifaceted and long-lasting.

- Short-term market volatility: The investigation has already created uncertainty in the market, leading to potential short-term volatility in ETF trading volumes and prices.

- Increased regulatory scrutiny: The investigation signals a new era of intensified regulatory scrutiny of the ETF industry in Taiwan, leading to more rigorous oversight and enforcement.

- Potential changes to sales practices and regulations: The investigation's outcome is expected to drive significant changes to sales practices, potentially involving mandatory training programs, stricter compliance guidelines, and improved monitoring systems. New regulations are also anticipated.

- Impact on investor confidence: The revelations emerging from the investigation could significantly impact investor confidence in the Taiwanese ETF market, potentially leading to reduced participation and investment.

Investor Protection and Future Regulatory Measures

Strengthening investor protection requires a multi-pronged approach encompassing several key initiatives:

- Strengthening investor education: More comprehensive and accessible investor education initiatives can empower investors to make informed decisions and recognize manipulative sales tactics.

- Implementing stricter sales regulations: Implementing stricter regulations on sales practices, including clearer guidelines on product suitability and disclosure requirements, is critical.

- Improving transparency and disclosure: Enhancing transparency and disclosure requirements related to fees, risks, and investment strategies will help investors assess the suitability of ETF products.

- Establishing clearer complaint channels: Establishing clear and easily accessible channels for investors to lodge complaints and report unethical sales practices is paramount.

Conclusion

The FSC's investigation into ETF sales pressure in Taiwan underscores a critical need for comprehensive reform within the ETF industry. Addressing aggressive sales tactics and safeguarding investors from unethical practices are paramount to maintaining the integrity and stability of the market. The investigation's outcome will significantly shape the future regulatory landscape and investor confidence. Staying informed about further developments regarding ETF sales pressure and the resulting regulatory changes is essential for both investors and industry professionals. Understanding the implications of this investigation is key to navigating the evolving landscape of Taiwanese ETFs. Monitor the FSC's findings and subsequent actions closely to ensure a fair and transparent ETF market.

Featured Posts

-

Find Andor Season 1 Episodes 1 3 Streaming Options On Hulu And You Tube

May 16, 2025

Find Andor Season 1 Episodes 1 3 Streaming Options On Hulu And You Tube

May 16, 2025 -

Colorado Rapids Outplay Earthquakes Steffen Unable To Prevent Defeat

May 16, 2025

Colorado Rapids Outplay Earthquakes Steffen Unable To Prevent Defeat

May 16, 2025 -

Tam Krwz Awr Mdah Ka Jwtwn Ka Waqeh Tfsyly Rpwrt Awr Wayrl Wydyw

May 16, 2025

Tam Krwz Awr Mdah Ka Jwtwn Ka Waqeh Tfsyly Rpwrt Awr Wayrl Wydyw

May 16, 2025 -

Gsw Campus Incident Individual Apprehended All Clear Signal Given

May 16, 2025

Gsw Campus Incident Individual Apprehended All Clear Signal Given

May 16, 2025 -

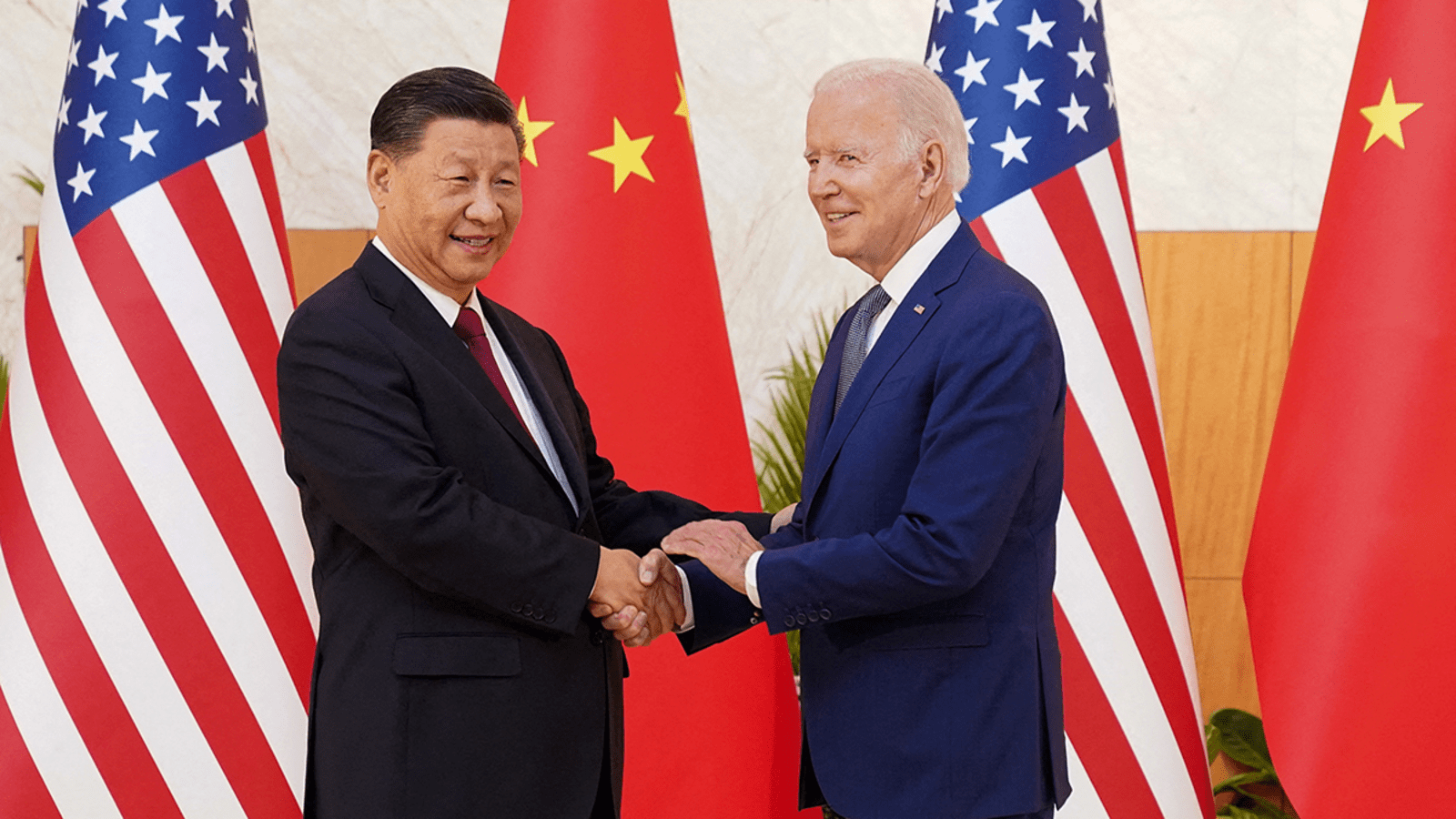

Analysis The Turning Point In Us China Trade Relations

May 16, 2025

Analysis The Turning Point In Us China Trade Relations

May 16, 2025