Ethereum Activity Surge: Address Interactions Up Nearly 10% In 48 Hours

Table of Contents

Increased Transaction Volume and Network Congestion

The most immediate indicator of this Ethereum activity surge is the sharp rise in daily transactions. Analyzing the data reveals a considerable increase compared to both recent averages and previous peak periods. This heightened transaction volume has led to noticeable network congestion, resulting in increased transaction processing times and potential delays for users.

Analyzing the rise in daily transactions:

- Comparison to Previous Peaks: While precise figures fluctuate depending on the data source, many analytics platforms show a substantial jump – potentially exceeding previous peaks seen earlier this year. This signifies a notable increase in user engagement and overall network utilization.

- Transaction Volume and Gas Fees: The correlation between transaction volume and gas fees is directly proportional. Higher transaction volume invariably leads to increased competition for block space, driving up gas fees. Users are paying more to have their transactions processed quickly, reflecting the increased demand on the network.

- Impact on User Experience: Network congestion directly impacts the user experience. Increased transaction times and higher gas fees can discourage participation, especially for users with smaller transaction values. This highlights the crucial need for scalability solutions within the Ethereum ecosystem.

Impact of DeFi Activity on Ethereum Network

Decentralized Finance (DeFi) applications play a significant role in the overall Ethereum activity. The recent surge is strongly linked to increased activity within various DeFi protocols.

DeFi protocols and their contribution:

- Growth of Specific DeFi Protocols: Several prominent DeFi platforms, including lending protocols like Aave and Compound, and decentralized exchanges (DEXs) like Uniswap, have reported heightened user activity and trading volumes in the past 48 hours.

- Dominant DeFi Transaction Types: The increase in Ethereum activity is driven by a variety of DeFi transactions, encompassing lending, borrowing, yield farming, and swapping of tokens. This broad-based participation points to a thriving and expanding DeFi ecosystem.

- New DeFi Projects: The launch of new and innovative DeFi projects can also contribute significantly to increased network activity. The introduction of novel functionalities or improved user interfaces can attract a larger user base, contributing to the overall surge.

NFT Market Dynamics and their Influence

The Non-Fungible Token (NFT) market is another significant factor influencing the recent Ethereum activity surge. The heightened trading volume and significant NFT events correlate strongly with the increased network congestion.

Exploring the NFT market’s impact:

- Significant NFT Drops and Auctions: Several major NFT drops and auctions took place in the past 48 hours, drawing considerable attention and contributing to the increased transaction volume on the Ethereum network. These events often attract a large number of users, leading to a spike in activity.

- Correlation between NFT Trading Volume and Ethereum Activity: A strong correlation exists between NFT trading volume and overall Ethereum network activity. High NFT trading volumes directly translate into a higher number of transactions on the Ethereum blockchain.

- Types of NFTs Contributing: The increased activity isn't limited to a single NFT category. Both Profile Picture (PFP) projects, gaming NFTs, and metaverse assets are contributing to the rise in transaction volume on the network.

Potential Implications and Future Outlook

The recent surge in Ethereum activity has significant implications for the future of the network. While demonstrating its continued relevance and growth potential, it also highlights challenges related to scalability and potential limitations.

Long-term effects on Ethereum's growth:

- Scalability Concerns: The surge underscores the ongoing need for scalability solutions. As Ethereum network activity continues to grow, addressing scalability issues will be crucial to maintain efficient transaction processing and user experience.

- Potential for Increased Gas Fees: The increased demand for block space may lead to sustained higher gas fees, potentially impacting the accessibility and affordability of using the Ethereum network for smaller transactions.

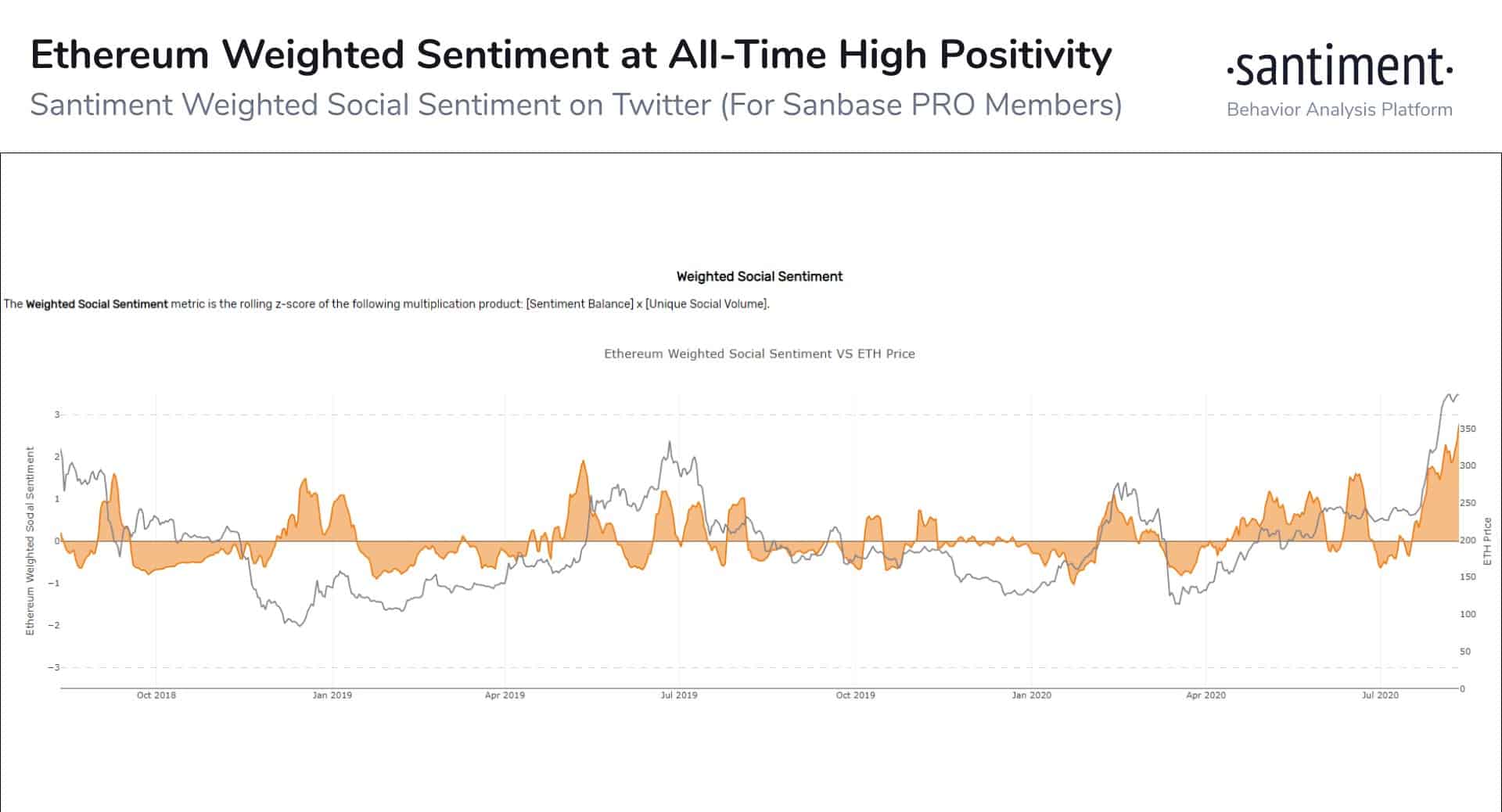

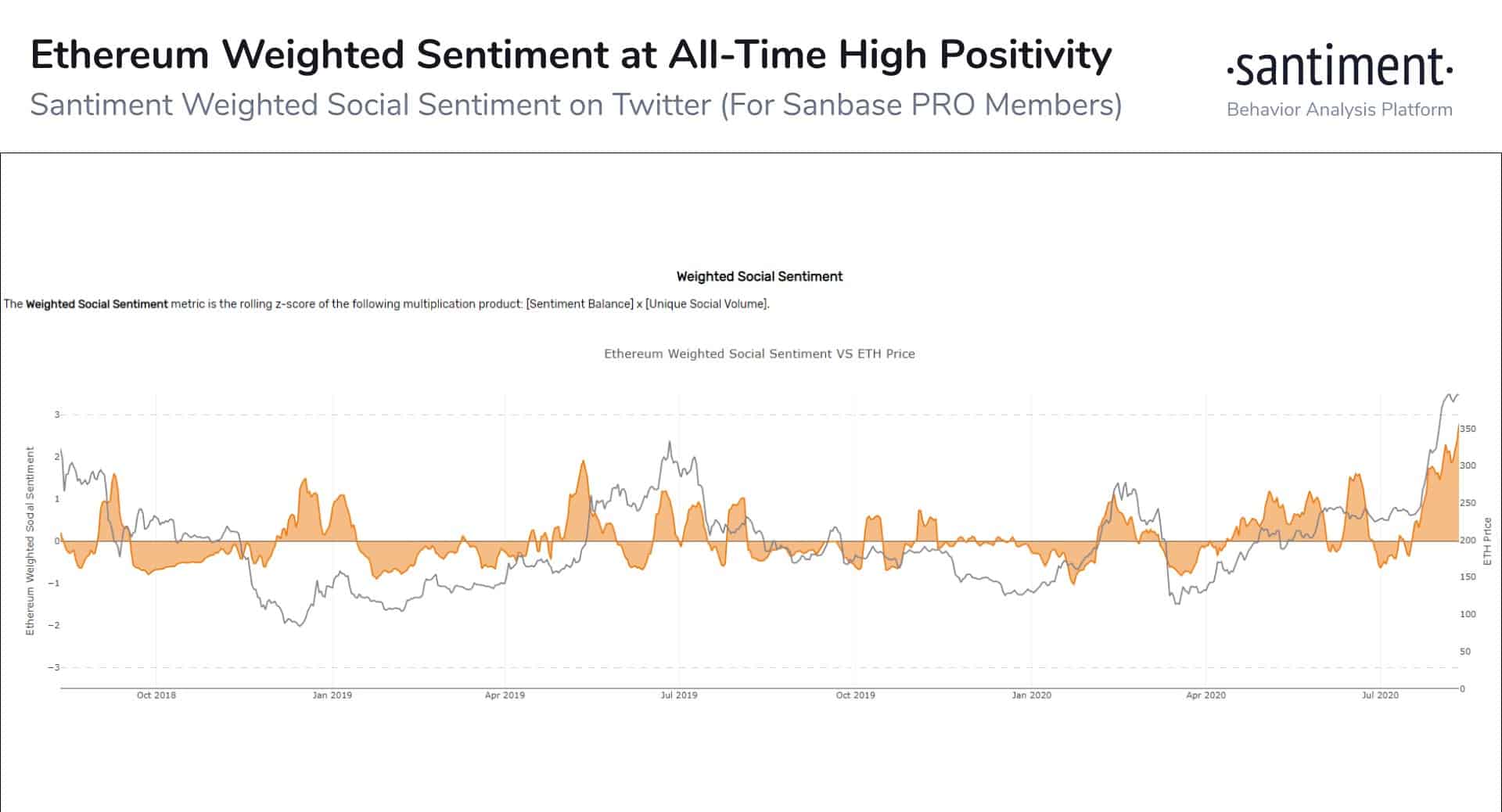

- Impact on Ethereum's Market Position: The increased activity could have a positive impact on Ethereum's market capitalization and price, attracting further investment and development in the ecosystem.

Conclusion:

The recent surge in Ethereum activity, evidenced by the nearly 10% increase in address interactions within 48 hours, is a significant development. Driven by a confluence of factors including increased transaction volume, booming DeFi activity, and a dynamic NFT market, this surge underscores Ethereum's ongoing relevance and growth potential. However, it simultaneously highlights the critical need for continued development and scalability improvements to effectively manage future increases in network demand. Stay updated on further developments in Ethereum activity, monitor Ethereum network metrics, and stay informed about the ever-evolving landscape of this dynamic cryptocurrency. Understanding these trends is crucial for anyone involved in the future of Ethereum's blockchain and its expanding ecosystem.

Featured Posts

-

Flamengo Confirma A Sergio Hernandez Como Su Nuevo Entrenador

May 08, 2025

Flamengo Confirma A Sergio Hernandez Como Su Nuevo Entrenador

May 08, 2025 -

Inside The Ps 5 Pro A Detailed Teardown And Analysis Of Its Liquid Metal Cooling

May 08, 2025

Inside The Ps 5 Pro A Detailed Teardown And Analysis Of Its Liquid Metal Cooling

May 08, 2025 -

Carneys White House Stand Canadas Economic Independence Asserted

May 08, 2025

Carneys White House Stand Canadas Economic Independence Asserted

May 08, 2025 -

Bitcoin Investment Strategies Navigating The Current Market Climate

May 08, 2025

Bitcoin Investment Strategies Navigating The Current Market Climate

May 08, 2025 -

Fettermans Health A Response To Ny Magazines Allegations

May 08, 2025

Fettermans Health A Response To Ny Magazines Allegations

May 08, 2025