Ethereum Price Analysis: Crucial Support Level And Potential Fall To $1,500

Table of Contents

Current Ethereum Price and Support Levels

At the time of writing, the Ethereum price is hovering around $1,720. However, this is subject to constant change, so it's crucial to refer to real-time data for the most accurate Ethereum price. This analysis focuses on identifying key support levels that could influence the short-term and medium-term Ethereum price prediction.

Identifying Key Support Levels

Several key support levels could prevent a sharper decline in the Ethereum price. These levels represent price points where buying pressure is expected to increase, potentially halting or slowing a price drop.

- $1,800: This level represents a significant psychological barrier and coincides with a previous high. A break below this level could signal weakening bullish sentiment.

- $1,700: This level is currently acting as immediate support. A sustained break below this could lead to further losses.

- $1,600: This level is a crucial support zone, supported by both technical indicators and historical price action. Breaking this support could trigger increased selling pressure.

- $1,500: This level represents a strong psychological support level and a potential bottom in a bearish scenario.

Several technical indicators support these levels:

- 200-Day Moving Average: Currently situated around $1,650, this long-term moving average often acts as a significant support level.

- Fibonacci Retracement Levels: Key retracement levels from recent highs could also offer support around the $1,600 - $1,700 range.

- Trendlines: Connecting key swing lows on the price chart often reveals crucial support and resistance zones. A break below the main trendline would be a bearish signal.

[Insert chart/graph visually representing these support levels here]

Breaking Support: Implications for ETH Price

Breaking below each support level could have significant implications for the Ethereum price.

- Breaking $1,800: Could lead to a test of the $1,700 support.

- Breaking $1,700: Could increase selling pressure and accelerate a move towards $1,600.

- Breaking $1,600: Could trigger a cascade effect, potentially leading to a rapid drop towards $1,500, signalling a bearish trend. This scenario highlights the importance of careful Ethereum price analysis.

Factors Influencing Ethereum Price

Several factors beyond technical analysis can significantly impact the Ethereum price.

Market Sentiment and Investor Confidence

Current market sentiment towards Ethereum is cautiously optimistic, but susceptible to change. Significant news events can drastically influence investor confidence.

- Regulatory Updates: Any negative news regarding regulatory uncertainty in major markets could trigger a sell-off, impacting the Ethereum price prediction.

- Network Upgrades: Successful implementations of major upgrades, like the Shanghai upgrade, can boost investor confidence and drive the price upwards.

- Competing Cryptocurrencies: The performance of competing cryptocurrencies and their adoption rates can indirectly affect Ethereum's market share and price.

Macroeconomic Conditions and Their Impact

Broader macroeconomic factors play a substantial role in cryptocurrency pricing, including Ethereum.

- Inflation and Interest Rates: Rising interest rates often lead to investors moving away from riskier assets like cryptocurrencies, potentially putting downward pressure on the Ethereum price.

- Global Economic Outlook: A pessimistic global economic outlook can also impact investor risk appetite, leading to lower cryptocurrency prices.

Ethereum Network Development and Upgrades

Upcoming developments on the Ethereum network are crucial factors in Ethereum price prediction.

- Layer-2 Scaling Solutions: The continued development and adoption of Layer-2 scaling solutions can improve network efficiency and reduce transaction costs, potentially boosting the price.

- Ethereum Improvement Proposals (EIPs): The implementation of EIPs can enhance the network's functionality and attract more users and developers.

Potential for a Drop to $1,500

Based on the analysis of support levels and influencing factors, a drop to $1,500 is a possibility, but not a certainty.

Technical Indicators Suggesting a Decline

Certain technical indicators suggest a potential decline:

- Bearish Divergence: If the price makes higher highs but the volume or momentum indicator makes lower highs, it could signal a weakening uptrend and potential price reversal.

- Decreasing Volume: Decreasing trading volume during an uptrend can indicate waning buying interest and potential for a price correction.

Scenario Planning: Best-Case and Worst-Case Outcomes

- Best-Case Scenario: The current support levels hold, and the price consolidates before resuming an upward trend, possibly driven by positive market sentiment and network upgrades.

- Worst-Case Scenario: Support levels break, leading to a rapid decline towards $1,500, potentially fueled by negative news and macroeconomic headwinds. This scenario highlights the need for thorough Ethereum price analysis.

Conclusion

This Ethereum price analysis highlights the crucial support levels currently holding the ETH price and explores the potential for a decline to $1,500. While a drop to $1,500 remains a possibility, considering the factors discussed, it's crucial to monitor market sentiment, macroeconomic conditions, and network developments. Stay informed and continue to monitor the Ethereum price and its support levels for informed decision-making. Regularly check back for updated Ethereum price analysis and Ethereum price predictions. Understanding these crucial support levels is vital for navigating the volatility of the ETH price.

Featured Posts

-

Cantina Canalla La Experiencia Gastronomica Mexicana En Malaga

May 08, 2025

Cantina Canalla La Experiencia Gastronomica Mexicana En Malaga

May 08, 2025 -

Long Term Investment Berkshire Hathaways Stake In Japanese Trading Houses

May 08, 2025

Long Term Investment Berkshire Hathaways Stake In Japanese Trading Houses

May 08, 2025 -

Exploring The Rogue Exiles Of Path Of Exile 2

May 08, 2025

Exploring The Rogue Exiles Of Path Of Exile 2

May 08, 2025 -

Transferred Files Ensuring Data Integrity During File Transfers

May 08, 2025

Transferred Files Ensuring Data Integrity During File Transfers

May 08, 2025 -

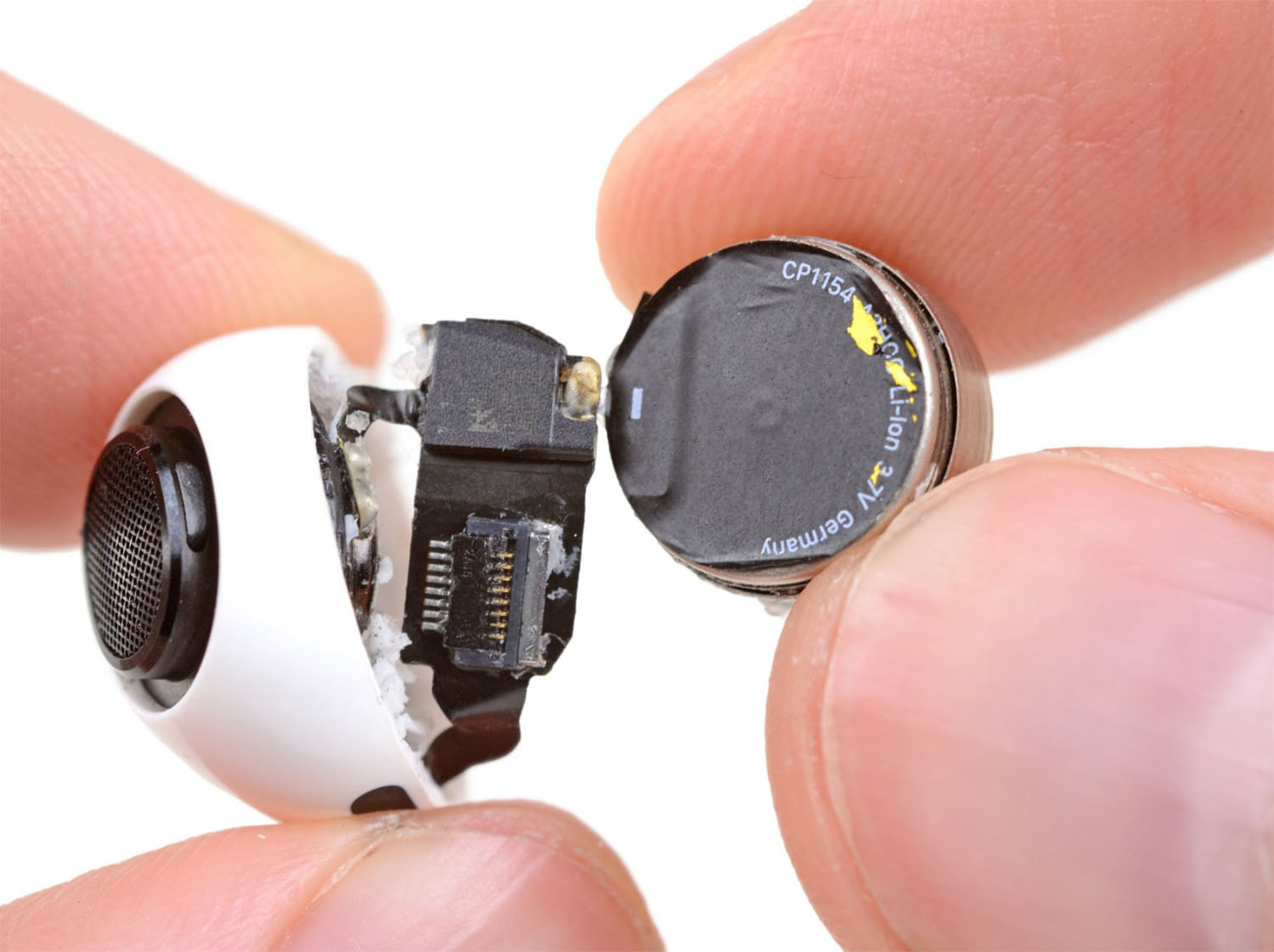

Play Station 5 Pro Teardown Reveals Cutting Edge Hardware And Design

May 08, 2025

Play Station 5 Pro Teardown Reveals Cutting Edge Hardware And Design

May 08, 2025