Ethereum Price Breakout: Could $2,000 Be Next?

Table of Contents

Recent Market Trends Fueling the Ethereum Price Breakout Narrative:

Positive Catalysts Driving ETH Price:

Ethereum's price action is influenced by a confluence of positive factors. The burgeoning decentralized finance (DeFi) ecosystem continues to drive network activity and transaction volume. The popularity of non-fungible tokens (NFTs) also contributes significantly to ETH's demand. Furthermore, ongoing development updates and upcoming upgrades play a crucial role.

- Increased Network Activity and Transaction Volume: DeFi platforms built on Ethereum handle billions of dollars in daily transactions, creating consistent demand for ETH. The NFT market, while cyclical, generates substantial trading volume whenever a new project gains traction. [Link to reputable DeFi data source] [Link to reputable NFT data source]

- Development Updates and Upcoming Upgrades: The highly anticipated Shanghai upgrade, enabling ETH withdrawals from staking, is expected to unlock significant liquidity and potentially boost the price. Layer-2 scaling solutions, like Optimism and Arbitrum, are alleviating network congestion and improving transaction speeds, enhancing the overall user experience. [Link to Ethereum Foundation blog post on Shanghai upgrade]

- Institutional Adoption and Investment: Major financial institutions are increasingly allocating capital to Ethereum, recognizing its potential as a foundational layer for future decentralized applications. This institutional interest provides a strong foundation for long-term price appreciation. [Link to news article about institutional Ethereum investment]

Addressing Potential Headwinds:

While the outlook is bullish, it's crucial to acknowledge potential challenges. Macroeconomic factors, regulatory uncertainty, and competition from other Layer-1 blockchains could impact ETH's price.

- Macroeconomic Factors: Global inflation and interest rate hikes can negatively affect investor risk appetite, potentially leading to a sell-off in the cryptocurrency market. Recessions could also impact investor confidence.

- Regulatory Uncertainty: Varying regulatory landscapes across different jurisdictions create uncertainty for investors and businesses operating within the crypto space. Clearer regulations, however, could eventually lead to increased institutional adoption.

- Competition from Other Layer-1 Blockchains: Competitors like Solana and Cardano are vying for market share, potentially diverting some development activity and user base away from Ethereum. However, Ethereum's established network effect and robust ecosystem provide a significant competitive advantage.

Technical Analysis: Predicting the Ethereum Price Breakout:

Chart Patterns and Indicators Suggesting a Breakout:

Analyzing Ethereum's price charts reveals potential clues about future price movements. Candlestick charts, in combination with technical indicators, provide valuable insights.

- Chart Patterns: The formation of bullish pennants or flags often precedes a significant price increase. A breakout above a key resistance level could signal a move towards $2,000. [Include a chart showcasing relevant patterns if possible.]

- Technical Indicators: The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can help identify overbought or oversold conditions, and potential trend reversals. A bullish crossover in the MACD could confirm an upward trend. [Include a chart showcasing these indicators if possible.]

- Support and Resistance Levels: Identifying key support and resistance levels allows traders to anticipate potential price reversals or breakouts. A sustained break above a significant resistance level would strongly suggest a bullish trajectory. [Include a chart showing support and resistance levels if possible.]

On-Chain Metrics Supporting a Bullish Outlook:

On-chain data provides valuable insights into network activity and investor behavior.

- Active Addresses and Network Activity: A rising number of active addresses and increasing transaction volume indicate growing network adoption and usage.

- Developer Activity and Network Growth: The number of active developers contributing to the Ethereum ecosystem reflects the health and long-term prospects of the platform.

- Exchange Balances and Accumulation/Distribution Trends: Decreasing exchange balances suggest that investors are accumulating ETH, potentially anticipating a future price increase.

Factors That Could Influence the Ethereum Price Breakout:

The Role of Ethereum's Ecosystem:

Ethereum's price is intrinsically linked to the health and growth of its ecosystem.

- Growth of DeFi Applications: The continued expansion of DeFi applications built on Ethereum increases demand for ETH, as users require it to participate in various protocols.

- NFT Market Trends: Booms in the NFT market often lead to increased ETH demand, as NFTs are typically bought and sold using ETH.

- Adoption of Ethereum for Enterprise Solutions: As more enterprises explore blockchain technology, Ethereum's scalability and security make it a compelling option, potentially driving further adoption and price appreciation.

Global Economic Conditions and Their Influence:

Macroeconomic factors can significantly impact investor sentiment and the price of ETH.

- Impact of Inflation and Recession: High inflation and economic uncertainty could lead to risk-averse behavior, potentially pushing down cryptocurrency prices.

- Regulatory Changes: Changes in regulations in key markets could influence investor confidence and ultimately impact the price of ETH.

Conclusion: Will Ethereum Reach $2,000? A Look Ahead:

The potential for an Ethereum price breakout to $2,000 is a complex issue with both bullish and bearish factors at play. Positive catalysts like increased network activity, significant upgrades, and growing institutional interest point towards a strong possibility. However, macroeconomic headwinds and regulatory uncertainty must be considered. A thorough analysis of technical indicators and on-chain metrics provides further insights, although predicting precise price movements remains challenging. By staying informed about the latest developments in the Ethereum ecosystem and continuing to research the Ethereum price breakout phenomenon, you can make more informed investment decisions. For further reading, we recommend exploring resources from reputable cryptocurrency news sites and analytical platforms. Keep an eye on the "Ethereum price breakout" and its potential to reach new heights!

Featured Posts

-

Capacites Geometriques Exceptionnelles Des Corneilles Depassement Des Performances Des Babouins

May 08, 2025

Capacites Geometriques Exceptionnelles Des Corneilles Depassement Des Performances Des Babouins

May 08, 2025 -

Saturday Night Lives Impact On Counting Crows Career A Retrospective

May 08, 2025

Saturday Night Lives Impact On Counting Crows Career A Retrospective

May 08, 2025 -

Filipe Luis Un Nuevo Titulo Para Su Palmares

May 08, 2025

Filipe Luis Un Nuevo Titulo Para Su Palmares

May 08, 2025 -

The Running Man Glen Powells Fitness Journey And Method Acting

May 08, 2025

The Running Man Glen Powells Fitness Journey And Method Acting

May 08, 2025 -

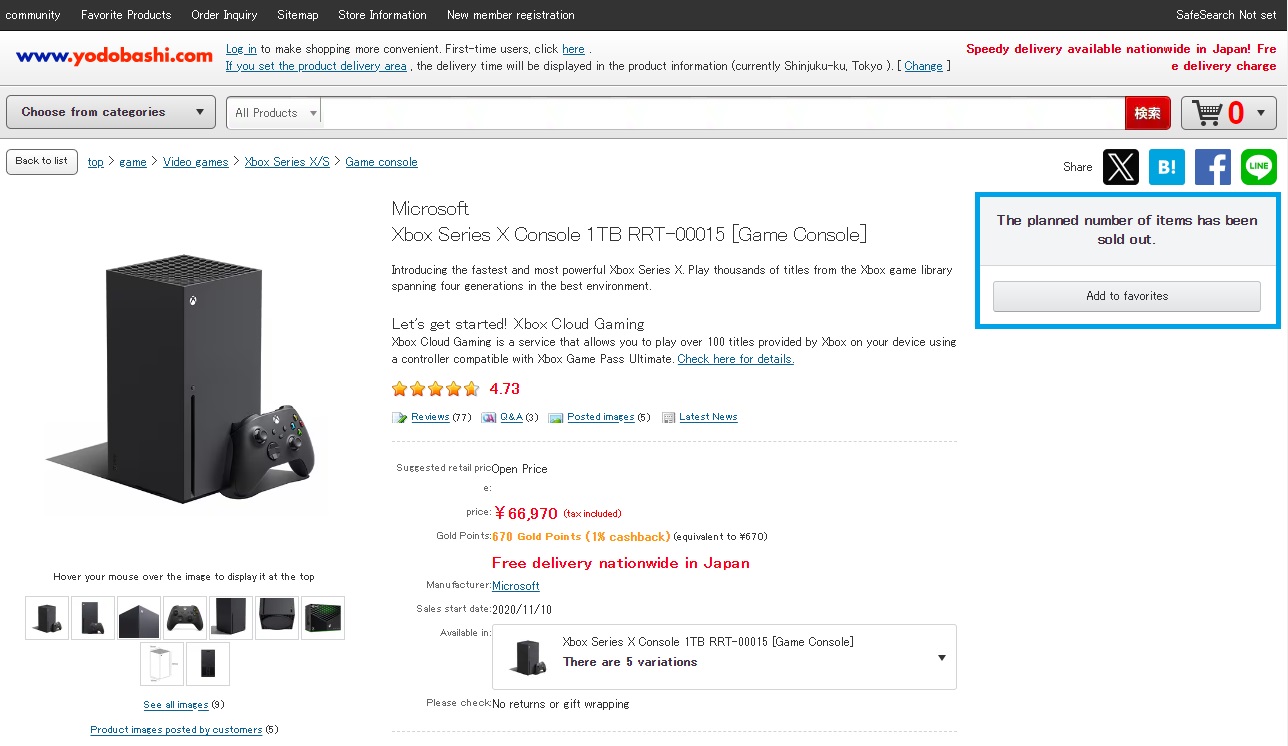

Ps 5 Price Hike Looms Where To Buy One Before Its Too Late

May 08, 2025

Ps 5 Price Hike Looms Where To Buy One Before Its Too Late

May 08, 2025