Ethereum Price Forecast: Factors Influencing Future Market Dynamics

Table of Contents

Technological Advancements and Network Upgrades

The Ethereum network's evolution significantly impacts its price forecast. Key improvements drive both user adoption and developer interest, influencing ETH's value.

Ethereum 2.0 and its Impact

The shift to a proof-of-stake (PoS) consensus mechanism, a core component of Ethereum 2.0, is a game-changer. This upgrade promises several benefits:

- Reduced transaction costs: PoS significantly reduces energy consumption and transaction fees, making Ethereum more accessible and competitive.

- Increased throughput: Sharding, another key feature, will dramatically increase the network's transaction processing capacity, handling significantly more transactions per second.

- Enhanced security: PoS enhances the network's security by requiring validators to stake a substantial amount of ETH, deterring malicious actors.

- Improved energy efficiency: The transition to PoS drastically reduces Ethereum's environmental footprint, addressing a major criticism of proof-of-work cryptocurrencies.

These improvements attract more users and developers, boosting demand for ETH and potentially driving its price upward. The Ethereum price prediction becomes more bullish with successful implementation and widespread adoption of these upgrades.

Development Activity and Ecosystem Growth

A thriving ecosystem is crucial for the long-term success of any cryptocurrency. Ethereum's strength lies in its vibrant and rapidly expanding ecosystem.

- Growth in Decentralized Applications (dApps): The number of dApps built on Ethereum continues to grow exponentially, offering diverse functionalities and attracting users across various sectors.

- Rise of DeFi protocols: Decentralized finance (DeFi) protocols built on Ethereum offer innovative financial services, increasing demand for ETH as collateral and transaction fees.

- NFT marketplace activity: Ethereum's dominant role in the Non-Fungible Token (NFT) market fuels significant demand for ETH, as NFTs are primarily bought and sold using the cryptocurrency.

A healthy and expanding ecosystem directly translates to increased demand for ETH, thereby positively impacting its price. This makes analyzing development activity a key factor in any Ethereum price forecast.

Regulatory Landscape and Government Policies

Government regulations and institutional adoption significantly influence the Ethereum price forecast and overall market sentiment.

Global Regulatory Scrutiny

The regulatory landscape surrounding cryptocurrencies is constantly evolving. The approach taken by different jurisdictions can significantly impact Ethereum's adoption and price.

- Impact of SEC regulations: Regulations from the Securities and Exchange Commission (SEC) and other regulatory bodies can create uncertainty and volatility in the market.

- Potential for future legislation: The future regulatory environment remains uncertain, and new legislation could either boost or hinder Ethereum's growth.

- International regulatory harmonization: A more coordinated global approach to cryptocurrency regulation could provide greater stability and predictability for the market.

Navigating this regulatory landscape is crucial for assessing any Ethereum price prediction. Clear and consistent regulations could contribute to a more stable and predictable Ethereum price.

Government Adoption and Institutional Investment

Growing acceptance by governments and institutional investors is a crucial factor in shaping future price dynamics.

- Central Bank Digital Currencies (CBDCs): The development of CBDCs may influence the adoption of cryptocurrencies and their underlying technologies.

- Institutional investment strategies: Increased institutional investment brings greater legitimacy and stability to the cryptocurrency market, potentially driving up prices.

- Government-backed initiatives: Government support for blockchain technology and cryptocurrencies can significantly boost investor confidence and market growth.

Institutional interest and government adoption are strong indicators of long-term price stability and potential growth, which must be considered in any detailed Ethereum price forecast.

Macroeconomic Factors and Market Sentiment

Broader economic conditions and market sentiment significantly influence cryptocurrency prices, including ETH.

Global Economic Conditions

Global economic factors directly impact cryptocurrency markets.

- Correlation between traditional markets and crypto markets: Cryptocurrencies, including Ethereum, often show correlation with traditional markets, reacting to events like inflation or recessionary fears.

- Impact of recessionary fears: During economic downturns, investors may sell off riskier assets, including cryptocurrencies, leading to price drops.

- Flight to safety: Conversely, some investors may view cryptocurrencies as a hedge against inflation or economic uncertainty, driving demand during times of economic instability.

Understanding these correlations is vital when assessing any Ethereum future price.

Bitcoin's Influence on Ethereum

Bitcoin's price often acts as a leading indicator for the broader crypto market, including Ethereum.

- Correlation between BTC and ETH: While not perfectly correlated, Bitcoin's price movements often influence Ethereum's price.

- Impact of Bitcoin's price volatility on ETH: Significant price swings in Bitcoin can trigger similar movements in Ethereum, highlighting the interconnectedness of the crypto market.

Keeping a close eye on Bitcoin's price action is important for understanding short-term fluctuations in the Ethereum price forecast.

Supply and Demand Dynamics

Supply and demand are fundamental economic principles driving asset prices, including ETH.

ETH Staking and Inflation

Ethereum's transition to proof-of-stake impacts the circulating supply and potential inflation.

- Effects of staking rewards: Staking rewards incentivize users to lock up their ETH, reducing the circulating supply and potentially increasing its value.

- Impact on token supply: The overall supply of ETH influences its price; a decrease in circulating supply can lead to price appreciation.

- Deflationary pressures: While not guaranteed, Ethereum's transition to PoS could create some deflationary pressures, potentially driving up the price over time.

Market Adoption and Demand

Widespread adoption across various sectors fuels demand for ETH.

- Growth in decentralized finance (DeFi): The continued expansion of DeFi applications increases the demand for ETH as collateral and transaction fees.

- Increasing NFT usage: The ongoing popularity of NFTs keeps demand for ETH high, as it remains the dominant blockchain for NFT creation and trading.

- Wider enterprise adoption: Growing adoption by enterprises for blockchain-based solutions could significantly drive demand for ETH.

Increased adoption leads directly to higher demand, a crucial factor in any Ethereum price prediction.

Conclusion

Predicting the Ethereum price forecast accurately is challenging due to the inherent volatility of the cryptocurrency market and the complex interplay of various factors. However, by carefully considering technological advancements, regulatory developments, macroeconomic conditions, and supply/demand dynamics, we can gain valuable insights into the potential future trajectory of ETH's price. Remember to conduct thorough research and always consider your own risk tolerance before investing in Ethereum or any other cryptocurrency. Stay informed about the latest Ethereum price forecast and market trends to make well-informed decisions. Understanding the factors influencing the Ethereum price prediction is key to navigating this exciting yet volatile market.

Featured Posts

-

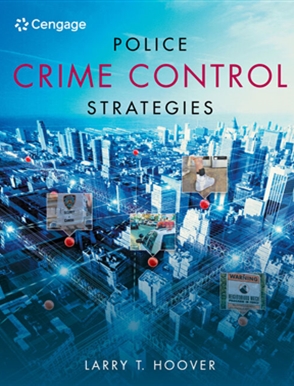

Effective Directives For Faster Crime Control Strategies And Implementation

May 08, 2025

Effective Directives For Faster Crime Control Strategies And Implementation

May 08, 2025 -

De Andre Carter Browns Land Experienced Wide Receiver From Bears

May 08, 2025

De Andre Carter Browns Land Experienced Wide Receiver From Bears

May 08, 2025 -

Uber Big Change Auto Service Now Cash Only

May 08, 2025

Uber Big Change Auto Service Now Cash Only

May 08, 2025 -

Strengthening Crime Control A Directive For Expedited Action

May 08, 2025

Strengthening Crime Control A Directive For Expedited Action

May 08, 2025 -

Saturday Night Live And Counting Crows How A Single Appearance Changed Everything

May 08, 2025

Saturday Night Live And Counting Crows How A Single Appearance Changed Everything

May 08, 2025