Ethereum Price Holds Strong: Potential For Further Gains

Table of Contents

Strong Fundamentals Driving Ethereum's Price

Ethereum's price strength isn't merely a fleeting market trend; it's underpinned by robust fundamentals that paint a picture of sustained growth.

The Ethereum Merge and its Impact

The successful transition to a proof-of-stake (PoS) consensus mechanism, commonly known as "The Merge," was a pivotal moment for Ethereum. This upgrade significantly altered the Ethereum network, resulting in:

- Increased efficiency: Transaction processing became more efficient, reducing congestion and improving overall network speed.

- Reduced energy consumption: The shift from proof-of-work to proof-of-stake drastically lowered Ethereum's environmental impact, addressing a major criticism of previous blockchain networks.

- Positive environmental impact: The reduced energy consumption translates to a significantly smaller carbon footprint, attracting environmentally conscious investors.

- Enhanced scalability: While challenges remain, the Merge laid the groundwork for future scalability improvements, enabling the network to handle a higher volume of transactions.

The successful execution of the Merge demonstrated Ethereum's ability to adapt and innovate, bolstering investor confidence and driving up the ETH price.

Growing DeFi Ecosystem and Dapp Usage

Ethereum's thriving decentralized finance (DeFi) ecosystem is another key driver of its price. The total value locked (TVL) in DeFi protocols built on Ethereum continues to grow, attracting users and developers alike.

- Increased number of decentralized applications (dApps): A vibrant ecosystem of decentralized applications offers diverse functionalities, increasing user engagement and network activity.

- Growing total value locked (TVL) in DeFi protocols: The substantial amount of cryptocurrency locked in DeFi protocols demonstrates high user confidence and signifies growing demand for ETH.

- User adoption: Increasing user adoption across various DeFi applications and platforms fuels further demand for ETH.

- Innovative use cases: The emergence of innovative applications and use cases within DeFi continues to attract new users and investors to the Ethereum network.

Examples like Uniswap, Aave, and Compound highlight the strength and innovation within the Ethereum DeFi ecosystem.

Institutional Investment and Adoption

The growing acceptance of Ethereum among institutional investors is providing a strong foundation for long-term price growth.

- Increased institutional interest in Ethereum: Large financial institutions are increasingly allocating funds to Ethereum, viewing it as a viable long-term investment.

- Large-scale investments from corporations and hedge funds: Significant investments from major corporations and hedge funds signal a growing belief in Ethereum's potential.

- Growing acceptance among financial institutions: The increasing acceptance of Ethereum by traditional financial institutions marks a significant milestone in its mainstream adoption.

This institutional interest lends stability and credibility to the Ethereum market, mitigating some of the volatility inherent in the broader cryptocurrency space.

Technical Analysis Suggests Further Upside Potential

While fundamental analysis provides a long-term perspective, technical analysis offers short-to-medium-term insights into potential price movements.

Chart Patterns and Indicators

Analyzing Ethereum's price charts reveals several positive signals suggesting further upside potential. (Note: This section would ideally include charts and specific data points. Due to the limitations of this text-based format, we'll provide a general overview.)

- Bullish chart patterns: Certain chart patterns, such as bullish flags or inverse head and shoulders, can indicate potential price increases.

- Positive technical indicators: Indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can signal upward price momentum.

- Support and resistance levels: Identifying support and resistance levels can help predict potential price movements.

It's crucial to remember that technical analysis is not an exact science, and it should be used in conjunction with fundamental analysis.

On-Chain Metrics

On-chain metrics provide valuable insights into the health and activity of the Ethereum network.

- Active addresses: A rising number of active addresses indicates growing user engagement and network participation.

- Transaction volume: Increased transaction volume demonstrates growing network activity and demand.

- Gas fees: While gas fees can fluctuate, generally stable and moderate levels indicate healthy network usage.

- Developer activity: High levels of developer activity reflect ongoing innovation and network development.

- Network growth: Consistent growth in various network metrics suggests a healthy and expanding ecosystem.

Potential Risks and Challenges

While the outlook for Ethereum is largely positive, it's important to acknowledge potential risks and challenges.

Market Volatility and Regulatory Uncertainty

The cryptocurrency market is inherently volatile, and Ethereum is not immune to these fluctuations.

- General cryptocurrency market volatility: External factors can significantly influence the overall cryptocurrency market, impacting Ethereum's price.

- Potential regulatory changes: Changes in regulations across different jurisdictions could impact the cryptocurrency market, including Ethereum.

- Geopolitical factors: Global events and geopolitical instability can also influence cryptocurrency prices.

Competition from Other Blockchains

Ethereum faces competition from other blockchain platforms offering alternative solutions.

- Competition from layer-1 and layer-2 solutions: Emerging layer-1 and layer-2 solutions aim to address Ethereum's scalability challenges, potentially impacting its market share.

- Potential challenges from rival blockchain technologies: Rival blockchain technologies with unique features or advantages could attract users and developers away from Ethereum.

Conclusion

Ethereum's price strength is driven by a combination of strong fundamentals, including the successful Merge, a flourishing DeFi ecosystem, and growing institutional adoption. Technical analysis also suggests further upside potential. While market volatility and competition remain inherent challenges, Ethereum's robust foundation and ongoing development point to significant potential for long-term price appreciation. Conduct your own thorough due diligence before investing, but the current Ethereum price and its trajectory warrant consideration for those seeking exposure to the growth of blockchain technology. Stay informed about the latest developments concerning the Ethereum price and market trends to make informed investment decisions.

Featured Posts

-

Winning Numbers Daily Lotto Tuesday 15th April 2025

May 08, 2025

Winning Numbers Daily Lotto Tuesday 15th April 2025

May 08, 2025 -

The End Of The Sonos And Ikea Symfonisk Line Analysis And Alternatives

May 08, 2025

The End Of The Sonos And Ikea Symfonisk Line Analysis And Alternatives

May 08, 2025 -

Thunder Vs Pacers Updated Injury Report For March 29th

May 08, 2025

Thunder Vs Pacers Updated Injury Report For March 29th

May 08, 2025 -

Made In Gujranwala Exhibition A Success Celebrated By Sufian And The Gcci

May 08, 2025

Made In Gujranwala Exhibition A Success Celebrated By Sufian And The Gcci

May 08, 2025 -

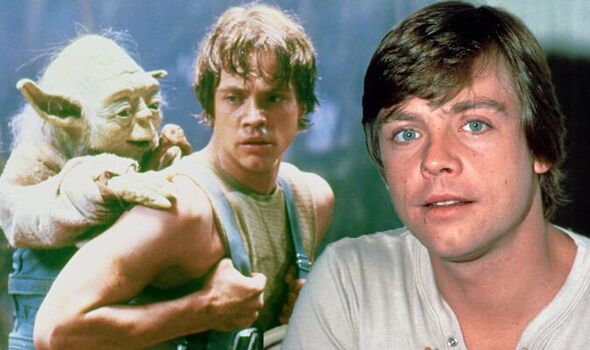

The Long Walk Mark Hamill Steps Away From Luke Skywalker

May 08, 2025

The Long Walk Mark Hamill Steps Away From Luke Skywalker

May 08, 2025