Ethereum Price Prediction: $2,700 On The Horizon As Wyckoff Accumulation Completes

Table of Contents

Understanding the Wyckoff Accumulation Pattern in Ethereum

The Wyckoff method is a technical analysis framework used to identify market manipulation and predict price movements. It focuses on identifying accumulation phases where large players are quietly buying, setting the stage for a future price increase. Applied to cryptocurrency markets like Ethereum, it helps spot potential breakout points.

- Key phases of Wyckoff accumulation: The Wyckoff method identifies several key phases, including the Preliminary Support (PS), the Secondary Test (ST), the Sign of Weakness (SOW), and the Spring. These phases are characterized by specific price action and volume patterns.

- How these phases manifest in Ethereum's price chart: Recent Ethereum price action shows potential signs consistent with a Wyckoff accumulation. We've observed periods of consolidation, followed by tests of support levels, suggesting a large player is accumulating ETH.

- Examples of past Wyckoff patterns in other cryptocurrencies: Similar Wyckoff patterns have been observed in Bitcoin and other altcoins before significant price increases, showcasing the predictive power of this method.

- Visual aids: [Insert chart here illustrating the Wyckoff accumulation pattern in Ethereum's price history. Clearly label the key phases (PS, ST, etc.)]

Technical Indicators Supporting the $2,700 Ethereum Price Prediction

Beyond the Wyckoff accumulation pattern, several technical indicators support the $2,700 Ethereum price prediction. These indicators provide further evidence of a potential bullish trend.

- Moving averages: The 50-day and 200-day moving averages are converging, a bullish signal often preceding a price breakout. [Insert chart showing moving averages.]

- Relative Strength Index (RSI): The RSI is currently [insert current RSI value], indicating [bullish or neutral; explain the interpretation]. This suggests that the current price is not overbought. [Insert chart showing RSI.]

- MACD and other momentum indicators: The Moving Average Convergence Divergence (MACD) is showing [bullish or neutral; explain the interpretation], reinforcing the potential for an upward price movement. [Insert chart showing MACD.]

- Support and resistance levels: The current support levels hold strong, and the next significant resistance level is around $2,700, suggesting a potential price target. [Insert chart showing support and resistance levels.]

Fundamental Factors Influencing Ethereum's Price

While technical analysis is crucial, fundamental factors also significantly influence Ethereum's price. Several bullish factors support the $2,700 prediction.

- Ethereum's growing adoption in DeFi and NFTs: The increasing usage of Ethereum in decentralized finance (DeFi) and non-fungible tokens (NFTs) fuels demand for the cryptocurrency.

- Upcoming Ethereum upgrades: The Shanghai upgrade and subsequent upgrades are expected to enhance Ethereum's scalability and efficiency, further boosting its value.

- Institutional investment in Ethereum: Major institutional investors are increasingly allocating funds to Ethereum, driving up demand and price.

- Regulatory developments: While regulatory uncertainty remains, positive developments could contribute to a bullish sentiment.

- Market sentiment: The overall market sentiment towards Ethereum is currently [bullish/bearish/neutral] which impacts the price.

Addressing Potential Risks and Challenges

While the outlook is positive, it's essential to acknowledge potential risks and challenges.

- Macroeconomic factors: Global economic conditions can significantly impact the cryptocurrency market, potentially hindering price growth.

- Competition from other cryptocurrencies: Competition from other smart contract platforms could affect Ethereum's market share and price.

- Regulatory uncertainty: Unfavorable regulations could negatively impact the price of Ethereum.

- Technical failures or unexpected events: Unexpected technical issues or security breaches could trigger a price drop.

Conclusion

This Ethereum price prediction of $2,700 is based on a confluence of factors, including a potential Wyckoff accumulation pattern, supportive technical indicators, and positive fundamental developments. The convergence of these elements suggests a strong possibility of a significant price increase. However, the analysis highlights potential risks and challenges, emphasizing the dynamic nature of the cryptocurrency market.

While this Ethereum price prediction is based on solid analysis, remember to always conduct your own thorough research before making any investment decisions. Stay informed on the latest Ethereum price developments and the potential for reaching the $2700 target. Consider diversifying your portfolio and only invest what you can afford to lose. Monitor the $2700 Ethereum price target and its progress carefully.

Featured Posts

-

Counting Crows Slip Into The Rain A Fans Perspective And Analysis

May 08, 2025

Counting Crows Slip Into The Rain A Fans Perspective And Analysis

May 08, 2025 -

Responding To Tariffs China Lowers Interest Rates Boosts Bank Lending

May 08, 2025

Responding To Tariffs China Lowers Interest Rates Boosts Bank Lending

May 08, 2025 -

Flamengo Vs Liga De Quito Analisis Previo A La Fecha 3 De Libertadores

May 08, 2025

Flamengo Vs Liga De Quito Analisis Previo A La Fecha 3 De Libertadores

May 08, 2025 -

Food Delivery War Heats Up Ubers Antitrust Lawsuit Against Door Dash

May 08, 2025

Food Delivery War Heats Up Ubers Antitrust Lawsuit Against Door Dash

May 08, 2025 -

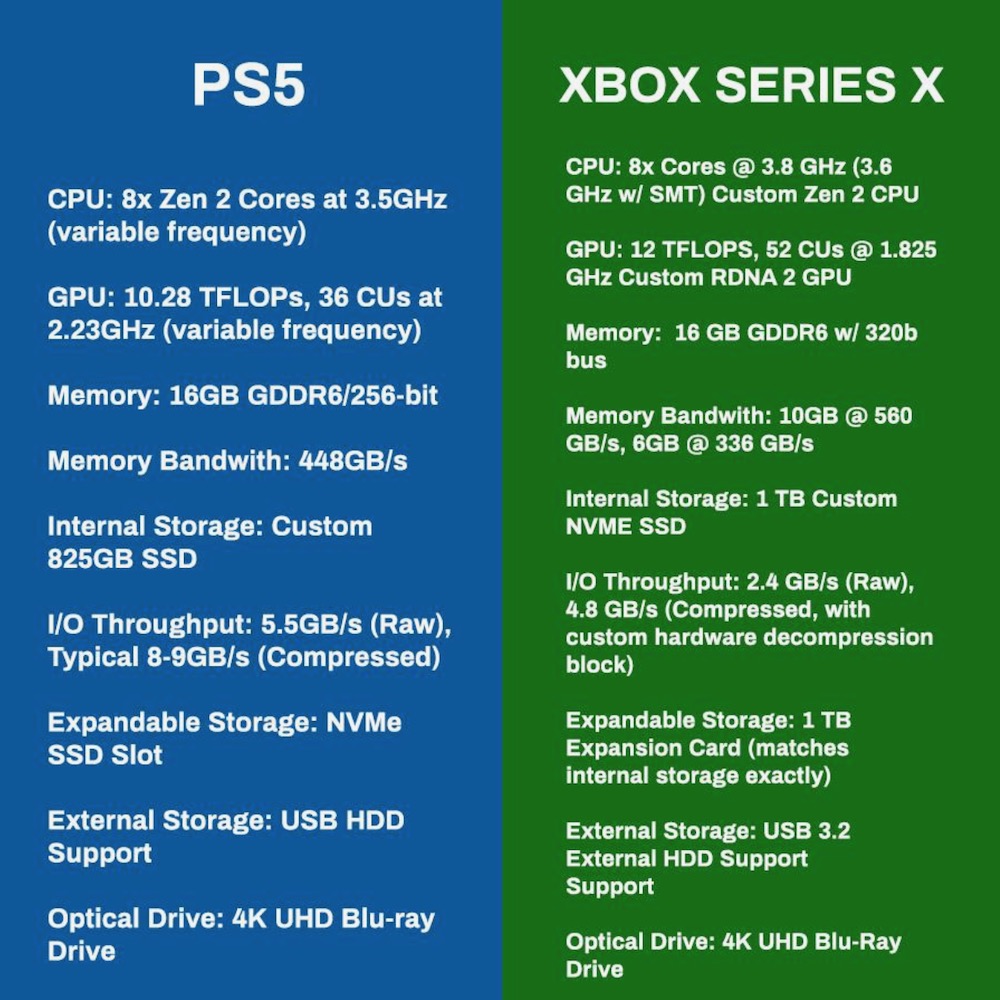

Choosing Between Ps 5 And Xbox Series S A Comprehensive Guide

May 08, 2025

Choosing Between Ps 5 And Xbox Series S A Comprehensive Guide

May 08, 2025