Ethereum Price Prediction: CrossX Indicators And Institutional Accumulation Point To $4,000

Table of Contents

Understanding CrossX Indicators and Their Implications for Ethereum

CrossX indicators are a suite of technical analysis tools that combine various market data points to provide a comprehensive overview of asset price trends. They aren't tied to a single metric but synthesize information from multiple sources, offering a more holistic perspective than relying on individual indicators alone. Currently, several CrossX indicators are signaling a strong bullish sentiment for ETH.

-

Specific CrossX indicator examples and their current readings: For example, the combined analysis of the Relative Strength Index (RSI), moving averages (e.g., 50-day and 200-day), and volume indicators suggests a potential breakout above significant resistance levels. Currently, the RSI is showing readings above 50, indicating bullish momentum, while the 50-day moving average is crossing above the 200-day moving average – a classic "golden cross" signal often associated with upward price trends.

-

Historical examples of how these indicators predicted past price movements: Historical data shows that similar patterns in CrossX indicators have often preceded significant price increases for Ethereum. Examining previous market cycles reveals correlations between these combined signals and subsequent price rallies.

-

Technical analysis supporting the interpretation of these indicators: The confluence of these positive signals, supported by increasing trading volume, strengthens the bullish outlook. This suggests a growing conviction among traders that the price is poised for a significant upward movement.

The Role of Institutional Accumulation in the Ethereum Price Prediction

Beyond technical indicators, the growing interest of institutional investors in Ethereum plays a crucial role in our $4,000 Ethereum price prediction. Large financial institutions are increasingly recognizing the value proposition of Ethereum as a foundational layer for decentralized applications (dApps), decentralized finance (DeFi), and non-fungible tokens (NFTs).

-

Examples of large institutional investors entering the ETH market: Grayscale Investments' Grayscale Ethereum Trust (ETHE) is a prime example. The substantial holdings managed by this trust indicate strong institutional conviction in Ethereum's long-term prospects. Other notable institutional investors include various pension funds and hedge funds who are allocating a considerable portion of their portfolios to ETH.

-

Analysis of the impact of their investments on ETH's price: The sustained buying pressure from institutional investors acts as a powerful catalyst, driving up demand and consequently pushing the price higher. This consistent accumulation absorbs sell-offs and creates a solid support base for further growth.

-

Future projections based on continued institutional investment: As more institutional money flows into the Ethereum ecosystem, the upward pressure on the price is likely to continue, further fueling the potential for Ethereum to reach the $4,000 mark.

Addressing Potential Risks and Challenges to the $4,000 Ethereum Price Prediction

While the outlook is bullish, it's crucial to acknowledge potential risks and challenges that could affect the Ethereum price prediction.

-

Regulatory uncertainty and its impact on crypto prices: Regulatory developments and uncertainty surrounding the crypto industry globally remain a significant factor. Changes in regulatory landscapes could impact market sentiment and investment flows.

-

Market-wide corrections and their potential effects on ETH: The cryptocurrency market is susceptible to broad corrections. A general downturn in the market could negatively impact Ethereum's price, regardless of its fundamental strength.

-

Competition from other cryptocurrencies: Competition from emerging blockchain technologies and alternative cryptocurrencies also needs consideration. The emergence of competitors could potentially divert some investment away from Ethereum.

Ethereum's Long-Term Potential and the Path to $4,000

Ethereum's long-term potential is underpinned by its robust development roadmap, including Ethereum 2.0's transition to a proof-of-stake consensus mechanism. This transition promises enhanced scalability, security, and energy efficiency.

-

Growth of decentralized finance (DeFi) applications on Ethereum: The burgeoning DeFi sector, built on Ethereum's blockchain, continues to drive significant demand for ETH.

-

Increasing adoption of NFTs and other blockchain-based technologies: The growing popularity of NFTs and the increasing use of blockchain technology in diverse sectors further bolster Ethereum's prospects.

-

The growing utility and scalability of the Ethereum network: As Ethereum's network scales and its utility expands across various sectors, its value proposition strengthens, creating further upward price pressure. These factors collectively support the potential for ETH to reach $4,000.

Conclusion

In summary, a confluence of factors points towards a potential surge in Ethereum's price. CrossX indicators suggest positive momentum, institutional accumulation is driving significant buying pressure, and Ethereum's robust long-term vision supports its growth potential. All these factors strongly indicate that the $4,000 price target is achievable. While risks exist, the evidence presented suggests a compelling case for a significant increase in Ethereum's price. Conduct your own thorough research, but stay informed on the latest Ethereum price prediction, monitor the Ethereum market closely, and learn more about CrossX indicators and their impact on Ethereum's price.

Featured Posts

-

Successful Made In Gujranwala Exhibition Sufians Acclaim For Gcci President

May 08, 2025

Successful Made In Gujranwala Exhibition Sufians Acclaim For Gcci President

May 08, 2025 -

Jayson Tatum Confirms Sons Birth With Ella Mai In New Commercial

May 08, 2025

Jayson Tatum Confirms Sons Birth With Ella Mai In New Commercial

May 08, 2025 -

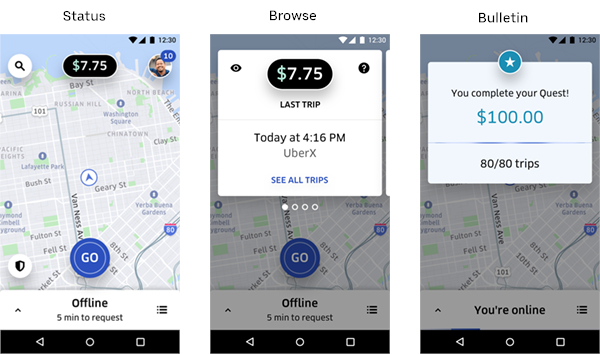

Uber Subscription Plan Details And Impact On Driver Earnings

May 08, 2025

Uber Subscription Plan Details And Impact On Driver Earnings

May 08, 2025 -

Universal Credit Refund Dwp To Issue Payments In April And May Following 5 Billion Reduction

May 08, 2025

Universal Credit Refund Dwp To Issue Payments In April And May Following 5 Billion Reduction

May 08, 2025 -

Multidao Se Reune No Vaticano Para O Funeral Do Papa Francisco

May 08, 2025

Multidao Se Reune No Vaticano Para O Funeral Do Papa Francisco

May 08, 2025