Ethereum Price Strength: Bulls In Control, Upside Potential High

Table of Contents

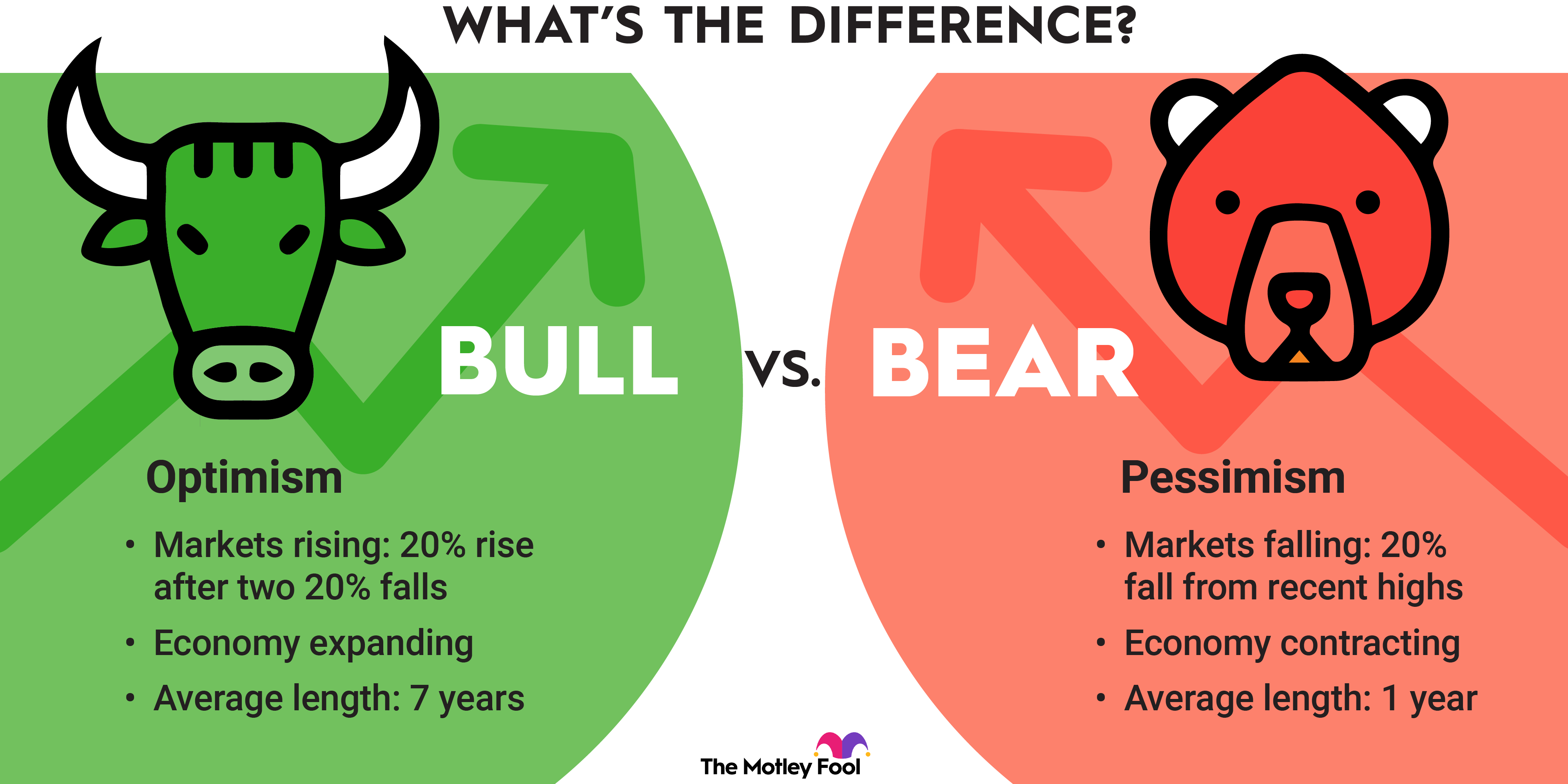

Technical Analysis: Signs of a Bullish Ethereum Market

Technical analysis provides valuable insights into the current market trend and potential future price movements. Several key indicators point towards a bullish outlook for Ethereum.

Strong Support Levels

Recent price action demonstrates strong support levels, preventing significant price drops. This indicates strong buying pressure at key price points.

- Specific Price Points: For example, the $1,600 and $1,800 levels have acted as significant support in recent weeks (Note: These figures are examples and should be updated with current, real-time data). A break below these levels would signal a potential shift in momentum.

- Moving Averages: The 50-day and 200-day moving averages are currently trending upwards, further reinforcing the bullish trend. (Include chart here showing support levels and moving averages). This suggests sustained upward momentum.

- Resistance Levels: While support is crucial, identifying resistance levels is equally important. Understanding these levels helps predict potential price ceilings and profit-taking opportunities. (Include chart illustrating resistance levels)

Increasing Trading Volume

The correlation between price increases and rising trading volume is a powerful indicator of strong buyer conviction. Increased volume confirms the price movement, suggesting it's not just a temporary fluctuation.

- Volume Data: Observe a significant increase in trading volume on major exchanges like Coinbase, Binance, and Kraken during recent price rallies. (Include chart or table showing trading volume alongside price).

- Exchange Data: Analyzing volume across different exchanges helps determine the breadth and depth of the buying pressure. High volume across multiple exchanges signifies a stronger, more widespread bullish sentiment.

- Implications: Sustained high volume alongside price increases strongly suggests a continuation of the bullish trend.

Positive RSI and MACD Signals

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are valuable momentum indicators. Currently, both are showing positive signals, supporting the bullish outlook.

- RSI Values: An RSI above 50 generally suggests bullish momentum. Readings above 70 might indicate overbought conditions, suggesting a potential short-term correction. (Link to a reputable source showing current RSI values for Ethereum).

- MACD Signals: A bullish crossover (MACD line crossing above the signal line) is a positive signal. (Link to a reputable source showing current MACD values for Ethereum). This suggests increasing buying pressure and potential upward momentum.

- Indicator Interpretation: Remember that these indicators are tools for analysis, not guarantees. It’s crucial to consider them in conjunction with other factors, such as price action and volume.

Fundamental Factors Driving Ethereum Price Strength

Beyond technical analysis, several fundamental factors are contributing to the current Ethereum price strength.

Ethereum 2.0 Development and Progress

The ongoing development and implementation of Ethereum 2.0 are significantly impacting the network's scalability, efficiency, and security.

- Milestones Achieved: The successful implementation of key phases of Ethereum 2.0, such as the Beacon Chain and shard chains, has improved transaction speeds and reduced gas fees.

- Improved Efficiency: Reduced gas fees make Ethereum more attractive to developers and users, driving increased network activity and demand.

- Investor Confidence: Progress on Ethereum 2.0 boosts investor confidence, attracting more capital into the ecosystem.

Growing DeFi Ecosystem

The flourishing Decentralized Finance (DeFi) ecosystem built on Ethereum is a major driver of demand.

- Total Value Locked (TVL): The total value locked in DeFi protocols on Ethereum continues to grow, indicating increasing user adoption and demand for ETH.

- DeFi Applications: The growth of popular DeFi applications, such as lending platforms, decentralized exchanges (DEXs), and yield farming protocols, contributes to ETH demand.

- Staking and Yield Farming: Staking ETH to secure the network and participate in yield farming opportunities further incentivizes holding ETH, reducing selling pressure.

NFT Market Boom

The ongoing popularity of Non-Fungible Tokens (NFTs) significantly impacts Ethereum's price.

- NFT Sales Volume: High sales volume on prominent NFT marketplaces built on Ethereum contributes to increased transaction activity and demand for ETH.

- NFT Marketplaces: The success of marketplaces like OpenSea and Rarible showcases the strong demand for NFTs and, by extension, Ethereum.

- Transaction Fees: High NFT trading volumes generate significant transaction fees, further boosting the demand for ETH.

Potential Risks and Challenges

Despite the bullish outlook, several potential risks and challenges could impact Ethereum price strength.

Regulatory Uncertainty

Government regulations regarding cryptocurrencies pose a significant risk to the market.

- Varying Regulations: Different countries have varying approaches to regulating cryptocurrencies, creating uncertainty for investors.

- Potential Bans or Restrictions: The possibility of future bans or restrictions on crypto trading or usage could significantly impact the price of Ethereum.

- Compliance Costs: Increased regulatory compliance costs could negatively impact the growth and development of the Ethereum ecosystem.

Market Volatility

The cryptocurrency market is inherently volatile, and price corrections are a normal occurrence.

- Price Swings: Expect significant price swings, both upward and downward.

- Market Sentiment: Market sentiment can change rapidly, leading to abrupt price movements.

- Risk Management: Implement appropriate risk management strategies to mitigate potential losses.

Competition from Other Blockchains

Ethereum faces competition from other blockchain platforms offering similar functionalities.

- Competing Platforms: Platforms like Solana, Cardano, and Polkadot offer scalability improvements and potentially lower transaction fees.

- Market Share: Increased competition could lead to a shift in market share, potentially impacting Ethereum's dominance.

- Innovation: Ethereum's continued success will depend on its ability to adapt and innovate to stay ahead of the competition.

Conclusion

The current Ethereum price strength demonstrates a bullish market sentiment, supported by strong technical indicators and fundamental factors like the progress of Ethereum 2.0, the thriving DeFi ecosystem, and the continued success of the NFT market. While regulatory uncertainty and market volatility remain potential challenges, the overall outlook for Ethereum's price appears positive. However, it's crucial to conduct your own thorough research before making any investment decisions. Stay informed about the latest developments in the Ethereum market to capitalize on the potential for further growth in Ethereum price strength. Remember to manage your risk appropriately.

Featured Posts

-

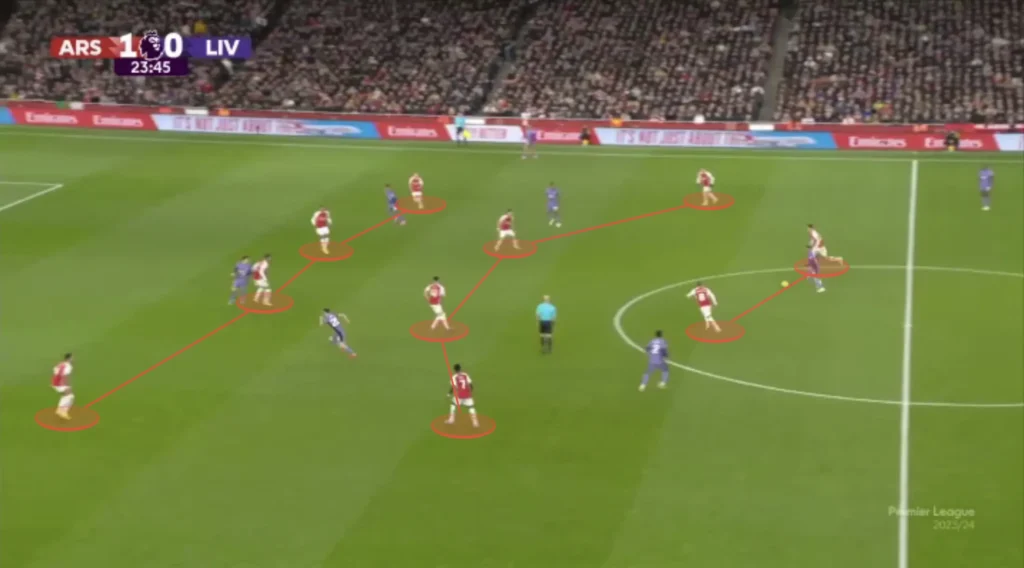

Pressure Builds On Arteta Latest Arsenal News And Analysis

May 08, 2025

Pressure Builds On Arteta Latest Arsenal News And Analysis

May 08, 2025 -

Uber Ceo Kalanick Admits Abandoning Project Name Was A Mistake

May 08, 2025

Uber Ceo Kalanick Admits Abandoning Project Name Was A Mistake

May 08, 2025 -

Superman Footage A Deeper Look Beyond Kryptos Show Stopping Moment

May 08, 2025

Superman Footage A Deeper Look Beyond Kryptos Show Stopping Moment

May 08, 2025 -

Lyon Sufre Derrota Local Ante El Psg

May 08, 2025

Lyon Sufre Derrota Local Ante El Psg

May 08, 2025 -

Another Aircraft Lost Second Us Navy Jet Goes Down Near Truman Carrier

May 08, 2025

Another Aircraft Lost Second Us Navy Jet Goes Down Near Truman Carrier

May 08, 2025