Euronext Amsterdam Market Reaction: 8% Stock Increase After Trump's Tariff Announcement

Table of Contents

Understanding Trump's Tariff Announcement and its Initial Market Predictions

The specific tariff announcement on October 26, 2023, targeted the European steel and aluminum industries. Analysts widely predicted negative consequences for European markets, particularly impacting Euronext Amsterdam's industrial sector. The anticipated impact was significant, leading to widespread concern among investors.

- Negative predictions: Most analysts foresaw a decline in stock prices across various sectors.

- Expected stock declines: Forecasts pointed towards a potential drop of 2-5% in the Euronext Amsterdam index.

- Analyst quotes predicting losses: Several leading financial experts publicly voiced concerns about the negative impact of the tariffs, fueling bearish sentiment.

Keywords: Trump tariffs, tariff announcement impact, market predictions, Euronext Amsterdam forecasts

The Unexpected 8% Surge on Euronext Amsterdam: A Detailed Analysis

Despite the negative predictions, the Euronext Amsterdam market experienced an astonishing 8% increase. This surge was particularly noticeable in steel and aluminum-related stocks, but the overall market index benefited from the unexpected positive sentiment.

- Specific stock performance examples: ASML Holding, a major player in the semiconductor industry, saw a 10% increase, while ArcelorMittal, a significant steel producer, surprisingly rose by 7%.

- Trading volume changes: Trading volumes increased significantly, suggesting heightened investor activity driven by the unexpected market movement.

- Time of day when the surge occurred: The majority of the price increase happened within the first hour of trading, indicating a rapid market response.

Keywords: Euronext Amsterdam stock surge, market volatility, stock market gains, unexpected market reaction

Potential Reasons Behind the Positive Market Reaction

The positive Euronext Amsterdam market reaction to the tariff announcement is puzzling, given the initially anticipated negative consequences. Several potential explanations exist:

- Unrelated positive economic news: Positive economic data released concurrently might have overshadowed the impact of the tariff announcement, boosting overall investor confidence.

- Market anticipation of the announcement: The market may have already priced in the anticipated negative effects of the tariffs, leading to a positive surprise when the actual impact proved less severe.

- Specific industry resilience to tariff impacts: Certain industries might have demonstrated unexpected resilience to the tariff impacts, mitigating the overall negative effects on the market.

- Investor confidence despite the tariffs: A general sense of optimism and investor confidence could have fueled the surge, overriding concerns about the tariffs.

Keywords: market analysis, positive market sentiment, economic indicators, investor confidence, unexpected market response

Long-Term Implications for Euronext Amsterdam and European Markets

The unexpected surge and its underlying reasons have significant long-term implications for Euronext Amsterdam and broader European markets:

- Continued market volatility: The incident underscores the inherent volatility of the market and the difficulty of predicting its behavior accurately.

- Potential future tariff announcements and their impact: Future tariff announcements will likely be scrutinized more carefully, leading to heightened market sensitivity.

- Investor strategies in response to the situation: Investors may adjust their strategies to incorporate the unpredictable nature of market responses to major news events.

Keywords: long-term market outlook, future market trends, investment strategies, European market analysis

Conclusion: Understanding the Euronext Amsterdam Market Reaction and its Significance

The 8% increase in the Euronext Amsterdam market following Trump's tariff announcement was a surprising and significant event. While several factors might have contributed to this positive Euronext Amsterdam market reaction, the incident highlights the unpredictable nature of market behavior and the need for careful analysis of news events and their potential impacts. Understanding these complex interactions is crucial for effective investment strategies. Stay informed about future Euronext Amsterdam market reactions by subscribing to our newsletter for regular updates and insightful analysis! Follow us on social media for the latest market news and in-depth reports on Euronext Amsterdam's stock performance.

Featured Posts

-

Skolko Let Geroyam V Filme O Bednom Gusare Zamolvite Slovo Razbor Vozrastov Personazhey

May 25, 2025

Skolko Let Geroyam V Filme O Bednom Gusare Zamolvite Slovo Razbor Vozrastov Personazhey

May 25, 2025 -

Carmen Joy Crookes New Single

May 25, 2025

Carmen Joy Crookes New Single

May 25, 2025 -

Lyudi Lyubyat Schekotat Nervy Fedor Lavrov O Pavle I I Trillerakh

May 25, 2025

Lyudi Lyubyat Schekotat Nervy Fedor Lavrov O Pavle I I Trillerakh

May 25, 2025 -

F1 Motorral Hajtott Porsche Teljesitmeny Es Luxus Az Utakon

May 25, 2025

F1 Motorral Hajtott Porsche Teljesitmeny Es Luxus Az Utakon

May 25, 2025 -

The Perils Of Dissent When Seeking Change Leads To Punishment

May 25, 2025

The Perils Of Dissent When Seeking Change Leads To Punishment

May 25, 2025

Latest Posts

-

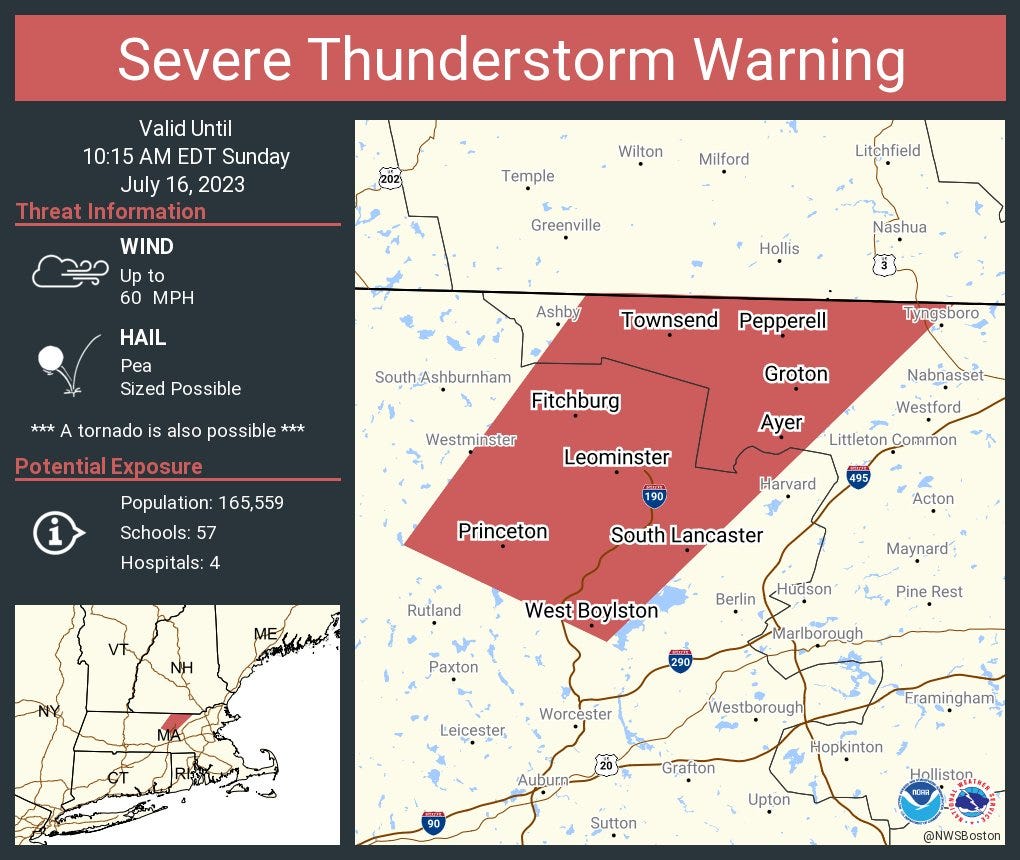

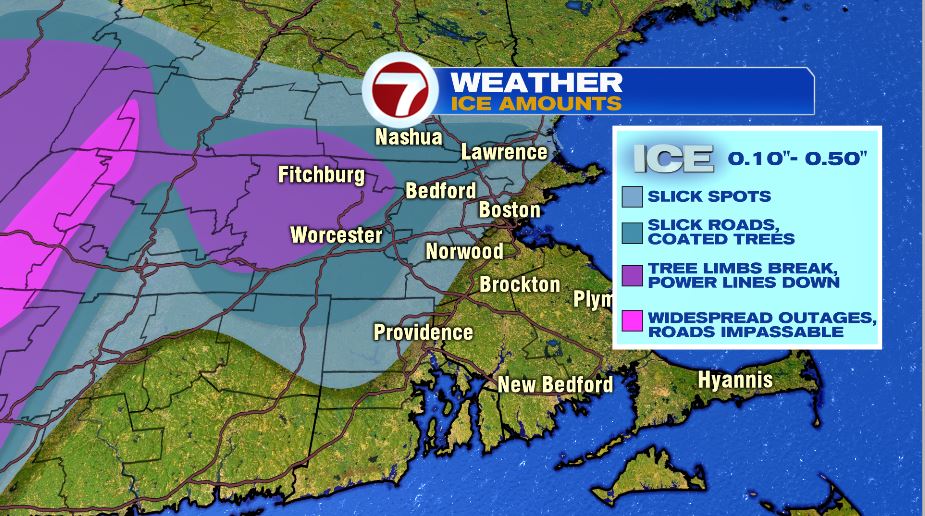

Severe Thunderstorms Bring Flash Flood Threat To Hampshire And Worcester Counties

May 25, 2025

Severe Thunderstorms Bring Flash Flood Threat To Hampshire And Worcester Counties

May 25, 2025 -

Hampshire And Worcester Counties Under Flash Flood Warning Thursday

May 25, 2025

Hampshire And Worcester Counties Under Flash Flood Warning Thursday

May 25, 2025 -

Flash Flood Warning Hampshire And Worcester Counties Thursday Night

May 25, 2025

Flash Flood Warning Hampshire And Worcester Counties Thursday Night

May 25, 2025 -

Pennsylvania Under Flash Flood Warning Thursday Morning Impacts Predicted

May 25, 2025

Pennsylvania Under Flash Flood Warning Thursday Morning Impacts Predicted

May 25, 2025 -

Coastal Flooding Southeast Pa Under Advisory Wednesday

May 25, 2025

Coastal Flooding Southeast Pa Under Advisory Wednesday

May 25, 2025