Euronext Amsterdam Stock Market: 8% Increase Following Tariff Delay

Table of Contents

The Tariff Delay: A Catalyst for Growth

The delay in implementing several proposed tariffs, primarily affecting the steel and agricultural sectors, acted as a powerful catalyst for growth within the Euronext Amsterdam Stock Market. These tariffs, initially slated for implementation at the beginning of the quarter, were postponed due to ongoing negotiations between the European Union and several trading partners. This uncertainty had created considerable market volatility in the preceding weeks, so the delay brought a welcome sense of relief.

- Delayed steel tariffs: Averted a potential downturn in the Dutch steel industry, boosting confidence among steel producers listed on the Euronext Amsterdam Stock Market. This sector had been bracing for significant price increases and decreased competitiveness.

- Postponement of agricultural tariffs: Significantly boosted investor confidence in related sectors, particularly food processing and export companies. The delay reduced the risk of reduced exports and lower profit margins.

- Uncertainty remains: While the delay is positive, uncertainty surrounding the future of these tariffs remains a significant factor. The possibility of future implementations continues to cast a shadow over long-term investment strategies within the Euronext Amsterdam Stock Market.

Market Reaction and Investor Sentiment

The immediate market reaction to the tariff delay was swift and dramatic. The Euronext Amsterdam Stock Market experienced an 8% increase within the first trading session following the announcement, indicating a strong positive response from investors. This surge reflects a significant shift in investor sentiment, characterized by increased optimism and a reduction in risk aversion.

- Increased trading volume: A notable increase in trading volume was observed immediately following the announcement, suggesting heightened investor activity and confidence in the market's future.

- Positive analyst commentary: Leading financial analysts offered positive commentary, reflecting an improved outlook for the Dutch economy and the Euronext Amsterdam Stock Market. Many revised their growth forecasts upwards.

- Foreign investment uptick: The delay also led to a notable uptick in foreign investment, suggesting that international investors view the Dutch market as more attractive following the positive news.

Impact on Key Sectors within the Euronext Amsterdam Stock Market

The impact of the tariff delay wasn't uniform across all sectors within the Euronext Amsterdam Stock Market. While the overall market saw significant gains, some sectors performed better than others.

- Technology stocks: Experienced disproportionately high gains, reflecting their generally robust performance and reduced sensitivity to trade disputes. The sector benefited from the improved overall market sentiment.

- Financial institutions: Saw a moderate increase in their stock prices, indicating a cautious but optimistic response to the news. The sector's performance was relatively muted compared to technology.

- Energy sector: Remained relatively stable, showcasing a lower degree of sensitivity to short-term trade policy changes. The sector's performance remained steady throughout the period.

Long-Term Implications and Future Outlook for the Euronext Amsterdam Stock Market

While the 8% surge is undeniably positive, the long-term implications of the tariff delay and its effect on the Euronext Amsterdam Stock Market remain uncertain. The future course of trade negotiations and the potential re-implementation of tariffs will significantly influence market performance.

- Continued positive growth: Continued positive growth in the Euronext Amsterdam Stock Market will hinge on sustained economic stability within the Netherlands and the wider European Union.

- Future tariff decisions: Future tariff decisions could significantly impact market performance, either positively or negatively. Close monitoring of trade negotiations is crucial.

- Geopolitical factors: Geopolitical factors remain a key source of uncertainty, with global events potentially influencing investor sentiment and market volatility within the Euronext Amsterdam Stock Market.

Conclusion

The 8% surge in the Euronext Amsterdam Stock Market following the tariff delay highlights the significant impact of trade policy on market performance. The event spurred increased investor confidence and positive sentiment, impacting various sectors. However, the long-term outlook remains dependent on various factors, including future policy decisions and broader economic conditions.

Call to Action: Stay informed on the latest developments affecting the Euronext Amsterdam Stock Market and the wider European economy. Understanding these dynamics is crucial for making informed investment decisions within the Euronext Amsterdam Stock Market. Monitor news and analysis to navigate the complexities of this dynamic market and capitalize on future opportunities within the Euronext Amsterdam Stock Market.

Featured Posts

-

Konchita Vurst Prognoz Pobediteley Evrovideniya 2025

May 24, 2025

Konchita Vurst Prognoz Pobediteley Evrovideniya 2025

May 24, 2025 -

Boosting Collaboration Bangladeshs Economic Growth Strategy In Europe

May 24, 2025

Boosting Collaboration Bangladeshs Economic Growth Strategy In Europe

May 24, 2025 -

The Ultimate Guide To An Escape To The Country

May 24, 2025

The Ultimate Guide To An Escape To The Country

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025 -

The Nfls War On Butts A Look At The Tush Push Controversy And Its Resolution

May 24, 2025

The Nfls War On Butts A Look At The Tush Push Controversy And Its Resolution

May 24, 2025

Latest Posts

-

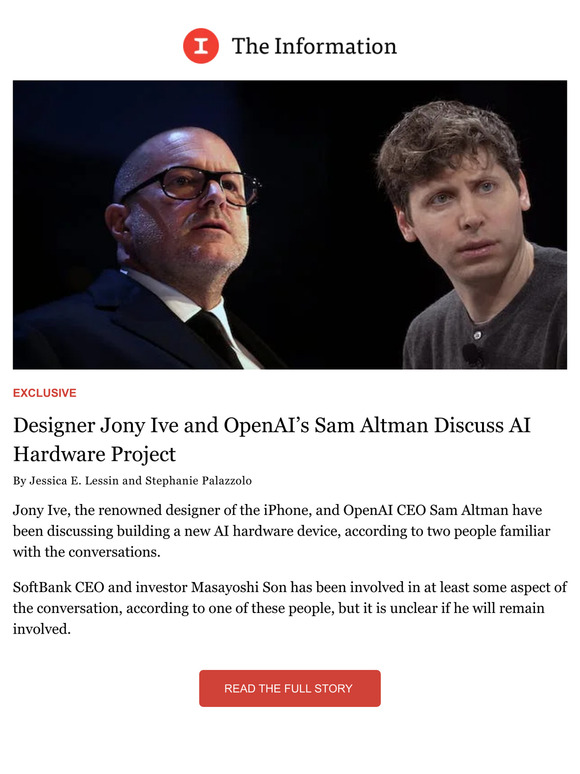

The Exclusive Collaboration Between Sam Altman And Jony Ive A New Device

May 24, 2025

The Exclusive Collaboration Between Sam Altman And Jony Ive A New Device

May 24, 2025 -

Universals Epic 7 Billion Investment Escalating The Theme Park Arms Race Against Disney

May 24, 2025

Universals Epic 7 Billion Investment Escalating The Theme Park Arms Race Against Disney

May 24, 2025 -

Exclusive Sam Altman And Jony Ives Undisclosed Project Details Revealed

May 24, 2025

Exclusive Sam Altman And Jony Ives Undisclosed Project Details Revealed

May 24, 2025 -

Universals 7 Billion Theme Park A New Era In The Disney Universal Rivalry

May 24, 2025

Universals 7 Billion Theme Park A New Era In The Disney Universal Rivalry

May 24, 2025 -

From Tik Tok To Dancing With The Stars Alix Earles Influencer Marketing Strategy

May 24, 2025

From Tik Tok To Dancing With The Stars Alix Earles Influencer Marketing Strategy

May 24, 2025