European Market Midday Briefing: Analyzing The Impact Of PMI Data On Stocks

Table of Contents

Understanding Purchasing Managers' Index (PMI) Data

What is the PMI and why is it important?

The Purchasing Managers' Index (PMI) is a leading economic indicator that measures the activity levels of purchasing managers within the manufacturing and services sectors. It provides a valuable snapshot of the current economic climate and offers insights into future trends. A higher PMI suggests expansion, while a lower PMI indicates contraction. Its importance stems from its ability to predict future economic growth and its impact on stock markets. Different PMI components offer a comprehensive view:

- Manufacturing PMI: Tracks the health of the manufacturing sector, focusing on factors like production, new orders, and employment.

- Services PMI: Monitors the performance of the service sector, encompassing areas such as retail, finance, and hospitality.

- Composite PMI: Combines manufacturing and services data to provide a broader overview of the overall economy.

Major sources for PMI data include IHS Markit, providing comprehensive coverage of various European economies.

Deciphering PMI Data – What constitutes positive and negative signals?

The PMI is presented as a number on a scale of 0 to 100. A reading above 50 indicates expansion, meaning the economy is growing, while a reading below 50 signals contraction or economic slowdown. The magnitude of the change is also significant:

- Sharp Increase: Suggests a robust economic expansion and can positively impact stock markets, particularly in related sectors.

- Sharp Decline: Indicates a potential economic downturn, often leading to market volatility and potential sell-offs.

- Slight Changes: Minor fluctuations around 50 might suggest a period of stability or stagnation.

Historically, sharp increases in PMI have correlated with upward trends in European stocks, while significant declines have often preceded market corrections. For example, the sharp drop in PMI in early 2020 mirrored the initial market reaction to the COVID-19 pandemic.

Impact of PMI Data on Specific European Stock Sectors

Analyzing Sectoral Response: Which sectors are most sensitive to PMI changes?

Different sectors exhibit varying sensitivities to PMI fluctuations. Some are more directly tied to the economic cycle than others:

- Manufacturing: Highly sensitive, directly impacted by production levels and new orders reflected in the PMI. Companies like Airbus (France) and Volkswagen (Germany) are prime examples.

- Technology: While less directly tied, strong economic growth often fuels tech investment, creating opportunities. Consider companies like ASML Holding (Netherlands).

- Consumer Discretionary: Sensitive to consumer confidence, which often mirrors broader economic health indicated by PMI. Luxury goods companies are particularly affected.

[Insert chart/graph visualizing the relationship between PMI and different sector performances]

Regional Variations: How do PMI data impact different European markets?

PMI data often shows regional variations across Europe, reflecting economic differences:

- Germany: Often considered a bellwether for the Eurozone due to its manufacturing strength. A decline in German PMI often foreshadows wider European weakness.

- France: Possesses a more diversified economy, showing somewhat less sensitivity to manufacturing PMI fluctuations than Germany.

- UK: Facing its own unique challenges post-Brexit, PMI data reflects the UK's independent economic trajectory.

- Italy & Spain: These economies show more sensitivity to shifts in consumer confidence and tourism, often lagging behind manufacturing-driven indicators.

[Insert comparative data showing regional differences in PMI response] These disparities highlight the importance of considering regional factors when interpreting PMI data and making investment decisions for specific European markets.

Strategic Investment Implications based on PMI Data

Opportunities and Risks for Investors:

PMI data offers valuable insights for investment strategies:

- Sector Rotation: Shift investments toward sectors expected to benefit most from PMI changes (e.g., moving into manufacturing stocks during periods of PMI expansion).

- Hedging: Employ strategies to mitigate losses during periods of PMI decline.

- Diversification: Spread investments across different sectors and geographical locations to reduce overall risk.

Risks: Relying solely on PMI data is risky. Other factors, such as geopolitical events and interest rate changes, significantly influence markets.

Trading Strategies in response to PMI Releases:

Some traders employ short-term strategies around PMI releases (Disclaimer: Short-term trading involves high risk). However, understanding market sentiment is crucial. Technical analysis, combined with fundamental analysis (such as PMI), aids in predicting short-term price movements.

Conclusion: European Market Midday Briefing: Key Takeaways and Next Steps

This European Market Midday Briefing highlights the significant influence of PMI data on European stock markets. Understanding PMI components, deciphering its signals, and recognizing sectoral and regional variations are essential for informed investment decisions. While PMI provides valuable insights, it's crucial to consider it alongside other economic indicators and market sentiment.

Stay informed on market trends by regularly checking our European Market Midday Briefing for the latest insights into PMI data and its influence on European stocks. Understanding the intricacies of PMI and its implications empowers you to make smarter investment choices within the dynamic European market. [Optional: Link to subscription service or further resources here]

Featured Posts

-

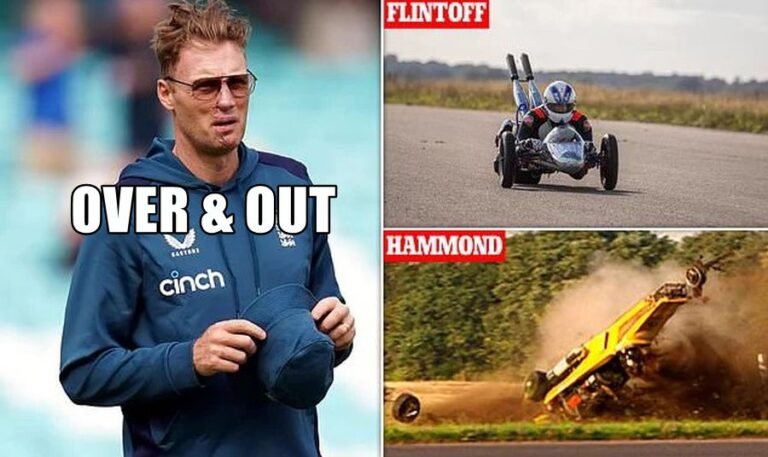

Freddie Flintoffs Accident A Disney Documentary Tells The Story

May 23, 2025

Freddie Flintoffs Accident A Disney Documentary Tells The Story

May 23, 2025 -

In Stock Cat Deeleys Midi Dress At Marks And Spencer

May 23, 2025

In Stock Cat Deeleys Midi Dress At Marks And Spencer

May 23, 2025 -

El Derbi En Memes Canada Vs Mexico Liga De Naciones Concacaf

May 23, 2025

El Derbi En Memes Canada Vs Mexico Liga De Naciones Concacaf

May 23, 2025 -

Netflixs Cobra Kai Direct Lineage To The Karate Kid Franchise

May 23, 2025

Netflixs Cobra Kai Direct Lineage To The Karate Kid Franchise

May 23, 2025 -

Bangladesh Vs Zimbabwe First Test A Tense Encounter

May 23, 2025

Bangladesh Vs Zimbabwe First Test A Tense Encounter

May 23, 2025

Latest Posts

-

Kartels Security Measures Police Source Sheds Light Trinidad And Tobago Newsday

May 23, 2025

Kartels Security Measures Police Source Sheds Light Trinidad And Tobago Newsday

May 23, 2025 -

Barclay Center Concert Vybz Kartels Nyc April Performance Confirmed

May 23, 2025

Barclay Center Concert Vybz Kartels Nyc April Performance Confirmed

May 23, 2025 -

Police Source Kartel Restrictions For His Own Protection Trinidad And Tobago Newsday

May 23, 2025

Police Source Kartel Restrictions For His Own Protection Trinidad And Tobago Newsday

May 23, 2025 -

Weekend Events A Blend Of Fashion Heritage Ballet And Puns

May 23, 2025

Weekend Events A Blend Of Fashion Heritage Ballet And Puns

May 23, 2025 -

Kartels Restrictions A Necessary Safety Measure Trinidad And Tobago Newsday

May 23, 2025

Kartels Restrictions A Necessary Safety Measure Trinidad And Tobago Newsday

May 23, 2025