Evaluating Palantir After A Significant 30% Price Correction

Table of Contents

Understanding the 30% Price Drop: Causes and Context

The recent 30% Palantir stock price correction is a multifaceted issue stemming from a confluence of factors. It's not solely attributable to one event but rather a combination of macroeconomic headwinds and company-specific concerns. Understanding these contributing factors is crucial to evaluating the current investment climate.

-

Impact of macroeconomic factors (inflation, interest rates): Rising inflation and subsequent interest rate hikes by central banks globally have created a challenging environment for growth stocks, particularly those with high valuations and less immediate profitability. Palantir, with its focus on long-term growth, has been particularly susceptible to this broader market downturn. Investors are shifting towards more conservative investments offering immediate returns.

-

Analysis of recent earnings reports and their effect on investor confidence: Recent earnings reports, while showing growth, might have fallen short of overly optimistic analyst expectations. Any deviation from projected revenue or profit margins can trigger significant sell-offs in the volatile tech sector. A careful review of the specific numbers and management commentary is essential.

-

Competition in the big data analytics market: The big data analytics market is fiercely competitive, with established tech giants like Microsoft, Google, and Amazon offering powerful competing solutions. Maintaining a competitive edge requires continuous innovation and significant investment, which can impact short-term profitability.

-

Influence of short-selling activity: Short-selling, where investors bet against a stock's price, can exacerbate downward price pressure. High short interest can contribute to a rapid decline, particularly in volatile situations.

Palantir's Fundamentals: A Deep Dive

Analyzing Palantir's financial health is critical to understanding the true value proposition post-correction. While the Palantir stock price correction might seem alarming, a closer look at the fundamentals can reveal a different story.

-

Revenue growth trajectory and its sustainability: Palantir has demonstrated consistent revenue growth, driven by both its government and commercial businesses. The sustainability of this growth depends on securing new contracts and expanding its client base across diverse sectors.

-

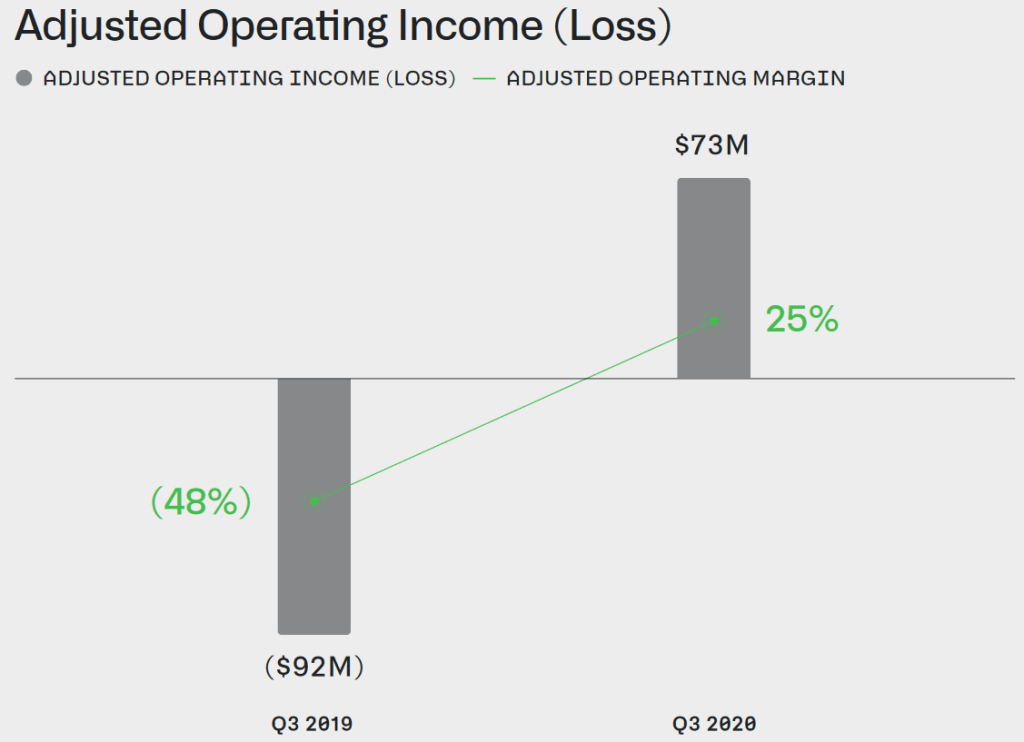

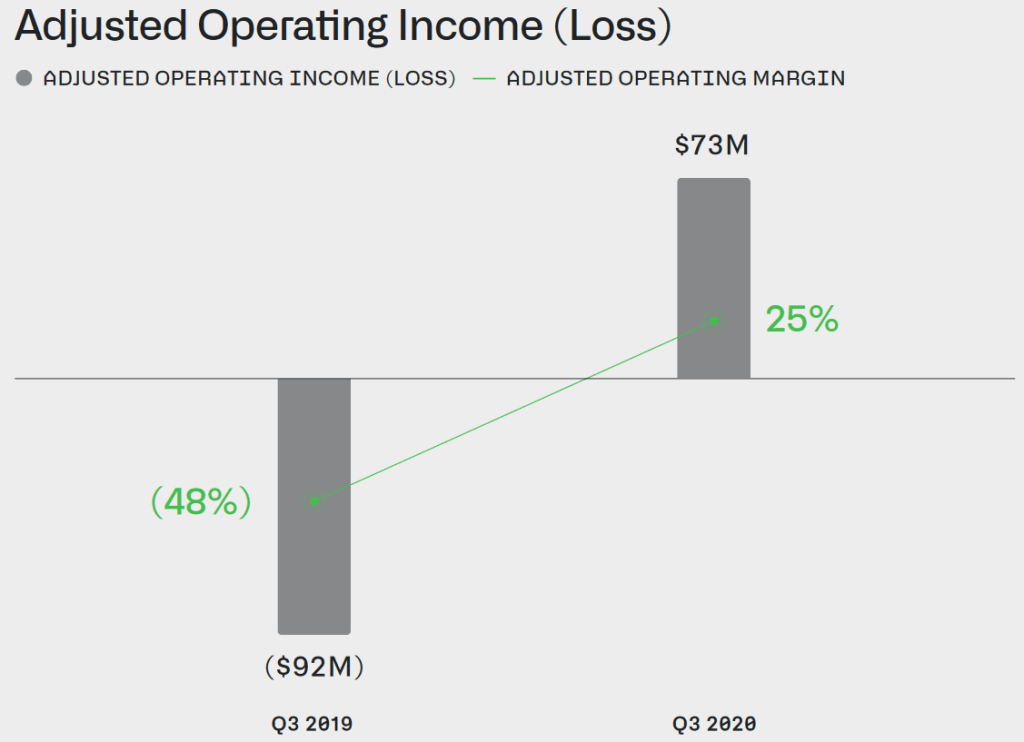

Profitability margins and their potential for improvement: While Palantir is not yet consistently profitable, its margins are improving. Analyzing the trends in operating expenses and their relation to revenue growth provides insight into the company's path to profitability.

-

Cash flow generation and its implications for future investments: Strong cash flow generation is vital for future investments in research and development, acquisitions, and expansion into new markets. Analyzing free cash flow is a key metric to assess the company's financial strength.

-

Debt-to-equity ratio and its implications for financial stability: A healthy debt-to-equity ratio indicates a strong financial foundation. A high ratio could pose risks, especially during economic downturns.

Assessing Palantir's Long-Term Growth Potential

Despite the recent Palantir stock price correction, Palantir retains significant long-term growth potential fueled by its unique position in the data analytics market.

-

Market share within the government and commercial sectors: Palantir holds a considerable market share in government contracts, particularly in defense and intelligence. Expanding its commercial presence across various industries represents a key growth driver.

-

Technological innovation and its competitive advantage: Palantir's proprietary software and AI capabilities offer a competitive advantage in data integration, analysis, and visualization. Continuous innovation is crucial for maintaining this edge.

-

Expansion plans into new markets and verticals: Diversification into new markets and vertical sectors reduces reliance on any single customer segment and mitigates risk. Strategic expansion plans are vital for long-term growth.

-

Potential for strategic partnerships and acquisitions: Strategic partnerships and acquisitions can accelerate growth by expanding market reach, adding new technologies, and strengthening the overall platform.

Risk Assessment: Factors to Consider Before Investing

Investing in Palantir, even after the correction, carries inherent risks that need careful consideration.

-

High valuation concerns (even after the correction): While the Palantir stock price correction has reduced the valuation, it may still be considered high relative to its current profitability.

-

Dependence on government contracts: A significant portion of Palantir's revenue comes from government contracts, making it vulnerable to changes in government spending priorities or geopolitical events.

-

Competition from established tech giants: The competitive landscape remains intense, with established tech giants constantly innovating and expanding their offerings.

-

Geopolitical risks affecting government contracts: Geopolitical instability can impact the timing and value of government contracts, creating uncertainty in revenue streams.

Conclusion

The 30% Palantir stock price correction presents a complex investment scenario. While the correction has lowered the valuation, considerable risks remain. The company's strong revenue growth, technological capabilities, and expansion plans suggest long-term potential. However, the macroeconomic environment, competition, and dependence on government contracts are significant factors to consider. A thorough due diligence process, weighing the potential benefits against the risks, is crucial before making any investment decisions. Conduct further research on the Palantir stock price correction and its implications before investing. Carefully consider your risk tolerance before acting on this information. Remember to consult with a financial advisor for personalized investment guidance related to Palantir stock.

Featured Posts

-

Watters Controversial Joke Fox News Host Called A Hypocrite

May 09, 2025

Watters Controversial Joke Fox News Host Called A Hypocrite

May 09, 2025 -

Indian Stock Market Sensex Nifty And Key Stock Updates Date

May 09, 2025

Indian Stock Market Sensex Nifty And Key Stock Updates Date

May 09, 2025 -

Alaskas Fur Rondy Mushers Persevere Despite Shorter Race

May 09, 2025

Alaskas Fur Rondy Mushers Persevere Despite Shorter Race

May 09, 2025 -

Tien Giang Xu Ly Nghiem Vu Bao Mau Bao Hanh Tre Em Dam Bao An Toan Cho Tre

May 09, 2025

Tien Giang Xu Ly Nghiem Vu Bao Mau Bao Hanh Tre Em Dam Bao An Toan Cho Tre

May 09, 2025 -

Benson Boone Vs Harry Styles Addressing The Plagiarism Claims

May 09, 2025

Benson Boone Vs Harry Styles Addressing The Plagiarism Claims

May 09, 2025