Evaluating Uber Technologies (UBER) As An Investment

Table of Contents

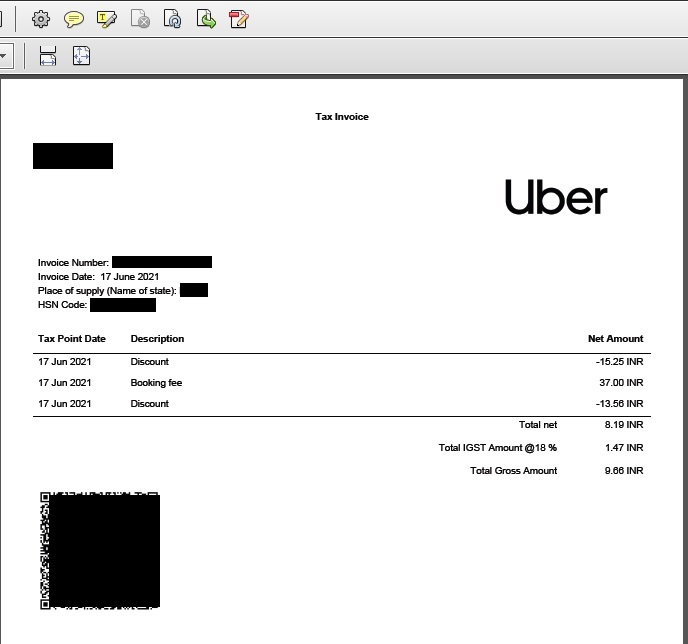

Uber's Financial Performance and Profitability

Revenue Growth and Trends

Uber's revenue growth has been significant, driven by its diverse business model. The company generates revenue from several key streams:

- Ride-hailing: This remains Uber's core business, though its growth rate has fluctuated with economic conditions and the rise of competitors.

- Uber Eats: The food delivery segment has experienced substantial growth, particularly during the pandemic, and continues to be a major revenue contributor.

- Freight: Uber Freight is a relatively newer segment but shows promise in expanding the company's logistics capabilities and revenue streams.

While Uber has demonstrated impressive revenue growth historically, analyzing the growth rates across these different segments is crucial. Seasonality also plays a role, with higher demand during peak travel times and holidays. Factors impacting revenue include intense competition, fluctuating fuel prices, economic downturns, and regulatory changes that affect pricing and operations. Analyzing historical data and forecasting future revenue based on these factors is essential for a thorough Uber Technologies (UBER) investment assessment.

Profitability and Margins

Achieving consistent profitability has been a challenge for Uber. While revenue has grown substantially, the company has often reported net losses. Key metrics to analyze include:

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): Provides insights into operational profitability, excluding the effects of financing and accounting choices.

- Net Income: The bottom line, reflecting profitability after all expenses and taxes.

- Operating Margins: Indicate the efficiency of Uber's operations and its ability to translate revenue into profit.

Uber's path to profitability involves managing expenses, optimizing pricing strategies, and improving operational efficiency. Driver compensation, marketing costs, and substantial technology investments represent significant expenses. Comparing Uber's profitability metrics with those of its competitors, like Lyft and DoorDash, offers valuable context and helps assess its relative financial health and competitive positioning within the broader transportation and delivery industries.

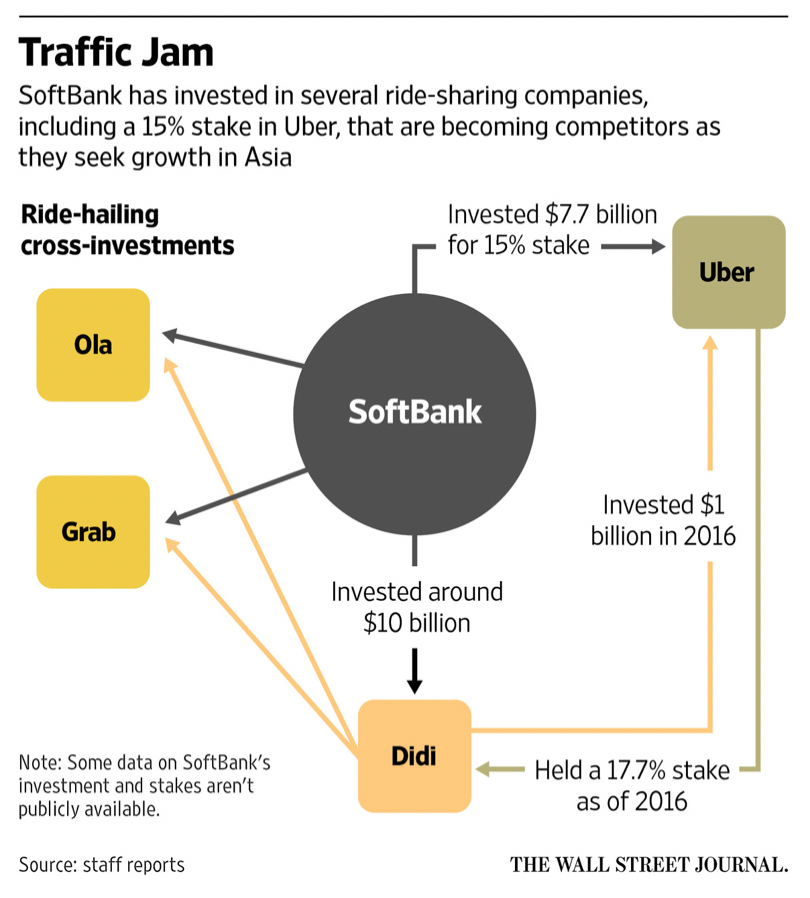

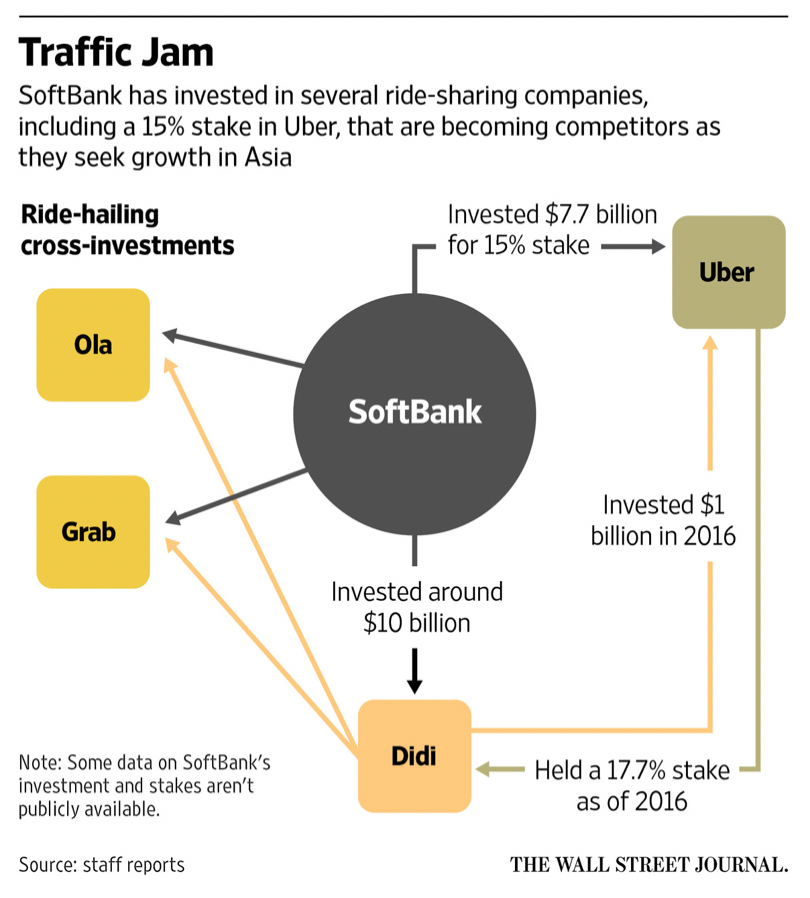

Market Position and Competitive Landscape

Market Share and Dominance

Uber holds a significant market share in the ride-hailing and food delivery sectors globally, but its dominance varies by region and market segment. Key aspects to consider include:

- Geographical penetration: Uber's presence in various countries and cities significantly impacts its market reach and overall market share.

- Competitive advantages: These could include brand recognition, technological superiority, extensive driver networks, and efficient logistics systems.

- Market leadership: Uber's position as a market leader (or challenger) in different segments impacts its growth potential and pricing power.

Comparing Uber's market share with key competitors like Lyft (in ride-hailing) and DoorDash (in food delivery) allows for a comprehensive understanding of its competitive strength and market positioning. The intensity of competition varies across different geographic regions and service categories.

Competitive Advantages and Threats

Uber's strengths include its extensive network effects, strong brand recognition, and continuous investment in technology. However, it faces significant threats:

- Intense competition: The ride-hailing and food delivery sectors are highly competitive, with established players and new entrants constantly challenging Uber's market position.

- Regulatory hurdles: Varying regulations across different jurisdictions pose a significant challenge to Uber's operations and profitability.

- Disruptive technologies: The emergence of autonomous vehicles and other innovative technologies could disrupt Uber's business model.

Analyzing these competitive advantages and threats is crucial for evaluating the long-term viability of an Uber Technologies (UBER) investment.

Future Growth Potential and Long-Term Outlook

Growth Strategies and Expansion Plans

Uber's growth strategies focus on various avenues:

- Expansion into new markets: Entering new geographic areas remains a key growth driver, although this expansion requires careful consideration of regulatory landscapes and local market conditions.

- New service offerings: Expanding beyond ride-hailing and food delivery into areas like autonomous vehicles, freight, and other mobility services offers opportunities for diversification and growth.

- Technological advancements: Investing in technology, such as improving its ride-matching algorithms and developing autonomous driving capabilities, can enhance efficiency and customer experience.

The feasibility and associated risks of these strategies require careful assessment. For instance, the development and deployment of autonomous vehicles involves significant technological challenges and substantial capital investment.

Long-Term Investment Risks and Opportunities

Investing in Uber Technologies (UBER) involves both substantial opportunities and significant risks:

- Regulatory changes: Evolving regulations globally can impact Uber's operations and pricing strategies.

- Economic downturns: Recessions can reduce consumer spending on ride-hailing and food delivery services.

- Technological disruptions: The emergence of new technologies could render Uber's current business model obsolete.

- Competition: The highly competitive nature of the industry could limit Uber's ability to achieve and maintain high profitability.

However, the potential for significant returns on investment remains, considering Uber's vast market reach, brand recognition, and ongoing innovation. A balanced evaluation of these risks and opportunities is critical for any investor considering an Uber Technologies (UBER) investment.

Investing in Uber Technologies (UBER) – A Final Verdict

Our analysis shows that Uber Technologies (UBER) presents a complex investment case. While its revenue growth is impressive and its market position strong, consistent profitability remains a challenge. The company's future growth hinges on successful execution of its expansion plans and technological advancements, while navigating intense competition and regulatory hurdles.

While Uber Technologies (UBER) presents exciting investment potential, careful consideration of the factors discussed is crucial. Conduct your own research and consult with a financial advisor before making any investment decisions regarding UBER stock.

Featured Posts

-

Delhi And Mumbai Get Uber Pet Convenient Pet Travel

May 19, 2025

Delhi And Mumbai Get Uber Pet Convenient Pet Travel

May 19, 2025 -

Autonomous Ride Hailing Expands Waymo And Uber Launch In Austin

May 19, 2025

Autonomous Ride Hailing Expands Waymo And Uber Launch In Austin

May 19, 2025 -

Ufc 313 Star Concedes Opponent Deserved Victory Amidst Robbery Claims

May 19, 2025

Ufc 313 Star Concedes Opponent Deserved Victory Amidst Robbery Claims

May 19, 2025 -

Mumbais Uber Now Accepts Pets A Complete Booking Guide

May 19, 2025

Mumbais Uber Now Accepts Pets A Complete Booking Guide

May 19, 2025 -

Ufc 313 Controversy Surrounds Prelims Fight Result

May 19, 2025

Ufc 313 Controversy Surrounds Prelims Fight Result

May 19, 2025

Latest Posts

-

The Fsu Tragedy Exploring The Background Of A Deceased Employees Family

May 19, 2025

The Fsu Tragedy Exploring The Background Of A Deceased Employees Family

May 19, 2025 -

Florida State University Shooting A Victims Family History And The Cold War

May 19, 2025

Florida State University Shooting A Victims Family History And The Cold War

May 19, 2025 -

The Morales Knockout Ufc Fighters React To Vegas 106 Headliner

May 19, 2025

The Morales Knockout Ufc Fighters React To Vegas 106 Headliner

May 19, 2025 -

Analyzing Michael Morales Performance At Ufc Vegas 106

May 19, 2025

Analyzing Michael Morales Performance At Ufc Vegas 106

May 19, 2025 -

Ufc Fight Night 222 Burns Vs Morales Full Event Details

May 19, 2025

Ufc Fight Night 222 Burns Vs Morales Full Event Details

May 19, 2025