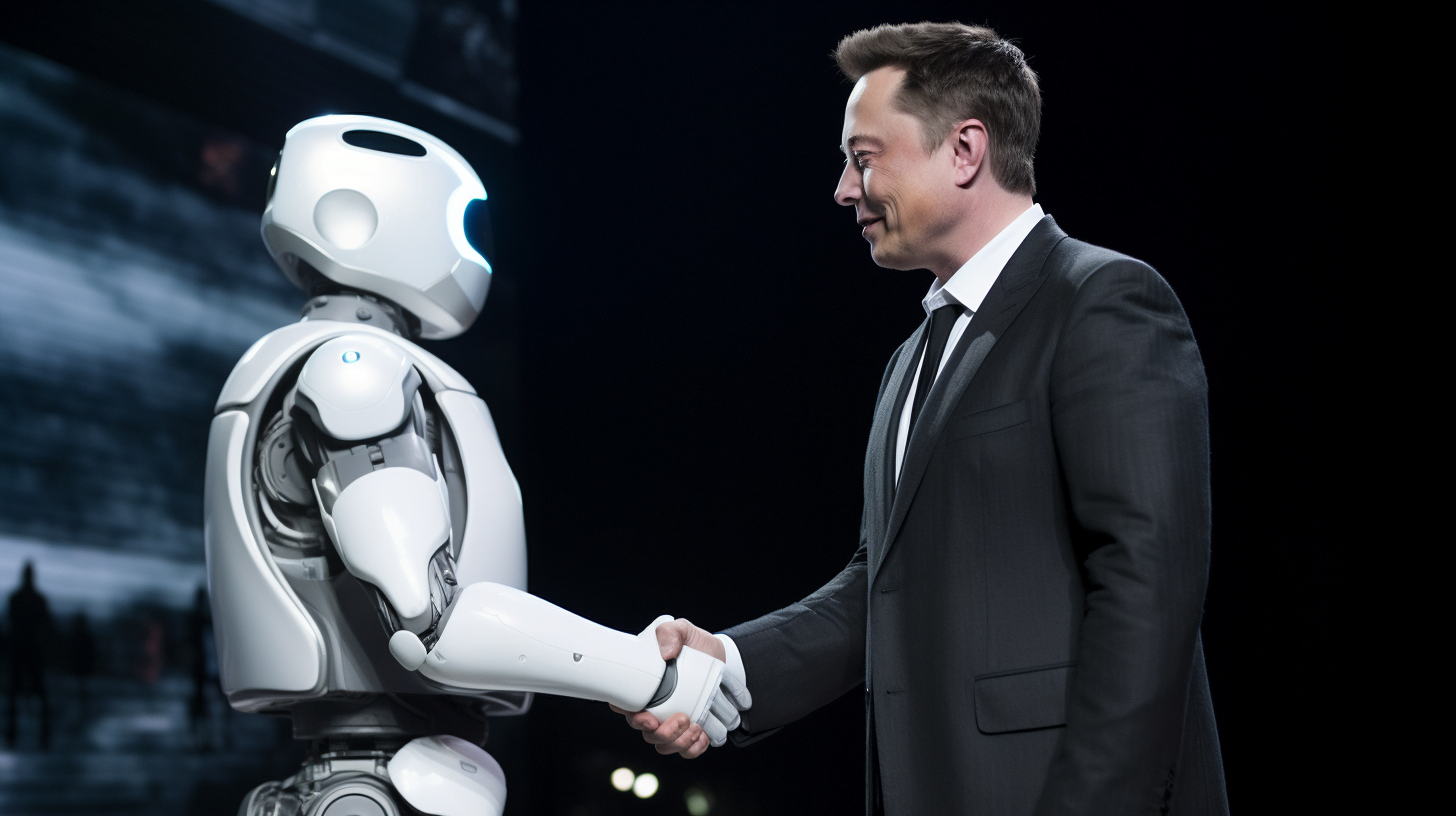

Exclusive: Final Sale Of Elon Musk's X Debt By Wall Street Banks

Table of Contents

Participating Wall Street Banks and their Roles

Several major Wall Street banks played crucial roles in the restructuring and subsequent sale of Elon Musk's X debt. This high-stakes operation involved a complex web of financial instruments and required significant expertise in debt management.

- Goldman Sachs: Reportedly acted as the lead advisor, guiding the process and managing negotiations with potential buyers. Their deep experience in high-yield debt markets proved invaluable.

- JPMorgan Chase: Likely played a significant role in structuring the debt and managing the syndication process, distributing portions of the debt amongst other financial institutions.

- Bank of America: Potentially involved in providing secondary financing or underwriting portions of the debt package. Their broad reach and financial power made them a key player.

- Other Participants: While specific details may remain confidential, other major investment banks likely contributed to this complex financial maneuver. The scale of the debt required a collaborative effort.

The risks for these banks were substantial. The initial loan to Musk was considered high-risk, and the fluctuating value of X, coupled with Musk’s often unpredictable business decisions, introduced considerable uncertainty. However, the potential rewards—fees generated from the transaction and the possibility of a profitable resale—were significant enough to justify the participation. The successful sale of Elon Musk's X debt represents a major win for these Wall Street giants and underscores their expertise in navigating complex financial situations. Keywords: X debt sale, Wall Street banks, high-risk investment, debt restructuring.

The Sale Price and Terms of the Agreement

While the exact final sale price of Elon Musk's X debt remains partially undisclosed due to confidentiality agreements, market analysts estimate the deal closed for a figure significantly below the initial investment. This reflects the considerable risk associated with financing the acquisition of a major social media platform under Musk's leadership.

The terms of the agreement are likely complex, including provisions for repayment schedules, interest rates (possibly adjusted to account for the risk), and potential penalties for default. It's also highly plausible that the agreement includes safeguards for the purchasing banks to mitigate future losses. These clauses might include provisions related to X's revenue generation or Musk's personal guarantees. The details of these terms are likely to emerge gradually as more information becomes available. Keywords: Elon Musk debt, X acquisition debt, sale price, debt agreement.

Impact on X's Future and Musk's Finances

The sale of Elon Musk's X debt significantly impacts both the platform's future and Musk’s personal finances. The relief from a substantial debt burden could allow X to focus on operational improvements and strategic growth initiatives. This could translate to new product development, enhanced user experience, and potentially more effective advertising strategies.

For Elon Musk, the debt sale alleviates a significant financial pressure point. It frees up capital that could be channeled into his other ventures, such as Tesla and SpaceX. However, the financial terms of the sale – potentially involving a loss for Musk – might affect his overall net worth. The long-term consequences of this debt restructuring on Musk's financial landscape remain to be seen. Keywords: X platform future, Elon Musk net worth, X financial stability, Tesla, SpaceX.

The Broader Implications for Tech Investments

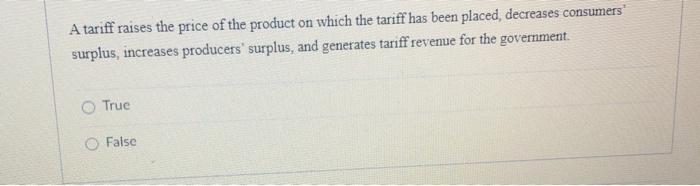

The successful (though possibly at a loss) sale of Elon Musk's X debt carries broader implications for the tech investment landscape. It highlights the increased risk associated with high-profile, high-growth tech companies, especially when financed through significant debt. The deal serves as a cautionary tale for investors and lenders alike, emphasizing the need for thorough due diligence and careful risk assessment before investing in such ventures.

The trend of debt financing in the tech industry has been rapidly evolving. While debt can fuel rapid growth, it also increases financial vulnerability. This deal will likely influence future funding rounds and investor decisions, leading to more stringent risk evaluations and potentially a shift towards alternative financing strategies for high-risk tech startups. Keywords: Tech investment, high-risk tech, venture capital, debt financing.

Conclusion

The final sale of Elon Musk's X debt marks a significant turning point for both the platform and its controversial owner. The involvement of major Wall Street banks, the estimated sale price, and the resulting impact on X's future and Musk's finances have wide-ranging implications. This deal underscores the complexities and risks inherent in financing ambitious tech acquisitions, influencing both investor confidence and future funding strategies in the industry. The long-term effects of this sale remain to be seen, but its impact on the tech world is undoubtedly substantial.

Call to Action: Stay informed about the latest developments in the world of finance and technology by subscribing to our newsletter for exclusive updates on Elon Musk's X and other high-profile deals. Learn more about the complexities of Elon Musk's X debt and similar high-risk investments. Follow us for continued coverage of the sale of Elon Musk's X debt.

Featured Posts

-

Top 5 Family Friendly Cruise Lines

May 01, 2025

Top 5 Family Friendly Cruise Lines

May 01, 2025 -

Retailers Brace For Tariff Price Increases

May 01, 2025

Retailers Brace For Tariff Price Increases

May 01, 2025 -

Gewelddadig Incident Van Mesdagkliniek Groningen Malek F Als Verdachte

May 01, 2025

Gewelddadig Incident Van Mesdagkliniek Groningen Malek F Als Verdachte

May 01, 2025 -

Remembering A Dallas Legend Passing At 100

May 01, 2025

Remembering A Dallas Legend Passing At 100

May 01, 2025 -

Royals Edge Guardians 4 3 Behind Garcia And Witts Offensive Power

May 01, 2025

Royals Edge Guardians 4 3 Behind Garcia And Witts Offensive Power

May 01, 2025

Latest Posts

-

Cavs 10 Game Winning Streak Continues With Overtime Victory Against Blazers

May 01, 2025

Cavs 10 Game Winning Streak Continues With Overtime Victory Against Blazers

May 01, 2025 -

Overtime Thriller Cavs Defeat Blazers 133 129 Hunter Scores 32

May 01, 2025

Overtime Thriller Cavs Defeat Blazers 133 129 Hunter Scores 32

May 01, 2025 -

Kinopoisk Otmechaet Rekord Ovechkina Soski S Ego Ulybkoy Dlya Malyshey

May 01, 2025

Kinopoisk Otmechaet Rekord Ovechkina Soski S Ego Ulybkoy Dlya Malyshey

May 01, 2025 -

Cleveland Cavaliers Defeat Portland Trail Blazers De Andre Hunters Impact On 10 Game Winning Streak

May 01, 2025

Cleveland Cavaliers Defeat Portland Trail Blazers De Andre Hunters Impact On 10 Game Winning Streak

May 01, 2025 -

Wayne Gretzkys Nhl Goal Record Tied By Alex Ovechkin Cp News Alert

May 01, 2025

Wayne Gretzkys Nhl Goal Record Tied By Alex Ovechkin Cp News Alert

May 01, 2025