Falling Iron Ore Prices: The Effect Of China's Steel Production Reduction

Table of Contents

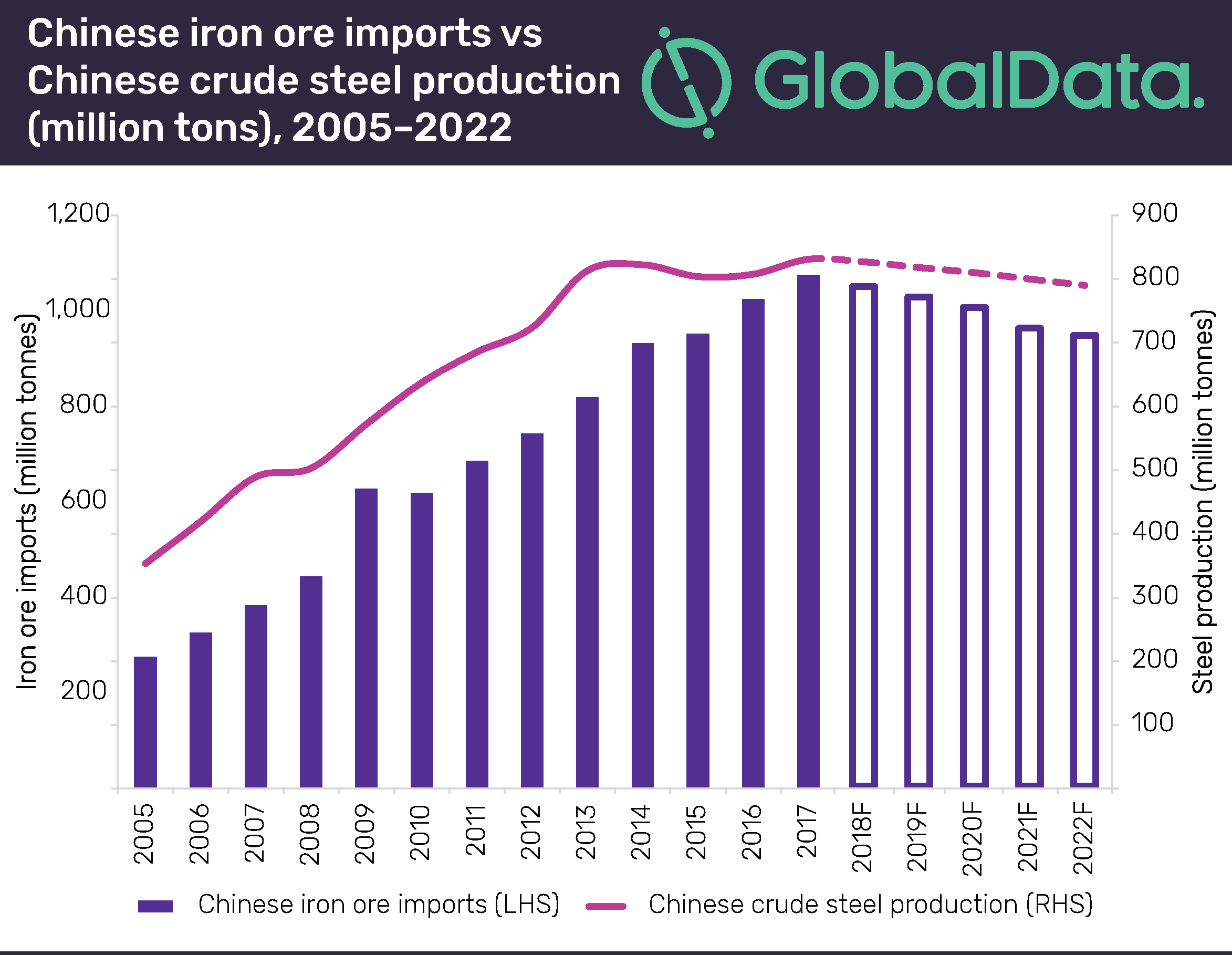

China's Steel Production Cuts: The Driving Force

China, the world's largest steel producer and iron ore consumer, has implemented stringent policies aimed at reducing its steel output. This initiative is driven primarily by ambitious environmental goals and a commitment to sustainable development. The government's strategy involves several key actions:

- Government regulations aimed at reducing carbon emissions: Stringent environmental regulations are forcing steel mills to adopt cleaner production methods, leading to reduced overall output. This includes limitations on the use of high-carbon coal and stricter emission standards.

- Crackdown on illegal steel production facilities: The Chinese government has cracked down on numerous unlicensed and inefficient steel plants, further contributing to the reduction in overall steel production capacity. This action targets facilities with poor environmental records and outdated technology.

- Focus on higher quality, value-added steel production: Instead of prioritizing sheer volume, China is now emphasizing the production of higher-quality, value-added steel products. This shift reduces the overall demand for raw iron ore, as less is needed to produce the same amount of higher-quality steel.

- Impact on overall steel output and demand for iron ore: The combined effect of these policies has resulted in a substantial decrease in China's steel output, directly impacting the global demand for iron ore, a key raw material in steelmaking. Reports indicate a reduction of X% in steel production in the last year, translating to a loss of Y million tons.

The Ripple Effect: Impact on Global Iron Ore Prices

The reduced demand for steel in China has created a direct and significant impact on global iron ore prices. The correlation is undeniable: less steel production translates to less iron ore needed. This has led to several key consequences:

- Decreased demand from major Chinese steel mills: Major Chinese steel mills, facing reduced production targets, have significantly lowered their iron ore procurement, causing a surplus in the market.

- Increased iron ore supply exceeding demand: The existing supply of iron ore from major producers like Australia and Brazil now significantly outstrips the reduced demand from China, creating a buyer's market.

- Price competition amongst iron ore producers: With excess supply, iron ore producers are forced into intense price competition, further driving down prices. This has led to significant losses for many companies in the sector.

- Impact on the stock prices of major iron ore companies: The falling iron ore prices have directly impacted the stock prices of major iron ore mining companies, causing significant volatility and losses for investors.

Other Factors Influencing Falling Iron Ore Prices

While China's steel production cuts are the primary driver, several other factors contribute to the current decline in iron ore prices:

- Global economic slowdown and reduced infrastructure spending: The global economic slowdown has reduced infrastructure projects worldwide, leading to lower demand for steel and, consequently, iron ore.

- Increased iron ore production from other countries: Increased iron ore production from countries besides Australia and Brazil is adding to the already substantial supply, putting further downward pressure on prices.

- Fluctuations in the currency exchange rates: Changes in currency exchange rates can affect the cost of iron ore imports and exports, influencing pricing dynamics in the global market.

- Speculation and market sentiment: Market speculation and overall negative sentiment surrounding the global economy have further contributed to the decline in iron ore prices.

The Future Outlook for Iron Ore Prices

Predicting future iron ore prices is challenging, given the complex interplay of factors. However, based on current trends and economic forecasts:

- Potential for price stabilization or further decline: The current market suggests a potential for further price decline in the short term, followed by a slow stabilization period.

- Factors that could lead to price recovery: A global economic recovery, increased infrastructure spending, and a potential reduction in iron ore supply could lead to price recovery in the long term.

- Long-term implications for the iron ore industry: The industry will likely see consolidation, with less efficient producers struggling to survive in a low-price environment. Technological advancements in steel production, such as the increased use of scrap metal, could also influence long-term demand.

Conclusion

In summary, China's significant reduction in steel production is the primary driver of falling iron ore prices. Other global economic factors have amplified this decline, creating uncertainty and volatility in the market. The reduced demand from China, coupled with increased supply, has put significant downward pressure on prices, impacting companies and investors across the global iron ore supply chain. To navigate this challenging market successfully, staying informed about the latest developments in the iron ore market is paramount. Stay informed about the latest developments in the iron ore market by regularly checking for updates on falling iron ore prices and their connection to China's steel production policies. Understanding the dynamics of falling iron ore prices is crucial for investors and businesses operating within this vital global commodity market.

Featured Posts

-

The Transgender Military Ban A Critical Examination Of Trumps Stance

May 10, 2025

The Transgender Military Ban A Critical Examination Of Trumps Stance

May 10, 2025 -

Kormanyepuelet Noi Mosdo Letartoztatas Transznemu No Esete Floridaban

May 10, 2025

Kormanyepuelet Noi Mosdo Letartoztatas Transznemu No Esete Floridaban

May 10, 2025 -

Analyzing Trumps Presidency A Focus On Day 109 May 8th 2025

May 10, 2025

Analyzing Trumps Presidency A Focus On Day 109 May 8th 2025

May 10, 2025 -

Council Approves Rezoning Edmonton Nordic Spa Development Progresses

May 10, 2025

Council Approves Rezoning Edmonton Nordic Spa Development Progresses

May 10, 2025 -

The Aoc Pirro Fact Check Debate What You Need To Know

May 10, 2025

The Aoc Pirro Fact Check Debate What You Need To Know

May 10, 2025