Falling Profits At Westpac (WBC): The Impact Of Margin Pressure

Table of Contents

Main Points: Dissecting Westpac's Margin Pressure

2.1. Rising Operational Costs & Increased Competition

H3: Escalating Operational Expenses

Westpac, like many financial institutions, is grappling with significantly escalating operational expenses. These rising costs are eroding profitability and directly contributing to the margin pressure the bank is experiencing. These expenses stem from several key areas:

- Staffing Costs: Salaries and benefits for a large workforce represent a substantial portion of operational costs. Increased demand for skilled professionals in the financial sector is driving up these expenses.

- Technology Investment: The banking industry requires substantial investment in technology to maintain competitive services, enhance security, and comply with evolving regulations. This includes upgrading systems, implementing new technologies, and ongoing maintenance. These investments, while necessary, significantly impact operational expenditure.

- Regulatory Compliance: The financial sector is heavily regulated, requiring significant resources to ensure compliance with AUSTRAC, APRA, and other regulatory bodies. Meeting these increasingly stringent requirements adds substantial cost burdens.

For example, reports suggest a year-on-year increase of X% in operational costs for Westpac, highlighting the severity of this challenge. This increase in the expense ratio directly impacts the bank's ability to maintain healthy profit margins.

H3: Intensified Competition in the Australian Banking Sector

The Australian banking sector is highly competitive, with established players like ANZ, NAB, and Commonwealth Bank vying for market share, alongside the emergence of disruptive fintech companies. This competition significantly impacts Westpac's ability to maintain its interest rate margins and lending volumes.

- Intense Price Competition: Competitors are frequently engaging in aggressive pricing strategies, leading to a compression of net interest margins (NIMs).

- Market Share Battles: The fight for market share involves significant marketing and promotional expenses, further impacting profitability.

- Fintech Disruption: Innovative fintech companies are challenging traditional banking models, offering alternative financial services and potentially attracting customers away from established banks like Westpac.

2.2. Impact of Low Interest Rates and Economic Slowdown

H3: The Low Interest Rate Environment

The prolonged period of historically low interest rates has significantly impacted Westpac's net interest margins (NIMs). The difference between the interest earned on loans and the interest paid on deposits has narrowed considerably, making it challenging to maintain profitability in a low-return lending environment. This low-interest-rate environment, driven by monetary policy decisions, presents a significant hurdle for banks seeking to maintain healthy profit margins.

H3: Economic Uncertainty and Reduced Lending Demand

Economic uncertainty, and potential recessionary pressures, have dampened lending demand. Businesses and consumers are becoming more cautious, reducing their borrowing activity. This reduced lending activity directly affects Westpac's revenue streams, as loan origination fees and interest income are key components of their revenue generation. Declining GDP growth and weakening consumer confidence further exacerbate this challenge, impacting the overall health of the Australian economy and subsequently Westpac's performance.

2.3. Regulatory Changes and Increased Scrutiny

H3: Increased Regulatory Burden

The banking industry is subject to increasingly stringent regulations designed to enhance stability and protect consumers. This increased regulatory burden translates into higher compliance costs and operational complexities for Westpac. Meeting these demands requires substantial investment in compliance systems, personnel, and processes, impacting profitability. Specific regulations like those from AUSTRAC (Australian Transaction Reports and Analysis Centre) and APRA (Australian Prudential Regulation Authority) significantly influence compliance costs.

H3: Reputational Damage and Customer Trust

Past scandals and controversies within the Australian banking sector have negatively impacted customer trust and market perception. Reputational damage can lead to a loss of customer loyalty and reduced business, directly impacting Westpac's profitability. Maintaining strong customer trust and a positive market reputation is crucial for long-term financial success.

Conclusion: Navigating the Challenges of Margin Pressure at Westpac (WBC)

Westpac's falling profits are a complex issue stemming from a confluence of factors: rising operational costs, fierce competition, a low-interest-rate environment, stricter regulations, and reputational considerations. To mitigate margin pressure, Westpac needs to explore strategies like cost-cutting measures, diversification into new revenue streams, and improvements in operational efficiency. The future financial performance of Westpac will depend heavily on its ability to successfully address these challenges. For a deeper understanding of Westpac's financial performance and the ongoing impact of margin pressure, we encourage you to review their financial reports and consider seeking professional financial advice. Understanding Westpac's falling profits and margin pressure is crucial for investors and stakeholders alike.

Featured Posts

-

Mindy Kalings Weight Loss A New Look At The Premiere

May 06, 2025

Mindy Kalings Weight Loss A New Look At The Premiere

May 06, 2025 -

Mindy Kalings Hollywood Walk Of Fame Star A Celebration

May 06, 2025

Mindy Kalings Hollywood Walk Of Fame Star A Celebration

May 06, 2025 -

Polski Nitro Chem I Produkcja Trotylu Standardy Europejskie

May 06, 2025

Polski Nitro Chem I Produkcja Trotylu Standardy Europejskie

May 06, 2025 -

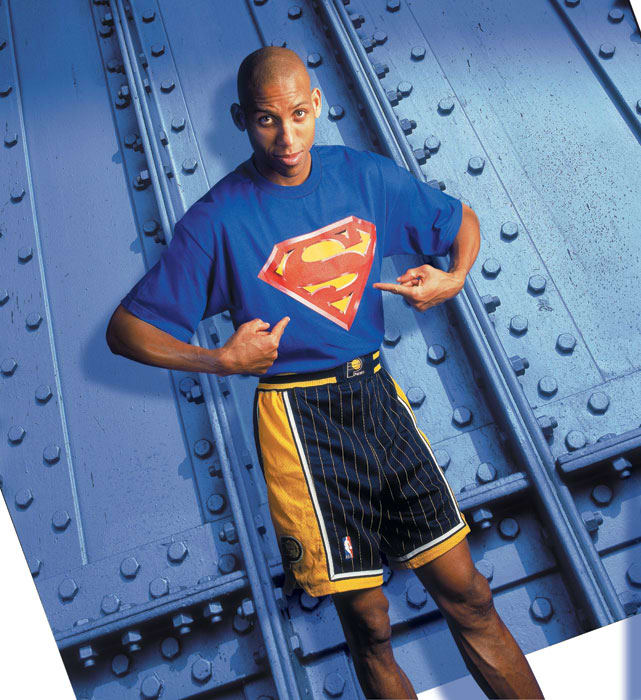

Nba Broadcasting Changes Reggie Millers Next Chapter With Nbc

May 06, 2025

Nba Broadcasting Changes Reggie Millers Next Chapter With Nbc

May 06, 2025 -

Polska Nitro Chem Kontrakt Zi S Sh A Na 310 Mln

May 06, 2025

Polska Nitro Chem Kontrakt Zi S Sh A Na 310 Mln

May 06, 2025

Latest Posts

-

Jurassic Parks Jeff Goldblum A London Fan Encounter

May 06, 2025

Jurassic Parks Jeff Goldblum A London Fan Encounter

May 06, 2025 -

New Ddg Song Take My Son Takes Aim At Halle Bailey

May 06, 2025

New Ddg Song Take My Son Takes Aim At Halle Bailey

May 06, 2025 -

Emilie Goldblum And Sons Join Jeff At Italian Football Match

May 06, 2025

Emilie Goldblum And Sons Join Jeff At Italian Football Match

May 06, 2025 -

London Welcomes Jeff Goldblum Jurassic Park Star Draws Huge Crowds

May 06, 2025

London Welcomes Jeff Goldblum Jurassic Park Star Draws Huge Crowds

May 06, 2025 -

Ddgs Take My Son A Diss Track Aimed At Halle Bailey

May 06, 2025

Ddgs Take My Son A Diss Track Aimed At Halle Bailey

May 06, 2025