Federal Debt's Growing Impact On The Housing Market

Table of Contents

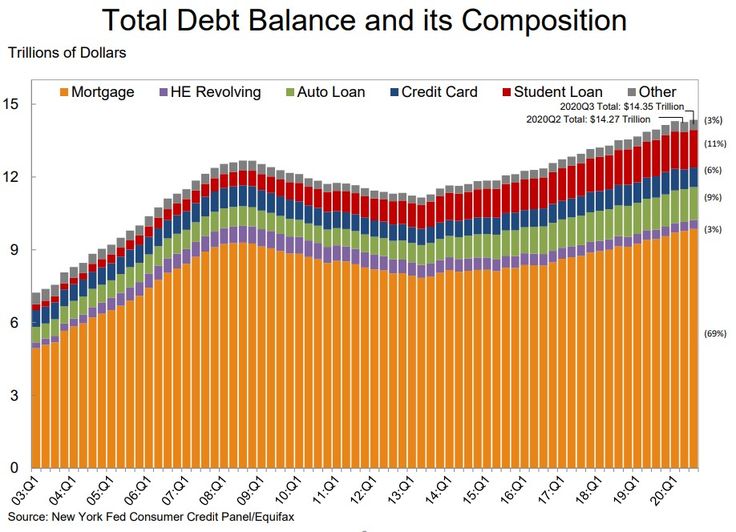

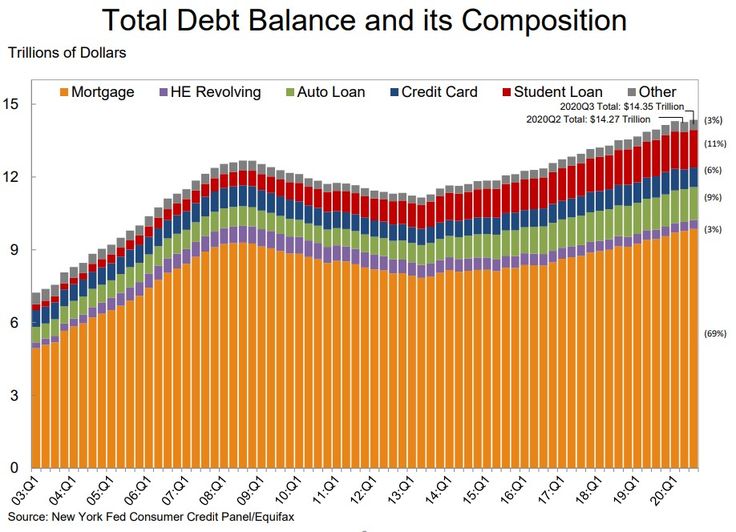

Rising Interest Rates Fueled by Federal Debt

The Mechanism of Interest Rate Increases

Increased government borrowing to finance the national debt is a major driver of interest rate hikes. This occurs because:

- Increased demand for loanable funds: The government competes with private borrowers for available capital. Increased government borrowing increases demand, pushing interest rates upward.

- Competition between government and private borrowers: When the government borrows heavily, it absorbs a significant portion of available funds, leaving less for private sector investment, including mortgages. This increased competition drives up interest rates across the board.

- The Federal Reserve's response to inflation: To combat inflation often spurred by increased government spending and the resulting increase in the money supply, the Federal Reserve may raise interest rates, further impacting mortgage rates.

Impact on Mortgage Rates

Higher interest rates directly translate to higher mortgage rates, making homeownership less accessible for many:

- Higher monthly payments: A higher interest rate significantly increases the monthly mortgage payment for a given loan amount.

- Reduced borrowing capacity: Borrowers can afford to borrow less with higher rates, limiting the price range of homes they can realistically purchase.

- Increased difficulty qualifying for a mortgage: Lenders use stricter criteria when rates rise, making it harder for potential homebuyers to qualify for a loan.

Inflation and its Effect on Housing Prices & Affordability

The Inflation-Debt Connection

Government spending financed by increasing the national debt contributes significantly to inflation through several mechanisms:

- Increased money supply: Government borrowing often leads to an expansion of the money supply, potentially outpacing economic growth and fueling inflation.

- Demand-pull inflation: Increased government spending can boost aggregate demand, exceeding the economy's capacity to produce goods and services, leading to price increases.

- Cost-push inflation: Government borrowing can indirectly contribute to cost-push inflation by increasing the cost of raw materials and labor, as the increased demand for resources drives up prices.

Impact on Home Prices and Affordability

Inflation erodes purchasing power, making homes less affordable:

- Higher construction costs: Inflation increases the cost of building materials, labor, and land, driving up the prices of new homes.

- Increased material prices: The rising cost of lumber, concrete, and other building materials directly impacts housing costs.

- Reduced real wages: If wage increases fail to keep pace with inflation, individuals' purchasing power diminishes, making it harder to afford a home.

Government Policies and their Influence on the Housing Market

Fiscal Policies and Housing

Government spending policies significantly impact housing affordability:

- Funding for affordable housing initiatives: Reductions in government funding for affordable housing programs can exacerbate housing shortages and affordability issues.

- Tax incentives for homebuyers: Tax credits and deductions can make homeownership more accessible, but these are often dependent on government fiscal health.

- Regulations affecting the housing industry: Government regulations can influence housing supply, construction costs, and ultimately, prices.

Monetary Policies and Their Ripple Effect

The Federal Reserve's actions to manage the national debt indirectly affect the housing market:

- Quantitative easing and its impact on interest rates: QE can temporarily lower interest rates, but its long-term effects on inflation and subsequent interest rate adjustments are complex.

- Reserve requirements and their influence on lending: Changes in reserve requirements influence the amount of money banks can lend, impacting mortgage availability.

Long-Term Implications for Homeowners and Investors

Risks for Homeowners

A high-debt environment poses several risks for homeowners:

- Increased vulnerability to economic downturns: High levels of national debt can increase the likelihood of economic instability, impacting home values and increasing foreclosure risks.

- Difficulty refinancing mortgages: Rising interest rates can make refinancing more challenging and costly.

- Potential for negative equity: If home values decline, homeowners may find themselves owing more on their mortgage than their home is worth.

Challenges for Investors

Real estate investors also face challenges in a high-debt environment:

- Lower rental yields: Increased competition and potentially lower rental demand can decrease the return on investment properties.

- Difficulty securing financing: Higher interest rates and stricter lending standards can make it more challenging to obtain financing for real estate investments.

- Increased risk of property devaluation: Economic instability linked to high national debt can lead to decreased property values, impacting investor returns.

Conclusion

Rising interest rates, inflation, and government policies all significantly impact the housing market, driven largely by the increasing federal debt. This interplay affects housing affordability, market stability, and the financial well-being of both homeowners and investors. Understanding the impact of the federal debt on the housing market is crucial for making informed decisions about homeownership. Stay updated on economic trends and consult financial advisors to navigate this complex landscape effectively. Learn more about how the federal debt impacts your housing decisions and take proactive steps to protect your financial future.

Featured Posts

-

Switzerland Eurovision 2025 Jamala Rumours

May 19, 2025

Switzerland Eurovision 2025 Jamala Rumours

May 19, 2025 -

Justyna Steczkowska Niespodziewany Taniec W Reczniku Do Przeboju Eurowizji

May 19, 2025

Justyna Steczkowska Niespodziewany Taniec W Reczniku Do Przeboju Eurowizji

May 19, 2025 -

Fatih Erbakandan Kibris A Dair Son Aciklama Sehitlerimiz Unutulmayacak

May 19, 2025

Fatih Erbakandan Kibris A Dair Son Aciklama Sehitlerimiz Unutulmayacak

May 19, 2025 -

Home And Abroad Fp Videos Insights On Ongoing Tariff Instability

May 19, 2025

Home And Abroad Fp Videos Insights On Ongoing Tariff Instability

May 19, 2025 -

Dispute Over Us Tariffs Canada Rebuts Oxford Report Findings

May 19, 2025

Dispute Over Us Tariffs Canada Rebuts Oxford Report Findings

May 19, 2025

Latest Posts

-

O Regresso De Sinner Hamburgo Marca O Fim Da Suspensao Por Doping

May 19, 2025

O Regresso De Sinner Hamburgo Marca O Fim Da Suspensao Por Doping

May 19, 2025 -

Comesana Debuta En El Atp 500 De Hamburgo

May 19, 2025

Comesana Debuta En El Atp 500 De Hamburgo

May 19, 2025 -

Jannik Sinner Competira Em Hamburgo Apos Suspensao

May 19, 2025

Jannik Sinner Competira Em Hamburgo Apos Suspensao

May 19, 2025 -

El Tenista Comesana Se Clasifica Para El Atp 500 De Hamburgo

May 19, 2025

El Tenista Comesana Se Clasifica Para El Atp 500 De Hamburgo

May 19, 2025 -

Juan Aguilera Fallecimiento De Una Figura Clave Del Tenis Espanol

May 19, 2025

Juan Aguilera Fallecimiento De Una Figura Clave Del Tenis Espanol

May 19, 2025