Federal Judge Allows IRS Data Use To Track Undocumented Immigrants

Table of Contents

The Court's Ruling and its Rationale

The court's decision, handed down on [Insert Date of Ruling, if available, otherwise remove this sentence], granted the Department of Homeland Security (DHS) access to specific IRS data for the purpose of identifying and tracking undocumented immigrants. The judge's ruling hinges on [Insert Specific Legal Precedent or Statute Cited by the Judge].

-

Specifics of the Decision: The ruling allows access to [Specify the type of data; e.g., tax return information, address information, income data] for individuals suspected of being undocumented. The data access is subject to [Specify any limitations imposed by the judge, e.g., judicial oversight, specific warrants required].

-

Legal Arguments: The government argued that access to this data is crucial for effective immigration enforcement, aiding in the identification and deportation of undocumented individuals. Plaintiffs, representing various civil liberties organizations, countered that the ruling represents an egregious violation of taxpayer privacy and raises serious concerns about potential misuse and discrimination.

-

Judge's Reasoning: The judge's rationale focused on [Summarize the judge's main justification for the ruling. E.g., national security interests, balancing government interests with individual rights, interpretation of existing law]. The decision emphasized [Mention key aspects of the judge's argument, e.g., the limited scope of data access, the need for efficient immigration enforcement].

-

Dissenting Opinions: [Mention any dissenting opinions or concerns raised by the judge or other parties involved in the case. If none, remove this bullet point].

Privacy Concerns and Potential for Abuse

The ruling's implications for data privacy are deeply troubling. The potential for misuse of IRS data is significant, raising serious concerns about the security and integrity of taxpayer information.

-

Identity Theft and Privacy Violations: The unauthorized release or misuse of this sensitive data could lead to widespread identity theft, financial fraud, and other serious privacy violations affecting millions of taxpayers.

-

Data Security and Hacking: The IRS's data security systems are not impervious to hacking attempts. A breach could expose sensitive taxpayer information, including financial details and personal identifying information, putting individuals at considerable risk.

-

Discriminatory Targeting: The use of IRS data for tracking undocumented immigrants raises concerns about potential discriminatory targeting of specific ethnic or racial communities. This could lead to disproportionate scrutiny and harassment of vulnerable populations.

-

Erosion of Public Trust: This decision may erode public trust in the government's ability to protect sensitive taxpayer information, potentially chilling future tax compliance.

The Role of Technology in Immigration Enforcement

The increasing reliance on technology for immigration enforcement has significant implications. Data analytics and other technological tools allow for the tracking and monitoring of individuals on an unprecedented scale.

-

Data Analytics and Surveillance: Advanced data analytics tools are employed to identify patterns and anomalies in large datasets, enabling more efficient targeting of undocumented immigrants. This raises questions about mass surveillance and potential abuse of power.

-

Ethical Implications: The ethical implications of utilizing sophisticated technologies for tracking individuals warrant careful consideration. The use of big data for immigration enforcement raises concerns about potential bias and discrimination inherent in algorithms and data interpretation.

-

Algorithmic Bias: There is a risk of algorithmic bias in data-driven immigration enforcement. Algorithms trained on biased data may perpetuate existing inequalities and discriminate against particular groups.

Public Reaction and Ongoing Legal Challenges

The ruling has sparked intense public and political debate. Advocacy groups and civil rights organizations have voiced strong opposition, highlighting the significant privacy concerns.

-

Public and Political Responses: Public opinion is sharply divided, with some supporting stricter immigration enforcement and others emphasizing the need to protect individual privacy rights. The ruling has become a focal point in ongoing political discussions about immigration reform and data privacy.

-

Legal Challenges and Appeals: Legal challenges and appeals are expected. Civil rights organizations are actively working to overturn the ruling, arguing it violates fundamental rights and constitutes an abuse of governmental power.

-

Advocacy Group Involvement: Groups like the [Mention specific organizations involved, e.g., ACLU, NAACP] have actively voiced their concerns and are taking legal action to challenge the decision.

-

Potential Future Legislation: The controversy surrounding the ruling may lead to calls for new legislation addressing the use of IRS data for immigration enforcement and the protection of taxpayer privacy.

Conclusion

The federal judge's decision to permit the IRS to utilize taxpayer data for tracking undocumented immigrants has profound implications for both immigration enforcement and data privacy. The ruling highlights the growing tension between national security interests and individual rights in the digital age. Concerns about potential misuse of sensitive information and the erosion of public trust remain significant. The use of IRS data for undocumented immigrant tracking sets a concerning precedent, raising critical questions about the balance between government power and individual liberties in the digital age. This issue demands ongoing vigilance and public discourse.

Call to Action: Stay informed about the ongoing legal challenges and public discourse surrounding the use of IRS data for tracking undocumented immigrants. Understanding the intricacies of this case is crucial to advocating for responsible data usage and protecting individual privacy rights. Engage with your representatives to express your concerns about the potential for abuse of IRS data and the erosion of privacy in the context of immigration enforcement. Demand accountability and transparency from the government in its use of taxpayer data.

Featured Posts

-

Donde Ver Atalanta Vs Lazio En Vivo Guia Serie A 2025

May 13, 2025

Donde Ver Atalanta Vs Lazio En Vivo Guia Serie A 2025

May 13, 2025 -

Elsbeth Season 2 Finale Returning Characters Confirmed

May 13, 2025

Elsbeth Season 2 Finale Returning Characters Confirmed

May 13, 2025 -

No Upsets For Sabalenka And Gauff In Rome

May 13, 2025

No Upsets For Sabalenka And Gauff In Rome

May 13, 2025 -

Local Area Obituaries Recent Passings

May 13, 2025

Local Area Obituaries Recent Passings

May 13, 2025 -

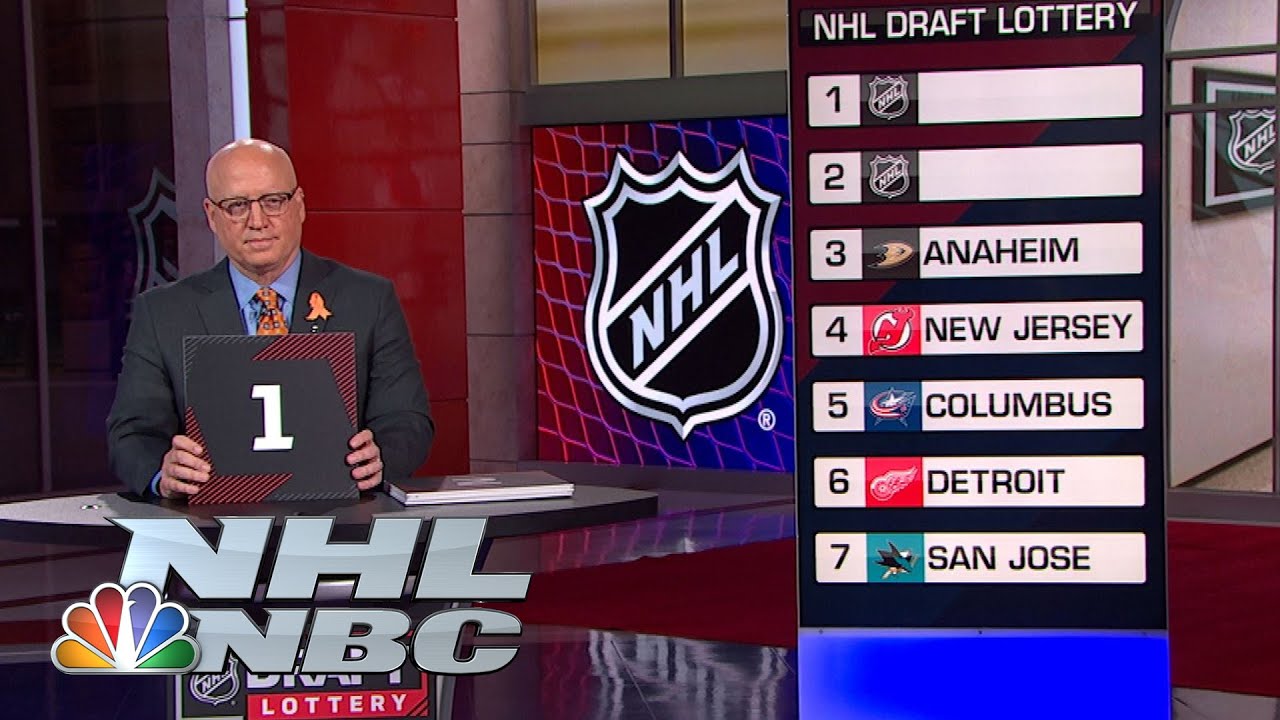

Islanders Win Nhl Draft Lottery No 1 Pick Secured

May 13, 2025

Islanders Win Nhl Draft Lottery No 1 Pick Secured

May 13, 2025