Federal Reserve Rate Decision: Holding Steady Amidst Mounting Pressures

Table of Contents

Inflationary Pressures and the Fed's Response

The current inflation rate remains a primary concern for the Federal Reserve. While recent figures show a slight moderation, inflation still significantly exceeds the Fed's target of 2%. Several factors contribute to this persistent inflationary pressure. Supply chain disruptions, particularly in the energy sector, have driven up the cost of goods and services. Furthermore, robust consumer demand, fueled by pent-up savings and a strong labor market, continues to put upward pressure on prices.

The Fed's rationale for maintaining interest rates, despite the ongoing inflationary pressures, likely stems from a cautious approach. A rapid increase in interest rates could potentially stifle economic growth and lead to job losses. The Fed is likely attempting to strike a delicate balance between curbing inflation and avoiding a recession.

- Current inflation figures: The Consumer Price Index (CPI) and Producer Price Index (PPI) remain above the Fed's target, though showing signs of slowing.

- Key factors driving inflation: Supply chain bottlenecks, elevated energy prices, and strong consumer spending are key contributors.

- Analysis of the Fed's communication: The Fed's recent statements indicate a data-dependent approach, suggesting that future interest rate decisions will hinge on upcoming economic data.

Employment Data and its Influence on the Rate Decision

The latest employment reports paint a picture of a robust labor market. Unemployment rates remain low, and job creation continues at a healthy pace. This strong employment picture presents a significant challenge for the Federal Reserve. While a strong labor market is generally positive, it can contribute to wage growth, which in turn can fuel inflationary pressures. The Fed must carefully consider this dynamic when setting monetary policy.

The relationship between employment levels, inflation, and interest rate policy is complex. Low unemployment can lead to higher wages, potentially increasing inflation. However, raising interest rates too aggressively could cool the economy and lead to job losses. The Fed is tasked with navigating this delicate balance.

- Unemployment rate and its trend: The unemployment rate remains historically low, suggesting a tight labor market.

- Job creation numbers and their impact on wage growth: Strong job growth contributes to wage increases, which can exacerbate inflation.

- Analysis of the Fed's assessment of the labor market: The Fed acknowledges the strength of the labor market but is also monitoring wage growth closely.

Global Economic Uncertainty and its Impact on the Fed's Strategy

Global economic uncertainty significantly influences the Federal Reserve's approach to monetary policy. Geopolitical risks, ongoing supply chain issues, and the war in Ukraine create headwinds for the global economy. These factors can impact the US economy through reduced exports, increased import costs, and decreased investor confidence.

The interconnectedness of the global economy means that international events can quickly ripple through domestic markets. The Fed must carefully assess these external factors and their potential impact on the US economy when making interest rate decisions.

- Specific global economic factors influencing the decision: Geopolitical instability, supply chain disruptions, and energy price volatility are significant concerns.

- Potential spillover effects on the US economy: Global economic weakness can reduce demand for US exports and increase inflationary pressure.

- How these factors might affect future rate decisions: Global uncertainty could lead the Fed to adopt a more cautious approach to raising interest rates.

Market Reaction and Future Expectations

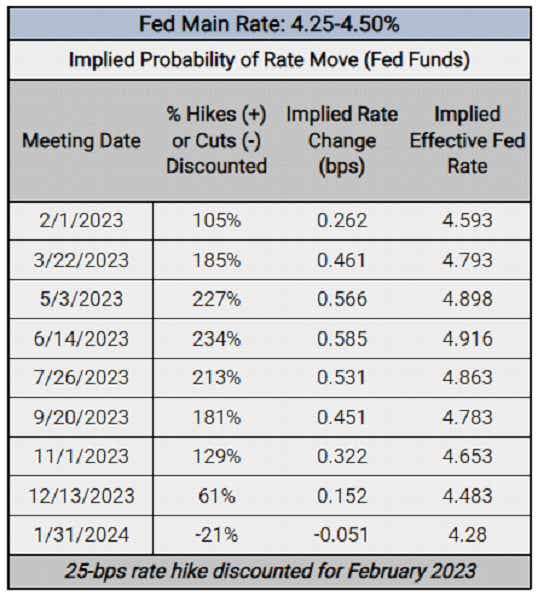

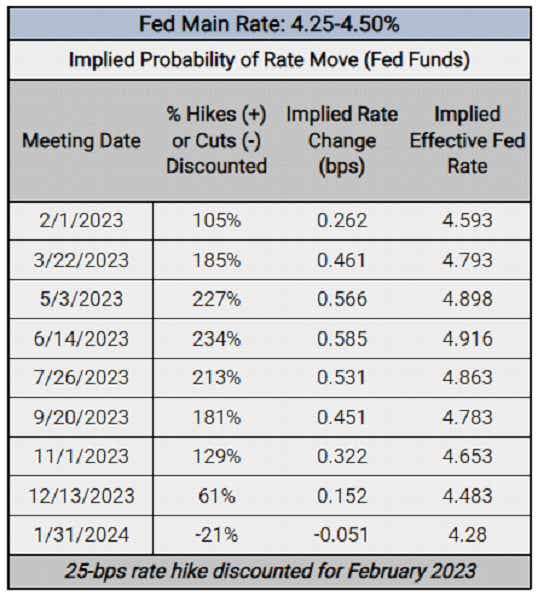

The market's initial reaction to the Federal Reserve rate decision was mixed. While some analysts interpreted the decision as a sign of confidence in the economy's resilience, others expressed concerns about the ongoing inflationary pressures. Stock market performance was relatively muted, while bond yields showed a slight increase, reflecting some investors' expectations of future interest rate hikes.

Expert opinions regarding future interest rate adjustments are divided. Some economists predict further rate increases in the coming months, citing persistent inflation, while others anticipate that the Fed will remain on hold, given the potential risks to economic growth. The future path of monetary policy will heavily depend on upcoming economic data releases, particularly inflation and employment figures.

- Stock market performance following the announcement: The stock market showed a mixed reaction, reflecting the uncertainty surrounding future policy.

- Changes in bond yields and their interpretation: Increased bond yields suggest some expectation of future rate increases.

- Expert predictions for future interest rate movements: Forecasts vary, with some predicting further increases, and others anticipating a hold.

Conclusion: Understanding the Federal Reserve Rate Decision and its Implications

This analysis highlights the complex factors influencing the recent Federal Reserve rate decision. The Fed's decision to hold interest rates steady reflects a delicate balancing act between managing inflation, maintaining a strong labor market, and navigating significant global economic uncertainty. The implications of this decision are far-reaching, impacting investors, businesses, and consumers alike. The future path of monetary policy remains uncertain, with future Federal Reserve rate decisions hinging on incoming economic data.

Key Takeaways: The Federal Reserve's decision underscores the challenges of managing the current economic environment. Inflation remains a key concern, but the strength of the labor market and global uncertainties are also significant considerations.

Call to Action: Stay updated on future Federal Reserve rate decisions and their impact on your investments. Understanding the intricacies of Federal Reserve rate decisions is crucial for making informed financial choices. Consider seeking professional financial advice to navigate the changing economic landscape.

Featured Posts

-

Skuadra E Psg Se 11 Lojtaret Kyc Ne Formacion

May 09, 2025

Skuadra E Psg Se 11 Lojtaret Kyc Ne Formacion

May 09, 2025 -

Tatums Respect For Curry Post All Star Game Comments

May 09, 2025

Tatums Respect For Curry Post All Star Game Comments

May 09, 2025 -

Barbashevs Ot Winner Golden Knights Beat Wild 4 3 Even Series

May 09, 2025

Barbashevs Ot Winner Golden Knights Beat Wild 4 3 Even Series

May 09, 2025 -

9 Maya Zelenskiy Ostalsya Odin Prichiny I Posledstviya

May 09, 2025

9 Maya Zelenskiy Ostalsya Odin Prichiny I Posledstviya

May 09, 2025 -

Fanatics Your One Stop Shop For Boston Celtics Gear During Their Back To Back Finals Run

May 09, 2025

Fanatics Your One Stop Shop For Boston Celtics Gear During Their Back To Back Finals Run

May 09, 2025