Figma IPO Filing: Details Emerge Following Adobe Deal Collapse

Table of Contents

The Fallout from the Failed Adobe Acquisition

The proposed acquisition of Figma by Adobe, valued at a staggering $20 billion, ultimately fell apart due to significant antitrust concerns raised by regulatory bodies. The deal, announced in September 2022, faced intense scrutiny, with regulators expressing worries about Adobe's potential monopolistic control over the collaborative design software market. This unexpected turn of events left both companies scrambling to adapt their strategies.

- Proposed Acquisition Price: $20 billion, a testament to Figma's rapid growth and market dominance.

- Regulatory Concerns and Objections: Concerns centered on Adobe's already substantial market share and the potential stifling of competition in the collaborative design space. The FTC and other regulatory bodies played a significant role in the deal's collapse.

- Impact on Adobe's Stock Price: Adobe's stock experienced a slight dip following the deal's termination, reflecting investor uncertainty about the company's future growth trajectory.

- Reaction from Figma's Users and the Design Community: The design community reacted with a mix of surprise and speculation. While some expressed concern about potential changes under Adobe's ownership, others were optimistic about Figma's independent future.

Speculation Surrounding the Figma IPO Filing

While no official Figma IPO filing has been announced, speculation is rife. Industry analysts predict a significant valuation, potentially exceeding the proposed Adobe acquisition price. Leaks and rumors suggest a strong interest from venture capitalists and institutional investors.

- Potential Valuation of the Figma IPO: Estimates range from $20 billion to potentially even higher, reflecting Figma's strong user base and growth potential. This Figma stock valuation is a major point of discussion.

- Expected Timeline for the Filing and Potential Listing: A concrete timeline remains unclear, but many speculate a filing could occur within the next year, with a subsequent listing on a major stock exchange like the NASDAQ.

- Analysis of Figma's Financial Performance and Growth Trajectory: Figma has demonstrated impressive revenue growth and a large, engaged user base, making it an attractive prospect for investors. Details regarding their financials will be crucial when the Figma filing officially occurs.

- Key Investors and Stakeholders Involved: While the specific investor lineup for a potential IPO is yet to be revealed, existing venture capitalists and early investors will undoubtedly play a significant role.

Analyzing Figma's Strengths as a Public Company

Figma possesses several key strengths that position it favorably for a successful IPO:

- Strong User Base and Market Share: Figma enjoys a substantial market share in the collaborative design space, boasting millions of users across various industries.

- Innovative Features and Ongoing Product Development: Figma’s commitment to innovation and regular updates keeps it ahead of the competition.

- Potential for Expansion into New Markets and Integrations: Figma has significant potential for expansion into new markets and integration with other software platforms.

- Strong Leadership Team and Experienced Management: A skilled leadership team is vital to navigate the challenges of a public company.

Risks and Challenges Facing a Figma IPO

Despite its strengths, Figma faces several challenges as a potential public company:

- Competition from Established Players: Adobe XD, Sketch, and other design software applications pose stiff competition.

- Maintaining Profitability and Growth: Sustaining high growth rates while achieving profitability will be crucial for long-term success.

- Managing User Expectations: Maintaining user satisfaction and delivering consistent updates will be critical to retaining market share.

- Potential Impact of Economic Downturns: The tech sector is susceptible to economic downturns, posing a risk to growth.

Impact on the Design Industry

A Figma IPO will likely have a substantial impact on the design industry:

- Increased Competition and Innovation: The IPO could spur further innovation and competition within the design software market.

- Potential Changes in Pricing Strategies and Accessibility: Figma's pricing strategies might shift, affecting the accessibility of the software for some designers.

- Influence on Industry Standards and Design Workflows: Figma's prominence could further influence industry standards and design workflows.

- Impact on the Broader Collaborative Design Ecosystem: The IPO will likely influence the overall collaborative design ecosystem, potentially fostering further collaboration and innovation.

Conclusion

The collapse of the Adobe deal and the emerging possibility of a Figma IPO filing represent a significant turning point for the design software landscape. While numerous challenges exist, Figma’s strong market position and innovative capabilities suggest a potentially successful public offering. The coming months will be crucial in understanding the full implications of this decision.

Call to Action: Stay tuned for updates and further analysis on the Figma IPO. Follow us for the latest news and insights on this developing story concerning the Figma initial public offering and its impact on the design industry and the broader tech market. Keep an eye out for our next article on the potential financial details surrounding the Figma stock.

Featured Posts

-

Safety First Walmart Recalls Electric Ride Ons And Phone Charging Devices

May 14, 2025

Safety First Walmart Recalls Electric Ride Ons And Phone Charging Devices

May 14, 2025 -

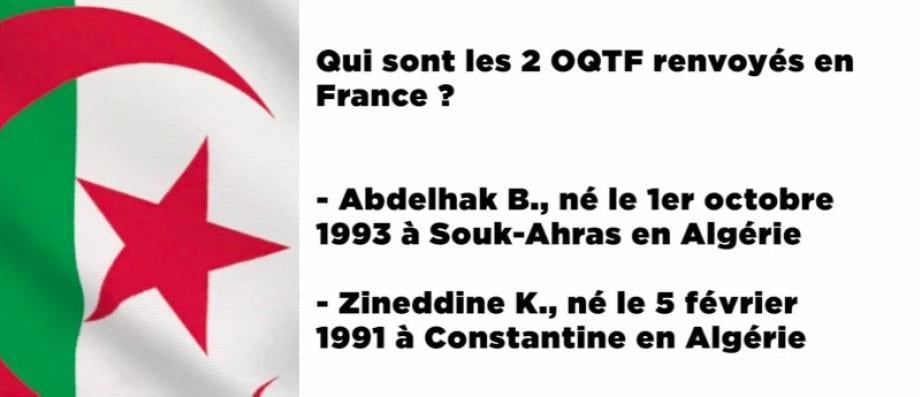

Separation Familiale L Expulsion Sous Oqtf De Deux Collegiens Et Leur Mere

May 14, 2025

Separation Familiale L Expulsion Sous Oqtf De Deux Collegiens Et Leur Mere

May 14, 2025 -

24 Heures Du Mans Roger Federer As Honorary Starter

May 14, 2025

24 Heures Du Mans Roger Federer As Honorary Starter

May 14, 2025 -

Shifting Sands Trump Administrations Ukraine Policy And Its Impact On Relations With Russia

May 14, 2025

Shifting Sands Trump Administrations Ukraine Policy And Its Impact On Relations With Russia

May 14, 2025 -

Voita 54 Miljoonaa Euroa Eurojackpotissa

May 14, 2025

Voita 54 Miljoonaa Euroa Eurojackpotissa

May 14, 2025