Final Two ECB Rate Cuts: Economists Warn Against Delays

Table of Contents

Economic Slowdown Fuels Concerns Over Delayed Rate Cuts

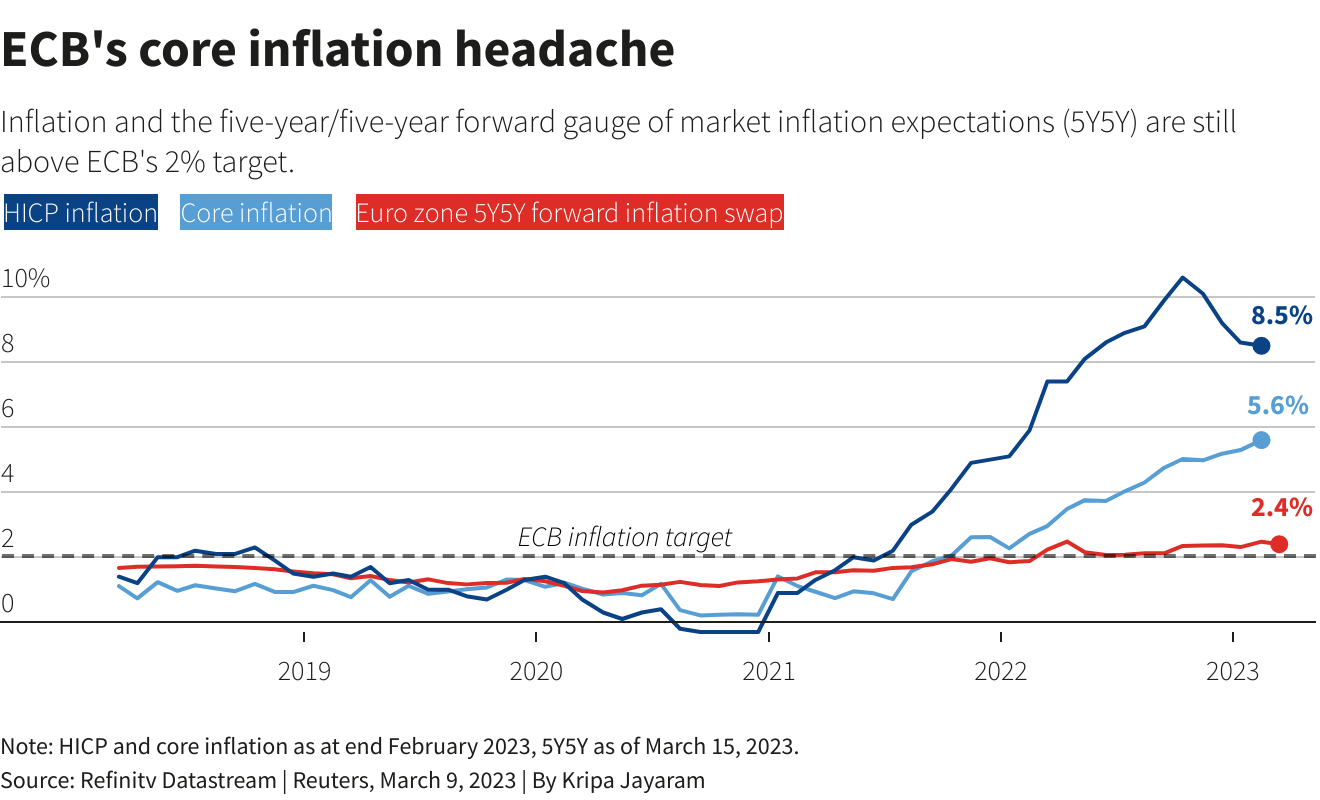

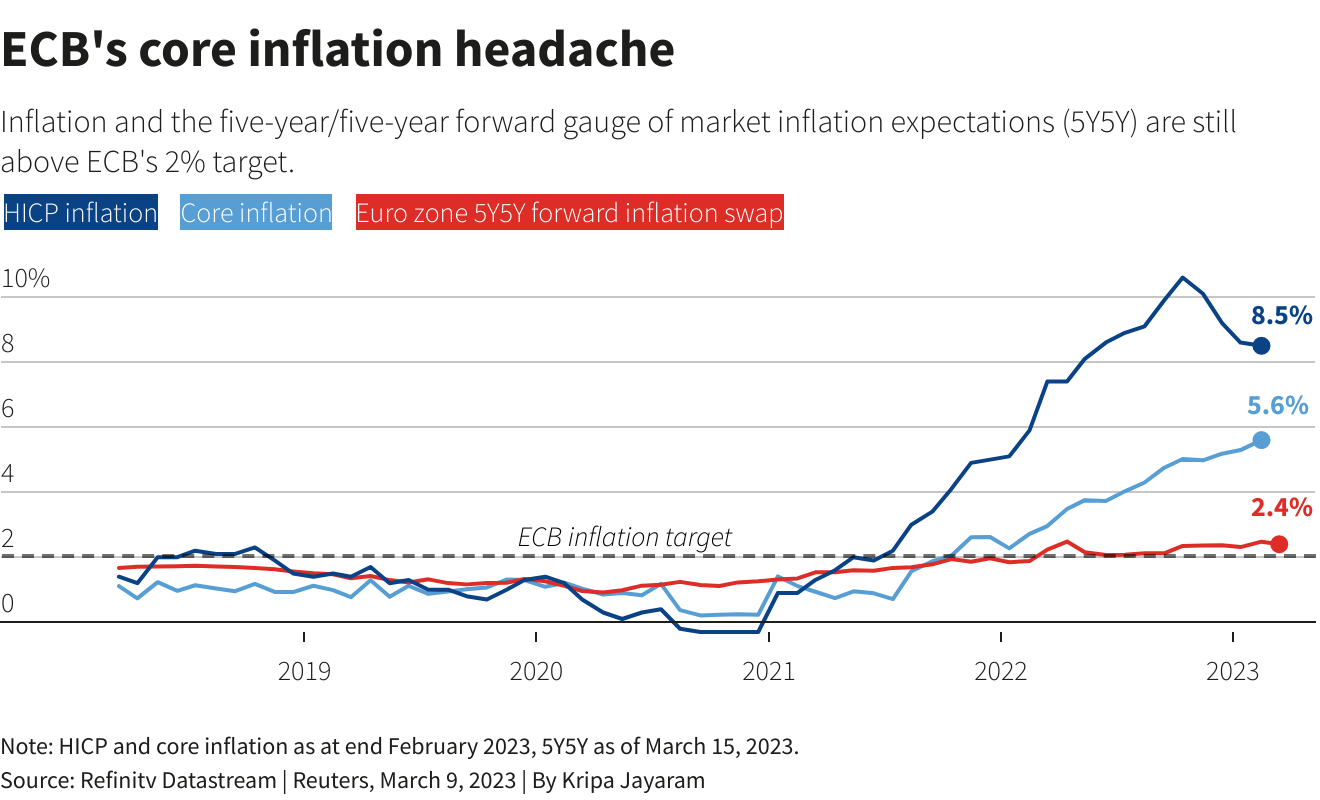

The Eurozone is grappling with a complex economic situation. While inflation remains stubbornly high, indicators point towards a significant economic slowdown, raising serious concerns about the impact of delaying further ECB rate cuts. GDP growth is faltering, consumer and business confidence is weakening, and the threat of rising unemployment casts a long shadow. Delaying the planned rate reductions could exacerbate this downturn, pushing the Eurozone closer to a full-blown recession.

- Rising inflation despite economic slowdown: This paradoxical situation creates a challenging environment for policymakers, requiring a delicate balancing act.

- Weakening consumer and business confidence: Uncertainty surrounding the economic outlook is leading to reduced spending and investment, further dampening growth.

- Potential for further job losses due to stagnation: A prolonged period of slow growth could lead to significant job losses across various sectors of the Eurozone economy. This, in turn, would further depress consumer spending and exacerbate the economic contraction.

Risks of Inflation Persistence Despite Economic Slowdown

The current economic climate presents the ECB with a formidable challenge: managing inflation in a slowing economy. The risk of stagflation – a simultaneous occurrence of slow economic growth and high inflation – is a very real possibility. This scenario would be particularly damaging, as it would severely impact both businesses and consumers. The ECB's mandate is to maintain price stability, but achieving this goal in the current environment requires a nuanced and potentially risky approach. Delaying ECB rate cuts could further entrench inflationary pressures.

- Supply chain disruptions' contribution to persistent inflation: While supply chains are gradually recovering, lingering disruptions continue to contribute to higher prices for goods and services.

- Wage pressures and their impact on inflation: Workers demanding higher wages to compensate for rising living costs can fuel a wage-price spiral, further exacerbating inflation.

- Debate among economists regarding the effectiveness of rate cuts in this situation: Some economists argue that rate cuts may be ineffective in tackling supply-side inflation and could even worsen the situation by fueling further demand.

Expert Opinions on the Urgency of ECB Rate Cuts

The debate among economists regarding the timing and necessity of the remaining ECB rate cuts is intense. While there is a broad consensus regarding the need for further monetary easing, opinions diverge on the urgency and the potential side effects of delaying action. Some prominent economists advocate for immediate action, emphasizing the urgency of preventing a deeper economic downturn. Others caution against overly aggressive rate cuts, citing concerns about potential inflationary consequences.

- Quotes from prominent economists supporting immediate action: "Delaying the rate cuts would be a grave mistake, risking a deeper and more prolonged recession," stated [Economist's Name], a renowned expert in European monetary policy.

- Quotes from economists advocating a more cautious approach: Others express concerns about the potential impact of further rate cuts on inflation, suggesting a more gradual approach.

- Analysis of the consensus among economists regarding the risks of delay: While there's a spectrum of opinions, the overwhelming consensus is that delaying the rate cuts presents a significant risk of exacerbating the economic slowdown and prolonging the period of high inflation.

Potential Alternatives and Mitigation Strategies

Alongside further ECB rate cuts, the ECB could consider alternative monetary policy tools and collaborate with fiscal authorities to mitigate the economic challenges. These complementary measures could enhance the effectiveness of the rate cuts and support economic recovery.

- Quantitative easing (QE) as a supporting measure: The ECB could resume or increase its quantitative easing program to inject liquidity into the market.

- Targeted lending programs for specific sectors: Supporting struggling sectors through targeted lending programs could help prevent widespread job losses and business failures.

- Coordination between fiscal and monetary policies: Close collaboration between the ECB and Eurozone governments on fiscal policies could create a more comprehensive and effective response to the economic challenges.

Conclusion: The Imperative for Timely ECB Rate Cuts

The urgency of avoiding delays in the final two ECB rate cuts cannot be overstated. Delaying these crucial monetary policy adjustments risks exacerbating the economic slowdown, fueling inflation, and increasing the likelihood of a deeper recession. The consensus among economists is clear: swift and decisive action is needed to address the current economic challenges. Stay informed about further developments regarding ECB rate cuts and their impact on the Eurozone economy by following reputable financial news sources and ECB publications. The future of the Eurozone economy hinges on the timely implementation of these vital policy adjustments.

Featured Posts

-

Understanding And Cultivating The Good Life

May 31, 2025

Understanding And Cultivating The Good Life

May 31, 2025 -

Is April The Rainiest Month A Look At Rainfall Totals

May 31, 2025

Is April The Rainiest Month A Look At Rainfall Totals

May 31, 2025 -

Brandon Inges Kalamazoo Dugout Return A One Night Stand

May 31, 2025

Brandon Inges Kalamazoo Dugout Return A One Night Stand

May 31, 2025 -

Wildfire Smoke Blankets Us As Canada Faces Largest Evacuation In History

May 31, 2025

Wildfire Smoke Blankets Us As Canada Faces Largest Evacuation In History

May 31, 2025 -

Lavender Milk Nails Der Sanfte Nageltrend Des Jahres

May 31, 2025

Lavender Milk Nails Der Sanfte Nageltrend Des Jahres

May 31, 2025