Financial Balance In Celebrity Marriages: When One Earns Significantly More

Table of Contents

The Importance of Prenuptial Agreements in High-Income Marriages

A prenuptial agreement, often referred to as a prenup, is a crucial legal document for protecting assets and outlining financial expectations before marriage. For celebrity couples, with their often-substantial wealth, a well-drafted prenup is paramount. It’s not just about protecting individual wealth; it's about establishing a clear understanding of the financial dynamics within the relationship. A comprehensive celebrity prenup goes beyond simply listing assets; it clarifies ownership of pre-marital assets, addresses the division of property in case of divorce, and can even outline spousal support arrangements. Engaging experienced legal counsel specializing in high-net-worth individuals is vital to ensure the agreement is legally sound and protects both parties' interests.

- Defines individual asset ownership before marriage: This prevents disputes over what constitutes separate property and marital property.

- Establishes parameters for asset division in the event of separation: This prevents protracted and potentially costly legal battles down the line.

- Offers protection against potential financial disputes: A clearly defined agreement minimizes the risk of conflict regarding finances.

- Provides clarity and transparency in the relationship's financial future: Openly addressing financial matters upfront fosters trust and communication.

- Mitigates potential emotional distress related to finances: Knowing the financial landscape is secure reduces stress and anxiety.

Effective Communication and Financial Transparency

Open communication about finances is paramount in any marriage, but it’s especially critical when there’s a significant income disparity. Financial transparency isn't just about sharing bank statements; it's about creating a shared understanding of the family's overall financial situation. This includes open discussions about income sources, expenses, financial goals, and long-term financial planning. Both partners should be involved in the decision-making process regarding investments, budgeting, and spending. Establishing joint accounts for shared expenses and maintaining separate accounts for personal spending can strike a healthy balance between shared and individual finances.

- Regular discussions regarding finances: Weekly or monthly reviews can help to track progress, address concerns, and maintain open dialogue.

- Shared financial goals: Creating a collective financial vision fosters teamwork and shared responsibility.

- Transparent access to financial information for both partners: Openness builds trust and prevents misunderstandings.

- Joint decision-making regarding financial matters: Both partners should have a voice in significant financial decisions.

- Seeking professional guidance to develop a comprehensive financial plan: A financial planner can provide objective advice and support.

The Role of Professional Financial Advisors

Navigating the complex world of wealth management in a high-income marriage requires expert guidance. A qualified financial advisor plays a crucial role in developing a comprehensive financial plan tailored to the couple's unique needs. Their expertise extends beyond investment strategies; they can also provide valuable insights into tax planning, estate planning, and risk management. A financial advisor acts as an objective third party, facilitating open communication and helping the couple make informed decisions about their financial future.

- Develop a personalized financial plan tailored to the couple's needs: This includes considering short-term and long-term goals.

- Provide advice on investment strategies to maximize returns and minimize risks: This helps to grow wealth responsibly and sustainably.

- Assist with tax planning to reduce the tax burden: This ensures the couple keeps more of their hard-earned money.

- Facilitate estate planning to ensure wealth transfer according to the couple’s wishes: This ensures the couple's legacy is protected.

- Offer ongoing financial guidance and support: A financial advisor provides continued support and expertise as needed.

Maintaining Separate Financial Independence

While shared finances are essential, maintaining a degree of financial independence can be beneficial, even in a high-income marriage. This doesn't necessarily mean complete separation; it can simply involve having separate accounts for personal spending, allowing each partner to pursue their own financial goals and maintain a sense of financial autonomy. This approach can foster a sense of individual identity and prevent resentment over spending habits. It also promotes financial responsibility and encourages each partner to be proactive in managing their personal finances.

- Allows for personal spending and individual financial goals: This respects individual preferences and aspirations.

- Prevents financial resentment and maintains individual autonomy: It helps to avoid conflicts stemming from differing spending habits.

- Encourages financial responsibility and independence: This fosters a sense of personal accountability.

- Promotes a healthy balance between shared and individual finances: It strikes a balance between teamwork and individuality.

- Helps to avoid conflicts related to personal spending: This minimizes potential sources of conflict in the relationship.

Conclusion

Maintaining financial balance in a celebrity marriage, or any marriage with significant income disparity, requires proactive planning, open communication, and professional guidance. Utilizing prenuptial agreements, seeking expert financial advice, establishing financial transparency, and maintaining some level of financial independence are all crucial steps to ensure a secure and harmonious financial future for both partners. Remember, addressing financial balance early and honestly can strengthen the relationship's overall stability. Don’t delay—seek professional advice today to establish strong financial foundations for your high-income marriage and navigate the complexities of financial balance effectively.

Featured Posts

-

A Durable Forever Mouse Logitechs Next Big Challenge

May 19, 2025

A Durable Forever Mouse Logitechs Next Big Challenge

May 19, 2025 -

Following Baby No 2 Reports Jennifer Lawrence And Cooke Maroney Step Out

May 19, 2025

Following Baby No 2 Reports Jennifer Lawrence And Cooke Maroney Step Out

May 19, 2025 -

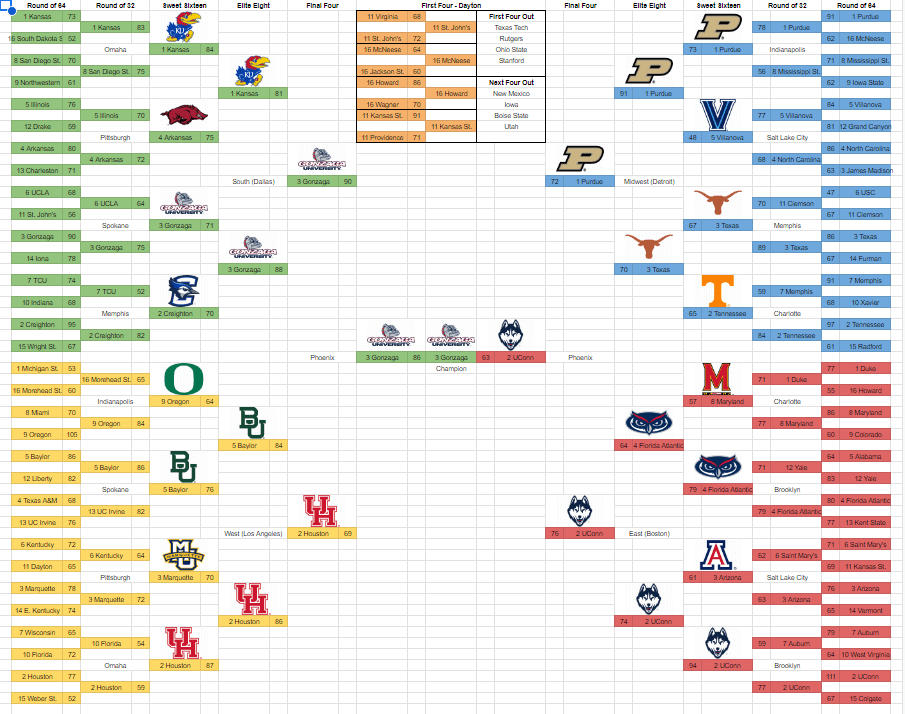

Finding Lipscomb In March Madness A Bracketology Overview

May 19, 2025

Finding Lipscomb In March Madness A Bracketology Overview

May 19, 2025 -

Ufc 313 A Rookie Report Newcomers To Look Out For

May 19, 2025

Ufc 313 A Rookie Report Newcomers To Look Out For

May 19, 2025 -

10 Najslabije Ocjena Hrvatske Na Eurosongu Analiza Rezultata

May 19, 2025

10 Najslabije Ocjena Hrvatske Na Eurosongu Analiza Rezultata

May 19, 2025

Latest Posts

-

Jannik Sinner Competira Em Hamburgo Apos Suspensao

May 19, 2025

Jannik Sinner Competira Em Hamburgo Apos Suspensao

May 19, 2025 -

El Tenista Comesana Se Clasifica Para El Atp 500 De Hamburgo

May 19, 2025

El Tenista Comesana Se Clasifica Para El Atp 500 De Hamburgo

May 19, 2025 -

Juan Aguilera Fallecimiento De Una Figura Clave Del Tenis Espanol

May 19, 2025

Juan Aguilera Fallecimiento De Una Figura Clave Del Tenis Espanol

May 19, 2025 -

Comesana Accede Al Cuadro Principal Del Atp 500 De Hamburgo

May 19, 2025

Comesana Accede Al Cuadro Principal Del Atp 500 De Hamburgo

May 19, 2025 -

Hamburgo Acolhe O Retorno De Jannik Sinner Apos Caso De Doping

May 19, 2025

Hamburgo Acolhe O Retorno De Jannik Sinner Apos Caso De Doping

May 19, 2025