Financial Support For Sustainable Practices In SMEs

Table of Contents

Government Grants and Subsidies for Sustainable Initiatives

Many governments recognize the vital role SMEs play in economic growth and are actively promoting sustainable practices. Numerous national and regional programs offer financial incentives to encourage SMEs to adopt eco-friendly business strategies. These grants and subsidies can significantly reduce the upfront cost of implementing sustainable technologies and practices.

Identifying Relevant Programs

Exploring available government programs is the first crucial step. These programs often focus on specific areas like:

- Energy efficiency: Grants for installing solar panels, upgrading energy-efficient equipment, and improving building insulation.

- Waste reduction: Funding for implementing waste management systems, recycling programs, and reducing packaging.

- Sustainable supply chains: Support for sourcing sustainable materials and implementing ethical sourcing practices.

Examples of Grant Programs (This section needs to be customized based on the target region/country): (Replace with actual, relevant grant programs and links)

- [Program Name 1]: Focuses on [area of sustainability], offers up to [amount], and requires [eligibility criteria]. [Link to program website]

- [Program Name 2]: Supports [area of sustainability], with grants up to [amount], targeting [types of SMEs]. [Link to program website]

- [Program Name 3]: Provides funding for [area of sustainability], with a specific emphasis on [niche]. [Link to program website]

Navigating the Application Process

Securing a government grant requires a well-prepared and compelling application. Key elements to focus on include:

- Clear articulation of your sustainability goals: Detail your planned initiatives, their environmental impact, and how they align with government objectives.

- Demonstrable financial viability: Present a realistic budget, demonstrating how the grant will be used effectively and showing the long-term financial sustainability of your project.

- Strong project management plan: Outline timelines, milestones, and key performance indicators (KPIs) to track progress and demonstrate accountability.

Green Loans and Financing Options for SMEs

Beyond grants, various financing options are specifically designed to support sustainable business practices. These “green loans” are becoming increasingly common as financial institutions recognize the growing importance of ESG (Environmental, Social, and Governance) factors.

Accessing Green Business Loans

Banks and other financial institutions are increasingly offering specialized loans with attractive terms for SMEs investing in sustainable technologies and practices. These loans often come with lower interest rates or extended repayment periods.

- Types of green loans: These can include term loans, lines of credit, and equipment financing tailored to sustainable investments.

- Interest rates and repayment terms: These will vary depending on the lender, the project, and your creditworthiness. Shop around and compare offers.

- Eligibility criteria: Check lender requirements regarding your business's sustainability initiatives, financial history, and credit score.

- Potential lenders: Many banks and credit unions have dedicated green lending programs. Research lenders in your area known for supporting sustainable businesses.

Exploring Crowdfunding and Impact Investing

For SMEs focused on sustainability, crowdfunding and impact investing represent exciting alternative financing options.

- Crowdfunding platforms: Platforms like Kickstarter and Indiegogo offer opportunities to directly engage with customers and raise capital. Highlight the environmental benefits of your project to attract supporters.

- Attracting impact investors: These investors seek financial returns while also generating positive social and environmental impact. Clearly articulate your company's sustainability goals and the measurable impact of your initiatives.

- Benefits and drawbacks: Crowdfunding can build brand awareness, but it's crucial to have a strong marketing plan. Impact investing can provide substantial capital, but it typically requires a high level of transparency and social impact reporting.

Private Sector Initiatives and Corporate Social Responsibility (CSR)

Beyond government and financial institutions, the private sector plays a significant role in supporting sustainable practices within SMEs.

Collaborating with Sustainable Businesses

Partnering with larger corporations committed to CSR can open doors to funding opportunities and collaborative projects promoting sustainability. These collaborations often involve joint ventures, supply chain partnerships, and technology sharing.

- Identifying potential partners: Research companies with strong CSR programs and a commitment to sustainability.

- Exploring collaborative ventures: Identify synergies and mutual benefits. Perhaps a larger company can provide resources or expertise, while your SME provides specialized knowledge or a niche product.

- Benefits of such partnerships: Access to funding, technology, market access, and brand enhancement.

Leveraging Supply Chain Sustainability

Working with sustainable suppliers can simultaneously reduce your environmental impact and attract investors and customers committed to ethical sourcing.

- Benefits of sustainable supply chains: Reduced environmental footprint, improved brand reputation, and access to innovative sustainable materials.

- Sourcing sustainable materials: Research suppliers who adhere to environmentally responsible practices and certifications (e.g., Fair Trade, organic).

- Building relationships with ethical suppliers: Transparency and collaboration are key to developing long-term, sustainable supply chain relationships.

Conclusion

Securing financial support for sustainable practices is crucial for SMEs aiming for long-term success in an increasingly environmentally conscious world. By exploring government grants, green loans, private sector initiatives, and impact investments, SMEs can access the necessary capital to implement eco-friendly strategies and achieve sustainable growth. Don't hesitate to thoroughly research and apply for the various funding options available. Start exploring financial support for sustainable practices in your SME today! Investing in sustainability is not just an ethical choice; it's a smart business decision that can lead to improved profitability, enhanced brand reputation, and long-term growth.

Featured Posts

-

Tonawanda Worker Arrested For Providing Drugs To Colleague

May 19, 2025

Tonawanda Worker Arrested For Providing Drugs To Colleague

May 19, 2025 -

Nyt Mini Crossword April 8 2025 Tuesday Complete Solution Guide

May 19, 2025

Nyt Mini Crossword April 8 2025 Tuesday Complete Solution Guide

May 19, 2025 -

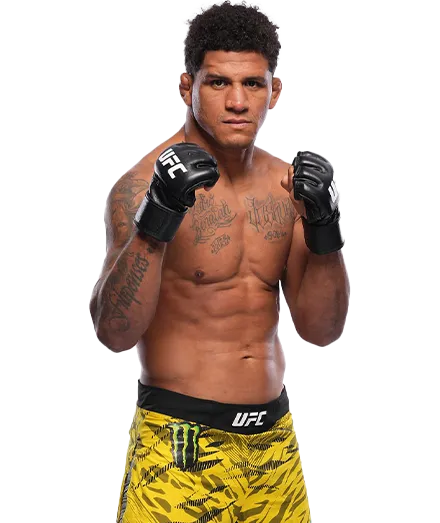

Ufc Vegas 106 A Complete Guide To Burns Vs Morales Odds And Predictions

May 19, 2025

Ufc Vegas 106 A Complete Guide To Burns Vs Morales Odds And Predictions

May 19, 2025 -

Postoje Li Sanse Za Popravak Marka Bosnjaka Analiza Kladionica

May 19, 2025

Postoje Li Sanse Za Popravak Marka Bosnjaka Analiza Kladionica

May 19, 2025 -

The United Kingdom At Eurovision 2025 A 19th Place Result

May 19, 2025

The United Kingdom At Eurovision 2025 A 19th Place Result

May 19, 2025

Latest Posts

-

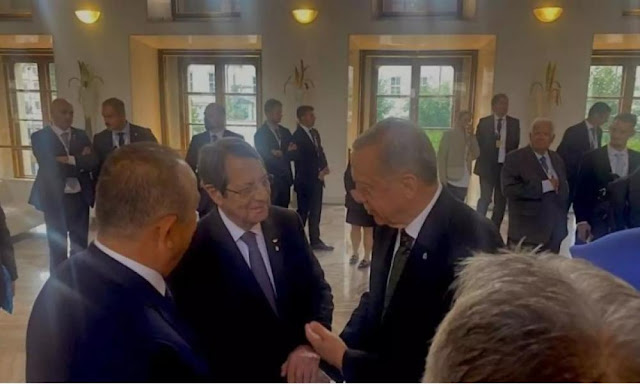

L Tzoymis Kai I Enallaktiki Toy Gia To Kypriako O Dromos Toy Kateynasmoy

May 19, 2025

L Tzoymis Kai I Enallaktiki Toy Gia To Kypriako O Dromos Toy Kateynasmoy

May 19, 2025 -

To Kypriako Zitima Kateynasmos I Antiparathesi I T Hesi Toy L Tzoymi

May 19, 2025

To Kypriako Zitima Kateynasmos I Antiparathesi I T Hesi Toy L Tzoymi

May 19, 2025 -

Times Kaysimon Kypros Enimeromenos Odigos

May 19, 2025

Times Kaysimon Kypros Enimeromenos Odigos

May 19, 2025 -

Kypriako I Simasia Toy Kateynasmoy Enanti Tis Antithesis

May 19, 2025

Kypriako I Simasia Toy Kateynasmoy Enanti Tis Antithesis

May 19, 2025 -

Anazitisi Gia Fthina Kaysima I Kypros Se Arithmoys

May 19, 2025

Anazitisi Gia Fthina Kaysima I Kypros Se Arithmoys

May 19, 2025