Financial Times: BP CEO's Plan To Double Company Value, No US Stock Market Switch

Table of Contents

The Core Strategy: A Two-Pronged Approach to Growth

Looney's strategy is a calculated two-pronged approach focused on maximizing returns from existing assets while simultaneously investing heavily in the renewable energy sector. This reflects a broader industry trend toward energy transition and sustainable practices. The plan hinges on a delicate balance between securing short-term profitability from existing oil and gas operations and making substantial long-term investments in a lower-carbon future.

-

Increased efficiency in existing fossil fuel production: BP plans to streamline its operations, improving efficiency and reducing costs across its existing oil and gas infrastructure. This includes leveraging advanced technologies and optimizing production processes.

-

Strategic divestment of underperforming assets: To free up capital for renewable energy investments, BP will strategically divest itself of underperforming or non-core assets. This will allow for a more focused investment strategy.

-

Massive investment in renewable energy sources (solar, wind, biofuels): A significant portion of BP's investment will be channeled into renewable energy projects, diversifying its portfolio and positioning the company for growth in a low-carbon economy. This includes developing both onshore and offshore wind farms, solar power plants, and biofuel production facilities.

-

Focus on technological innovation within the energy sector: BP plans to invest heavily in research and development, exploring new technologies in both fossil fuel optimization and renewable energy generation. This focus on innovation will be crucial to maintaining a competitive edge.

This comprehensive energy transition strategy aims to ensure profitability while successfully navigating the shift towards a greener energy landscape.

Addressing Concerns: Why No US Stock Market Shift?

While a US stock market listing might seem advantageous for some companies, BP has strategically decided against this move. This decision is based on several factors.

-

Advantages of remaining on the London Stock Exchange: BP benefits from an established investor base on the London Stock Exchange, and changing its listing would require significant administrative efforts and potential disruption. Furthermore, London remains a key global financial center.

-

Potential disadvantages of a US listing: A US listing involves substantial regulatory and compliance costs, potentially impacting profitability. Navigating the different regulatory landscapes in the US could prove complex and time-consuming.

-

Focus on attracting global investors despite the location: BP's strong global presence and reputation will attract investors worldwide, regardless of its primary stock exchange listing. The company's strategy will focus on attracting global investment based on the merits of its plan, rather than its geographic listing.

The decision to remain on the London Stock Exchange is a strategic one that balances the advantages of its current position with the potential complications of a US listing.

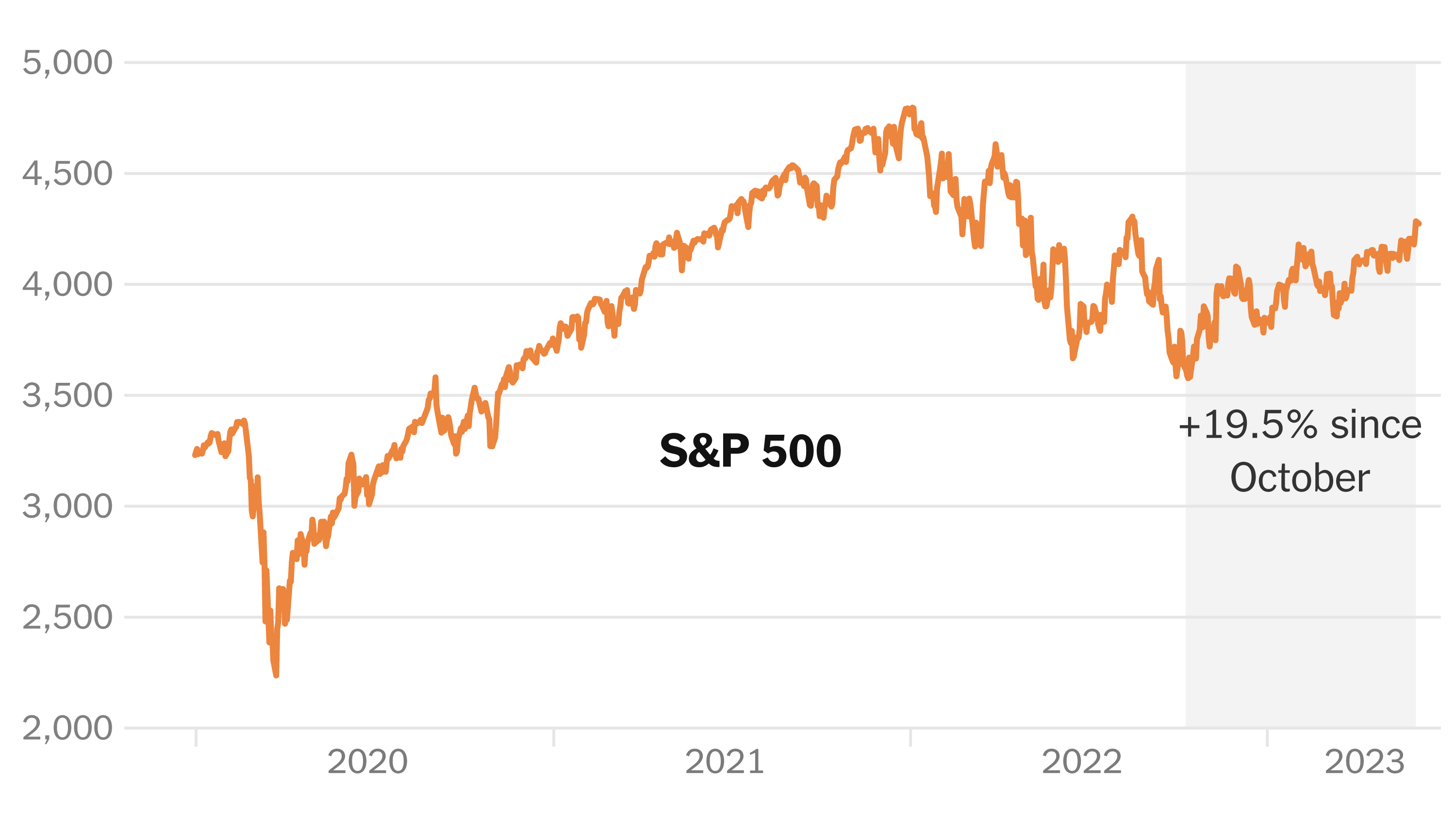

Financial Projections and Market Reaction

The Financial Times report detailed ambitious financial projections for BP. While specific figures vary depending on market conditions and unforeseen events, BP aims for substantial revenue growth over the next decade.

-

Projected revenue growth over the next decade: BP projects significant revenue growth fueled by both its existing oil and gas operations and its burgeoning renewable energy portfolio.

-

Expected increase in shareholder value: The core goal of this strategy is to double the company's value, delivering significant returns for shareholders through a combination of increased dividends and share price appreciation.

-

Analyst opinions and market forecasts: Analyst opinions are divided, with some expressing cautious optimism regarding the feasibility and timeline of BP's ambitious goals, while others highlight the inherent risks associated with such a significant energy transition. Market forecasts generally reflect a cautious yet positive outlook, with many anticipating substantial growth in the long term.

-

Stock price performance following the announcement: The market's initial reaction to the announcement was generally positive, indicating a degree of confidence in BP's long-term strategy. However, the stock price remains subject to market volatility and external factors.

These financial projections highlight the ambitious nature of BP's plan and its potential to significantly increase shareholder value.

Risks and Challenges Ahead

While BP's plan is ambitious, it faces several significant challenges and risks.

-

Challenges of the energy transition (e.g., regulatory hurdles, technological advancements): The energy transition presents numerous challenges, including evolving regulatory frameworks, technological uncertainties, and the need for large-scale infrastructure investment.

-

Geopolitical risks impacting oil and gas prices: Geopolitical instability and global events can significantly impact oil and gas prices, potentially affecting BP's revenue from its existing operations and creating uncertainty in its overall projections.

-

Competition from other major energy companies: The energy sector is fiercely competitive, with major players vying for market share in both traditional and renewable energy markets. Successfully navigating this competitive landscape will be crucial to BP's success.

These risks underscore the need for robust risk management strategies and the potential for market volatility to impact the company's overall performance.

Conclusion

BP CEO Bernard Looney's plan to double company value is a bold and ambitious strategy that involves a dual focus: optimizing existing oil and gas operations while simultaneously making significant investments in renewable energy. This plan, while ambitious, does not include a relocation to the US stock market. The potential rewards are substantial, but the challenges—from geopolitical risks to the inherent complexities of the energy transition—are significant. The success of this strategy will depend on effective execution, innovative technologies, and the ability to adapt to a rapidly changing energy landscape.

Call to Action: Stay informed on BP's progress toward its goal of doubling company value. Follow reputable financial news sources like the Financial Times for further updates on this significant development in the energy sector and BP’s strategy to successfully navigate the energy transition. Learn more about BP's plans to double company value by researching their investor relations materials and industry analyses.

Featured Posts

-

The World Trading Tournament Wtt How Aimscap Fared

May 22, 2025

The World Trading Tournament Wtt How Aimscap Fared

May 22, 2025 -

The Allure Of Cassis Blackcurrant Flavor Profile Uses And Cultivation

May 22, 2025

The Allure Of Cassis Blackcurrant Flavor Profile Uses And Cultivation

May 22, 2025 -

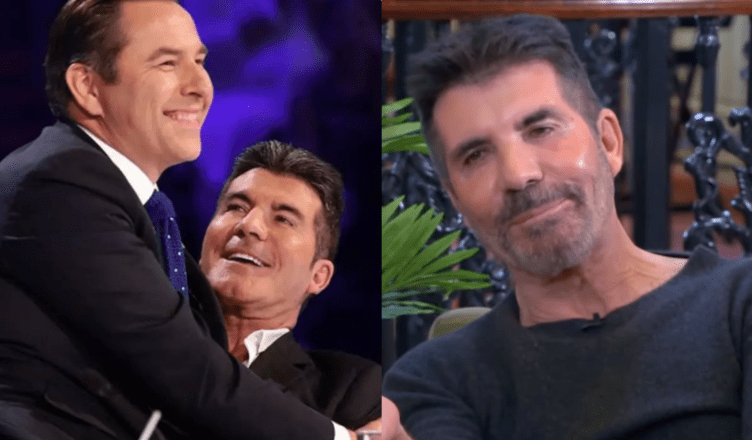

Celebrity News David Walliams Speaks Out Against Simon Cowell

May 22, 2025

Celebrity News David Walliams Speaks Out Against Simon Cowell

May 22, 2025 -

Kartels Restrictions A Police Source Explains Why

May 22, 2025

Kartels Restrictions A Police Source Explains Why

May 22, 2025 -

L Evolution De Moncoutant Sur Sevre Et Clisson Un Siecle De Diversification

May 22, 2025

L Evolution De Moncoutant Sur Sevre Et Clisson Un Siecle De Diversification

May 22, 2025

Latest Posts

-

Dexter Familiar Faces Fuel The New Seasons Conflict

May 22, 2025

Dexter Familiar Faces Fuel The New Seasons Conflict

May 22, 2025 -

Dexter New Blood Resurrection Trailer Release Date Speculation

May 22, 2025

Dexter New Blood Resurrection Trailer Release Date Speculation

May 22, 2025 -

Dexter Resurrection The Return Of Fan Favorite Antagonists

May 22, 2025

Dexter Resurrection The Return Of Fan Favorite Antagonists

May 22, 2025 -

Dexter Resurrection De Impact Van John Lithgow En Jimmy Smits Op Het Verhaal

May 22, 2025

Dexter Resurrection De Impact Van John Lithgow En Jimmy Smits Op Het Verhaal

May 22, 2025 -

Record Breaking 19 Indian Paddlers Compete In Wtt Star Contender Chennai

May 22, 2025

Record Breaking 19 Indian Paddlers Compete In Wtt Star Contender Chennai

May 22, 2025