Financial Update: Musk's X Debt Sale And Its Implications

Table of Contents

The Details of Musk's X Debt Sale

The specifics of Musk's X debt sale remain somewhat opaque, but reports suggest a substantial amount of debt was secured. The exact figures fluctuate depending on the source, but the sale likely involved a combination of high-yield bonds and loans from various financial institutions. Interest rates are expected to be high, reflecting the inherent risk associated with lending to a company under Musk's leadership, considering its recent history and financial restructuring.

- Key details:

- The reported amount of debt sold varies widely across news sources, ranging from billions to tens of billions of dollars. Confirmation of the exact figures is still awaited.

- Lenders are likely a mix of investment banks, hedge funds, and potentially private equity firms comfortable with high-risk, high-reward investments.

- The timeline of the sale suggests a swift and decisive move, potentially indicating a pressing need for liquidity.

- Collateral for the debt is likely tied to X's assets, which could include intellectual property, user data, and potentially even physical infrastructure.

The primary reasons behind this massive debt sale remain speculative. Possible explanations include bridging a significant funding gap, financing acquisitions, or simply refinancing existing debt at more favorable terms (although this seems less likely given the high-risk nature of the new debt).

- Possible Explanations:

- Addressing substantial operating losses incurred since Musk's acquisition.

- Funding ambitious expansion plans, including potential forays into payments and other adjacent markets.

- Refinancing existing debt, although the high interest rates suggest this is a less probable reason.

- The timing coincided with a period of economic uncertainty, which might indicate difficulty in securing alternative funding.

Short-Term Implications for X (formerly Twitter)

The immediate effect of the debt sale is a substantial influx of cash, which should provide some breathing room for X's operations. However, this short-term benefit is offset by the long-term burden of increased debt.

- Impact on X's finances:

- The debt-to-equity ratio will significantly increase, raising concerns about X's financial leverage and its ability to withstand economic shocks.

- Credit rating agencies will likely downgrade X's credit rating, making future borrowing more expensive and difficult.

- Operational spending might be impacted; however, the nature of this impact could be either a need for cost-cutting or the ability to finance additional projects.

The impact on X's ongoing operations and projects is likely to be multifaceted. While the increased cash flow provides some flexibility, the added debt burden necessitates prudent financial management.

- Operational Impacts:

- Cost-cutting measures might be implemented to improve profitability and manage the debt burden, potentially affecting workforce or features.

- Some planned projects might be accelerated to generate quicker returns and alleviate financial pressure.

- Conversely, less crucial projects might be delayed or canceled to prioritize debt repayment.

Long-Term Implications for X's Financial Health

The increased debt burden presents significant long-term challenges for X's financial health. The risk of default becomes a real possibility if revenue generation doesn't meet projections.

- Potential Long-Term Risks:

- The high interest payments will strain X's cash flow, potentially limiting its ability to invest in growth and innovation.

- Rising interest rates could further exacerbate the debt burden, making repayment even more challenging.

- X's heavy reliance on advertising revenue makes it vulnerable to economic downturns and changes in the digital advertising market.

The debt sale's impact on X's ability to attract investors and secure future funding is substantial. Investor confidence is likely to decrease due to the increased risk profile.

- Impact on Future Funding:

- It will be harder to secure future funding rounds due to the significant debt and potentially lowered credit ratings.

- To attract investors, Musk may need to offer more equity, resulting in a dilution of ownership and a reduced stake for existing shareholders.

- The potential for further debt restructuring or even bankruptcy cannot be ruled out.

Broader Implications for the Tech Industry

Musk's X debt sale has significant implications for the broader tech industry, particularly for companies pursuing aggressive growth strategies.

- Industry-Wide Impacts:

- Other tech companies might reconsider similar high-risk debt strategies, opting for more conservative financial planning.

- Investor sentiment towards high-risk ventures could shift, leading to increased scrutiny of financial models and greater risk aversion.

- Lending practices in the tech industry may become more stringent, with lenders demanding stricter terms and higher collateral.

The valuation of social media companies and similar platforms might be affected. The perceived risk associated with high-debt models could lead to downward pressure on valuations across the sector.

- Impact on Social Media Valuation:

- Market perceptions of risk in the social media sector could shift, leading to a reassessment of valuations.

- The incident could potentially accelerate consolidation within the social media landscape, with weaker players merging or being acquired.

- Future funding rounds for social media companies might be more challenging, with investors demanding greater transparency and financial stability.

Conclusion

Musk's X debt sale presents a complex picture with both short-term benefits and substantial long-term risks. While the immediate influx of cash provides some financial breathing room, the increased debt burden significantly impacts X's financial health and its ability to compete in the long run. This situation has broader implications for the tech industry, affecting investor sentiment, lending practices, and the valuation of similar companies. The success of this strategy hinges heavily on X's ability to generate substantial revenue growth to offset its considerable debt obligations. Failure to do so could lead to a variety of negative consequences.

Call to Action: Stay informed about the evolving financial situation at X and the implications of Musk's X debt sale and its ongoing impact. Follow our updates for continued analysis on this crucial development and its repercussions. For deeper insights into the financial strategies of major tech companies, explore our other articles.

Featured Posts

-

Nintendos Action Ryujinx Switch Emulator Development Ends

Apr 28, 2025

Nintendos Action Ryujinx Switch Emulator Development Ends

Apr 28, 2025 -

Driving The Overseas Highway A Florida Keys Road Trip

Apr 28, 2025

Driving The Overseas Highway A Florida Keys Road Trip

Apr 28, 2025 -

Americas Truck Bloat Finding A Solution

Apr 28, 2025

Americas Truck Bloat Finding A Solution

Apr 28, 2025 -

Ryujinx Switch Emulator Development Ceases After Nintendo Intervention

Apr 28, 2025

Ryujinx Switch Emulator Development Ceases After Nintendo Intervention

Apr 28, 2025 -

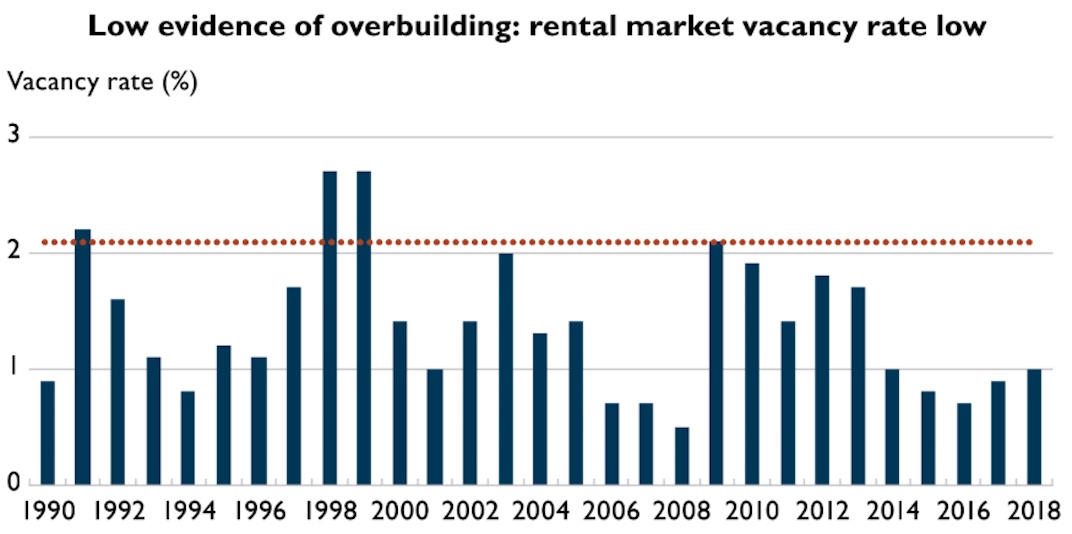

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Remain High

Apr 28, 2025

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Remain High

Apr 28, 2025

Latest Posts

-

Red Sox Roster Update Outfielders Return Impacts Lineup Casas Moves Down

Apr 28, 2025

Red Sox Roster Update Outfielders Return Impacts Lineup Casas Moves Down

Apr 28, 2025 -

Boston Red Sox Adjust Lineup Casas Lowered Outfielder Back In Action

Apr 28, 2025

Boston Red Sox Adjust Lineup Casas Lowered Outfielder Back In Action

Apr 28, 2025 -

Red Sox Lineup Changes Triston Casas Slide And Outfield Return

Apr 28, 2025

Red Sox Lineup Changes Triston Casas Slide And Outfield Return

Apr 28, 2025 -

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

Red Sox Outfielder Breakout Could This Player Be The Next Jarren Duran

Apr 28, 2025

Red Sox Outfielder Breakout Could This Player Be The Next Jarren Duran

Apr 28, 2025