Financing A 270MWh BESS In Belgium's Complex Merchant Market

Table of Contents

Understanding the Belgian Energy Market and its Impact on BESS Financing

The Belgian energy market's transition to renewables significantly impacts BESS financing. Understanding the regulatory framework and the intricacies of the merchant market is crucial for securing funding.

Regulatory Framework and Incentives

Belgium's ambitious renewable energy targets, such as those outlined in its Climate and Energy Package, create a favorable environment for BESS deployment. Several government initiatives provide incentives to support energy storage projects:

- Specific government programs: The Belgian government offers various subsidies and tax breaks for renewable energy projects, many of which can be applied to BESS installations. These include direct grants, tax exemptions, and accelerated depreciation allowances. Detailed information can be found on the website of the Federal Public Service Economy.

- Feed-in tariffs: While not always directly applicable to BESS, the feed-in tariffs for renewable energy generation indirectly stimulate the need for BESS to manage fluctuating output.

- Regulations impacting large-scale storage: Regulations concerning grid connection, safety standards, and licensing procedures for large-scale BESS installations must be carefully navigated. These are constantly evolving, so staying updated on changes is crucial for successful BESS financing in Belgium.

The Merchant Market and Revenue Streams

Belgium's electricity market operates largely on a merchant basis, meaning electricity prices are determined by supply and demand. This creates both opportunities and challenges for BESS projects:

- Potential revenue streams: A 270MWh BESS can generate revenue through various services, including:

- Frequency regulation: Providing grid stabilization services to Elia, the Belgian transmission system operator.

- Arbitrage: Buying energy at low prices and selling it at higher prices during peak demand.

- Ancillary services: Providing other services to maintain grid reliability and stability.

- Price volatility: The fluctuating electricity prices inherent in the merchant market introduce considerable risk. Sophisticated forecasting and hedging strategies are crucial for accurate financial modeling and securing funding. Detailed analysis of historical price data and future market projections is essential.

Exploring Financing Options for a 270MWh BESS Project in Belgium

Securing funding for a large-scale BESS project requires a diverse approach, combining different financing options to optimize the capital structure.

Equity Financing

Private equity and venture capital firms are increasingly interested in investing in the renewable energy sector, including BESS.

- Advantages: Equity financing provides long-term capital and reduces debt burden.

- Disadvantages: Equity investors typically demand a share of profits and may influence project decisions.

- Potential equity investors: Identify potential investors specializing in renewable energy or infrastructure projects active in the Belgian or European markets.

Debt Financing

Several debt financing options are available, each with its own advantages and disadvantages:

- Bank loans: Traditional bank loans are a common source of funding, but securing loans for large-scale BESS projects might require strong creditworthiness and comprehensive project documentation.

- Green bonds: These bonds are specifically designed to finance green projects and are increasingly popular among investors committed to sustainability.

- Project finance: This approach involves structuring the financing around the specific cash flows of the BESS project.

- Government-backed loan guarantees: These can significantly reduce the risk for lenders and improve access to financing.

Hybrid Financing Models

Combining equity and debt financing creates a balanced capital structure:

- Benefits: Hybrid models minimize the financial burden on each financing source while increasing the overall financial strength of the project.

- Successful case studies: Research successful hybrid financing structures for similar BESS projects globally to inform your strategy for Financing BESS Belgium. Case studies from other European countries with similar energy market structures can provide valuable insights.

Mitigating Risks and Ensuring Project Viability

Successful BESS project financing hinges on proactive risk management:

Technology Risk

The technology used in BESS is constantly evolving, and associated risks must be addressed:

- Reliable battery technology: Select proven battery technology from reputable manufacturers and ensure adequate warranty coverage.

- Experienced contractors: Partner with experienced EPC contractors with a demonstrated track record in BESS project development and execution.

- Insurance: Comprehensive insurance coverage can mitigate risks associated with equipment failure or unforeseen circumstances.

Regulatory Risk

Changes in Belgian regulations could impact project profitability:

- Regulatory monitoring: Stay abreast of changes in regulatory frameworks and government policies.

- Policy risk mitigation: Incorporate regulatory uncertainty into financial modeling and develop contingency plans.

Market Risk

Fluctuating electricity prices directly affect project revenue:

- Price forecasting: Develop detailed price forecasts using sophisticated modeling techniques.

- Hedging strategies: Implement hedging strategies to mitigate price volatility risks.

Conclusion

Financing a 270MWh BESS in Belgium's merchant market presents significant challenges, but also lucrative opportunities. Understanding the Belgian regulatory landscape, utilizing diverse financing options (equity, debt, and hybrid models), and effectively managing technology, regulatory, and market risks are crucial for project success. By leveraging available incentives, securing robust revenue streams, and implementing a well-structured financing strategy, developers can unlock the potential of large-scale BESS deployment in Belgium. To learn more about successful BESS financing strategies in the Belgian market, contact [Contact Information/Link to relevant resources]. Start planning your BESS financing strategy in Belgium today.

Featured Posts

-

Fortnite Community Backlash Recent Shop Update Disappoints

May 03, 2025

Fortnite Community Backlash Recent Shop Update Disappoints

May 03, 2025 -

Tulsas Winter Road Maintenance A Fleet Of 66 Salt Spreaders

May 03, 2025

Tulsas Winter Road Maintenance A Fleet Of 66 Salt Spreaders

May 03, 2025 -

New Fortnite Shop Update A Breakdown Of Player Complaints

May 03, 2025

New Fortnite Shop Update A Breakdown Of Player Complaints

May 03, 2025 -

15 April 2025 Daily Lotto Winning Numbers

May 03, 2025

15 April 2025 Daily Lotto Winning Numbers

May 03, 2025 -

The Crucial Role Of Mental Health Policy In Employee Productivity

May 03, 2025

The Crucial Role Of Mental Health Policy In Employee Productivity

May 03, 2025

Latest Posts

-

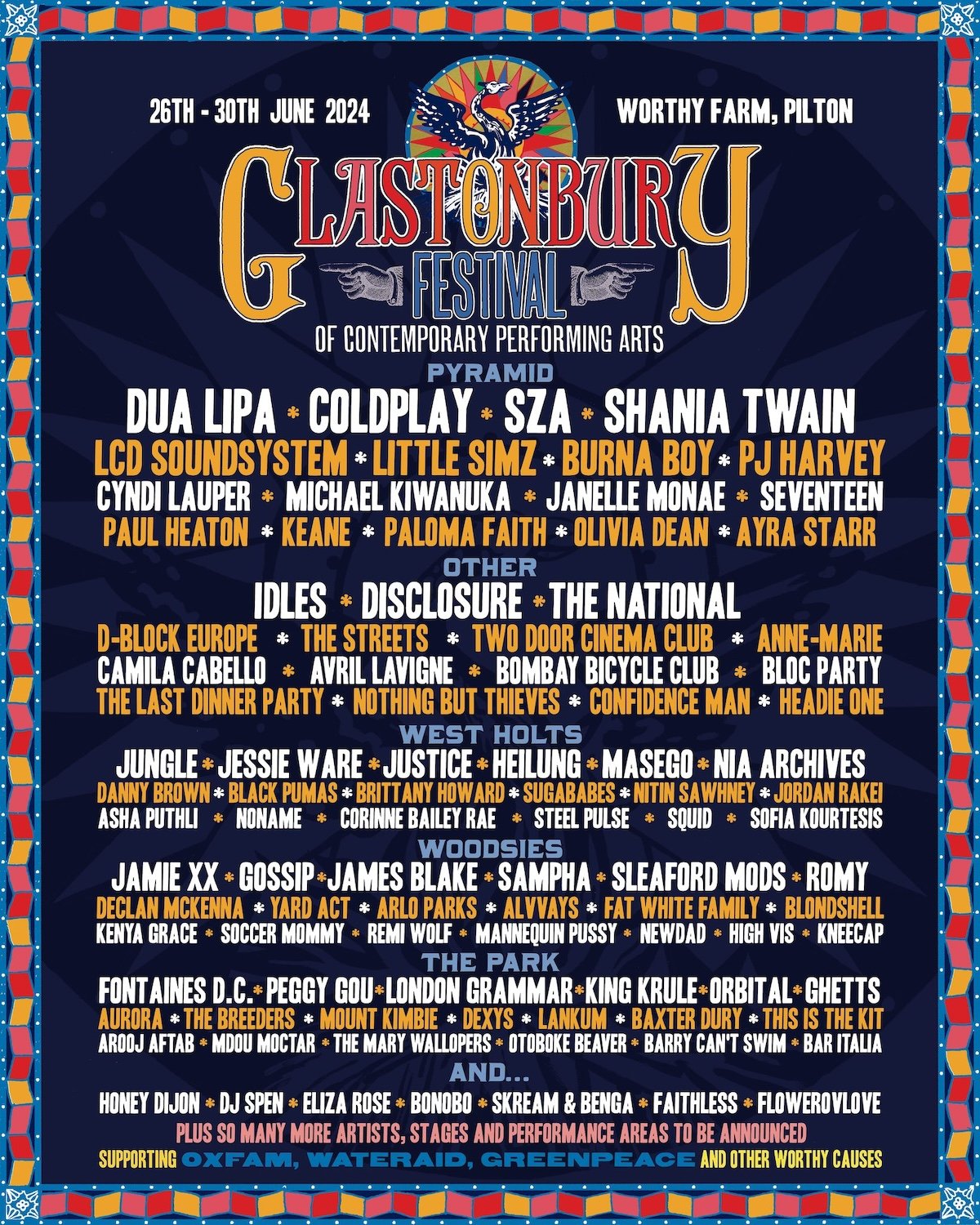

Glastonbury Headliners 2024 Speculation On The 1975 And Olivia Rodrigo

May 03, 2025

Glastonbury Headliners 2024 Speculation On The 1975 And Olivia Rodrigo

May 03, 2025 -

Daisy May Cooper And Anthony Huggins Announce Engagement

May 03, 2025

Daisy May Cooper And Anthony Huggins Announce Engagement

May 03, 2025 -

Glastonbury Festival 2024 The 1975 And Olivia Rodrigo Confirmed

May 03, 2025

Glastonbury Festival 2024 The 1975 And Olivia Rodrigo Confirmed

May 03, 2025 -

Dont Miss Out Glastonbury 2025 Resale Tickets

May 03, 2025

Dont Miss Out Glastonbury 2025 Resale Tickets

May 03, 2025 -

Rosie Huntington Whiteleys All White Lingerie Look A Study In Perfection

May 03, 2025

Rosie Huntington Whiteleys All White Lingerie Look A Study In Perfection

May 03, 2025