Find The Best Personal Loan For Bad Credit: Direct Lender Options

Table of Contents

Understanding Direct Lenders and Their Advantages

What is a Direct Lender?

A direct lender is a financial institution—like a bank or credit union—that provides loans directly to borrowers. This contrasts with brokers or third-party lenders who act as intermediaries, connecting borrowers with multiple lenders. Dealing directly with the lender offers several key benefits, particularly for those seeking a personal loan for bad credit.

- Avoids middlemen fees: Brokers often charge fees for their services, increasing the overall cost of your loan. Direct lenders eliminate this extra expense, potentially saving you significant money.

- Simpler application process: Applying directly to a lender streamlines the process. You submit one application, avoiding the multiple applications required when using a broker. This is especially beneficial when your credit score is less than perfect.

- Direct communication with the lender: Direct communication ensures clarity and transparency throughout the loan process. You can easily address any questions or concerns directly with the decision-makers.

- Greater transparency in terms and conditions: Direct lenders provide clear and concise loan agreements, avoiding hidden fees or confusing clauses often found with less reputable lenders.

Finding Reputable Direct Lenders for Bad Credit Loans

Research and Comparison Tools

Finding a reputable direct lender is crucial, especially when applying for a personal loan for bad credit. Thorough research is vital to avoid predatory lenders who might exploit your financial situation.

- Check the lender's licensing and registration: Ensure the lender is legally operating and authorized to provide loans in your state. You can often find this information on your state's financial regulatory website.

- Look for reviews and testimonials from previous borrowers: Websites like the Better Business Bureau (BBB) and Trustpilot offer valuable insights into a lender's reputation and customer service. Pay close attention to reviews mentioning experiences with bad credit loan applications.

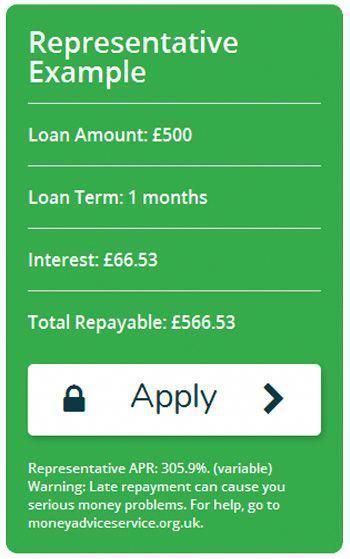

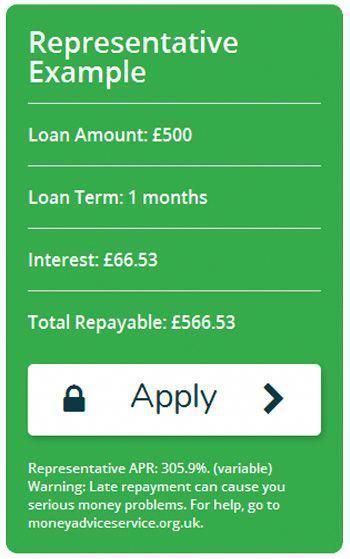

- Compare APRs (Annual Percentage Rates) and fees: APR represents the total cost of borrowing, including interest and fees. Compare APRs from several lenders to find the most competitive offer. Be sure to also compare origination fees, late payment penalties, and any other potential fees.

- Be wary of lenders promising guaranteed approval: No legitimate lender can guarantee approval for a loan, especially for those with bad credit. Beware of lenders making such promises, as they are often predatory.

Improving Your Chances of Approval for a Bad Credit Personal Loan

Improving Your Credit Score

Improving your credit score before applying for a personal loan significantly increases your chances of approval and securing better terms. Even small improvements can make a big difference.

- Pay down existing debt: Reducing your debt-to-income ratio demonstrates responsible financial management to lenders.

- Monitor your credit report regularly: Check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) regularly for errors and to track your progress.

- Correct any inaccuracies on your credit report: Dispute any inaccurate information on your credit report that could be negatively impacting your score.

- Consider a secured loan as a stepping stone: If your credit is severely damaged, a secured loan (requiring collateral) might be easier to obtain, allowing you to rebuild your credit history and qualify for better loan options in the future. This can be a pathway to a better personal loan for bad credit later on.

Types of Personal Loans for Bad Credit from Direct Lenders

Secured vs. Unsecured Loans

Understanding the difference between secured and unsecured personal loans is crucial when dealing with bad credit.

- Secured loans typically have lower interest rates: Secured loans require collateral (like a car or savings account) which reduces the risk for the lender, leading to lower interest rates. However, you risk losing the collateral if you default on the loan.

- Unsecured loans require no collateral but often come with higher interest rates: Unsecured loans are riskier for lenders, resulting in higher interest rates for borrowers with bad credit.

- Payday loans and title loans are high-risk options to avoid: These short-term loans often carry extremely high interest rates and fees, making them financially detrimental. They should be avoided if at all possible.

What to Look For in a Loan Agreement

Key Terms and Conditions

Carefully reviewing the loan agreement is paramount before accepting any personal loan, especially a personal loan for bad credit.

- Understand the APR clearly: The APR reflects the total cost of borrowing. Ensure you understand all fees included in the APR calculation.

- Read the fine print carefully: Pay close attention to all clauses, including prepayment penalties, late payment fees, and any other potential charges.

- Ask questions if anything is unclear: Don't hesitate to contact the lender directly to clarify any unclear terms or conditions.

- Compare offers from multiple lenders: Before committing, compare loan offers from multiple direct lenders to secure the best terms and rates.

Conclusion

Finding the best personal loan for bad credit requires careful research and planning. By understanding direct lenders, improving your creditworthiness, and carefully comparing loan offers, you can increase your chances of securing a fair and affordable loan. Remember to always review loan agreements thoroughly before signing. Start your search for the right personal loan for bad credit today and take control of your finances.

Featured Posts

-

Securing A Tribal Loan With Bad Credit A Direct Lender Guide

May 28, 2025

Securing A Tribal Loan With Bad Credit A Direct Lender Guide

May 28, 2025 -

Mlb Betting Brewers Vs Diamondbacks Predictions And Best Odds Today

May 28, 2025

Mlb Betting Brewers Vs Diamondbacks Predictions And Best Odds Today

May 28, 2025 -

Ozempic And Beyond The Growing Applications Of Glp 1 Receptor Agonists In Healthcare

May 28, 2025

Ozempic And Beyond The Growing Applications Of Glp 1 Receptor Agonists In Healthcare

May 28, 2025 -

Garnacho Autograph Controversy Young Fan Left Disappointed

May 28, 2025

Garnacho Autograph Controversy Young Fan Left Disappointed

May 28, 2025 -

Irish Euro Millions Winner Sought Ticket Sold In Shop Name Location

May 28, 2025

Irish Euro Millions Winner Sought Ticket Sold In Shop Name Location

May 28, 2025

Latest Posts

-

Prison Isere Le Deplacement Ministeriel Face Aux Attaques Recentes

May 30, 2025

Prison Isere Le Deplacement Ministeriel Face Aux Attaques Recentes

May 30, 2025 -

Elections Municipales Metz 2026 L Avenir Politique De Laurent Jacobelli

May 30, 2025

Elections Municipales Metz 2026 L Avenir Politique De Laurent Jacobelli

May 30, 2025 -

Alliance Improbable Le Rn Et La Gauche Sur L Age De Depart A La Retraite

May 30, 2025

Alliance Improbable Le Rn Et La Gauche Sur L Age De Depart A La Retraite

May 30, 2025 -

Europe 1 Retrouvez Aurelien Veron Et Laurent Jacobelli Le Week End

May 30, 2025

Europe 1 Retrouvez Aurelien Veron Et Laurent Jacobelli Le Week End

May 30, 2025 -

Proces Hanouna Le Pen Appel En 2026 Jacobelli Denonce Un Malaise Judiciaire

May 30, 2025

Proces Hanouna Le Pen Appel En 2026 Jacobelli Denonce Un Malaise Judiciaire

May 30, 2025