Finding Alternatives: China's Response To US Pharmaceutical Imports

Table of Contents

Domestic Production Boost: Investing in R&D and Manufacturing

China's strategy hinges on significantly bolstering its domestic pharmaceutical manufacturing capabilities. This involves substantial investment in research and development (R&D), technological advancements, and workforce development.

Increased Government Funding

The Chinese government has implemented numerous initiatives to stimulate domestic pharmaceutical manufacturing. This includes:

- The "Made in China 2025" initiative: This ambitious plan allocates considerable resources to upgrading key industries, including pharmaceuticals, with a focus on technological innovation and self-reliance. Funding has increased by an estimated 20% annually in the past five years (Source needed – replace with actual data).

- Targeted subsidies and tax breaks: These incentives encourage domestic pharmaceutical companies to invest in new facilities, equipment, and R&D projects. Specific examples include tax reductions for companies investing in advanced manufacturing technologies and grants for successful clinical trials of domestically produced drugs.

- National pharmaceutical innovation funds: These funds specifically target high-potential research projects and early-stage drug development, mitigating financial risk for domestic companies.

These initiatives have led to a significant increase in domestic pharmaceutical manufacturing capacity and output. The keyword "domestic pharmaceutical manufacturing" has become increasingly relevant within the context of these ambitious funding programs.

Technological Advancements

China is actively investing in advanced pharmaceutical technologies, including:

- Biotechnology: Significant investment in biotechnology research has led to advancements in areas like biosimilars, cell therapy, and gene editing, reducing dependence on foreign suppliers for cutting-edge therapies.

- Artificial intelligence (AI) in drug discovery: AI-driven platforms are accelerating drug discovery processes, enabling faster development and reduced costs.

- Pharmaceutical manufacturing automation: Increased automation in manufacturing plants improves efficiency, reduces errors, and increases overall output.

Collaborations with international pharmaceutical companies outside the US (e.g., European and Indian firms) are also playing a crucial role in accelerating technological transfer and enhancing domestic capabilities. This emphasizes the growing importance of "pharmaceutical technology" and "domestic innovation" in China's strategy.

Talent Acquisition and Training

Developing a highly skilled pharmaceutical workforce is vital for sustainable growth. China is addressing this through:

- Expansion of pharmaceutical education programs: Universities are expanding their programs to train more scientists, researchers, and manufacturing professionals.

- Government-sponsored training programs: These programs provide opportunities for upskilling existing professionals and attracting talent from abroad (again, excluding the US).

- Incentives for pharmaceutical professionals to return to China: Attracting skilled Chinese professionals working overseas is a key component of the strategy.

These initiatives directly address the need for a strong "pharmaceutical workforce development" and the acquisition of "skilled labor" vital to the success of China’s pharmaceutical industry.

Strategic Partnerships: Collaborations with Other Countries

Diversifying its sources of pharmaceutical imports is another key component of China's strategy.

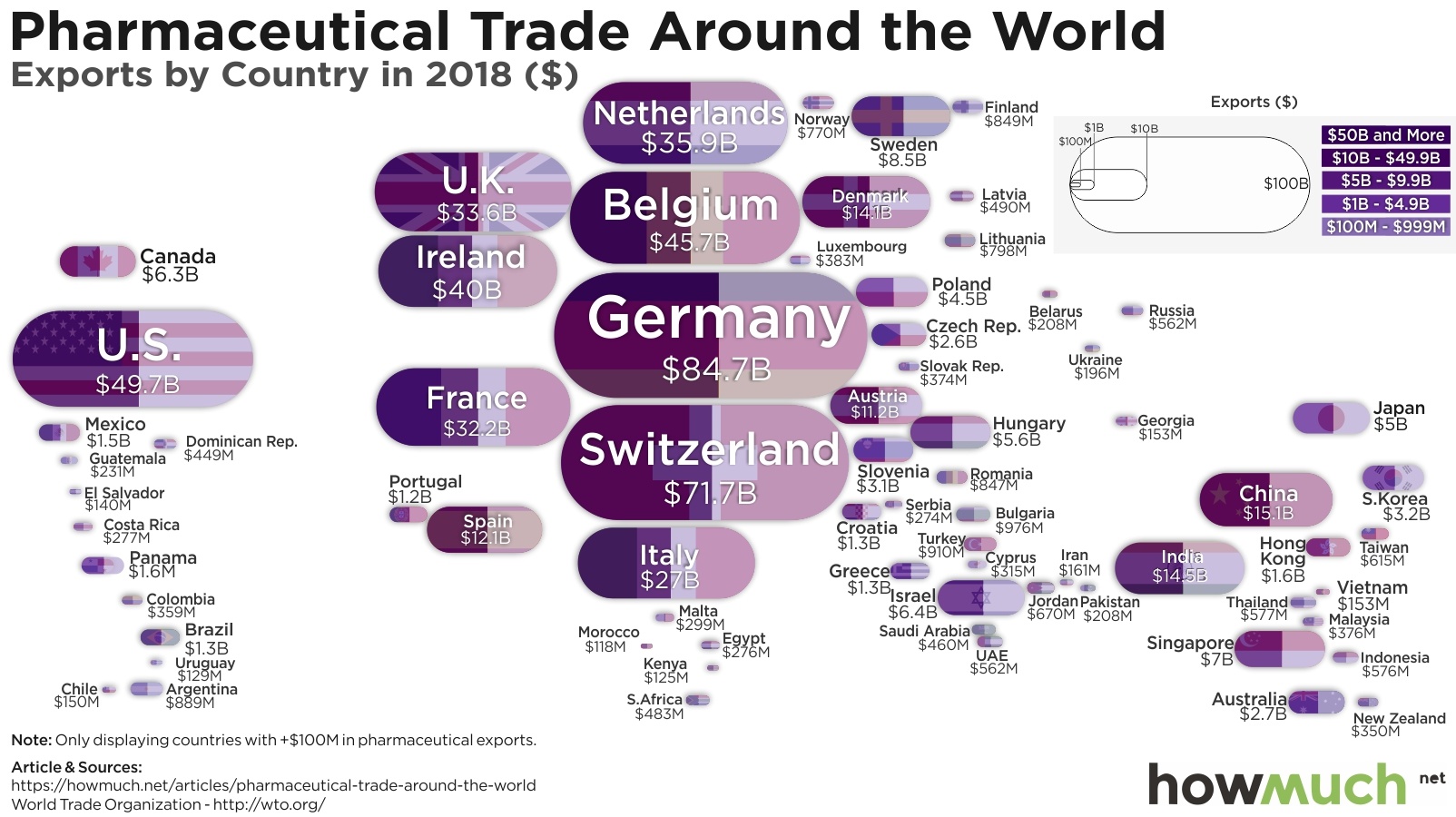

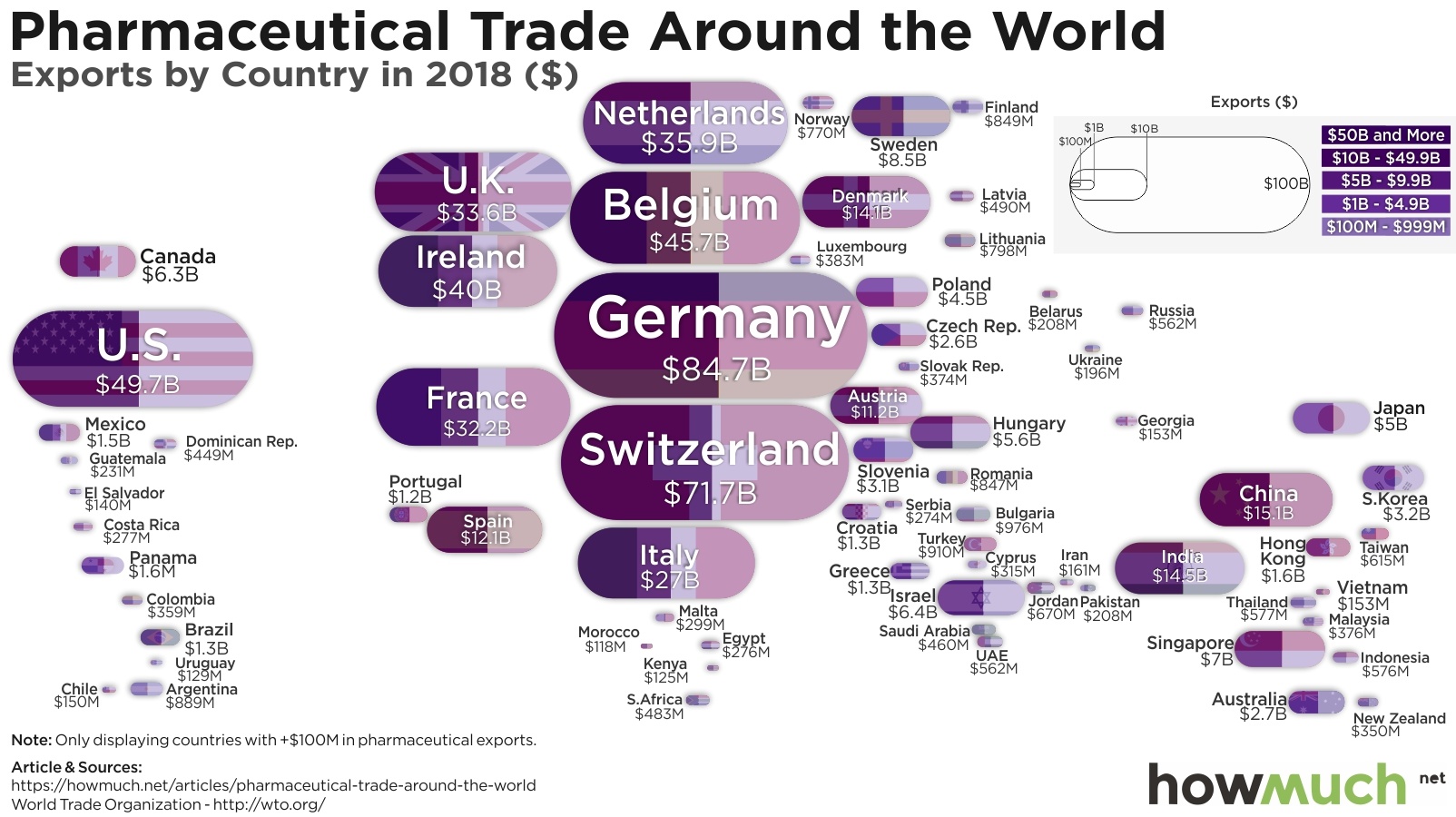

Diversifying Import Sources

China is actively forging partnerships with countries other than the US, including:

- India: India is a major supplier of generic drugs, and China is expanding its trade relations to secure access to affordable medications.

- European Union: Several EU countries are key suppliers of specialized pharmaceuticals and active pharmaceutical ingredients (APIs). Trade agreements facilitate smoother access to these products.

- Other Asian countries: China is exploring collaborations with countries like Japan, South Korea, and Singapore to secure access to cutting-edge technologies and specialized medications.

This "pharmaceutical import diversification" strategy strengthens China’s resilience against disruptions in supply chains. The focus is on establishing reliable "alternative suppliers" and expanding the network of "international partnerships."

Joint Ventures and Technology Transfer

Joint ventures and technology transfer agreements play a crucial role in transferring expertise and technology to Chinese pharmaceutical companies. This includes:

- Collaborations with European companies: These partnerships provide access to advanced manufacturing processes, R&D expertise, and product portfolios.

- Technology transfer agreements with Indian pharmaceutical companies: These agreements often involve the licensing of production technology or the transfer of manufacturing know-how for generic drugs.

- Joint ventures focused on the development and manufacturing of innovative drugs: These collaborations facilitate the development of new drugs and treatments for the Chinese market and beyond.

These "joint ventures" and "technology transfer" initiatives accelerate the growth of China's pharmaceutical capabilities. Furthermore, these "global pharmaceutical collaborations" are integral to their plan for long-term independence.

Regulatory Reforms and Market Access

Streamlining the drug approval process and enhancing intellectual property (IP) protection are crucial for attracting investment and fostering innovation.

Streamlining Approval Processes

China has undertaken significant regulatory reforms to expedite drug approvals:

- Accelerated approval pathways: These pathways are designed to expedite the approval of innovative drugs for critical medical needs.

- Harmonization of drug approval standards: This aims to align Chinese standards with international norms, thereby simplifying the process for foreign (non-US) pharmaceutical companies.

- Improved efficiency within regulatory agencies: Measures have been taken to reduce bureaucratic hurdles and streamline the approval process, resulting in faster market entry for new drugs.

These reforms significantly impact the "drug approval process," promoting "regulatory reform" and enhancing "market access."

Intellectual Property Protection

Strengthening intellectual property rights (IPR) is critical to attracting foreign investment and fostering innovation:

- Improved enforcement of patent laws: Efforts are being made to better protect patents and other forms of intellectual property.

- Increased penalties for IP infringement: This is meant to deter counterfeiting and piracy of pharmaceuticals.

- Improved transparency in the IP protection system: This aims to increase trust and confidence among foreign investors.

While there are ongoing concerns about IP protection, improvements in this area are essential for attracting foreign (non-US) investment and fostering "pharmaceutical innovation" in China. Strengthening "intellectual property rights" and ensuring robust "patent protection" are crucial to this process.

Conclusion: Finding Alternatives – A Path to Pharmaceutical Independence

China's multifaceted approach to reducing its dependence on US pharmaceutical imports is yielding tangible results. By boosting domestic production, fostering international collaborations, and implementing significant regulatory reforms, China is making substantial progress towards pharmaceutical independence. While challenges remain, including concerns about IP protection and the need for continued investment in R&D, China’s commitment to diversifying its pharmaceutical supply chain and developing its domestic capabilities is evident.

Key Takeaways: China’s success depends on sustained investment in R&D, technological advancements, robust regulatory frameworks, and strategic international partnerships. The success of its approach will significantly influence global pharmaceutical trade dynamics.

To further explore this vital topic and its implications, search for keywords such as "China pharmaceutical independence," "alternative pharmaceutical sources," and "US-China pharmaceutical trade." Understanding China's strategies for "finding alternatives" is crucial for navigating the evolving landscape of global pharmaceutical markets.

Featured Posts

-

Khai Mac Giai Bong Da Thanh Nien Thanh Pho Hue Nhung Diem Noi Bat

Apr 30, 2025

Khai Mac Giai Bong Da Thanh Nien Thanh Pho Hue Nhung Diem Noi Bat

Apr 30, 2025 -

Disney Cuts 200 Abc News Jobs Impacting 538

Apr 30, 2025

Disney Cuts 200 Abc News Jobs Impacting 538

Apr 30, 2025 -

Aanklacht Tegen Diddy Beyonce En Jay Z Niet Langer Betrokken

Apr 30, 2025

Aanklacht Tegen Diddy Beyonce En Jay Z Niet Langer Betrokken

Apr 30, 2025 -

Khai Mac Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Thong Tin Chi Tiet

Apr 30, 2025

Khai Mac Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Thong Tin Chi Tiet

Apr 30, 2025 -

Blue Ivy And Rumi Carters Stylish Super Bowl Appearance

Apr 30, 2025

Blue Ivy And Rumi Carters Stylish Super Bowl Appearance

Apr 30, 2025

Latest Posts

-

Futbol Argentino De Luto La Muerte De Un Joven Promesa De Afa

Apr 30, 2025

Futbol Argentino De Luto La Muerte De Un Joven Promesa De Afa

Apr 30, 2025 -

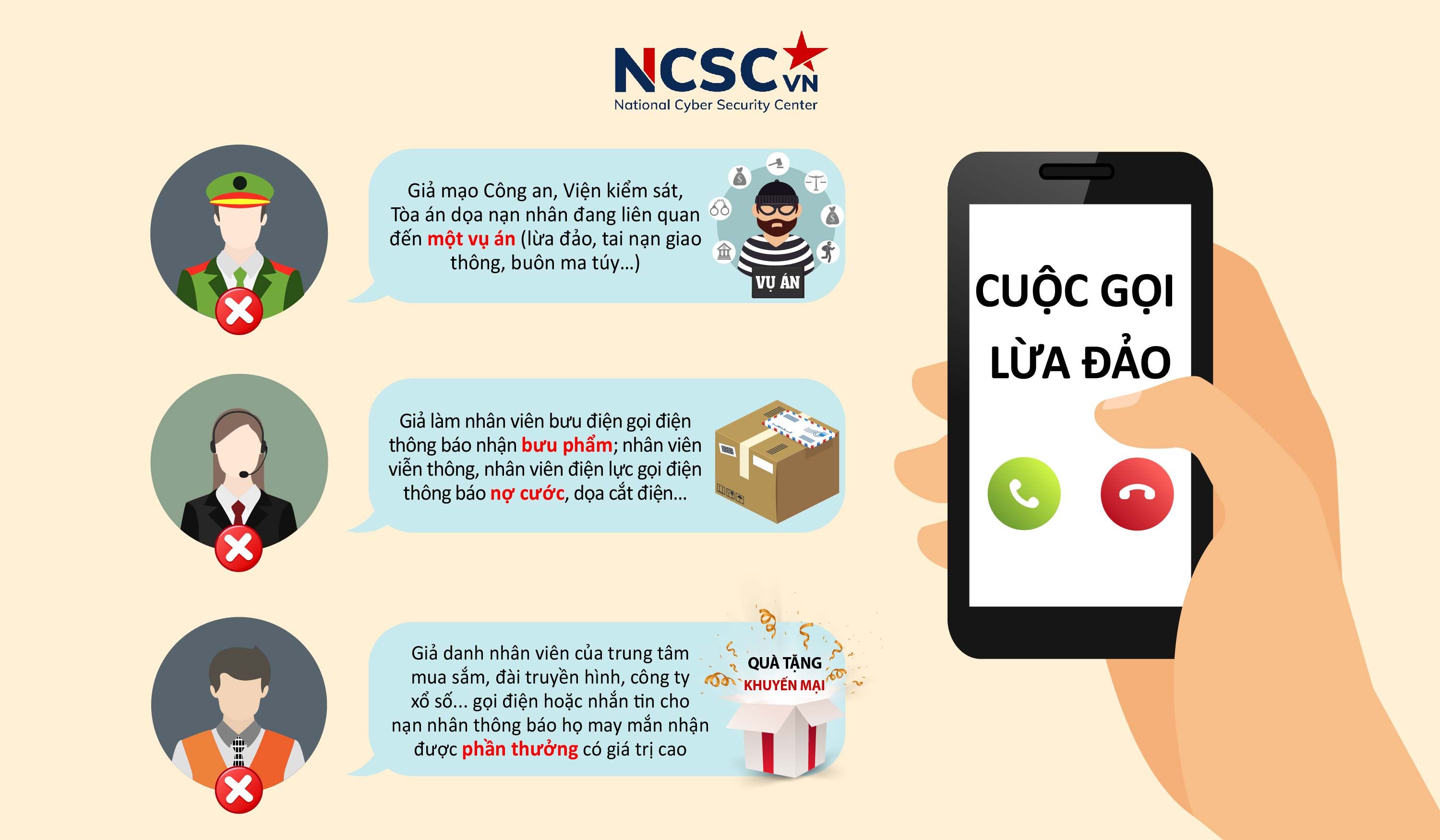

Kiem Tra Ky Cang Truoc Khi Dau Tu Tranh Rui Ro Tu Cac Cong Ty Bi Nghi Van Lua Dao

Apr 30, 2025

Kiem Tra Ky Cang Truoc Khi Dau Tu Tranh Rui Ro Tu Cac Cong Ty Bi Nghi Van Lua Dao

Apr 30, 2025 -

Giai Bong Da Thanh Nien Thanh Pho Hue Cap Nhat Ket Qua Thi Dau

Apr 30, 2025

Giai Bong Da Thanh Nien Thanh Pho Hue Cap Nhat Ket Qua Thi Dau

Apr 30, 2025 -

Luto En El Futbol Argentino Fallece Joven Referente De Afa

Apr 30, 2025

Luto En El Futbol Argentino Fallece Joven Referente De Afa

Apr 30, 2025 -

Than Trong Voi Cac Cong Ty Co Tien Le Lua Dao Huong Dan Bao Ve Von Dau Tu Cua Ban

Apr 30, 2025

Than Trong Voi Cac Cong Ty Co Tien Le Lua Dao Huong Dan Bao Ve Von Dau Tu Cua Ban

Apr 30, 2025