Finding Your Dream A Place In The Sun: Top Tips For Overseas Property Buyers

Table of Contents

2.1. Researching Your Dream Destination: (Target keyword: Overseas property research)

Before diving into the exciting world of overseas property, thorough research is paramount. This initial step lays the foundation for a successful and stress-free purchase.

2.1.1. Understanding Your Needs and Wants:

What kind of lifestyle are you seeking? Do you envision yourself in a bustling city, a quiet coastal town, or a secluded mountain retreat? Consider factors like climate, culture, proximity to amenities (hospitals, schools, shops), and access to transportation. Think about your long-term goals: is this overseas property a retirement haven, a family vacation home, or a strategic investment? Clarifying these aspects will significantly narrow down your search and help you focus your overseas property research effectively.

2.1.2. Thorough Market Research:

Once you have a clearer picture of your ideal lifestyle, it's time for in-depth market research. Utilize a variety of resources:

- Online Property Portals: Numerous websites specialize in international property listings, allowing you to compare properties across different countries and regions.

- Local Estate Agents: Engaging with local estate agents provides invaluable insights into the local market, including current property prices, rental yields (if you’re considering an investment property), and upcoming developments.

- Expat Forums and Communities: Connecting with expats already living in your potential destination offers firsthand accounts of the local experience, including hidden costs and cultural nuances.

Bullet Points:

- Compare property prices across different locations, considering factors like property size, location within the area, and amenities.

- Analyze local market trends to understand the potential for growth or depreciation in property values.

- Consider the overall cost of living in your chosen location—this includes utilities, taxes, and everyday expenses.

- Research visa requirements and residency options to understand the legal implications of owning overseas property.

2.2. Securing Financing for Your Overseas Property: (Target keyword: Overseas mortgage)

Securing the necessary financing is a crucial step in the overseas property buying process. Options vary depending on your financial situation and the country of purchase.

2.2.1. Exploring Financing Options:

You might consider several financing options:

- Overseas Mortgages: Many international banks and lenders offer mortgages for overseas properties. However, securing an overseas mortgage often requires a larger down payment and a more stringent credit check.

- International Money Transfers: If you’re planning a cash purchase, you'll need to arrange for the transfer of funds internationally. Be aware of potential fees and exchange rate fluctuations.

- Cash Purchases: Buying outright with cash eliminates the complexities of mortgages but requires significant upfront capital. Getting pre-approved for a mortgage (even if you plan to use cash) can streamline the process and demonstrate your financial capability to sellers.

2.2.2. Understanding Exchange Rates and Transfer Costs:

Currency fluctuations can significantly impact the overall cost of your overseas property. Exchange rates are constantly changing, so it's crucial to monitor them closely and plan accordingly. Factor in:

- Transfer Fees: Banks and money transfer services charge fees for international transactions.

- Exchange Rate Variations: A seemingly small fluctuation can translate into significant cost differences.

Bullet Points:

- Compare mortgage rates and terms from several different lenders to secure the most favorable deal.

- Factor in all associated costs, including legal fees, transfer taxes, and other transaction expenses.

- Consult a financial advisor specializing in international finance to mitigate currency risks and optimize your transfer strategy.

2.3. Working with Local Professionals: (Target keyword: Overseas property lawyer)

Navigating the legal complexities of buying overseas property requires the expertise of local professionals. Don't underestimate the importance of sound legal and professional guidance.

2.3.1. The Importance of a Solicitor/Lawyer:

Engaging a solicitor or lawyer specializing in overseas property transactions is non-negotiable. They will ensure all legal requirements are met, protect your interests, and guide you through the complexities of local property laws and regulations. They'll review contracts and help you avoid any potential legal issues.

2.3.2. Finding a Reputable Estate Agent:

A reputable local estate agent with a proven track record can significantly ease the buying process. Thoroughly research and verify the agent's credentials and experience before engaging their services.

Bullet Points:

- Always seek legal advice before signing any contracts related to the purchase of overseas property.

- Conduct thorough due diligence on the property and the seller, ensuring everything is above board.

- Carefully review all contracts and documentation with your lawyer before committing to any financial transactions.

2.4. Due Diligence and Avoiding Scams: (Target keyword: Overseas property scams)

Due diligence is crucial to avoid falling prey to overseas property scams. Unfortunately, fraud is a real risk, especially when buying property internationally.

2.4.1. Verifying Property Ownership:

Ensure you verify the seller’s legal right to sell the property. Check property titles and land registries to confirm ownership and avoid purchasing a property with existing liens or disputes.

2.4.2. Identifying Potential Red Flags:

Be wary of:

- Deals that seem too good to be true.

- High-pressure sales tactics.

- Requests for upfront payments without proper verification.

- Lack of transparency or readily available documentation.

Bullet Points:

- Verify property boundaries and access rights to prevent future disputes.

- Treat all deals with a healthy dose of skepticism.

- Never transfer funds until all legal verification and checks have been completed.

3. Conclusion: Making Your Dream a Reality with Overseas Property

Buying overseas property involves careful planning, thorough research, and the assistance of qualified professionals. By following the steps outlined in this guide—researching your dream destination, securing financing, working with local professionals, and conducting thorough due diligence—you can significantly increase your chances of a successful and rewarding experience. Remember, investing in overseas property, whether for personal use or as an investment, is a significant decision that requires careful consideration. Don't rush the process! Start your overseas property search today, and transform your dream of owning a piece of paradise into a reality. Share your experiences or questions in the comments section below. Let's help each other find our dream overseas homes and make sound investment decisions in buying overseas property!

Featured Posts

-

Thdhyr Ham Mn Jw 24 Lslah Bshan Wdeh Alhaly

May 03, 2025

Thdhyr Ham Mn Jw 24 Lslah Bshan Wdeh Alhaly

May 03, 2025 -

Exclusive Which A Lister Wants Access To Melissa Gorgas Beach House

May 03, 2025

Exclusive Which A Lister Wants Access To Melissa Gorgas Beach House

May 03, 2025 -

Facelift Fears Fan Backlash Over Celebritys Altered Appearance

May 03, 2025

Facelift Fears Fan Backlash Over Celebritys Altered Appearance

May 03, 2025 -

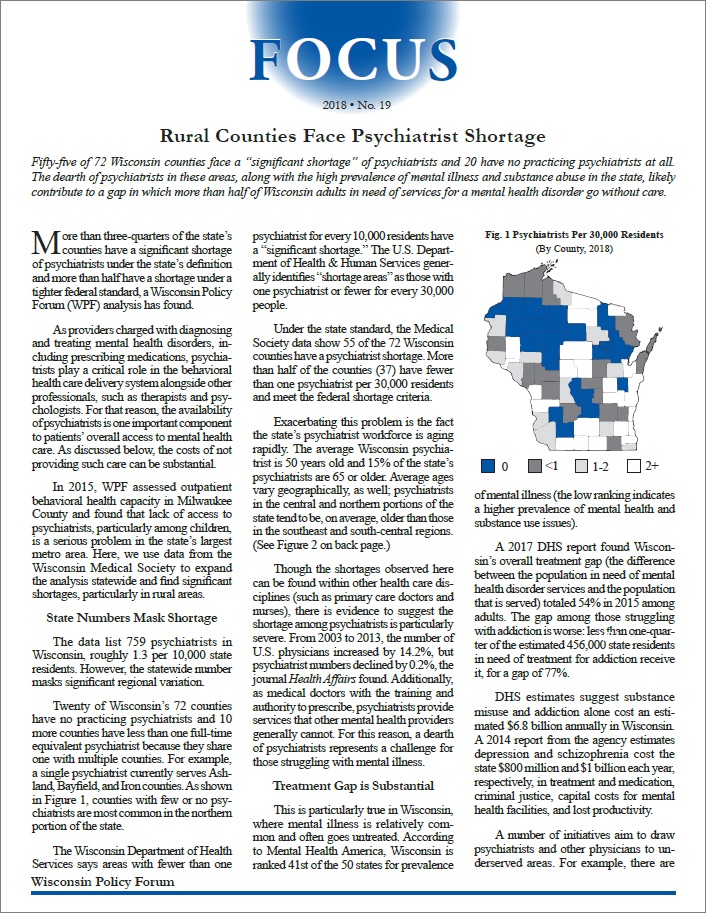

Mental Health In Ghana A Call For Action To Address The Psychiatrist Shortage

May 03, 2025

Mental Health In Ghana A Call For Action To Address The Psychiatrist Shortage

May 03, 2025 -

Analyzing The Ap Decision Notes Implications Of The Minnesota Special House Election

May 03, 2025

Analyzing The Ap Decision Notes Implications Of The Minnesota Special House Election

May 03, 2025

Latest Posts

-

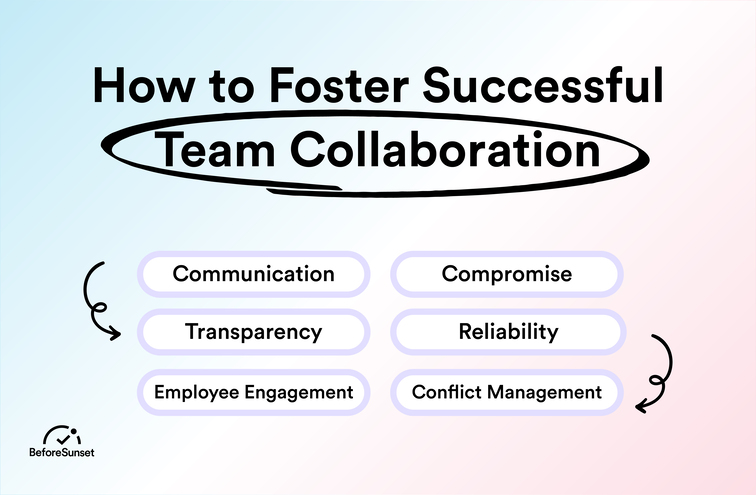

Effective Middle Management Key To Employee Engagement And Business Growth

May 04, 2025

Effective Middle Management Key To Employee Engagement And Business Growth

May 04, 2025 -

The China Factor Assessing Risks And Opportunities For Automakers Like Bmw And Porsche

May 04, 2025

The China Factor Assessing Risks And Opportunities For Automakers Like Bmw And Porsche

May 04, 2025 -

The Power Of Middle Management Fostering Collaboration And Driving Results

May 04, 2025

The Power Of Middle Management Fostering Collaboration And Driving Results

May 04, 2025 -

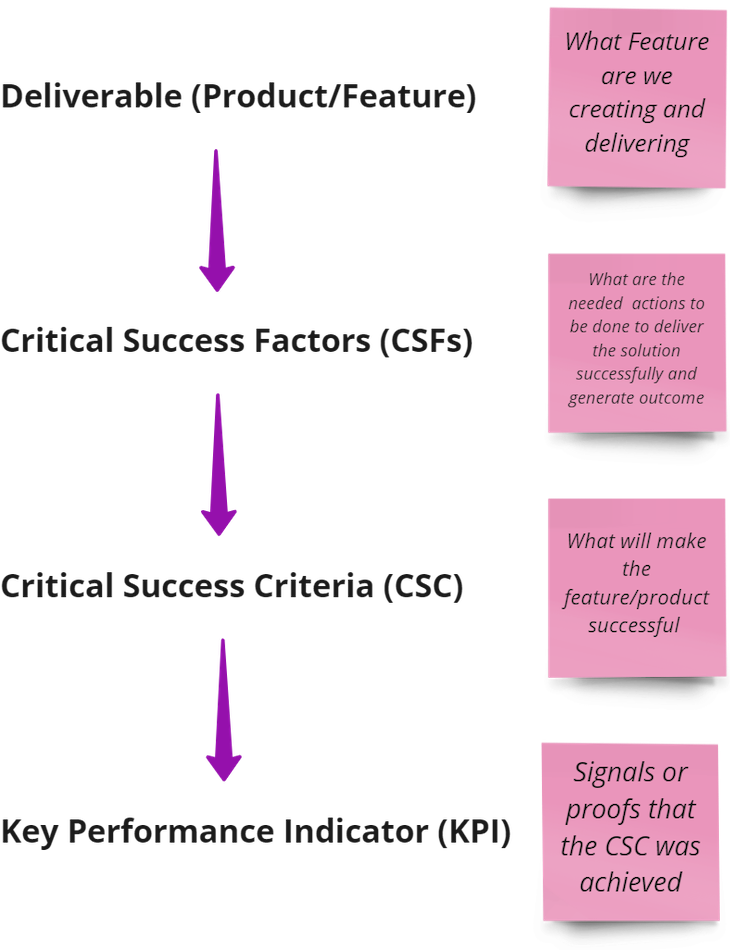

Investing In Middle Management A Strategic Approach To Business Growth

May 04, 2025

Investing In Middle Management A Strategic Approach To Business Growth

May 04, 2025 -

Middle Management A Critical Link In The Chain Of Success

May 04, 2025

Middle Management A Critical Link In The Chain Of Success

May 04, 2025