FIU-IND's ₹5.45 Crore Fine: Paytm Payments Bank's Money Laundering Failures

Table of Contents

The FIU-IND's Findings and the ₹5.45 Crore Fine

The FIU-IND investigation into Paytm Payments Bank uncovered significant shortcomings in its AML and KYC compliance framework. The investigation, spanning several months, meticulously examined transaction records and internal compliance procedures. The findings revealed a pattern of non-compliance with RBI guidelines, leading to the substantial ₹5.45 crore penalty. This amount represents a considerable financial blow and underscores the seriousness with which the FIU-IND views such violations.

Key violations identified by the FIU-IND include:

- Insufficient KYC checks and verification procedures: The investigation revealed inadequate verification of customer identities, allowing for potential misuse of accounts. This included insufficient checks on address verification and potentially lax checks on documentation.

- Failures in detecting and reporting suspicious transactions: Paytm Payments Bank failed to effectively flag and report suspicious transactions, a critical aspect of AML compliance. This points to deficiencies in their transaction monitoring systems.

- Inadequate monitoring of customer accounts: The bank's monitoring systems failed to identify potentially high-risk accounts, leading to vulnerabilities for money laundering activities. This highlights the need for proactive risk assessment and ongoing monitoring.

- Breaches of AML guidelines set by the Reserve Bank of India (RBI): The FIU-IND's findings indicated several instances where Paytm Payments Bank violated specific AML guidelines stipulated by the RBI, further emphasizing the severity of the infractions.

The ₹5.45 crore fine is one of the largest penalties imposed on a digital payment provider in India for AML/KYC failures, demonstrating the increasing rigor of regulatory enforcement. This penalty carries significant weight, impacting Paytm's reputation and potentially influencing investor confidence.

The Implications for Paytm Payments Bank

The ₹5.45 crore fine carries significant short-term and long-term consequences for Paytm Payments Bank. The immediate impact includes reputational damage and a potential erosion of customer trust. The longer-term effects could be more far-reaching.

Potential effects include:

- Increased scrutiny from regulatory bodies: Expect heightened regulatory oversight and more frequent audits.

- Potential loss of customer trust: Customers may be hesitant to use a service perceived as having lax security measures.

- Higher operational costs associated with improving compliance: The bank will need to invest significantly in upgrading its systems and processes.

- Impact on future fundraising and expansion plans: The penalty could impact investor confidence and make securing future funding more challenging.

Paytm Payments Bank has announced that they are taking immediate action to rectify the identified shortcomings, including strengthening KYC procedures, enhancing transaction monitoring systems, and providing additional training to employees.

The Broader Implications for the Indian Fintech Industry

The Paytm Payments Bank case sends a clear message to the entire Indian fintech industry. It emphasizes the crucial role of robust AML and KYC compliance and the potential consequences of neglecting these critical aspects.

The broader effects include:

- Increased pressure on other digital payment providers to enhance compliance: This case sets a precedent, pushing other players to proactively strengthen their compliance frameworks.

- Strengthening of regulatory oversight and enforcement: Regulatory bodies are likely to increase scrutiny and enforcement across the sector.

- Potential for stricter KYC and AML regulations: This incident could lead to the introduction of more stringent regulations.

- A renewed focus on ethical and responsible fintech practices: The case underlines the importance of ethical considerations and responsible business practices within the fintech ecosystem.

Regulatory bodies like the RBI play a pivotal role in maintaining the integrity of the digital payments ecosystem. They need to continue proactively monitoring and enforcing compliance to protect consumers and prevent financial crimes.

Best Practices for AML and KYC Compliance in the Fintech Sector

To prevent similar situations, fintech companies need to adopt robust and proactive AML and KYC compliance measures. This includes:

- Implementing robust KYC procedures: This should encompass biometric verification, AI-powered fraud detection, and thorough due diligence for all customer onboarding.

- Regularly monitoring transactions for suspicious activity: Employ advanced transaction monitoring systems with AI and machine learning capabilities to identify potentially suspicious patterns.

- Investing in advanced AML compliance technologies: Leverage technology to enhance detection and reporting capabilities.

- Providing regular training to employees on AML and KYC regulations: Keep employees updated on evolving regulations and best practices.

- Maintaining clear and up-to-date compliance policies and procedures: Establish and maintain comprehensive policies that are regularly reviewed and updated.

Conclusion:

The ₹5.45 crore fine levied by FIU-IND on Paytm Payments Bank serves as a stark reminder of the crucial importance of robust AML and KYC compliance in the Indian fintech sector. The case underscores the need for heightened vigilance and the adoption of best practices to prevent money laundering and maintain the integrity of the digital payments ecosystem. The penalty highlights the serious consequences of neglecting regulatory requirements. This case should prompt all digital payment providers to thoroughly review their compliance measures and strengthen their systems to prevent similar violations. Understanding the intricacies of AML and KYC compliance is essential to avoid facing penalties for Money Laundering Failures and ensuring the long-term success and sustainability of your fintech business.

Featured Posts

-

Best Bets Round 2 Nba And Nhl Playoffs

May 15, 2025

Best Bets Round 2 Nba And Nhl Playoffs

May 15, 2025 -

Spring Training Baseball Cubs Vs Padres Preview March 4th 2 05 Ct In Mesa

May 15, 2025

Spring Training Baseball Cubs Vs Padres Preview March 4th 2 05 Ct In Mesa

May 15, 2025 -

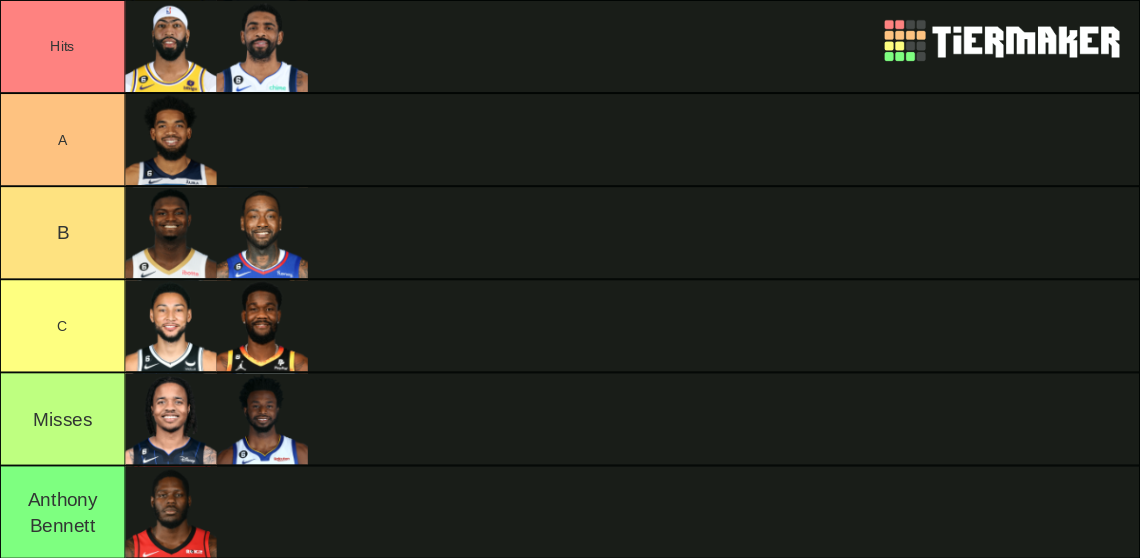

1 Thing Holding Back Every Top 10 Nba Contender

May 15, 2025

1 Thing Holding Back Every Top 10 Nba Contender

May 15, 2025 -

Mistrovstvi Sveta V Hokeji Svedska Nhl Dominance Vs Nemecka Vyzva Pro Cechy

May 15, 2025

Mistrovstvi Sveta V Hokeji Svedska Nhl Dominance Vs Nemecka Vyzva Pro Cechy

May 15, 2025 -

Renos Boxing Future A Heavyweight Champions Vision

May 15, 2025

Renos Boxing Future A Heavyweight Champions Vision

May 15, 2025