FMX's Treasury Futures Launch: A Direct Challenge To CME Dominance

Table of Contents

FMX's Strategic Move and Market Implications

FMX's foray into the Treasury futures market is a strategic move driven by several factors. They aim to capture a significant share of the market currently dominated by the CME Group, offering competitive pricing and leveraging technological advantages to attract traders. This move has several potential implications for the broader market:

- Increased Competition Leading to Lower Costs: The entry of FMX introduces more competition, potentially leading to lower transaction costs and tighter spreads for traders. This translates to increased profitability for market participants.

- Enhanced Liquidity and Trading Volume: Increased competition often stimulates higher trading volumes and improved liquidity. This is beneficial for both buyers and sellers, facilitating easier entry and exit from positions.

- Innovation in Trading Technology and Infrastructure: New entrants often bring innovative technologies and infrastructure. FMX may introduce advancements in trading platforms, order execution, and data analytics, benefiting the entire market.

- Impact on Existing Market Structure: The established market structure, long dominated by the CME Group, will inevitably feel the pressure of this new competition. This could lead to adjustments in pricing strategies, product offerings, and overall market dynamics.

Keywords: FMX Treasury futures, CME Group, Treasury futures market, competition, market share

Comparing FMX and CME Treasury Futures Contracts

A direct comparison of FMX and CME Treasury futures contracts is crucial for understanding the implications of this new entrant. Key differences lie in contract specifications, including contract size, tick size, trading hours, and margin requirements.

-

Side-by-Side Comparison: A detailed comparison table highlighting these key differences would provide a clear overview. (Note: A table would be inserted here in a published article, comparing contract size, tick size, minimum price fluctuation, trading hours, margin requirements, etc. for both FMX and CME contracts.)

-

Advantages and Disadvantages: Analyzing the advantages and disadvantages of each exchange's contracts will help traders determine which is more suitable for their specific needs and trading strategies. For example, FMX might offer lower margin requirements, appealing to smaller traders, while CME might benefit from established liquidity and deeper market depth.

-

Attractiveness to Different Trader Types: The choice between FMX and CME contracts will depend on various factors, including trading style, risk tolerance, and capital availability. High-frequency traders might favor FMX's technological advantages, while institutional investors might prioritize the established liquidity of CME.

Keywords: FMX Treasury futures contracts, CME Treasury futures contracts, contract specifications, margin requirements, trading hours, tick size

The Potential Impact on Traders and Market Participants

The launch of FMX Treasury futures significantly impacts various market participants:

- Increased Choice and Flexibility: Traders now have increased choice and flexibility in selecting the exchange that best suits their needs, leading to optimized trading strategies.

- Arbitrage Opportunities: The existence of two competing exchanges presents opportunities for arbitrage, where traders can profit from price discrepancies between FMX and CME contracts.

- Risk Management and Hedging Strategies: Traders can diversify their risk by utilizing contracts from both exchanges, potentially improving their overall risk management and hedging strategies.

- Role of Technology and Accessibility: FMX's technological advantages, such as user-friendly platforms and mobile accessibility, may attract new traders to the market, increasing overall participation.

Technological Advantages of FMX

FMX may leverage several technological advantages over CME:

- Faster Execution Speeds: Advanced technology may result in faster order execution, a significant advantage in highly competitive markets.

- Improved Trading Platforms: User-friendly and intuitive trading platforms can enhance the overall trading experience, attracting more participants.

- Enhanced Data Analytics: Sophisticated data analytics tools can provide traders with valuable insights, potentially improving trading decisions.

Keywords: FMX Treasury futures trading, CME Treasury futures trading, arbitrage opportunities, risk management, hedging strategies, market participants, FMX trading platform, trading technology, execution speed, data analytics, technological advantage

Conclusion

FMX's entry into the Treasury futures market presents a significant challenge to the CME Group's dominance, offering potential benefits such as increased competition, improved liquidity, and technological innovation. The long-term impact will depend on various factors, including market adoption and the ongoing evolution of trading technology.

Call to Action: Stay informed about the evolving landscape of FMX Treasury futures and the ongoing competition between exchanges. Monitor the performance of both FMX and CME contracts to optimize your trading strategies and take advantage of new opportunities in the Treasury futures market. Learn more about FMX's Treasury futures offerings and how they can benefit your investment portfolio.

Featured Posts

-

Mlb Baseball Home Run Prop Bets And Expert Picks For Games On May 8th

May 18, 2025

Mlb Baseball Home Run Prop Bets And Expert Picks For Games On May 8th

May 18, 2025 -

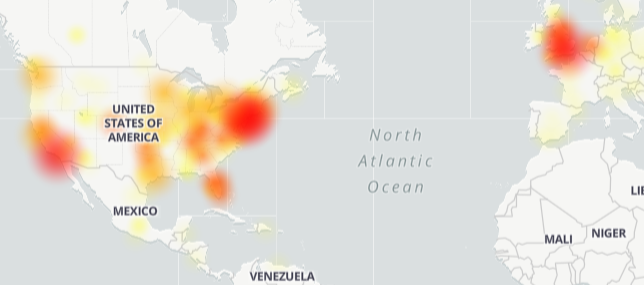

Global Reddit Outage Users Report Issues Accessing The Platform

May 18, 2025

Global Reddit Outage Users Report Issues Accessing The Platform

May 18, 2025 -

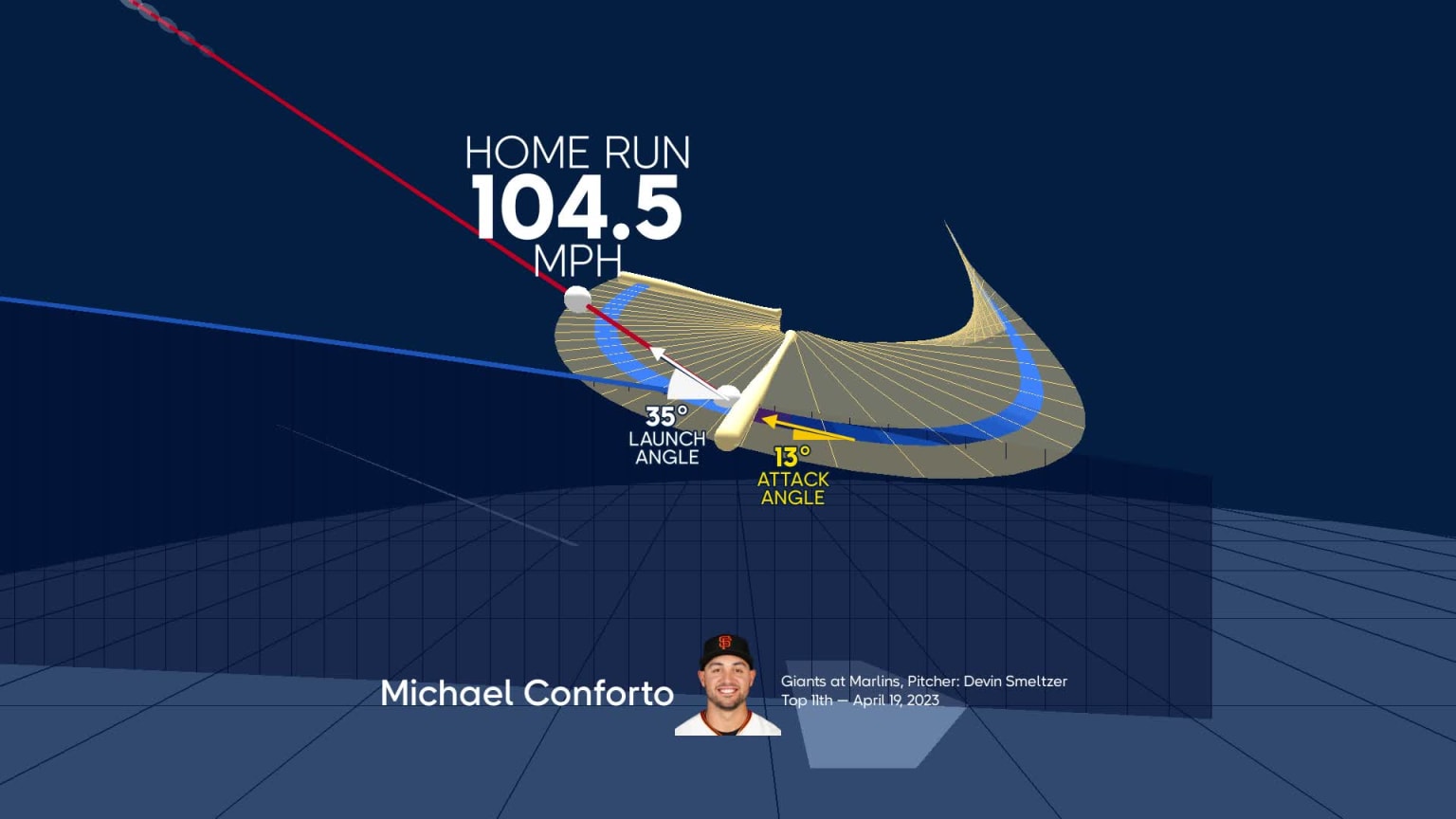

Can Conforto Emulate Hernandezs Success With The Dodgers

May 18, 2025

Can Conforto Emulate Hernandezs Success With The Dodgers

May 18, 2025 -

Trumps China Trip Offer A Meeting With Xi Jinping On The Horizon

May 18, 2025

Trumps China Trip Offer A Meeting With Xi Jinping On The Horizon

May 18, 2025 -

Gonsolin Dominates In First 2023 Start Leading Dodgers To Victory

May 18, 2025

Gonsolin Dominates In First 2023 Start Leading Dodgers To Victory

May 18, 2025

Latest Posts

-

Confortos Spring Training Slump How He Bounced Back

May 18, 2025

Confortos Spring Training Slump How He Bounced Back

May 18, 2025 -

Michael Confortos Early Season Struggles A Look At His Overcoming Them

May 18, 2025

Michael Confortos Early Season Struggles A Look At His Overcoming Them

May 18, 2025 -

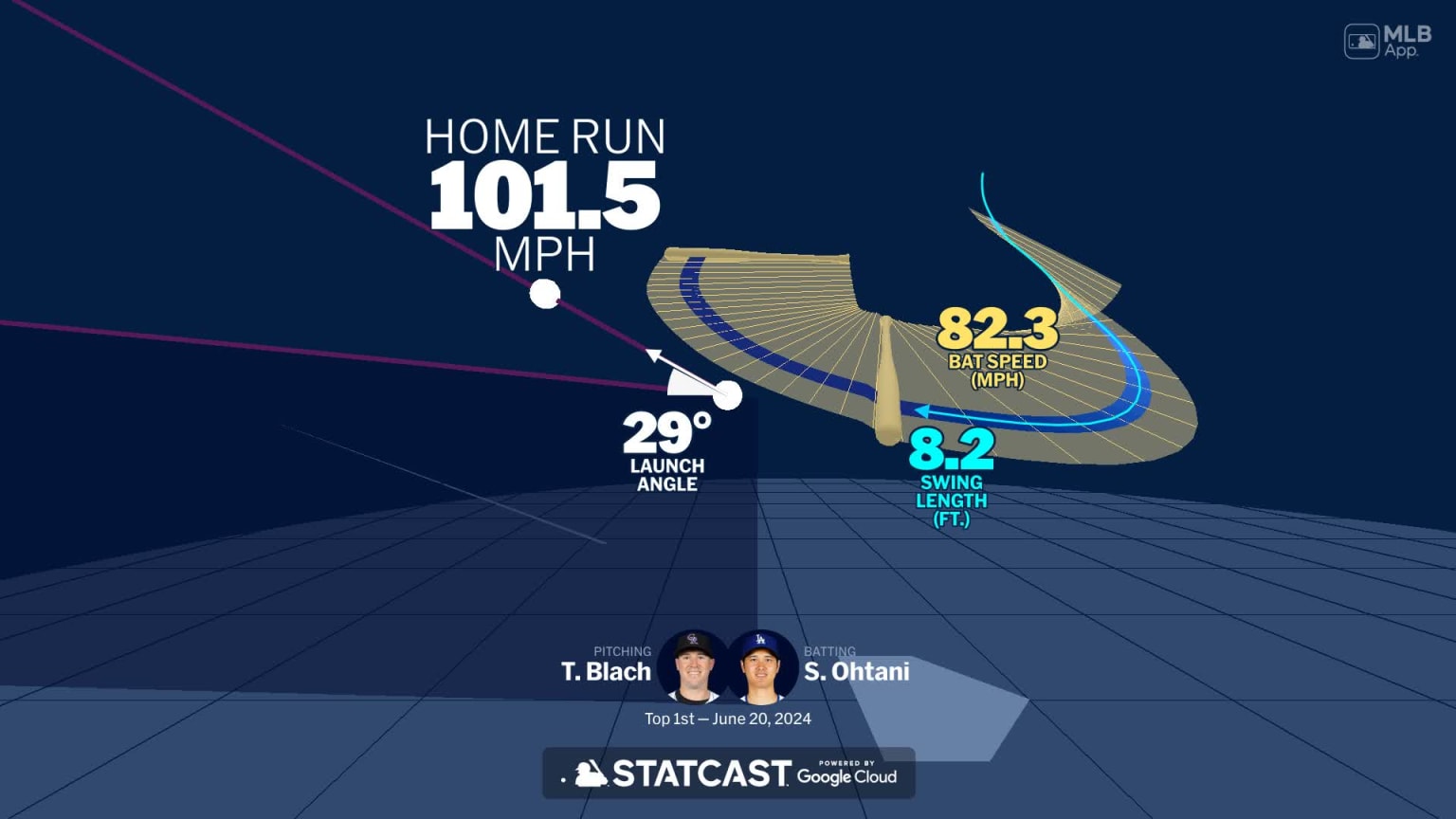

Shohei Ohtani Rising To The Occasion Against The Yomiuri Giants

May 18, 2025

Shohei Ohtani Rising To The Occasion Against The Yomiuri Giants

May 18, 2025 -

Analyzing Confortos Chances Of Replicating Hernandezs Dodger Success

May 18, 2025

Analyzing Confortos Chances Of Replicating Hernandezs Dodger Success

May 18, 2025 -

Ohtanis 2 Run Homer Highlights Return To Japan Game

May 18, 2025

Ohtanis 2 Run Homer Highlights Return To Japan Game

May 18, 2025