Focus On PMI: European Stock Market Update - Midday Briefing

Table of Contents

PMI Data Deep Dive: Unveiling the Economic Picture

The Purchasing Managers' Index (PMI) is a crucial economic indicator that tracks the activity levels of purchasing managers in manufacturing and services sectors. It provides a valuable snapshot of the overall health of the economy, offering insights into business activity, employment, and future economic trends. A PMI reading above 50 indicates expansion, while a reading below 50 signals contraction. Analyzing PMI data is essential for understanding the current economic climate and making informed investment decisions in the European stock market.

-

Latest PMI Releases: The latest PMI releases for key European economies show a mixed picture. Germany's Manufacturing PMI registered a slight decline to 48.1, indicating a contraction in the manufacturing sector. France, however, saw its Services PMI rise to 52.7, suggesting continued growth in the services sector. The UK's composite PMI fell to 49.9, remaining just below the expansion threshold. These figures, along with others, paint a nuanced picture of the European economy's overall health.

-

Manufacturing vs. Services PMI: The Manufacturing PMI focuses solely on the manufacturing sector, providing insights into production, new orders, and employment within that specific industry. The Services PMI, on the other hand, tracks activity within the services sector, including retail, finance, and hospitality, offering a complementary view of economic conditions. Understanding the divergence between these two PMIs is crucial for a comprehensive assessment of economic health. For instance, a strong Services PMI might offset a weak Manufacturing PMI, and vice versa.

-

Implications for Economic Growth and Inflation: The PMI data has significant implications for economic growth and inflation. A strong PMI generally indicates strong economic growth and potentially upward pressure on inflation. Conversely, a weak PMI often suggests slowing economic growth and potentially downward pressure on inflation. This relationship is complex, however, and other factors must be considered.

-

Unexpected Surprises and Deviations: While some PMI figures aligned with analyst expectations, others presented surprises. The unexpected dip in the UK's composite PMI, for example, exceeded forecasts, leading to immediate market reactions. These deviations highlight the dynamic nature of the European economy and the importance of closely monitoring these indicators.

-

Visualizing PMI Trends: [Insert relevant chart/graph visualizing PMI data trends for key European economies here].

Market Reaction: How European Indices are Responding to PMI

The release of the latest PMI data has had a noticeable impact on major European stock market indices. The reaction has been largely in line with the data itself: negative in sectors directly impacted by the contraction and more positive in others.

-

Percentage Changes in Indices: Since the PMI release, the DAX (Germany) has experienced a [Insert percentage change] decline, the CAC 40 (France) has seen a [Insert percentage change] increase, and the FTSE 100 (UK) has shown a [Insert percentage change] decrease. These movements illustrate the direct correlation between the PMI release and market sentiment.

-

Sectors Most Affected: Manufacturing and export-oriented companies have been among the hardest hit by the weaker-than-expected PMI data. Consumer goods sectors, heavily reliant on consumer confidence, also saw some negative impact. Conversely, sectors less sensitive to manufacturing activity showed resilience.

-

Market Sentiment: Overall market sentiment can be described as cautiously bearish. Investors are assessing the implications of the PMI data on future corporate earnings and economic growth, and some hesitancy is evident.

-

Correlation Between PMI and Stock Market Movements: Historically, there's a strong correlation between PMI data and European stock market performance. A strong PMI often leads to increased investor confidence and higher stock prices, whereas a weak PMI can trigger sell-offs. This relationship, however, is not always straightforward and depends on multiple factors.

-

Significant Trading Volume Changes: Trading volumes have increased significantly across major European exchanges following the PMI release, indicating heightened investor activity and increased volatility.

Key Sectors Affected: A Sector-Specific Analysis

The impact of the PMI data is not uniform across all sectors. Some sectors are more sensitive to economic fluctuations and PMI changes than others.

-

Individual Stock Performance: [Insert examples of specific stocks within affected sectors and their percentage changes since the PMI release]. For example, automotive manufacturers in Germany have been particularly affected by the decline in the Manufacturing PMI.

-

Impact on Future Earnings and Investor Confidence: The weaker PMI data may lead to downward revisions of corporate earnings forecasts for companies heavily reliant on manufacturing and exports. This could further dampen investor confidence and lead to further market corrections.

-

Company-Specific Responses: Some companies have already started responding to the PMI data. Some have announced cost-cutting measures, while others are delaying investment decisions. These responses further highlight the immediate impact of the PMI on the real economy.

-

Opportunities and Risks: While the current climate presents risks, there are opportunities for astute investors. Companies that can demonstrate resilience during economic downturns can stand to gain market share.

Expert Opinions: What the Analysts Say

Leading financial analysts offer diverse perspectives on the implications of the PMI data.

-

Differing Perspectives: Some analysts believe the current weakness is temporary and the European economy will recover soon. Others are more pessimistic, forecasting a prolonged period of slower growth.

-

Consensus View: The consensus view seems to lean towards a cautious outlook, with many analysts suggesting a wait-and-see approach before making significant investment decisions.

-

Significant Disagreements: There is some disagreement on the extent of the impact of the PMI on the European stock market and the overall health of the European economy.

Conclusion

This midday briefing analyzed the impact of the latest PMI data on the European stock market. We examined the key PMI indicators, their effect on major indices, and the performance of individual sectors. Expert opinions provided valuable insights into the potential future trajectories of the market. The current situation underscores the importance of constant monitoring of economic indicators like the PMI for informed investment decision-making.

Call to Action: Stay informed on crucial economic indicators like the PMI to effectively manage your investments in the European stock market. Keep checking back for further updates and analysis on the PMI and its influence on the European stock market. Subscribe to our newsletter for daily briefings on European market developments.

Featured Posts

-

Swiss Alpine Village Evacuates Livestock Landslide Risk Forces Unique Rescue Operation

May 23, 2025

Swiss Alpine Village Evacuates Livestock Landslide Risk Forces Unique Rescue Operation

May 23, 2025 -

Cat Deeleys Sons Rare Twin Photo In Zara Ski Jackets

May 23, 2025

Cat Deeleys Sons Rare Twin Photo In Zara Ski Jackets

May 23, 2025 -

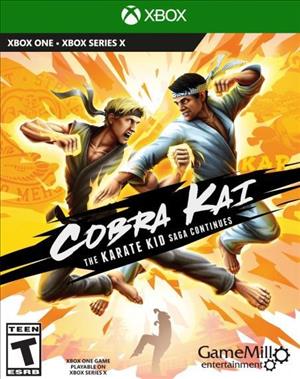

Cobra Kai Examining Its Connections To The Original Karate Kid Films

May 23, 2025

Cobra Kai Examining Its Connections To The Original Karate Kid Films

May 23, 2025 -

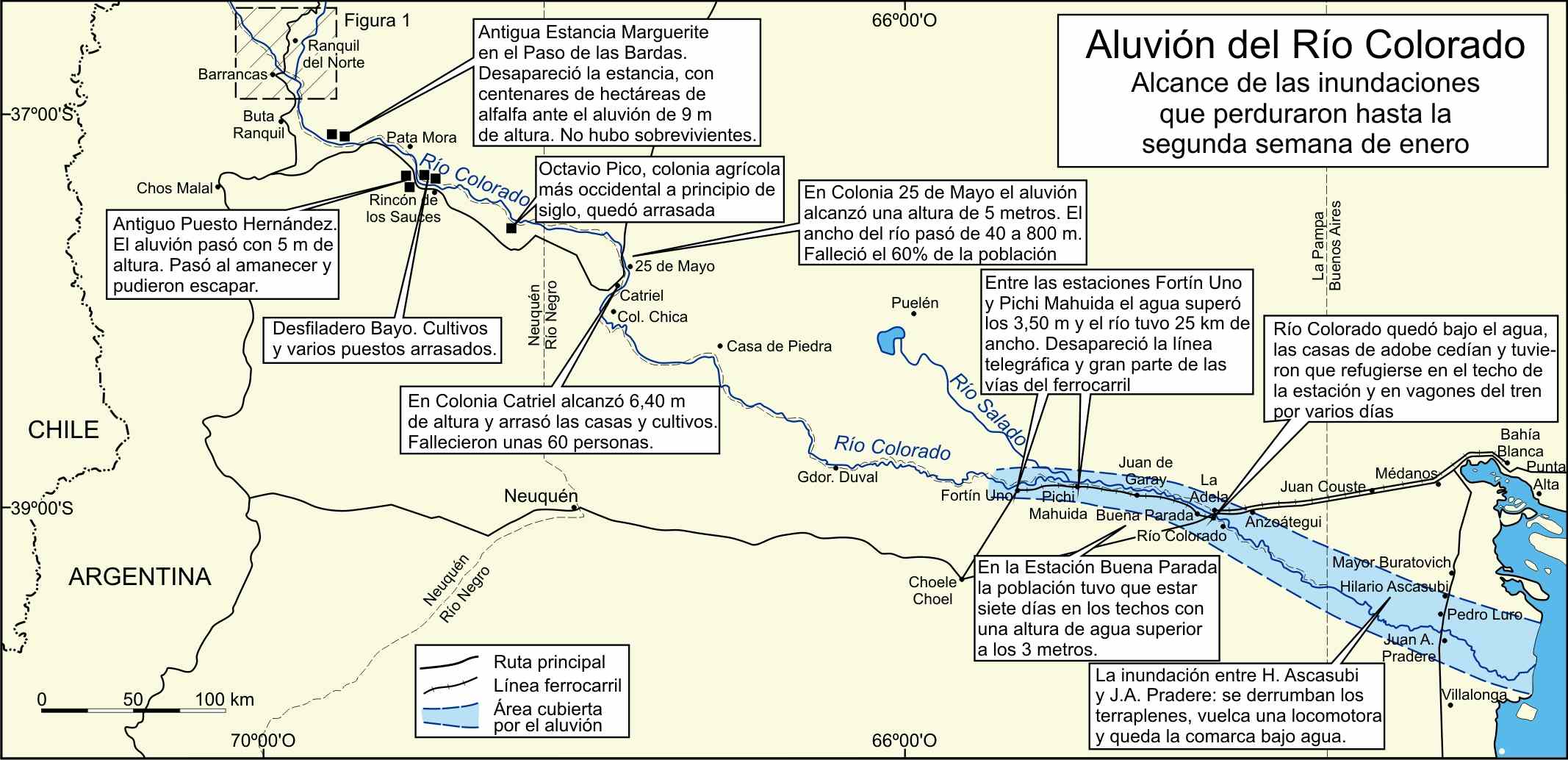

Real Sociedad Sin Descanso Ahogada Por El Aluvion De Partidos Del Virus Fifa

May 23, 2025

Real Sociedad Sin Descanso Ahogada Por El Aluvion De Partidos Del Virus Fifa

May 23, 2025 -

Netflix Schimba Regulile Jocului Cu Un Nou Serial Si O Distributie Impresionanta

May 23, 2025

Netflix Schimba Regulile Jocului Cu Un Nou Serial Si O Distributie Impresionanta

May 23, 2025

Latest Posts

-

Qmrt Qtr Ahtdan Snae Alaflam Alqtryyn

May 23, 2025

Qmrt Qtr Ahtdan Snae Alaflam Alqtryyn

May 23, 2025 -

Fratii Tate Primirea Spectaculoasa In Bucuresti Dupa Eliberare

May 23, 2025

Fratii Tate Primirea Spectaculoasa In Bucuresti Dupa Eliberare

May 23, 2025 -

Bolid De Lux Si Baie De Multime Cum Au Fost Intampinati Fratii Tate In Bucuresti

May 23, 2025

Bolid De Lux Si Baie De Multime Cum Au Fost Intampinati Fratii Tate In Bucuresti

May 23, 2025 -

Revenirea Fratilor Tate In Romania Imagini De La Parada Prin Centrul Bucurestiului

May 23, 2025

Revenirea Fratilor Tate In Romania Imagini De La Parada Prin Centrul Bucurestiului

May 23, 2025 -

Witkoff Hamas Duplicity And The Role Of An Emissary

May 23, 2025

Witkoff Hamas Duplicity And The Role Of An Emissary

May 23, 2025