Foot Locker (FL) Q4 2024 Earnings: Performance Review And Lace Up Plan Update

Table of Contents

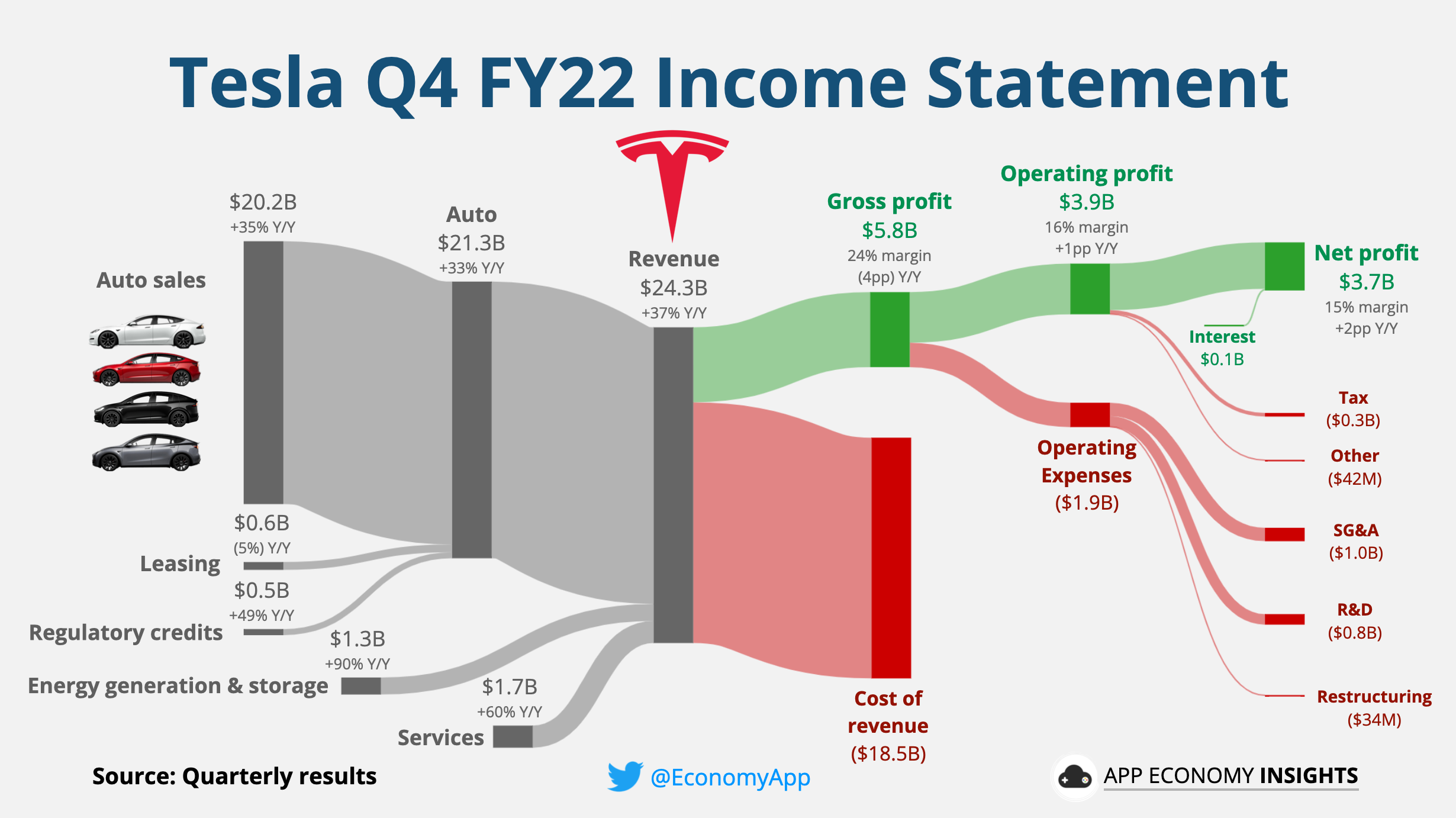

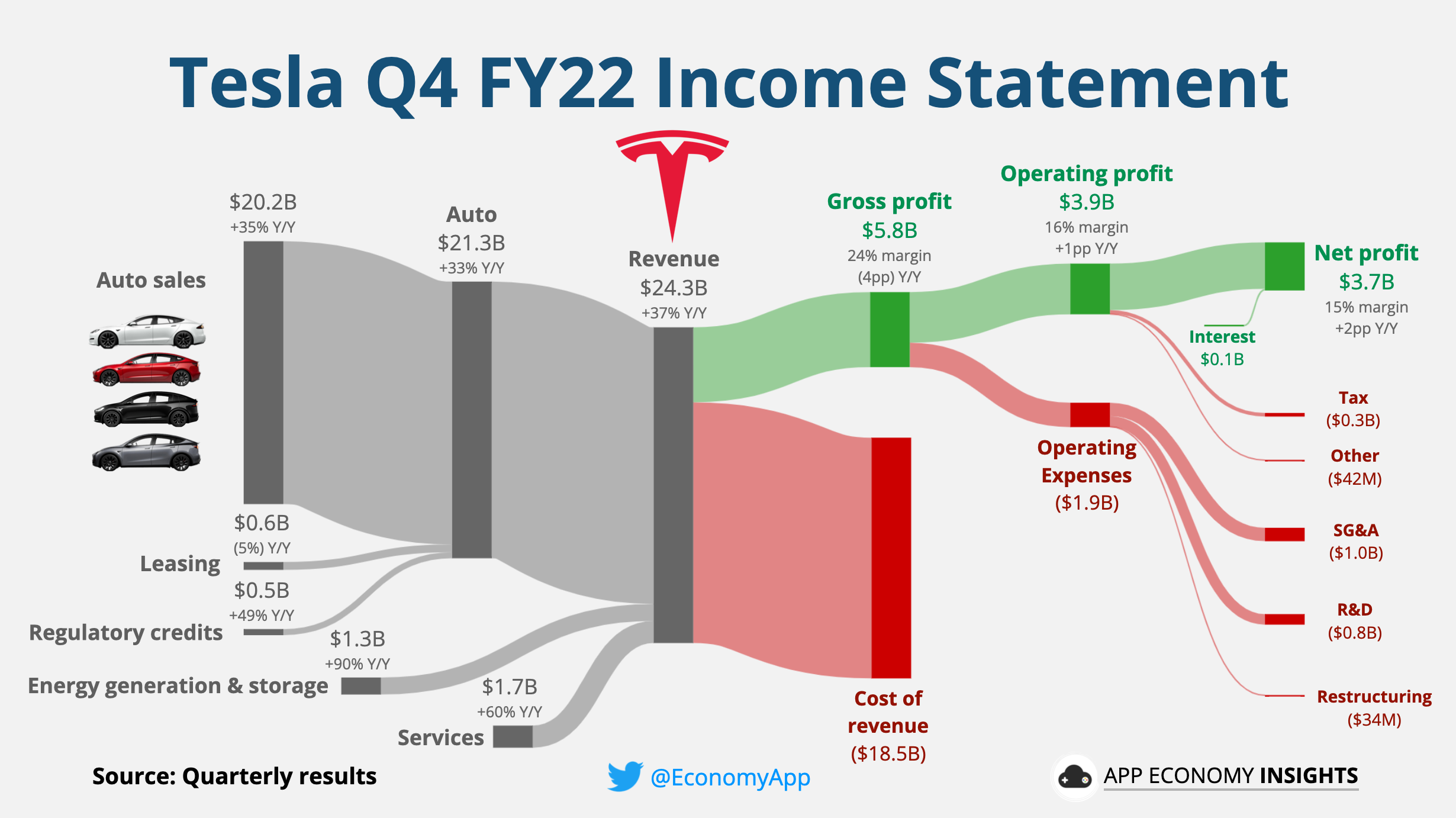

Foot Locker Q4 2024 Revenue and Profitability Analysis

Foot Locker's Q4 2024 revenue figures will be closely scrutinized against previous quarters and the same period last year (YoY). A significant YoY increase would signal strong consumer demand and effective operational strategies. Conversely, a decline might indicate challenges in the market or shortcomings in the company's approach. Profitability will be assessed through several key metrics: gross margin, operating income, and net income, along with earnings per share (EPS). These figures will reveal Foot Locker's ability to translate sales into profit, factoring in the costs of goods sold, operational expenses, and taxes.

Factors influencing both revenue and profitability are numerous and interconnected. Changes in consumer spending habits, particularly in response to economic conditions, will be a major factor. Product demand, particularly for trending footwear styles and brands, will play a key role. Supply chain efficiency and inventory management will also significantly impact profitability, influencing both the cost of goods and the ability to meet consumer demand effectively.

- Detailed breakdown of revenue by product category: Analyzing revenue contributions from basketball shoes, running shoes, apparel, and other segments provides crucial insights into market trends and the success of specific product lines. This allows for identification of best-performing categories and areas needing strategic adjustment.

- Comparison with competitor performance: Comparing Foot Locker's Q4 2024 performance with competitors like Nike and Adidas will provide context and highlight areas of relative strength or weakness. This comparative analysis helps to gauge Foot Locker's competitive positioning within the industry.

- Analysis of geographic performance: Examining performance across different regions reveals geographical market trends and pinpoints areas requiring specific strategic intervention. This allows for a targeted approach to address regional challenges or capitalize on regional opportunities.

Assessment of the "Lace Up" Plan's Progress

Foot Locker's "Lace Up" plan represents a significant strategic initiative aimed at driving growth and enhancing profitability. This section evaluates the plan's progress, examining the extent to which its objectives have been achieved. Key initiatives, such as strengthening brand partnerships, accelerating digital transformation efforts (including e-commerce enhancements and mobile app engagement), and optimizing inventory management, will be closely examined.

- Specific examples of successful implementations: Highlighting specific examples of "Lace Up" plan successes—whether it's a successful new partnership, significant e-commerce growth, or an optimized supply chain leading to reduced costs—demonstrates the tangible impact of the strategic plan.

- Challenges encountered in executing the plan: Identifying and analyzing challenges helps to understand the hurdles faced in implementing the "Lace Up" plan. This might include unforeseen economic downturns, competition, or internal challenges. Acknowledging these challenges allows for a more realistic evaluation of progress.

- Quantifiable results demonstrating the impact of the "Lace Up" plan: Quantifiable results – for instance, percentage increases in online sales, improvements in inventory turnover rates, or reduced logistics costs – are crucial in evaluating the tangible success of the plan.

Foot Locker's Inventory Management and Supply Chain

Efficient inventory management and a resilient supply chain are paramount for success in the athletic footwear industry. This section analyses Foot Locker's inventory levels and their impact on profitability. Excess inventory can tie up capital and reduce profitability, while insufficient stock can lead to lost sales. The supply chain's efficiency and its ability to withstand disruptions—whether caused by economic conditions, geopolitical instability, or other unforeseen events—are crucial factors influencing overall performance.

- Discussion of inventory turnover rates: Analyzing inventory turnover rates indicates how effectively Foot Locker is managing its inventory. High turnover suggests efficient stock management, while low turnover indicates potential problems with slow-moving items or overstocking.

- Analysis of logistics costs and their impact on margins: Examining logistics costs—including warehousing, transportation, and handling—and their impact on profit margins is crucial. Effective logistics are essential for minimizing costs and maximizing profitability.

- Future strategies to improve supply chain efficiency: Identifying strategies for improving supply chain efficiency is vital for future growth. This might involve exploring new technologies, optimizing logistics networks, or strengthening supplier relationships.

Future Outlook and Guidance for Foot Locker

Foot Locker's guidance for future quarters and its long-term outlook will provide crucial insights into investor expectations. This section will analyze this guidance, identifying key assumptions and potential risks and opportunities. The company's competitive positioning within the athletic footwear market, taking into account the actions of competitors and evolving consumer preferences, will also be evaluated.

- Key assumptions used in developing their future guidance: Understanding the assumptions underpinning Foot Locker's projections, such as anticipated economic growth or consumer spending patterns, is crucial for assessing the validity of their predictions.

- Potential threats and opportunities: Identifying potential threats, such as economic downturns or shifts in consumer preferences, and opportunities, such as emerging markets or innovative product lines, provides a well-rounded view of the company's prospects.

- Investment implications based on the future outlook: Based on the analysis of Foot Locker's Q4 2024 earnings and future guidance, this section will offer an assessment of the investment implications for potential investors.

Conclusion: Foot Locker Q4 2024 Earnings – Key Takeaways and Next Steps

Foot Locker's Q4 2024 earnings announcement offers significant insights into the company's performance and the success of its "Lace Up" plan. The analysis has highlighted key aspects of revenue, profitability, inventory management, and the future outlook. Understanding these factors is crucial for investors and industry professionals alike.

The success of Foot Locker's "Lace Up" plan in driving revenue growth, improving profitability, and optimizing its supply chain will be a key determinant of its future performance. It is imperative to continue monitoring Foot Locker Q4 2024 earnings reports and subsequent announcements to stay abreast of the company's progress and adapt investment strategies accordingly. Stay informed about future Foot Locker developments and conduct further research into the company's performance to make informed decisions. Analyzing Foot Locker's Q4 2024 earnings is vital for understanding the dynamics of the athletic footwear market.

Featured Posts

-

Trumps Sleepy Joe Attacks Analyzing Bidens Presidency

May 16, 2025

Trumps Sleepy Joe Attacks Analyzing Bidens Presidency

May 16, 2025 -

The Future Of Cobalt Congos Quota Plan After The Export Ban

May 16, 2025

The Future Of Cobalt Congos Quota Plan After The Export Ban

May 16, 2025 -

Nba Play In Game Preview Golden State Vs Memphis

May 16, 2025

Nba Play In Game Preview Golden State Vs Memphis

May 16, 2025 -

Unexpectedly High Sales Figures For Kid Cudis Auctioned Items

May 16, 2025

Unexpectedly High Sales Figures For Kid Cudis Auctioned Items

May 16, 2025 -

Oakland Athletics News Muncys Impact On The Second Base Position

May 16, 2025

Oakland Athletics News Muncys Impact On The Second Base Position

May 16, 2025