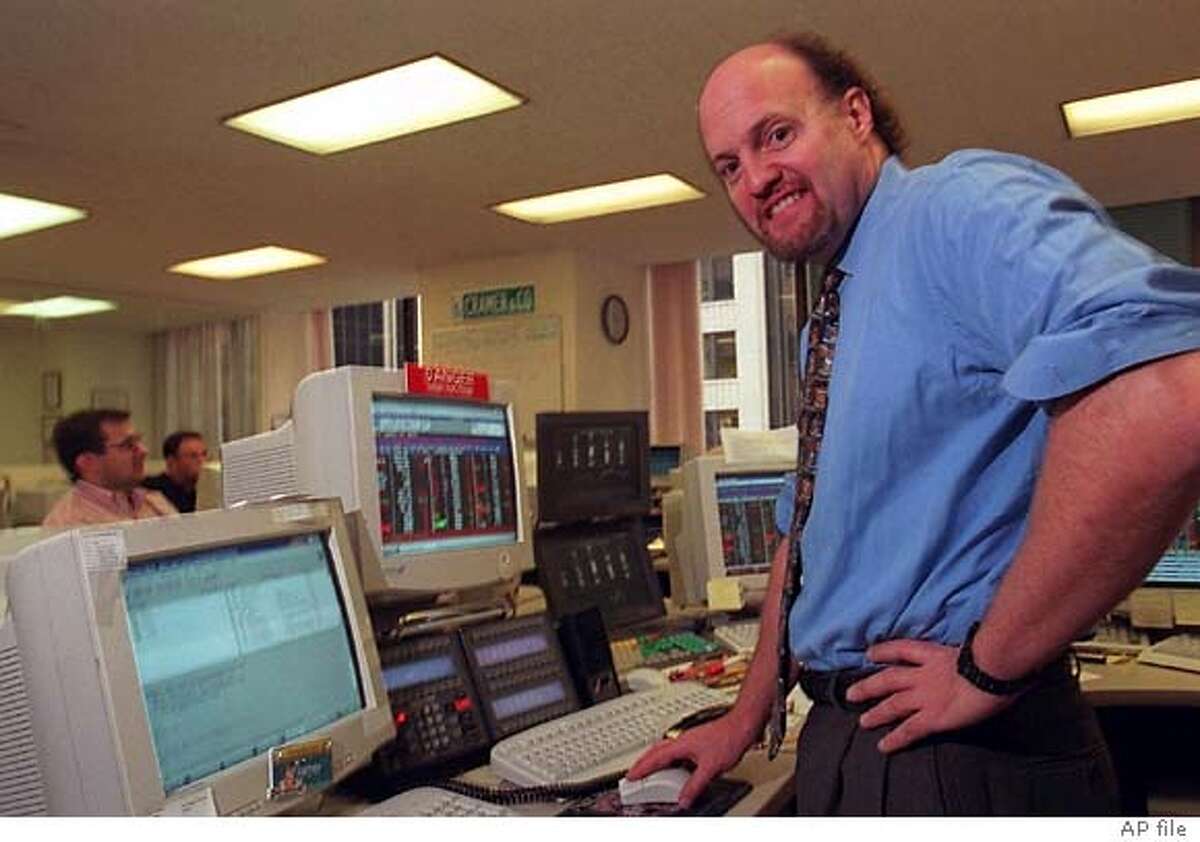

Foot Locker (FL) Stock: A Deep Dive Based On Jim Cramer's Analysis

Table of Contents

Jim Cramer's Historical Stance on Foot Locker (FL) Stock

Jim Cramer's pronouncements on Foot Locker stock haven't always been consistent, reflecting the fluctuating nature of the retail and athletic footwear market. While precise dates and transcripts for every mention are difficult to compile comprehensively, a review of Mad Money segments and online archives reveals a pattern of varying recommendations.

- Bullet Points:

- In periods of strong consumer spending and positive earnings reports (e.g., specific dates if available from research), Cramer has expressed a more bullish sentiment, potentially assigning a "buy rating" or suggesting it as a strong addition to a diversified portfolio focused on retail. These periods often coincided with positive industry trends like increased athletic apparel sales.

- Conversely, during periods of economic uncertainty or when Foot Locker faced challenges from competitors or shifting consumer preferences (e.g., the rise of online retailers), Cramer's stance has been more cautious, possibly issuing a "hold" or even "sell" recommendation. These instances might be linked to discussions about decreasing profit margins or concerns about inventory management.

- Finding specific video clips or transcripts from Mad Money requires dedicated research using their online archive and search functionality. [Include links to relevant videos or transcripts if found]. Note that direct quotes from Jim Cramer require proper attribution.

Analyzing Foot Locker's Financial Performance and Key Metrics

Understanding Foot Locker's financial health is critical to assessing its investment potential. Analyzing key performance indicators (KPIs) reveals a complex picture. Examining recent quarterly and annual reports (accessible through the SEC's EDGAR database and Foot Locker's investor relations website) allows for a comprehensive view.

- Bullet Points:

- Revenue Growth/Decline: Analyze recent trends in revenue. Has FL experienced consistent growth, stagnation, or decline? This reveals the company's success in attracting customers and managing sales.

- Earnings Per Share (EPS): Track the EPS over time to gauge profitability. Increasing EPS generally signifies a healthy financial outlook.

- Profit Margins: Analyze gross and net profit margins to determine how efficiently Foot Locker converts sales into profit. Decreasing margins might signal increased competition or rising operational costs.

- Debt Levels: High debt can be a significant risk factor. Examining Foot Locker's debt-to-equity ratio helps assess its financial leverage and stability.

- Stock Price Performance: Analyze the historical and recent performance of FL stock. This provides a clear visual representation of its market valuation and investor sentiment.

Competitive Landscape and Industry Trends Affecting FL Stock

Foot Locker operates in a fiercely competitive landscape. Analyzing its position within the athletic footwear and apparel industry is crucial.

- Bullet Points:

- Key Competitors: Major competitors include Nike, Adidas, Under Armour, and other specialty retailers. Analyzing their market share and strategies provides insight into FL's competitive standing.

- Industry Trends: The industry is influenced by significant trends. E-commerce continues to disrupt traditional retail, forcing companies to adapt their online presence and supply chain strategies. Shifting consumer preferences towards specific brands or styles also influence demand.

- Foot Locker's Response: How effectively is Foot Locker adapting to these challenges? Its success in embracing e-commerce, managing inventory, and innovating its retail experiences will significantly influence its future performance.

- Supply Chain: The efficiency and resilience of Foot Locker's supply chain are paramount, particularly considering global disruptions.

Future Outlook for Foot Locker (FL) Based on Cramer's Insights (and other analysis)

Predicting the future of any stock is inherently speculative. However, by combining Cramer's past analysis with current market trends and Foot Locker's financial performance, we can develop a potential outlook.

- Bullet Points:

- Potential Growth Areas: Foot Locker could see growth through expansion into new markets, partnerships with popular brands, or the successful implementation of new retail strategies.

- Risks and Challenges: Maintaining profitability amidst fierce competition, managing supply chain complexities, and adapting to evolving consumer preferences remain significant challenges.

- Catalysts for Price Changes: Positive news like strong earnings reports or strategic partnerships could drive price increases. Negative news, such as disappointing sales figures or supply chain disruptions, could trigger price drops.

- Long-Term vs. Short-Term: Investing in Foot Locker requires a clear understanding of your investment horizon. Short-term investors may focus on quick price fluctuations, while long-term investors will consider the company's overall growth trajectory.

Conclusion

This deep dive into Foot Locker (FL) stock, informed by Jim Cramer's insights and broader market analysis, paints a nuanced picture. While Cramer's past recommendations have varied, a thorough examination of Foot Locker's financials, its competitive landscape, and industry trends is essential for making an informed decision. Whether the current outlook suggests a buy, sell, or hold strategy depends heavily on your personal risk tolerance and investment goals. Remember to carefully evaluate the factors discussed above before making any investment decisions.

Call to Action: This deep dive into Foot Locker (FL) stock provides a framework for your own analysis. Continue your research on Foot Locker (FL) stock, considering the information presented here alongside your own due diligence, and make a well-informed investment decision regarding Foot Locker stock. Remember to always conduct thorough due diligence before investing in any stock.

Featured Posts

-

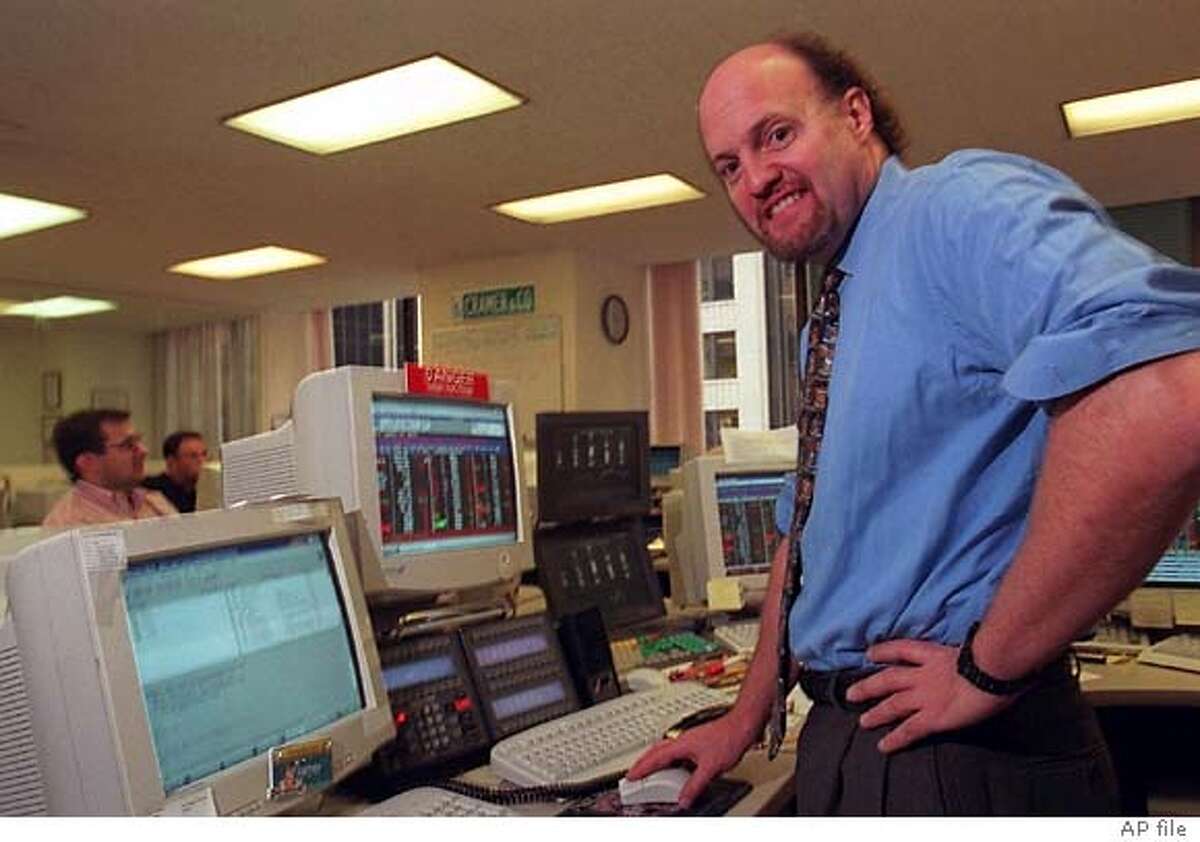

Pimblett Vs Poirier A Debate On Retirement And Future Fights

May 15, 2025

Pimblett Vs Poirier A Debate On Retirement And Future Fights

May 15, 2025 -

Onrust Bij De Npo Actie Gericht Op Frederieke Leeflang

May 15, 2025

Onrust Bij De Npo Actie Gericht Op Frederieke Leeflang

May 15, 2025 -

Npo Baas Beschuldigd Van Het Creeren Van Een Angstcultuur Door Tientallen Medewerkers

May 15, 2025

Npo Baas Beschuldigd Van Het Creeren Van Een Angstcultuur Door Tientallen Medewerkers

May 15, 2025 -

Bvg Streik Berlin Was Fahrgaeste Jetzt Wissen Muessen

May 15, 2025

Bvg Streik Berlin Was Fahrgaeste Jetzt Wissen Muessen

May 15, 2025 -

The Countrys New Business Hot Spots A Geographic Overview

May 15, 2025

The Countrys New Business Hot Spots A Geographic Overview

May 15, 2025