Forecasting Apple Stock (AAPL) Price Movements: Key Levels To Consider

Table of Contents

Understanding Support and Resistance Levels in AAPL

Support and resistance levels are critical price points in technical analysis. Support represents a price floor where buying pressure is strong enough to prevent further price declines. Conversely, resistance is a price ceiling where selling pressure outweighs buying pressure, hindering upward movement. In the context of Apple stock, these levels act as potential turning points. Identifying them involves examining past price action and using various technical analysis tools.

-

Identifying Key Psychological Levels: Round numbers like $150, $200, or $300 often act as significant psychological support or resistance levels for AAPL, as investors tend to react emotionally to these milestones.

-

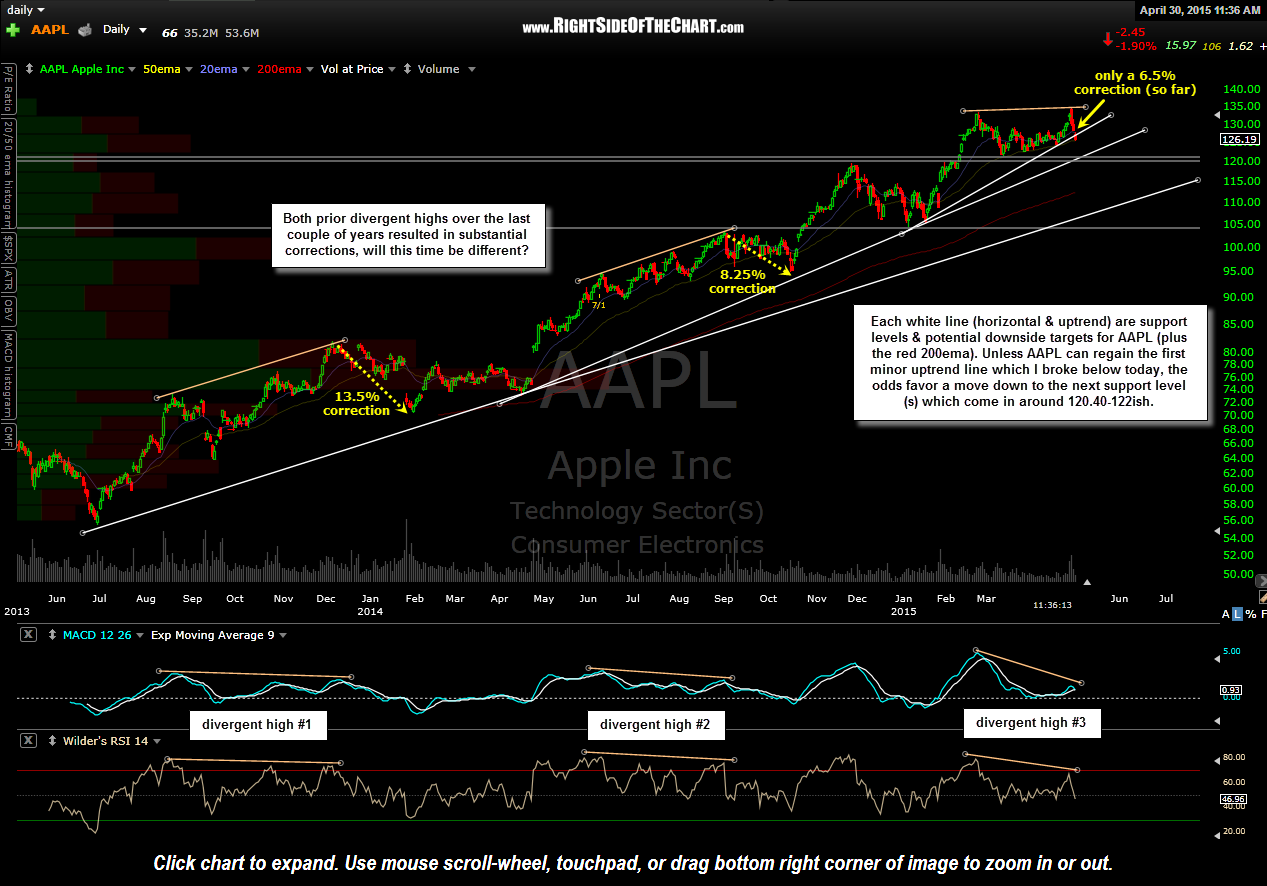

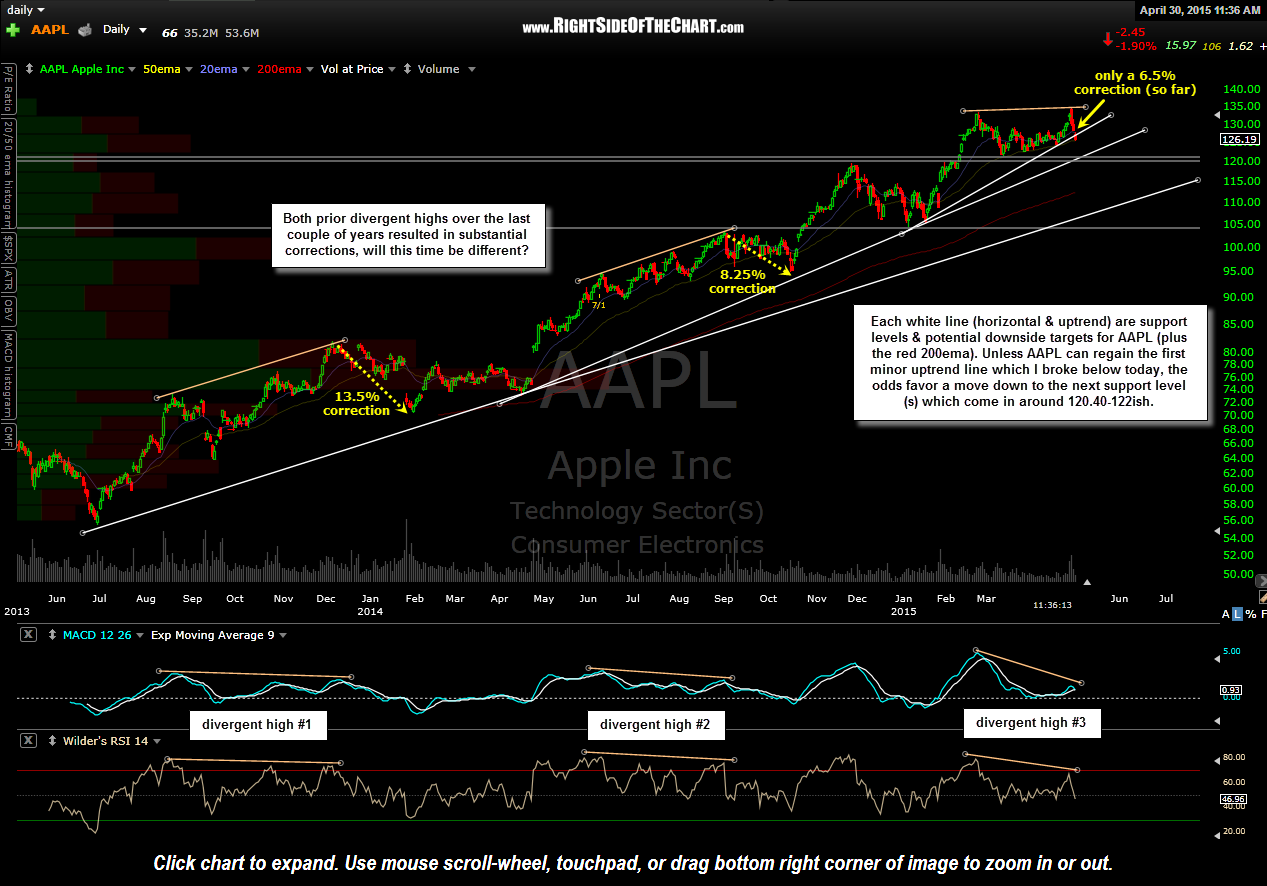

Using Moving Averages: Moving averages, such as the 50-day and 200-day simple moving averages (SMA), provide dynamic support and resistance. Breaks above the 200-day SMA can signal a bullish trend, while breaks below can suggest bearish pressure. [Include a chart here showing AAPL's price with 50-day and 200-day SMAs].

-

Recognizing Chart Patterns: Chart patterns like head and shoulders, double tops, and double bottoms offer visual clues about potential support and resistance levels. A head and shoulders pattern, for example, often precedes a price decline. [Include a chart here illustrating a common chart pattern].

Analyzing Apple's Fundamental Performance for Price Forecasting

While technical analysis focuses on price charts, fundamental analysis delves into the underlying financial health of Apple. Combining both approaches offers a more comprehensive view for forecasting Apple stock price movements. Analyzing Apple's financial statements, product launches, and competitive landscape is vital.

-

Impact of New Product Releases: The launch of new iPhones, iPads, Macs, and services significantly influences Apple's revenue and profitability, directly impacting its stock price. Strong sales figures often lead to price increases.

-

Analysis of Quarterly Earnings Reports and Future Guidance: Apple's quarterly earnings reports provide insights into its financial performance and management's outlook for the future. Beating expectations usually triggers positive price reactions.

-

Competitive Landscape and Market Share: Apple's position in the tech market, its competitive advantages, and its market share significantly impact its valuation and stock price. A loss of market share to competitors could negatively impact AAPL's price.

-

Overall Economic Conditions and Their Effect on Consumer Spending: Economic downturns or increased inflation can affect consumer spending, potentially impacting demand for Apple products and thus its stock price.

Key Technical Indicators for AAPL Price Prediction

Several technical indicators enhance the accuracy of AAPL price predictions. These indicators provide signals based on price movements and volume.

-

Overbought/Oversold Conditions using RSI (Relative Strength Index): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 suggests the stock might be overbought and due for a correction, while below 30 suggests it might be oversold.

-

Identifying Potential Trend Reversals with MACD (Moving Average Convergence Divergence): MACD identifies changes in the strength, direction, momentum, and duration of a trend. Crossovers of the MACD lines can signal potential trend reversals.

-

Measuring Price Volatility with Bollinger Bands: Bollinger Bands measure price volatility. When prices touch the upper band, it might signal an overbought condition and a potential price reversal. Conversely, touching the lower band could indicate an oversold condition.

External Factors Influencing Apple Stock Prices

Beyond Apple's internal performance, several external factors influence its stock price. These macroeconomic and geopolitical events require careful consideration.

-

Impact of Currency Fluctuations: Changes in currency exchange rates impact Apple's revenue and profitability, particularly as a significant portion of its sales are international.

-

Influence of Supply Chain Disruptions: Global supply chain issues can affect Apple's production and product availability, potentially influencing its stock price.

-

Effects of Regulatory Changes: Changes in regulations or government policies can impact Apple's operations and its stock price. For instance, antitrust investigations or changes in data privacy laws can have an effect.

Conclusion: Mastering Apple Stock (AAPL) Price Forecasting

Successfully forecasting Apple stock (AAPL) price movements requires a balanced approach, combining both technical and fundamental analysis. Understanding key support and resistance levels, incorporating relevant technical indicators, and considering external factors all contribute to a more comprehensive prediction. Continuous monitoring of market trends and adapting your strategy based on new information are crucial for navigating the dynamic nature of the stock market. Start refining your Forecasting Apple Stock (AAPL) Price Movements strategy today by incorporating these key levels into your analysis. Further research into technical indicators and fundamental analysis will enhance your understanding and potentially improve your investment outcomes. Consider subscribing to reputable financial news sources for ongoing updates on Apple and the broader market.

Featured Posts

-

Ilya Ilich I Ego Gryozy Lyubvi Analiz Publikatsii V Gazete Trud

May 24, 2025

Ilya Ilich I Ego Gryozy Lyubvi Analiz Publikatsii V Gazete Trud

May 24, 2025 -

Forbes 2025 La Classifica Degli Uomini Piu Ricchi Del Mondo Cambia Ancora

May 24, 2025

Forbes 2025 La Classifica Degli Uomini Piu Ricchi Del Mondo Cambia Ancora

May 24, 2025 -

The Demna Gvasalia Effect Reshaping Guccis Brand Identity

May 24, 2025

The Demna Gvasalia Effect Reshaping Guccis Brand Identity

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Dist A Comprehensive Guide To Net Asset Value

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist A Comprehensive Guide To Net Asset Value

May 24, 2025 -

H Nonline Sk Hospodarsky Pokles V Nemecku Prehlad Prepustania V Najvaecsich Spolocnostiach

May 24, 2025

H Nonline Sk Hospodarsky Pokles V Nemecku Prehlad Prepustania V Najvaecsich Spolocnostiach

May 24, 2025

Latest Posts

-

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025 -

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025 -

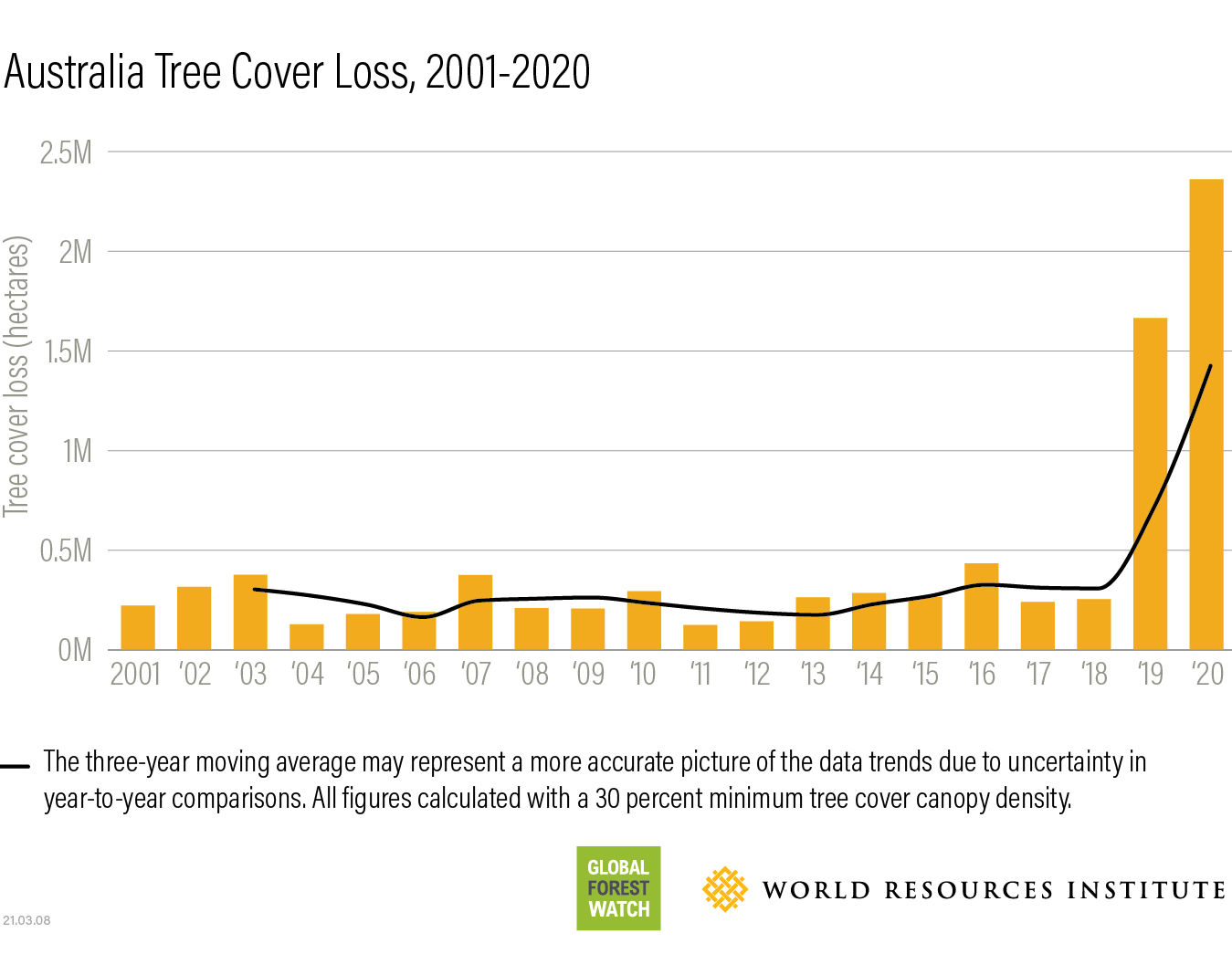

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025 -

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025 -

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025