Foreign Airlines Acquire 25% Of WestJet, Marking Onex Investment Exit

Table of Contents

Details of the Acquisition

The acquisition involves [Insert Names and Countries of Foreign Airlines Here] acquiring a significant 25% stake in WestJet. While the precise financial terms of the deal remain undisclosed at this time, the magnitude of the investment represents a substantial commitment to the Canadian airline market. The lack of publicly available financial details fuels speculation, but the sheer size of the acquisition signals a major shift in the landscape.

- Investment Amount: [Insert Amount if available, otherwise state "Undisclosed"]

- Investment Breakdown: [Specify how the 25% is divided amongst the foreign airlines, if known. Otherwise, state "Details not yet publicly available."]

- Expected Closing Date: [Insert Date if available, otherwise state "To be announced"]

Onex Corporation's Exit Strategy

Onex Corporation, the previous major investor in WestJet, has exited its investment with this acquisition. Onex's involvement with WestJet spanned [Number] years, during which they [Describe Onex's role and contributions]. Their decision to divest likely stems from a combination of factors, including achieving a satisfactory return on investment and potentially a strategic realignment of their portfolio.

- Onex's Initial Investment: [Insert Amount and Year]

- Profitability for Onex: [Estimate or state "Details not yet publicly disclosed," if unavailable]

- Onex's Future Plans: [Speculate or cite statements from Onex about future aviation investments, if available.]

Impact on WestJet's Operations and Future

The influx of foreign ownership will undoubtedly influence WestJet's future trajectory. While the precise impact remains to be seen, several potential consequences emerge. The new strategic partners could bring expertise and resources, potentially leading to expansion into new markets or improvements in operational efficiency. However, concerns regarding potential changes in corporate culture and employee relations may also arise.

- Potential Route Changes: [Speculate on potential new routes based on the foreign airlines' existing networks]

- Influence on Business Strategy: [Discuss potential changes in pricing, customer service, and other aspects of WestJet's business model]

- Impact on Brand and Loyalty: [Analyze potential effects on customer perception and loyalty]

Implications for the Canadian Aviation Industry

This acquisition carries far-reaching implications for the Canadian aviation industry. The increased foreign presence could intensify competition, potentially leading to lower fares for consumers. Conversely, it might also trigger consolidation within the sector, impacting the overall market structure. Government regulatory oversight will be crucial in ensuring fair competition and consumer protection.

- Increased Competition: [Compare WestJet to Air Canada and other major players, analyzing the impact of increased competition]

- Potential Airfare Changes: [Discuss the potential for price increases or decreases, depending on market forces]

- Impact on Canadian Aviation Policy: [Analyze how this acquisition could influence government policies and regulations concerning foreign ownership of Canadian airlines]

Global Aviation Market Context

The WestJet acquisition is not an isolated incident; it reflects broader trends in the global airline industry. Consolidation, strategic partnerships, and foreign investment are reshaping the competitive landscape. This acquisition aligns with a global pattern of increased international investment in major airlines worldwide.

- Comparison to Global Acquisitions: [Cite examples of similar acquisitions in other countries]

- Global M&A Trends: [Analyze global trends in airline mergers and acquisitions, citing relevant statistics]

- Long-Term Global Implications: [Discuss how this event contributes to the long-term restructuring of the global aviation industry]

Conclusion: Foreign Airlines Acquire 25% of WestJet – What's Next?

The acquisition of a 25% stake in WestJet by foreign airlines marks a watershed moment, impacting WestJet's operations, the Canadian aviation industry, and the broader global landscape. Onex Corporation's exit signals the end of an era, while the new foreign ownership promises a new chapter, filled with potential opportunities and challenges. The long-term consequences will unfold over time, but this event undeniably reshapes the competitive dynamics of the industry. Stay informed on further developments by following reputable news sources for updates on the evolving situation surrounding Foreign Airlines Acquire 25% of WestJet and other significant industry news. [Link to a relevant news source or subscription service].

Featured Posts

-

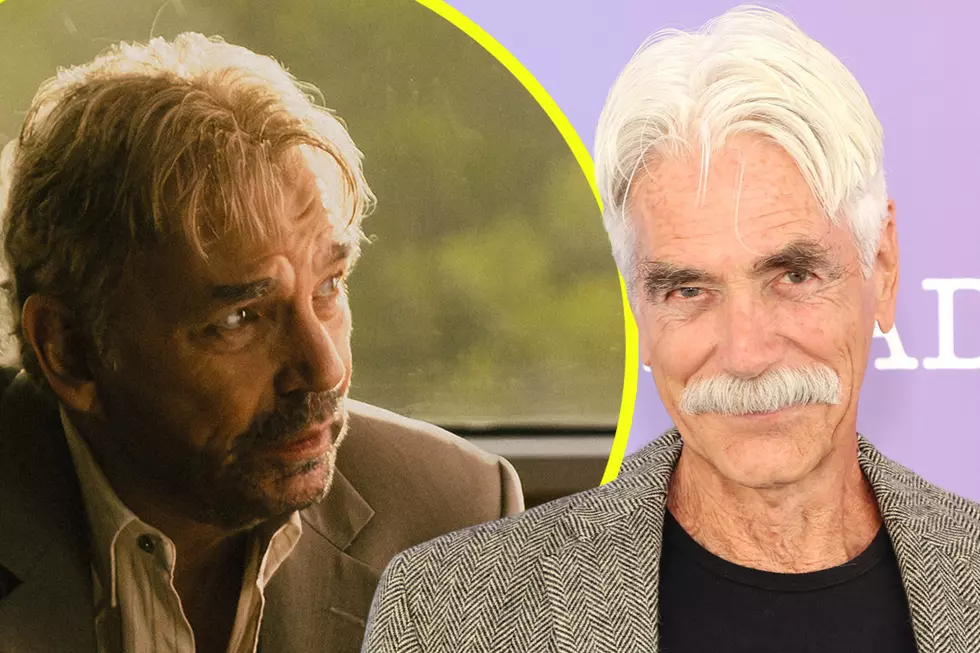

New Report Sam Elliott Set For Landman Season 2

May 13, 2025

New Report Sam Elliott Set For Landman Season 2

May 13, 2025 -

Reporter Under Fire After A Ap Rocky Bet Question To 50 Cent And Tory Lanez

May 13, 2025

Reporter Under Fire After A Ap Rocky Bet Question To 50 Cent And Tory Lanez

May 13, 2025 -

Manila Heatwave Schools Closed Bangkok Post Reports

May 13, 2025

Manila Heatwave Schools Closed Bangkok Post Reports

May 13, 2025 -

Tory Lanez And 50 Cents Furious Reaction To A Ap Rocky Bet Inquiry

May 13, 2025

Tory Lanez And 50 Cents Furious Reaction To A Ap Rocky Bet Inquiry

May 13, 2025 -

Sobolenko Skandal Na Madridskom Turnire

May 13, 2025

Sobolenko Skandal Na Madridskom Turnire

May 13, 2025