FP Video Explains: The Bank Of Canada Holds Rates – What It Means

Table of Contents

The Bank of Canada's recent decision to hold interest rates has sparked considerable discussion across Canada. This seemingly small move has significant implications for the Canadian economy, impacting everything from your mortgage payments to your savings account interest. This article will dissect the Bank of Canada's rate decision, explaining the factors behind it and outlining its potential short-term and long-term effects on your personal finances. We'll explore what this means for you, whether you're a homeowner, a saver, or an investor.

Why the Bank of Canada Held Rates

The Bank of Canada's decision to hold interest rates reflects a careful assessment of the current economic climate. Several key factors influenced this decision. The central bank considers a multitude of economic indicators when setting interest rates, primarily focusing on its mandate to control inflation while fostering sustainable economic growth.

- Current inflation figures and their trajectory: While inflation has cooled somewhat from its peak, it remains above the Bank of Canada's target of 2%. The recent figures show a continued, albeit slower, decline, suggesting a cautious approach to further rate adjustments.

- Recent GDP growth and forecasts: Economic growth in Canada has been more moderate than anticipated, prompting a more measured response from the Bank of Canada. Forecasts for future GDP growth are also factoring into their decision-making process.

- Unemployment rates and their impact on the decision: Unemployment rates remain relatively low, indicating a strong labor market. This factor can be a double-edged sword, as strong employment can contribute to inflationary pressures but also shows economic resilience.

- Global economic factors influencing the Bank of Canada's decision: Global economic uncertainty, including geopolitical factors and international inflation trends, play a significant role in the Bank of Canada's overall strategy. These external pressures necessitate a cautious approach to domestic interest rate adjustments.

The Bank of Canada's mandate is to maintain the value of the Canadian dollar and to promote sustainable economic growth. The rate hold reflects a balancing act between these competing objectives, prioritizing a cautious approach in the face of ongoing economic uncertainties.

Impact on Mortgages and Borrowing

The Bank of Canada's decision to hold rates has immediate and future implications for mortgages and borrowing across the country.

- No immediate change in mortgage payments for existing borrowers: Those with existing mortgages will not see an immediate impact on their monthly payments. However, future rate adjustments could significantly alter their payments.

- Potential impact on future mortgage rates: While current mortgage rates are not immediately affected, the hold doesn’t guarantee future stability. Further rate hikes or cuts remain possibilities, influencing future mortgage rates.

- Effect on borrowing costs for other loans (e.g., car loans, personal loans): Interest rates for other types of loans are often linked to the Bank of Canada's benchmark rate. A rate hold provides some temporary relief, but the future direction of these rates remains uncertain.

- Considerations for those planning to buy a home in the near future: Prospective homebuyers should carefully consider the current economic climate and its potential impact on future mortgage rates and housing prices.

Impact on Savings and Investments

The implications of the rate hold extend to savings and investment strategies.

- Effect on interest earned on savings accounts: The rate hold will likely mean that interest earned on savings accounts remains relatively unchanged in the short term. However, future rate increases could improve returns.

- Potential impact on investment returns: The stability offered by the rate hold could positively impact certain investments, while negatively affecting others. Careful portfolio diversification is crucial.

- Strategies for maximizing returns in a stable interest rate environment: Investors might consider shifting their portfolios to assets that may offer better returns in a stable interest rate environment, such as certain types of stocks or real estate.

- Considerations for different investment portfolios (e.g., bonds, stocks): The rate hold may influence the relative attractiveness of bonds versus stocks, impacting investment decisions for various portfolio strategies.

Future Outlook and Predictions

Predicting future interest rate movements is challenging, but several factors could influence the Bank of Canada's next decisions.

- Factors that could lead to future rate increases or decreases: Future inflation data, economic growth forecasts, and global economic developments will all play crucial roles in shaping the Bank of Canada's future decisions.

- Expert opinions and predictions for the next few months: Economists offer varying opinions on the short-term outlook for interest rates, highlighting the uncertainty inherent in economic forecasting.

- Long-term implications of the current rate hold: The long-term impact will depend on how the Canadian economy responds to the current conditions and how global factors evolve.

- Advice on preparing for potential changes in the economy: Maintaining financial flexibility, diversifying investments, and monitoring economic indicators are crucial steps in preparing for future economic uncertainties.

Conclusion

The Bank of Canada's decision to hold interest rates presents both opportunities and challenges for Canadians. While the hold provides short-term stability, it's vital to stay informed about the evolving economic landscape. Understanding the interconnectedness of inflation, economic growth, and interest rates is crucial for effective financial planning. By staying informed about future adjustments to the Bank of Canada interest rates and adapting your strategies accordingly, you can navigate this period of economic uncertainty more effectively.

Call to Action: Stay updated on the latest developments regarding Bank of Canada interest rates and their implications for your financial well-being by regularly checking FP Video for insightful analysis and expert commentary on the Canadian economy. Learn more about managing your finances effectively during periods of economic uncertainty by exploring other resources on the FP Video website.

Featured Posts

-

Velikiy Post 2025 Chistiy Ponedelnik Traditsii Obryady I Pravila Posta

Apr 23, 2025

Velikiy Post 2025 Chistiy Ponedelnik Traditsii Obryady I Pravila Posta

Apr 23, 2025 -

The Future Of Luxury Cars In China Lessons From Bmw And Porsches Struggles

Apr 23, 2025

The Future Of Luxury Cars In China Lessons From Bmw And Porsches Struggles

Apr 23, 2025 -

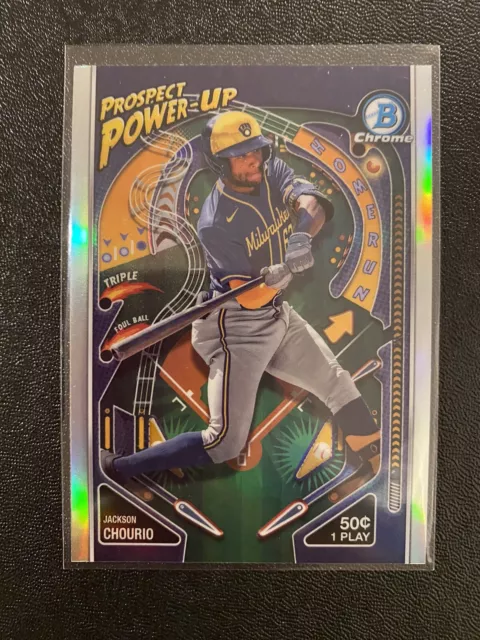

Chourios Power Display Brewers Defeat Rockies In Dominant Fashion

Apr 23, 2025

Chourios Power Display Brewers Defeat Rockies In Dominant Fashion

Apr 23, 2025 -

11th Inning Walk Off Bunt Gives Brewers Victory Over Royals

Apr 23, 2025

11th Inning Walk Off Bunt Gives Brewers Victory Over Royals

Apr 23, 2025 -

Watch Rowdy Tellez Get Revenge On The Team That Traded Him

Apr 23, 2025

Watch Rowdy Tellez Get Revenge On The Team That Traded Him

Apr 23, 2025