FP Video Report: The Ongoing Effects Of Tariff Instability On Global Trade

Table of Contents

Increased Uncertainty and Investment Hesitation

Unpredictable tariffs create a significant obstacle to long-term planning and investment. Businesses, especially those heavily reliant on international trade, find it incredibly difficult to forecast costs and profits accurately when tariffs fluctuate wildly. This tariff instability leads to a chilling effect on investment, hindering growth and innovation.

- Reduced foreign direct investment (FDI): The uncertainty surrounding future tariff policies makes multinational corporations hesitant to commit significant capital to expansion in affected markets. Data from the IMF shows a clear correlation between tariff instability and declines in FDI.

- Difficulty in forecasting costs and profits: Businesses struggle to price their products and services accurately when faced with fluctuating import and export duties. This unpredictability makes it nearly impossible to create reliable financial projections.

- Hesitation to establish new international supply chains: The risk of sudden tariff hikes discourages companies from investing in new, globally integrated supply chains, leading them to favor more localized, and often less efficient, alternatives.

- Increased risk aversion among investors: Investors are naturally risk-averse. The unpredictability caused by tariff instability increases perceived risk, leading to reduced investment in both domestic and international markets.

For instance, the automotive industry, a sector highly reliant on global supply chains, has faced significant challenges due to tariff fluctuations, resulting in reduced production and investment.

Supply Chain Disruptions and Increased Costs

Changes in tariffs disrupt established supply chains, forcing companies to scramble for alternative suppliers, often at significantly higher costs. This tariff instability not only increases expenses but also leads to delays and inefficiencies.

- Increased transportation costs: Companies may need to reroute shipments to avoid higher tariffs, adding substantial costs to transportation and logistics.

- Higher input costs: Sourcing from alternative suppliers, often located further away, drives up the cost of raw materials and components.

- Delays in production and delivery: The complexities of navigating altered supply chains often lead to delays in production and delivery, potentially damaging relationships with customers.

- Loss of efficiency and productivity: The constant need to adapt to shifting tariff landscapes diverts resources and attention away from core business activities, decreasing overall efficiency and productivity.

The electronics industry, for example, has experienced significant supply chain disruptions due to trade wars and resulting tariff instability, leading to increased prices for consumers. Analysis from the WTO shows a demonstrable link between tariff increases and supply chain disruption costs.

Impact on Consumer Prices and Inflation

Tariffs, by their very nature, increase the cost of imported goods. When this happens repeatedly and unpredictably due to tariff instability, the cumulative effect is passed on to consumers in the form of higher prices. This contributes to inflationary pressures and reduces consumer purchasing power.

- Reduced consumer purchasing power: Higher prices for goods and services, caused by increased tariffs, leave consumers with less disposable income.

- Increased inflationary pressures: The increased cost of imported goods fuels inflationary pressures, impacting overall economic stability.

- Potential for social and political unrest: Rising living costs due to inflation, fueled by tariff instability, can lead to social and political unrest.

- Impact on various consumer goods sectors: The impact of increased prices varies across different consumer goods sectors, but the overall effect is a reduction in affordability.

Studies have shown a direct correlation between tariff increases and inflation rates, particularly in countries heavily reliant on imported goods.

Geopolitical Tensions and Trade Wars

Tariff instability often fuels protectionist sentiment and escalates geopolitical tensions, leading to trade wars and retaliatory measures. This destructive cycle damages international cooperation and hinders global economic growth.

- Increased protectionist sentiment: The perceived unfairness of tariffs and the resulting economic disruptions often strengthen protectionist sentiments among nations.

- Escalation of trade disputes and retaliatory tariffs: Trade disputes often escalate into full-blown trade wars, with countries imposing retaliatory tariffs on each other's goods.

- Damage to international cooperation and multilateral trade agreements: Trade wars undermine international cooperation and threaten the stability of multilateral trade agreements.

- Negative impact on global economic growth: The uncertainty and disruptions caused by trade wars significantly hamper global economic growth.

Recent trade wars, such as the US-China trade war, serve as stark examples of how tariff instability can negatively impact global trade and economic relationships. The resulting damage to international cooperation is a significant concern for global economic stability.

Conclusion

In summary, tariff instability creates a climate of uncertainty that negatively affects global trade. It leads to reduced investment, disrupted supply chains, higher consumer prices, and heightened geopolitical tensions. Understanding the ongoing effects of tariff instability is crucial for navigating the complexities of global trade. Stay informed on this critical issue by following future FP Video Reports and advocating for policies that promote stability and predictability in the international marketplace. We need to work towards a more stable and predictable global trading environment, minimizing the negative impacts of tariff fluctuations and fostering fair and open competition.

Featured Posts

-

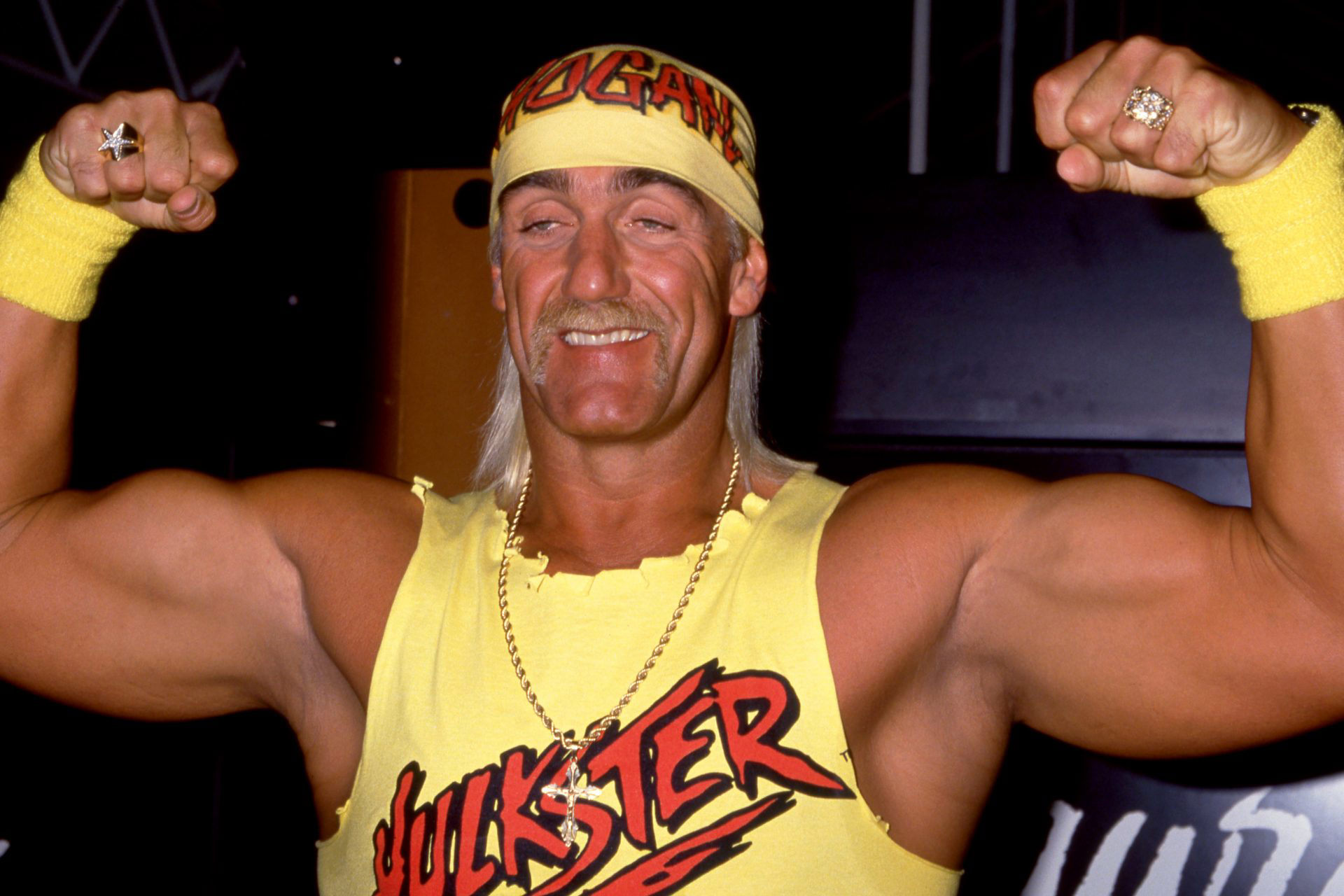

A Hell Of A Run Understanding Ftv Lives Controversies And Contributions

May 21, 2025

A Hell Of A Run Understanding Ftv Lives Controversies And Contributions

May 21, 2025 -

Voedselexport Naar Vs Keldert Abn Amro Analyseert De Impact Van Heffingen

May 21, 2025

Voedselexport Naar Vs Keldert Abn Amro Analyseert De Impact Van Heffingen

May 21, 2025 -

Apples Llm Siri Challenges And Opportunities

May 21, 2025

Apples Llm Siri Challenges And Opportunities

May 21, 2025 -

Post Nuclear Taiwan The Growing Reliance On Lng Cargoes

May 21, 2025

Post Nuclear Taiwan The Growing Reliance On Lng Cargoes

May 21, 2025 -

Walliams And Cowells Fallout A Look At The Celebrity Rift

May 21, 2025

Walliams And Cowells Fallout A Look At The Celebrity Rift

May 21, 2025

Latest Posts

-

Fremantle Q1 Revenue Decline 5 6 Drop Due To Buyer Budget Cuts

May 21, 2025

Fremantle Q1 Revenue Decline 5 6 Drop Due To Buyer Budget Cuts

May 21, 2025 -

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Maalitykki

May 21, 2025

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Maalitykki

May 21, 2025 -

Benjamin Kaellman Kehittynyt Pelaaja Valmis Huuhkajiin

May 21, 2025

Benjamin Kaellman Kehittynyt Pelaaja Valmis Huuhkajiin

May 21, 2025 -

Kaellmanin Nousu Kentaeltae Ja Sen Ulkopuolelta Huuhkajiin

May 21, 2025

Kaellmanin Nousu Kentaeltae Ja Sen Ulkopuolelta Huuhkajiin

May 21, 2025 -

Benjamin Kaellman Huuhkajien Uusi Maaliruisku

May 21, 2025

Benjamin Kaellman Huuhkajien Uusi Maaliruisku

May 21, 2025