France's CAC 40: Week's Performance - Minor Losses, Stable Outlook (March 7, 2025)

Table of Contents

The past week saw significant volatility in global markets, largely driven by the unexpected interest rate hike announced by the European Central Bank on Wednesday. This announcement had a ripple effect across European markets, impacting the performance of the CAC 40, France's leading stock market index. This article analyzes the CAC 40 index's performance for the week ending March 7th, 2025, highlighting the minor losses observed and the overall stable outlook for the French stock market. We will delve into key performance indicators, sectoral trends, the impact of global economic factors, and offer a forecast for the coming weeks. Keywords: CAC 40, French stock market, index performance, weekly analysis, market outlook, French economy.

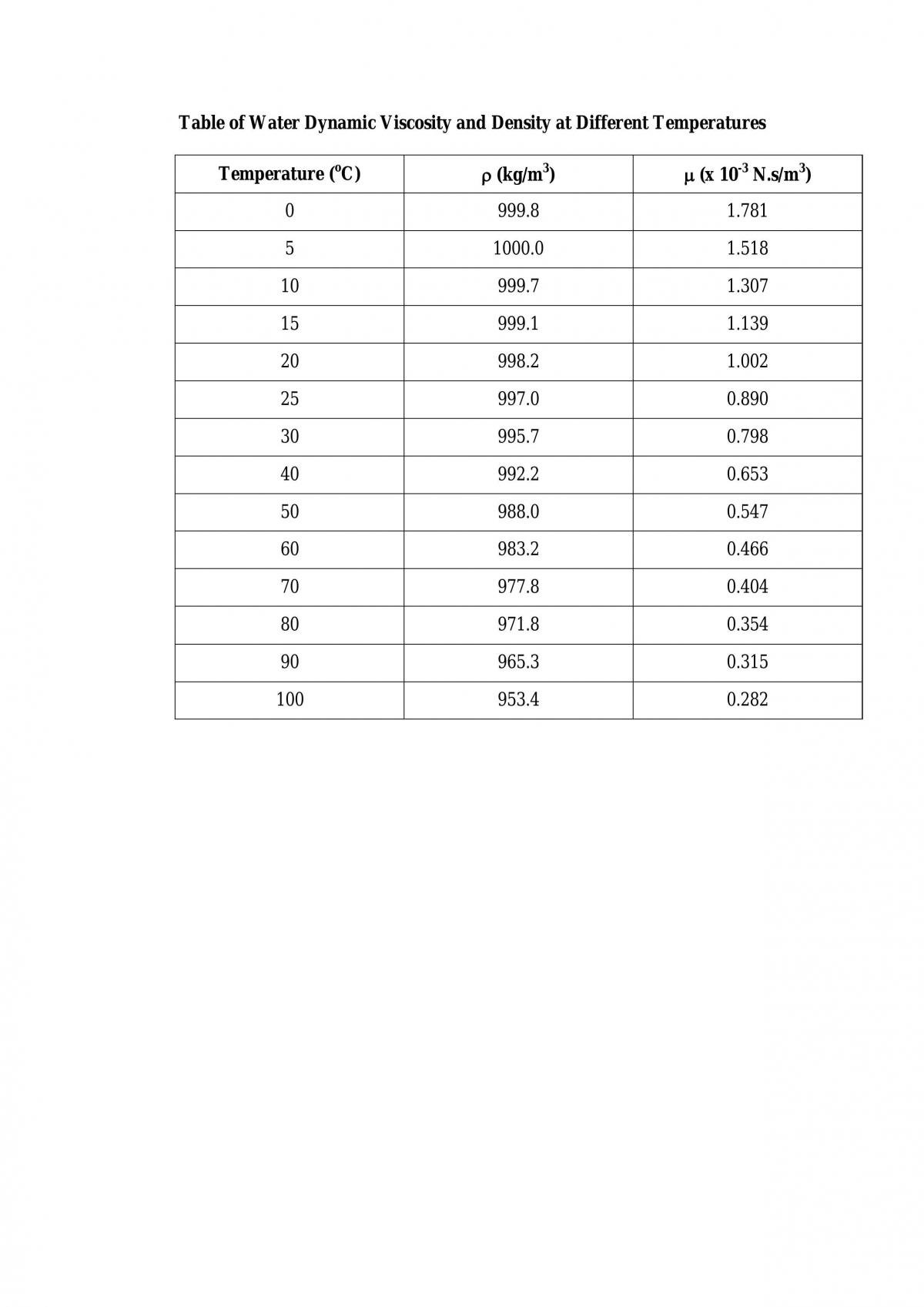

H2: Key Performance Indicators of the CAC 40

The CAC 40 experienced a minor decline of 0.8% for the week ending March 7th, 2025, closing at 7,250. This represents a slight decrease compared to the previous week's closing value of 7,310. Weekly trading volume was 15% higher than the average, indicating increased investor activity likely fueled by the ECB's announcement and subsequent market uncertainty.

- Daily Fluctuations: Monday saw a sharp initial drop of 1.2%, followed by a partial recovery throughout the rest of the week.

- Weekly High/Low: The index reached a weekly high of 7,325 on Monday morning before the ECB announcement and a low of 7,220 on Wednesday afternoon.

- Previous Week Comparison: The CAC 40's performance this week marks a reversal from the previous week's 1.5% gain, highlighting the impact of global economic news on the French stock market's short-term trajectory.

H2: Sectoral Performance within the CAC 40

Sectoral performance within the CAC 40 was mixed. The energy sector, benefiting from sustained high oil prices, was a top performer, registering a 2% increase. Conversely, the technology sector underperformed, with a 1.5% decline, reflecting concerns about global tech valuations and interest rate hikes. The financial sector showed resilience, with a relatively flat performance, only slightly down by 0.2%.

- Top 3 Performing Sectors:

- Energy (+2%)

- Healthcare (+0.5%)

- Utilities (+0.3%)

- Bottom 3 Performing Sectors:

- Technology (-1.5%)

- Consumer Discretionary (-1%)

- Retail (-0.8%)

- Unexpected Performance: The resilience of the financial sector despite rising interest rates was somewhat unexpected, potentially indicating confidence in the long-term prospects of French banks.

H2: Impact of Global Economic Factors on the CAC 40

The CAC 40's performance this week was significantly influenced by global economic factors. The unexpected ECB interest rate hike created uncertainty across European markets, directly impacting investor sentiment towards French equities. Furthermore, ongoing geopolitical tensions in Eastern Europe continued to exert pressure on global markets, contributing to the week's volatility. The release of weaker-than-expected Eurozone manufacturing data also weighed on investor confidence.

- Global Events Impacting the CAC 40: The ECB's interest rate hike, geopolitical tensions, and weaker-than-expected Eurozone manufacturing data.

- Correlation Analysis: A strong negative correlation was observed between the ECB's announcement and the CAC 40's performance on Wednesday.

- Potential Future Factors: Future announcements regarding inflation rates and further interest rate decisions by the ECB will likely continue to influence the CAC 40's performance.

H2: Outlook for the CAC 40: A Stable Forecast?

Despite the minor losses this week, the outlook for the CAC 40 remains relatively stable. While short-term volatility is expected, driven by ongoing global uncertainty, the long-term fundamentals of the French economy remain positive. Upcoming corporate earnings announcements will play a crucial role in shaping investor sentiment in the coming weeks. Potential catalysts for growth include continued strength in the energy sector and improved consumer confidence. However, risks remain, including further interest rate hikes and persistent geopolitical instability.

- Short-Term Prediction (Next 1-2 weeks): We predict a slight upward trend for the CAC 40, assuming no major negative global economic developments.

- Risks and Opportunities: Risks include further interest rate hikes and global recessionary fears; opportunities lie in the potential for strong corporate earnings and sustained growth in certain sectors.

- Key Upcoming Events: Upcoming corporate earnings reports and any further announcements from the ECB will be crucial for market performance.

Conclusion: Understanding the CAC 40's Trajectory

This week's analysis of the CAC 40 reveals minor losses, but a largely stable outlook for the French stock market. The performance was influenced significantly by the ECB's interest rate hike, global geopolitical tensions, and sectoral performance variations. While short-term volatility is expected, the long-term prospects remain positive, contingent on global economic developments and corporate performance. Stay informed on the latest developments in the CAC 40 by regularly checking our website for updated analysis and insights on the French stock market and the broader French economy.

Featured Posts

-

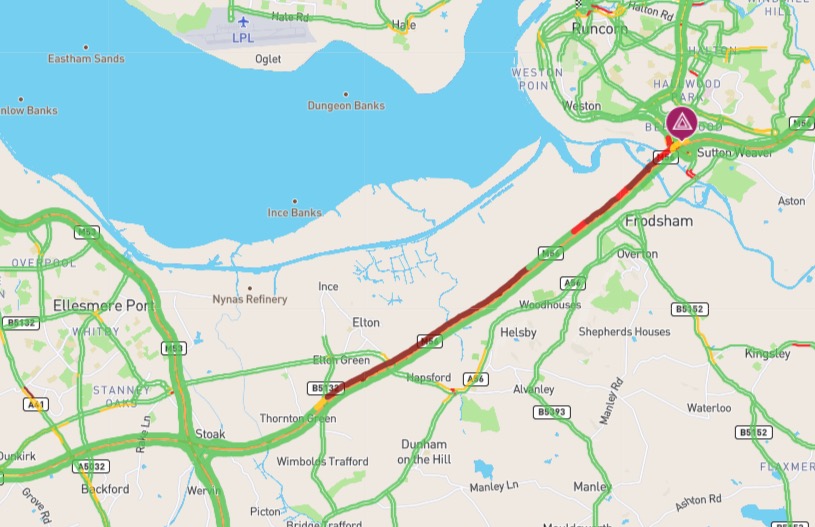

Significant Delays On M56 Near Cheshire Deeside After Collision

May 25, 2025

Significant Delays On M56 Near Cheshire Deeside After Collision

May 25, 2025 -

Astonishing 90mph Refueling Police Helicopter Chase Ends In Dramatic Moment

May 25, 2025

Astonishing 90mph Refueling Police Helicopter Chase Ends In Dramatic Moment

May 25, 2025 -

Wedbush Remains Bullish On Apple Despite Price Target Reduction Long Term Investment Analysis

May 25, 2025

Wedbush Remains Bullish On Apple Despite Price Target Reduction Long Term Investment Analysis

May 25, 2025 -

Annie Kilners Social Media Posts Spark Controversy After Kyle Walker Incident

May 25, 2025

Annie Kilners Social Media Posts Spark Controversy After Kyle Walker Incident

May 25, 2025 -

Garazh Ryazanova Istoriya Sozdaniya Tsenzura I Pomosch Brezhneva

May 25, 2025

Garazh Ryazanova Istoriya Sozdaniya Tsenzura I Pomosch Brezhneva

May 25, 2025

Latest Posts

-

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025