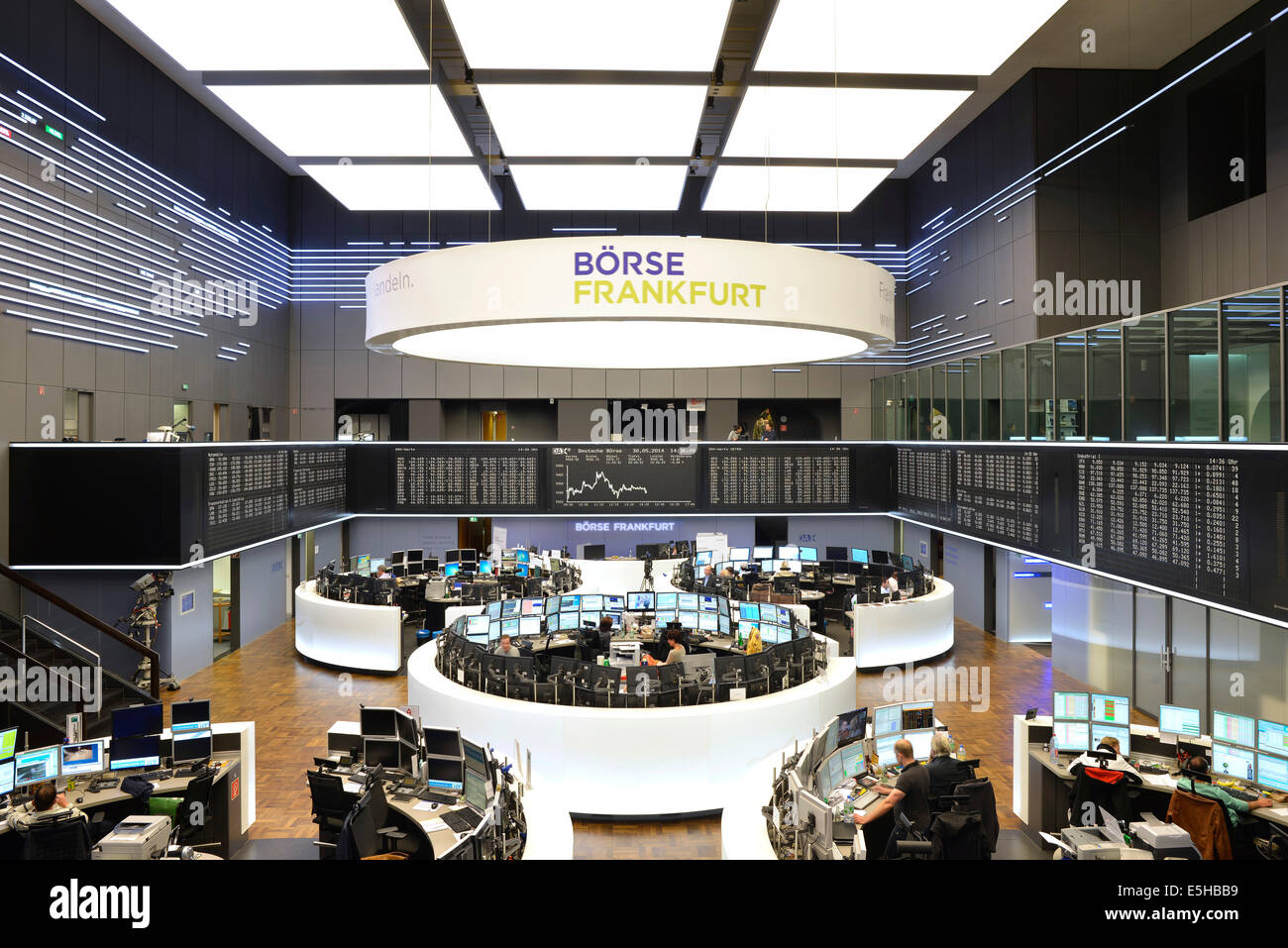

Frankfurt Stock Market Update: DAX Trading Below 24,000

Table of Contents

Factors Contributing to the DAX Decline Below 24,000

Several interconnected factors have contributed to the DAX's recent decline below the 24,000 level. Analyzing these factors is key to understanding the current market dynamics in the German Stock Market.

Global Economic Uncertainty

Rising inflation and interest rates globally are significantly impacting investor confidence. Central banks worldwide are aggressively raising interest rates to combat inflation, increasing borrowing costs for businesses and dampening economic growth. This global economic uncertainty directly impacts the DAX, as many German companies are exposed to international markets.

- Rising Inflation: Inflation rates in many major economies remain stubbornly high, eroding purchasing power and impacting consumer spending.

- Geopolitical Tensions and Energy Crisis: The ongoing war in Ukraine continues to fuel geopolitical uncertainty and disrupt global energy markets. Germany's heavy reliance on Russian energy has made it particularly vulnerable to these disruptions, leading to higher energy prices and impacting industrial production.

- Uncertainty surrounding the war in Ukraine: The unpredictable nature of the conflict creates significant uncertainty for businesses, impacting investment decisions and overall market sentiment.

- Economic Indicators: Weakening GDP growth forecasts in major economies, coupled with persistent inflationary pressures, signal a challenging economic environment.

Company-Specific Performance

Beyond macroeconomic factors, the performance of individual companies within the DAX index also plays a significant role in its overall trajectory. Several sectors are underperforming, weighing down the index.

- Underperforming Sectors: The automotive and industrial sectors, crucial components of the German economy, have been particularly hard hit by supply chain disruptions, rising energy costs, and weakening global demand.

- Specific Company Performance: Several large-cap companies within the DAX have experienced declines in share prices due to disappointing earnings reports, revised guidance, or specific company-related challenges.

- Earnings Reports: Negative earnings surprises and lowered future earnings expectations from key DAX companies have further contributed to the index's decline.

- Examples: [Insert examples of specific companies and their performance, linking to relevant news articles].

Technical Analysis of the DAX

A technical analysis of the DAX chart reveals several indicators suggesting bearish sentiment. This analysis provides further insight into the potential future direction of the index.

- Bearish Chart Patterns: The appearance of bearish chart patterns, such as head and shoulders or double tops, signals potential further declines.

- Support and Resistance Levels: Key support levels have been breached, indicating a weakening trend. Investors are closely watching for potential new support levels to emerge.

- Technical Indicators: Indicators such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) may suggest oversold conditions, indicating a potential rebound, or confirm bearish momentum, suggesting further declines.

- Interpretation: [Insert specific technical indicator readings and interpretations, supporting claims with charts if possible].

Impact on Investors and Investment Strategies

The DAX trading below 24,000 presents both challenges and opportunities for investors in the Frankfurt Stock Market. A proactive approach to risk management and investment strategy is crucial.

Risk Assessment and Portfolio Diversification

Navigating a volatile market requires a robust risk assessment and a well-diversified portfolio.

- Risk Mitigation Strategies: Implementing stop-loss orders, hedging strategies, and diversifying across asset classes can help mitigate potential losses.

- Portfolio Diversification: Reducing exposure to the German market by investing in international stocks, bonds, and other asset classes can help buffer against market fluctuations.

- Risk Tolerance: Investors should adjust their investment portfolios based on their individual risk tolerance and investment goals.

- Diversification Strategies: Consider sector diversification, geographic diversification, and asset class diversification to reduce overall portfolio risk.

Opportunities Amidst the Downturn

While the current market conditions present challenges, they also offer potential opportunities for savvy investors.

- Value Investing: The decline in the DAX may present opportunities for value investors to identify undervalued stocks with strong long-term potential.

- Undervalued Stocks: Careful research can reveal companies within the DAX whose share prices have fallen disproportionately to their intrinsic value.

- Long-Term Investment Strategies: A long-term investment horizon allows investors to weather market corrections and capitalize on potential rebounds.

- Investment Opportunities: Focus on companies with strong fundamentals, robust business models, and sustainable competitive advantages.

Conclusion

The DAX trading below 24,000 reflects a complex interplay of global and regional factors, demanding careful assessment from investors. While uncertainty persists, understanding the contributing factors and implementing appropriate risk management strategies is crucial. This includes considering portfolio diversification and exploring potential investment opportunities that may arise during market corrections.

Call to Action: Stay informed about the Frankfurt Stock Market and the DAX Index performance. Regularly monitor market updates and consider consulting a financial advisor to develop a tailored investment strategy to navigate the current DAX trading below 24,000 and capitalize on potential opportunities within the German stock market. Continue to follow our updates for further analysis of the DAX and Frankfurt Stock Market trends.

Featured Posts

-

Alartfae Alqyasy Ldks Atfaq Tjary Amryky Syny Kmhfz Ryysy

May 24, 2025

Alartfae Alqyasy Ldks Atfaq Tjary Amryky Syny Kmhfz Ryysy

May 24, 2025 -

Live Pedestrian Hit By Vehicle On Princess Road Emergency Services Respond

May 24, 2025

Live Pedestrian Hit By Vehicle On Princess Road Emergency Services Respond

May 24, 2025 -

Young Hawaiian Artists Shine Memorial Day Lei Poster Contest

May 24, 2025

Young Hawaiian Artists Shine Memorial Day Lei Poster Contest

May 24, 2025 -

Esc 2025 Conchita Wurst And Jjs Eurovision Village Performance

May 24, 2025

Esc 2025 Conchita Wurst And Jjs Eurovision Village Performance

May 24, 2025 -

Konchita Vurst Prognoz Pobediteley Evrovideniya 2025

May 24, 2025

Konchita Vurst Prognoz Pobediteley Evrovideniya 2025

May 24, 2025

Latest Posts

-

Successful Imcd N V Annual General Meeting All Resolutions Adopted

May 24, 2025

Successful Imcd N V Annual General Meeting All Resolutions Adopted

May 24, 2025 -

Shareholders Approve All Resolutions At Imcd N V Annual General Meeting

May 24, 2025

Shareholders Approve All Resolutions At Imcd N V Annual General Meeting

May 24, 2025 -

L Impatto Dei Dazi Sulle Borse Europee La Minaccia Di Ritorsioni

May 24, 2025

L Impatto Dei Dazi Sulle Borse Europee La Minaccia Di Ritorsioni

May 24, 2025 -

Dazi Le Borse Crollano La Reazione Dell Ue

May 24, 2025

Dazi Le Borse Crollano La Reazione Dell Ue

May 24, 2025 -

Borse In Picchiata La Ue Risponde Ai Nuovi Dazi

May 24, 2025

Borse In Picchiata La Ue Risponde Ai Nuovi Dazi

May 24, 2025