From Crypto To Corporations: Elon Musk's Strategic Pivot

Table of Contents

The Cryptocurrency Rollercoaster and its Impact

Elon Musk's past pronouncements and actions regarding cryptocurrencies, particularly Dogecoin and Bitcoin, have been nothing short of dramatic. His enthusiastic tweets sent prices soaring, creating both excitement and significant market volatility. However, this rollercoaster ride has had consequences.

-

Volatility and Regulatory Uncertainty: The cryptocurrency market is notoriously volatile, subject to wild price swings and unpredictable regulatory landscapes. Governments worldwide are grappling with how to regulate crypto, creating uncertainty for investors and businesses.

-

Negative Impacts of Musk's Crypto Tweets: Musk's tweets, while boosting short-term prices, have also been criticized for contributing to market instability and potentially misleading investors. His influence on the crypto market is undeniable, and his pronouncements carry significant weight.

-

Legal and Financial Risks: His endorsements of cryptocurrencies, particularly Dogecoin, have drawn scrutiny from regulatory bodies, including the SEC. The potential for legal repercussions and financial risks associated with such endorsements are significant.

This period of intense crypto involvement has led to a noticeable shift. Musk appears to be adopting a more cautious and measured approach to cryptocurrency, focusing instead on the more established and predictable realms of his core businesses.

Focus Shift Towards Sustainable Energy and Space Exploration

Musk's renewed emphasis is clearly on Tesla's expansion and the development of sustainable energy solutions. Simultaneously, SpaceX continues its ambitious space exploration endeavors. This represents a strategic move away from the unpredictable crypto market toward ventures offering more predictable, long-term returns.

-

Tesla's Growth Strategies: Tesla is aggressively expanding its manufacturing capabilities, building new Gigafactories globally and introducing new product lines like the Cybertruck and advancements in battery technology. This represents a significant investment in long-term growth.

-

Renewable Energy Infrastructure: Investing in renewable energy infrastructure is crucial for a sustainable future and offers Tesla a massive, long-term market opportunity. This is a far more stable investment landscape than the highly volatile crypto market.

-

SpaceX's Ambitions: SpaceX's goals in space exploration and colonization represent a massive, long-term investment. While risky, the potential rewards far outweigh the short-term gains of cryptocurrency speculation. This exemplifies a long-term, strategic vision.

These ventures offer more predictable revenue streams and stronger long-term growth potential compared to the speculative nature of the cryptocurrency market.

The Corporate Governance Angle and Reputation Management

Musk's previous cryptocurrency-related actions have undoubtedly impacted his corporate image. The volatility caused by his tweets, coupled with ongoing regulatory scrutiny, necessitates a more cautious public persona.

-

SEC Investigations and Controversies: The SEC investigations and controversies surrounding his tweets highlight the risks of impulsive pronouncements on volatile markets. Maintaining a responsible public image is crucial.

-

Attracting Investors: A stable and reliable public image is essential for attracting long-term investors. The erratic nature of Musk's past actions in the crypto space could deter potential investors seeking stability and predictability.

-

Responsible Decision-Making: The corporate world demands more responsible and calculated decision-making. Musk's shift reflects a recognition of this need, prioritizing long-term corporate stability over short-term gains in speculative markets.

The corporate pivot is a strategic move to improve his reputation, enhance investor confidence, and solidify the long-term stability of his enterprises.

Diversification as a Risk Mitigation Strategy

Diversifying investments and business ventures is a fundamental principle of risk management. Focusing solely on cryptocurrencies poses significant risks due to their volatility and regulatory uncertainty.

-

Risks of Crypto-Only Focus: A portfolio heavily concentrated in cryptocurrencies is exposed to significant potential losses due to market fluctuations.

-

Benefits of Diversification: Diversification minimizes overall risk by spreading investments across different asset classes and business ventures.

-

Musk's Pivot as Risk Reduction: Musk's pivot reflects a strategic move toward reducing overall risk by diversifying his focus away from the high-risk cryptocurrency market and toward more established and stable businesses.

Conclusion

Elon Musk's strategic pivot from the unpredictable world of cryptocurrency to a more traditional corporate focus signifies a crucial shift in his business approach. This move, driven by factors ranging from regulatory uncertainty and market volatility to reputational management and risk mitigation, underscores the importance of long-term stability and sustainable growth in the business world. While his ventures in crypto might remain a part of his portfolio, his increasing emphasis on sustainable energy, space exploration, and responsible corporate governance signals a new era for Musk and his companies. To stay updated on Elon Musk's evolving strategies and their impact on various industries, keep following news and analyses surrounding Elon Musk's strategic pivot.

Featured Posts

-

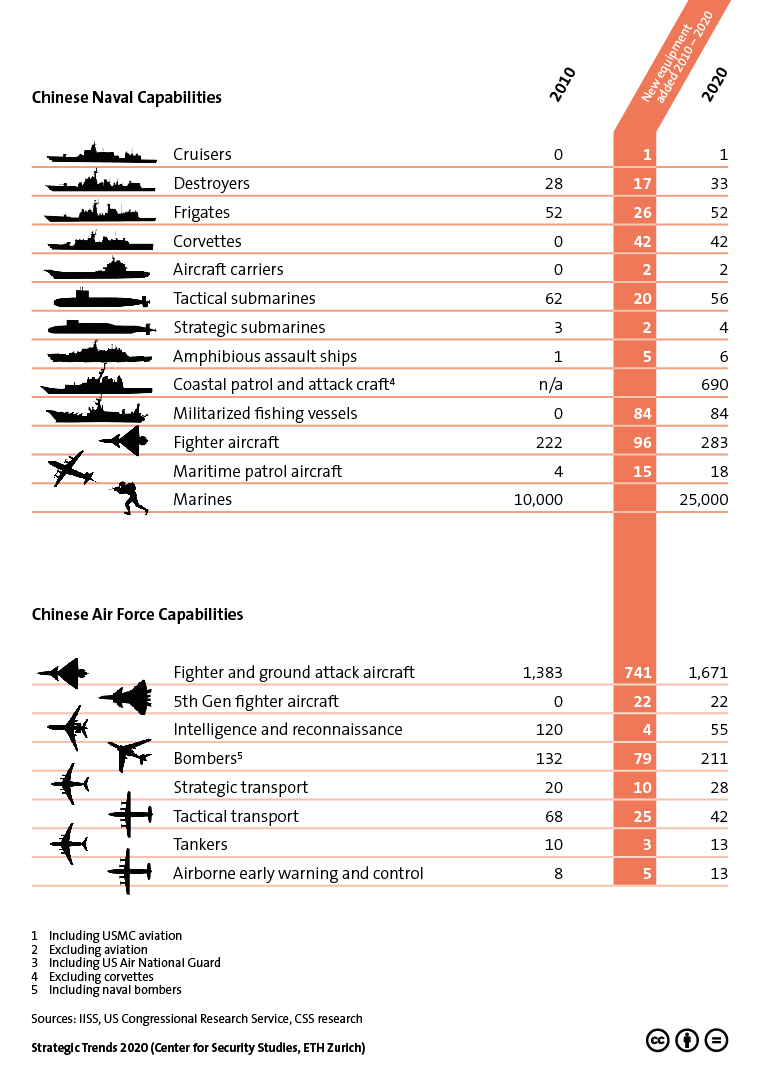

The Future Of Global Power Assessing Us And Chinese Military Capabilities

May 31, 2025

The Future Of Global Power Assessing Us And Chinese Military Capabilities

May 31, 2025 -

Activision Blizzard Acquisition Ftc Challenges Judges Decision

May 31, 2025

Activision Blizzard Acquisition Ftc Challenges Judges Decision

May 31, 2025 -

Rachel Reeves And Arthur Scargill A Study In Economic Ideology

May 31, 2025

Rachel Reeves And Arthur Scargill A Study In Economic Ideology

May 31, 2025 -

Analyzing The Psg Vs Inter Milan Champions League Final

May 31, 2025

Analyzing The Psg Vs Inter Milan Champions League Final

May 31, 2025 -

Padel Courts Coming To Bannatyne Health Club Essex

May 31, 2025

Padel Courts Coming To Bannatyne Health Club Essex

May 31, 2025