FTC Appeals Activision Blizzard Acquisition: Future Of The Gaming Industry

Table of Contents

The FTC's Arguments Against the Acquisition

The FTC's opposition to the Microsoft-Activision Blizzard merger rests on two primary pillars: concerns about anti-competitive practices and worries about market domination.

Concerns about Anti-Competitive Practices

The FTC argues that the merger would grant Microsoft an unfair competitive advantage, ultimately stifling competition and harming consumers. This is a key element in the ongoing debate surrounding the FTC Activision Blizzard Acquisition. Their central concern revolves around the potential for Microsoft to leverage its newly acquired power to the detriment of gamers and competitors.

- Microsoft's potential to make Call of Duty exclusive to its Xbox ecosystem: This would significantly reduce the game's availability on competing platforms like PlayStation, potentially driving gamers towards Xbox consoles.

- Reduced choice for gamers on other platforms: Limiting access to popular Activision Blizzard titles could force gamers to switch ecosystems or miss out on playing some of the industry's most beloved franchises.

- Potential for higher prices and reduced innovation due to lack of competition: A lack of competition could lead to increased prices for games and subscriptions, and a decrease in innovation as Microsoft would face less pressure to improve its offerings.

- The impact on cloud gaming services: The FTC is concerned that Microsoft could leverage its control over Activision Blizzard's properties to disadvantage competing cloud gaming platforms, hindering innovation and consumer choice in this rapidly growing sector.

Market Domination Concerns

Beyond specific game titles, the FTC expresses broader concerns about Microsoft's potential to dominate the gaming market through this acquisition, especially within the burgeoning cloud gaming sector. The scale of the FTC Activision Blizzard Acquisition fuels these anxieties.

- Microsoft's existing market share in gaming consoles and PC gaming: Microsoft already holds a significant market share in both consoles and PC gaming, and the addition of Activision Blizzard's portfolio would dramatically increase its dominance.

- Activision Blizzard's significant portfolio of popular game franchises: Activision Blizzard boasts a roster of hugely successful franchises like Call of Duty, World of Warcraft, and Candy Crush, adding immense value and market influence to Microsoft's existing assets.

- The potential for Microsoft to leverage its position to exclude competitors: The FTC fears that Microsoft could use its expanded market power to exclude competitors from key distribution channels, effectively creating barriers to entry for new players and stifling innovation.

Microsoft's Defense of the Acquisition

Microsoft counters the FTC's arguments by emphasizing its commitment to fair competition and highlighting potential benefits for both gamers and developers. The company's defense against the claims in the FTC Activision Blizzard Acquisition case centers on these points.

Commitment to Fair Competition

Microsoft argues that the acquisition will actually benefit gamers by expanding access to gaming content and bringing more games to more platforms.

- Microsoft's pledges to keep Call of Duty available on PlayStation: A key element of Microsoft's defense is its repeated commitment to continue releasing Call of Duty on PlayStation consoles, addressing one of the FTC's primary concerns.

- Plans for broader game streaming accessibility: Microsoft has outlined plans to expand the accessibility of its game streaming services, potentially benefiting gamers who may not own a powerful gaming PC or console.

- Arguments for increased innovation and competition: Microsoft contends that the combined resources and expertise will foster innovation, ultimately benefiting consumers through a richer gaming experience.

Benefits for Gamers and Developers

Microsoft also highlights the potential positive impacts on both gamers and developers.

- Investment in game development and infrastructure: Microsoft pledges increased investment in game development, creating more high-quality titles and enhancing the overall gaming experience.

- Potential for cross-platform play and integration: The merger could lead to greater cross-platform compatibility, allowing players on different consoles and platforms to interact more easily.

- Expansion of game studios and development capabilities: Microsoft emphasizes its plans to expand its network of game studios, fostering creativity and potentially leading to a wider variety of games.

Implications for the Future of the Gaming Industry

The FTC Activision Blizzard Acquisition case has profound implications for the future of the gaming industry, setting precedents and potentially influencing regulatory landscapes for years to come.

Setting Precedents for Future Mergers & Acquisitions

The outcome of this case will undoubtedly set a precedent for future mergers and acquisitions in the gaming industry and the tech sector more broadly.

- Increased regulatory oversight of tech mergers: The FTC's challenge signals a potential shift towards more stringent regulatory scrutiny of large tech mergers.

- Potential for stricter antitrust regulations: This case could lead to tighter antitrust regulations, potentially making it harder for large companies to acquire smaller competitors.

- Impacts on future investment and consolidation within the gaming market: The outcome could impact future investment decisions and the pace of consolidation within the gaming industry.

Long-Term Effects on Competition and Consumer Choice

The long-term effects on competition and consumer choice are uncertain, heavily dependent on the court's decision.

- Potential for increased prices for gaming services: Reduced competition could potentially lead to higher prices for games, subscriptions, and other gaming services.

- Limited game availability on competing platforms: Exclusive titles could limit game availability on competing platforms, potentially harming consumers.

- The possibility of reduced innovation in the gaming industry: A less competitive market could stifle innovation, leading to a less dynamic and exciting gaming landscape.

Conclusion

The FTC's appeal against the Microsoft-Activision Blizzard acquisition is a pivotal moment for the gaming industry. The arguments surrounding the FTC Activision Blizzard Acquisition highlight the complex interplay between business strategy, regulatory oversight, and consumer welfare. The outcome will profoundly impact future mergers and acquisitions, competition, and consumer choice. Continued monitoring of the legal proceedings is crucial for anyone involved in or following the gaming industry. Understanding the ramifications of this case will be essential for navigating the evolving landscape of the gaming sector. The future of gaming hinges on the resolution of this significant FTC Activision Blizzard Acquisition case.

Featured Posts

-

Bianca Censoris Italy Trip Rollerblading Lingerie And No Kanye

May 28, 2025

Bianca Censoris Italy Trip Rollerblading Lingerie And No Kanye

May 28, 2025 -

Wes Andersons Style In The Phoenician Scheme Trailer

May 28, 2025

Wes Andersons Style In The Phoenician Scheme Trailer

May 28, 2025 -

Arrest Calls Mount After Bianca Censoris Latest Public Appearance

May 28, 2025

Arrest Calls Mount After Bianca Censoris Latest Public Appearance

May 28, 2025 -

Bon Plan Samsung Galaxy S25 256 Go 5 Etoiles A 862 42 E

May 28, 2025

Bon Plan Samsung Galaxy S25 256 Go 5 Etoiles A 862 42 E

May 28, 2025 -

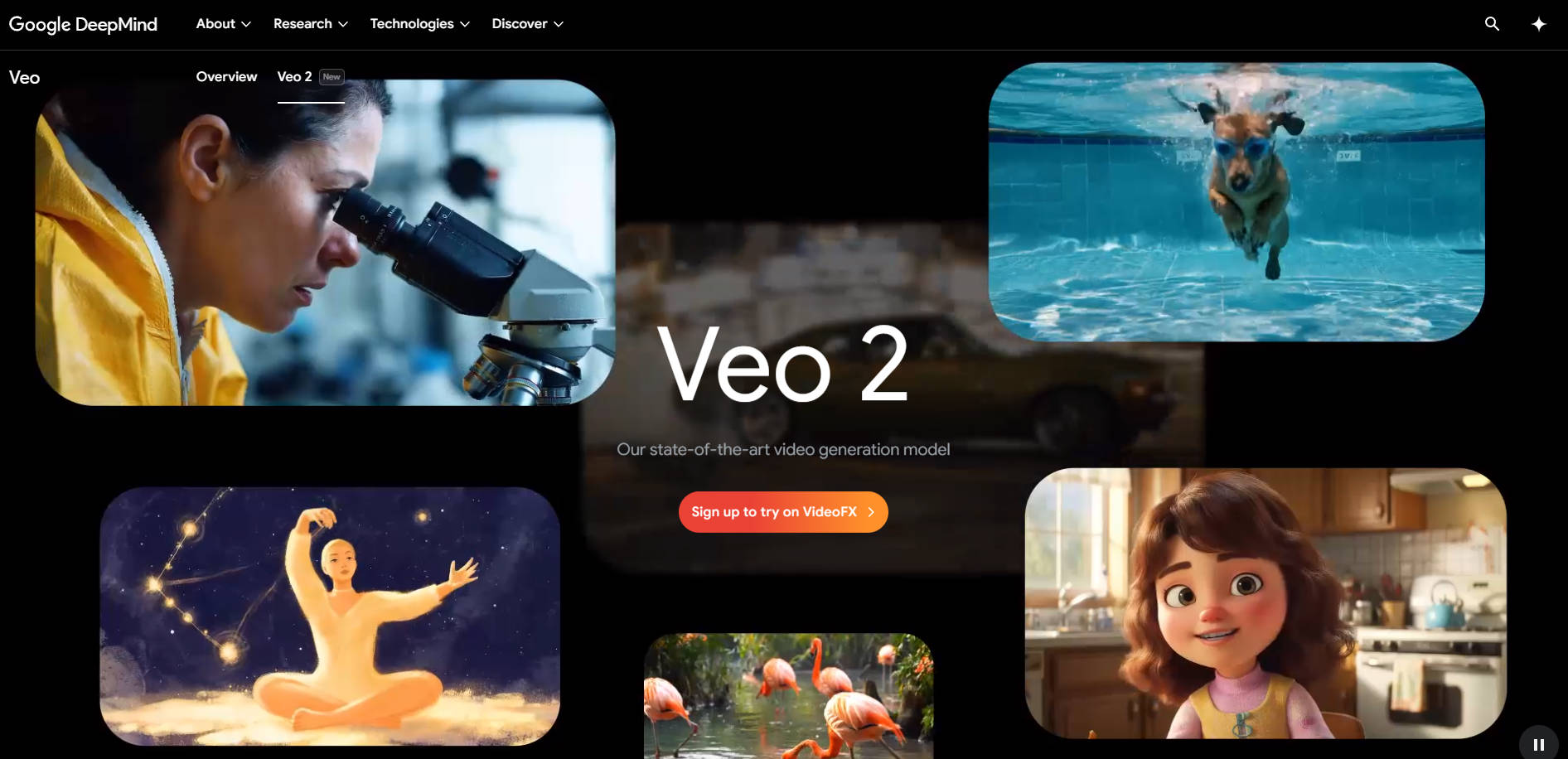

Google Veo 3 Ai Video Generation Capabilities And Limitations

May 28, 2025

Google Veo 3 Ai Video Generation Capabilities And Limitations

May 28, 2025

Latest Posts

-

Hospitalization Of Former Nypd Commissioner Bernard Kerik A Health Update

May 31, 2025

Hospitalization Of Former Nypd Commissioner Bernard Kerik A Health Update

May 31, 2025 -

Ex Nypd Commissioner Bernard Kerik Hospitalized Full Recovery Expected

May 31, 2025

Ex Nypd Commissioner Bernard Kerik Hospitalized Full Recovery Expected

May 31, 2025 -

Vers Une Reconnaissance Des Droits Du Vivant L Histoire Des Etoiles De Mer

May 31, 2025

Vers Une Reconnaissance Des Droits Du Vivant L Histoire Des Etoiles De Mer

May 31, 2025 -

Le Cas Des Etoiles De Mer Plaidoyer Pour Une Reconnaissance Des Droits Du Vivant

May 31, 2025

Le Cas Des Etoiles De Mer Plaidoyer Pour Une Reconnaissance Des Droits Du Vivant

May 31, 2025 -

Droits Du Vivant Le Cas Emblematique De L Etoile De Mer

May 31, 2025

Droits Du Vivant Le Cas Emblematique De L Etoile De Mer

May 31, 2025