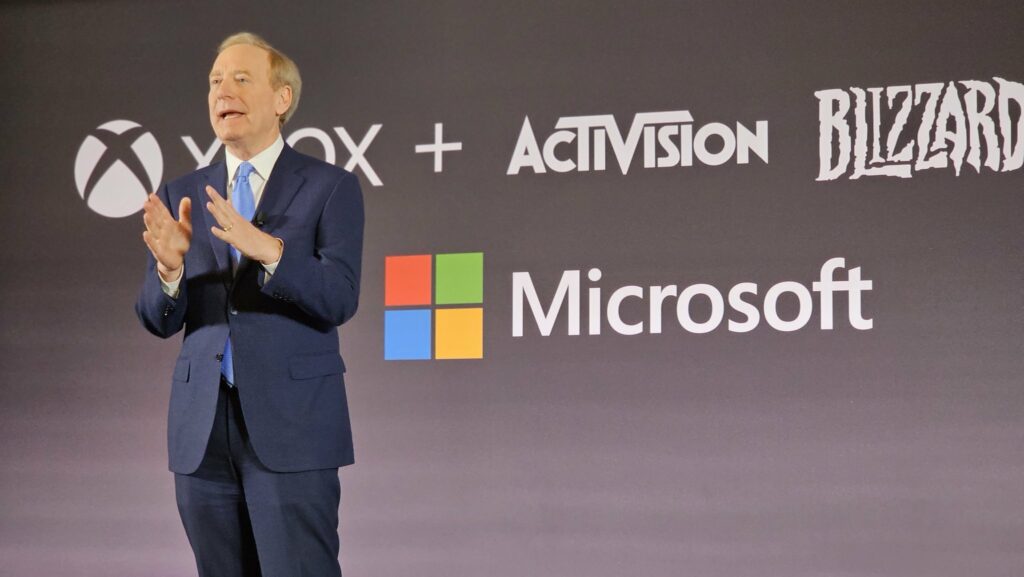

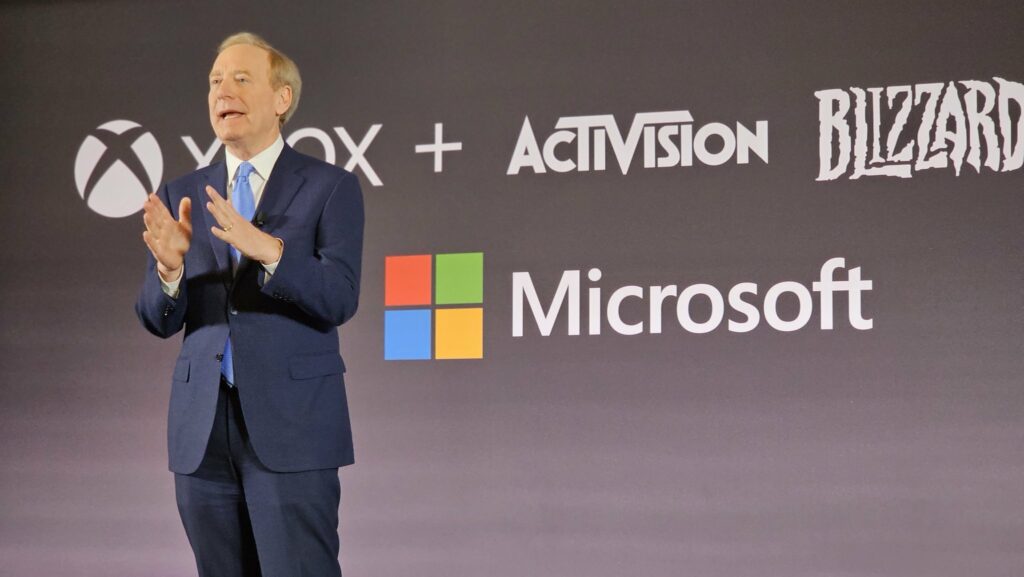

FTC's Appeal Of Microsoft-Activision Merger: Implications For The Gaming Industry

Table of Contents

Competitive Concerns at the Heart of the FTC's Appeal

The FTC's primary argument against the Microsoft-Activision Blizzard merger centers on concerns about substantially reduced competition, especially within the rapidly growing cloud gaming market. The commission argues that allowing the merger would give Microsoft an unfair competitive advantage, potentially stifling innovation and harming consumers.

-

Domination of the console market: Microsoft's acquisition of Activision Blizzard would significantly increase its market share in the console gaming market, potentially leading to a monopoly. This dominance could allow Microsoft to leverage its power to disadvantage competitors.

-

Control over key franchises: Activision Blizzard boasts incredibly popular and influential franchises such as Call of Duty, World of Warcraft, Candy Crush, and Overwatch. Microsoft's control over these titles raises concerns about potential exclusionary practices.

-

Exclusionary practices: The FTC fears Microsoft could use its ownership of Activision Blizzard's properties to limit or prevent the availability of these games on competing platforms like PlayStation, Nintendo Switch, and other cloud gaming services. This could force gamers to switch to Xbox ecosystems, reducing choice and competition.

-

Harm to competitors: The merger's potential impact on Sony, in particular, is a major concern. Sony relies heavily on Call of Duty for its PlayStation ecosystem. Restricting access to this popular title could severely damage Sony's competitiveness and ultimately harm consumers who prefer PlayStation.

The FTC cites data showing the significant market share held by both Microsoft and Activision Blizzard, highlighting the potential for anti-competitive behavior post-merger. The concern is not solely about Call of Duty; it encompasses the broader impact on the entire gaming landscape and the potential for Microsoft to leverage its newfound power to control other aspects of the industry.

Microsoft's Counterarguments and Proposed Solutions

Microsoft has vehemently defended the merger, arguing that it will benefit gamers and promote competition. They've presented several counterarguments and proposed solutions to address the FTC's concerns.

-

Commitment to cross-platform availability of Call of Duty: Microsoft has repeatedly pledged to continue releasing Call of Duty on PlayStation, even offering long-term contracts to ensure its availability.

-

Agreements with competitors to ensure fair access: Microsoft has attempted to negotiate agreements with competitors to guarantee fair access to Activision Blizzard's games and cloud gaming services, aiming to alleviate concerns of exclusionary practices.

-

Investment in cloud gaming infrastructure: Microsoft has emphasized its significant investment in expanding its cloud gaming infrastructure, suggesting this will benefit consumers by offering wider access to games.

-

Emphasis on expanding gaming accessibility: Microsoft argues the merger will benefit gamers by expanding access to games across different platforms and devices, broadening the gaming community.

Microsoft executives have publicly stated their commitment to fair competition, asserting that the merger will ultimately foster innovation and enhance the gaming experience for consumers. However, the FTC remains unconvinced, citing the potential for Microsoft to renege on these promises post-acquisition.

The Broader Implications for the Gaming Industry

Regardless of the outcome of the FTC's appeal, this case has significant long-term consequences for the gaming industry.

Game Pricing and Availability

The merger could potentially lead to:

- Potential for price increases: Increased market consolidation might lead to higher prices for popular Activision Blizzard titles.

- Limited availability of certain titles: Exclusive deals or platform limitations could restrict access to games for consumers using competing platforms.

- Changes to game development practices: The merger could influence game development practices, potentially favoring Microsoft's own platforms and services.

Innovation and Technological Advancements

The FTC's appeal could impact:

- Effects on innovation in cloud gaming: Reduced competition could slow down innovation and advancements in cloud gaming technologies.

- Potential for slower development of new games or gaming platforms: A less competitive market might discourage the development of new games and platforms.

- Impact on independent game developers: The dominance of a few large players could potentially marginalize smaller, independent developers.

Regulatory Scrutiny of Tech Mergers

This case is setting a precedent for:

- Increased regulatory oversight of tech mergers and acquisitions: The FTC's actions demonstrate a greater willingness to scrutinize large tech mergers, impacting future acquisitions in the industry.

- The setting of precedents for future mergers in the tech industry: The outcome of this case will shape how future mergers in the tech industry are reviewed and regulated.

- The influence of this case on international regulatory bodies: The case could influence regulatory bodies in other countries, leading to stricter oversight of large tech mergers globally.

Conclusion

The FTC's appeal of the Microsoft-Activision merger is a pivotal moment for the gaming industry. The potential impact on competition, game pricing, innovation, and the broader regulatory landscape is immense. The case highlights the growing concerns surrounding the power of large tech companies and the role of regulators in ensuring fair competition and protecting consumer interests. The ongoing developments and their ramifications for the future of gaming are far-reaching and require close attention. Stay informed about the ongoing developments and their ramifications for the future of gaming. Continue to follow the news surrounding the FTC's appeal of the Microsoft-Activision merger for further updates and insights. Understanding the potential outcomes of this landmark case is crucial for gamers, developers, and investors alike.

Featured Posts

-

Is Chief Justice John Roberts Dismantling The Church State Separation

May 02, 2025

Is Chief Justice John Roberts Dismantling The Church State Separation

May 02, 2025 -

Fortnites 1000 Day Skin Comeback What Items Are Returning To The Item Shop

May 02, 2025

Fortnites 1000 Day Skin Comeback What Items Are Returning To The Item Shop

May 02, 2025 -

Dallas Legend Dies At Age 100

May 02, 2025

Dallas Legend Dies At Age 100

May 02, 2025 -

Malek F Steekt Patient Neer In Van Mesdagkliniek Groningen Details Over Het Incident

May 02, 2025

Malek F Steekt Patient Neer In Van Mesdagkliniek Groningen Details Over Het Incident

May 02, 2025 -

Kashmiri Cat Owners Alarmed By Viral Social Media Posts

May 02, 2025

Kashmiri Cat Owners Alarmed By Viral Social Media Posts

May 02, 2025

Latest Posts

-

Poppys Family A Touching Tribute To A Beloved Manchester United Supporter

May 02, 2025

Poppys Family A Touching Tribute To A Beloved Manchester United Supporter

May 02, 2025 -

Family Mourns Loss Of Devoted Manchester United Fan Poppy

May 02, 2025

Family Mourns Loss Of Devoted Manchester United Fan Poppy

May 02, 2025 -

New Loyle Carner Album Incoming Details Revealed

May 02, 2025

New Loyle Carner Album Incoming Details Revealed

May 02, 2025 -

Family Mourns The Loss Of Devoted Manchester United Fan Poppy

May 02, 2025

Family Mourns The Loss Of Devoted Manchester United Fan Poppy

May 02, 2025 -

Manchester United Fan Poppy Family Shares Emotional Tribute Following Her Passing

May 02, 2025

Manchester United Fan Poppy Family Shares Emotional Tribute Following Her Passing

May 02, 2025