Fuel Hedging And Risk Management In The Airline Sector

Table of Contents

The airline industry is a high-stakes game where fluctuating fuel prices can make or break a business. Fuel represents a significant portion of an airline's operating costs, making effective fuel hedging and risk management absolutely crucial for profitability and long-term survival. This article will explore the challenges airlines face, the strategies they employ, and the best practices for navigating this volatile market. We'll delve into the intricacies of fuel hedging, exploring different strategies and their implications, ultimately guiding you towards building a robust risk management framework.

Understanding Fuel Price Volatility and its Impact on Airlines

The Challenges of Fuel Cost Fluctuations: Fuel price volatility presents a major hurdle for airlines. These unpredictable costs make accurate financial forecasting incredibly difficult, impacting everything from investment decisions and route planning to overall competitive standing. Sudden spikes in fuel prices can rapidly erode profits, while prolonged periods of high prices can severely threaten an airline's financial health and even its existence.

- Impact on Profitability: High fuel costs directly compress profit margins, leaving less room for investment and growth.

- Competitive Landscape: Airlines with robust fuel hedging strategies gain a distinct competitive advantage, allowing them to offer more stable fares and maintain profitability during price shocks.

- Route Planning: Fuel costs are a major factor in determining the feasibility and profitability of different flight routes. High fuel costs may make certain routes unsustainable.

- Financial Planning: Accurate fuel cost forecasting is vital for securing funding, managing cash flow effectively, and making sound long-term financial decisions.

Factors Influencing Airline Fuel Prices: Airline fuel prices are influenced by a complex interplay of global and local factors.

- Crude Oil Prices: The price of crude oil is the most significant driver of jet fuel costs. Global supply and demand dynamics directly impact crude oil prices, and thus, fuel costs for airlines.

- Refining Margins: The cost of refining crude oil into jet fuel adds another layer of variability to the final price airlines pay. Changes in refining capacity and efficiency can affect these margins.

- Geopolitical Events: Geopolitical instability and international conflicts can cause significant and sudden disruptions to oil markets, leading to price spikes and volatility.

- Seasonal Demand: Fuel demand typically increases during peak travel seasons, leading to higher prices. Airlines must factor this seasonal variability into their planning.

- Currency Exchange Rates: Airlines often purchase fuel internationally, making them susceptible to fluctuations in currency exchange rates. A weakening domestic currency can significantly increase fuel costs.

The Importance of Proactive Fuel Risk Management: Proactive fuel risk management is not merely about minimizing losses; it's about building a more stable and predictable financial foundation.

- Protecting Profitability: Hedging strategies help to stabilize fuel costs and safeguard profit margins, providing a buffer against market fluctuations.

- Enhancing Financial Stability: Reduced fuel price volatility translates into improved financial stability, reducing the risk of financial distress.

- Improving Investor Confidence: Demonstrating a commitment to effective fuel risk management enhances investor confidence, making it easier to secure funding and attract investments.

- Supporting Long-term Planning: Predictable fuel costs enable airlines to make more informed, long-term strategic decisions regarding fleet expansion, route development, and overall business growth.

Fuel Hedging Strategies for Airlines

Types of Fuel Hedging Instruments: A range of financial instruments can be used to mitigate fuel price risk.

- Futures Contracts: These are agreements to buy or sell a specific amount of fuel at a predetermined price on a future date. They offer price certainty but require careful timing and market analysis.

- Options Contracts: Options provide the right, but not the obligation, to buy or sell fuel at a specified price by a certain date. They offer flexibility but at a premium cost.

- Swaps: Swaps involve exchanging fixed-rate payments for floating-rate payments linked to fuel prices, transferring price risk to a counterparty.

- Collars: Collars involve a combination of buying put options and selling call options, limiting both upside and downside price movements.

- Average Price Contracts: These contracts settle based on the average fuel price over a defined period, offering price stability but potentially missing out on favorable market swings.

Developing a Hedging Strategy: Considerations for Airlines: Creating an effective hedging strategy is a complex process.

- Risk Tolerance: Airlines must assess their risk appetite and determine the level of hedging appropriate for their financial profile and business goals.

- Forecasting Accuracy: Accurate fuel price forecasting is crucial. Sophisticated forecasting models are often employed to predict future price movements.

- Hedging Horizon: The duration of the hedging strategy should align with the airline's operational and financial planning horizons.

- Liquidity Management: Hedging strategies can require significant capital commitments, so airlines need robust liquidity management to meet potential margin calls.

- Regulatory Compliance: Airlines must ensure their hedging strategies comply with all relevant regulations and accounting standards.

Benefits and Limitations of Fuel Hedging: While fuel hedging offers substantial benefits, it is not without potential drawbacks.

- Benefits:

- Reduced price volatility, leading to more predictable operating costs.

- Improved budget certainty, facilitating better financial planning and investment decisions.

- Limitations:

- Potential losses if the market moves favorably (opportunity cost).

- Complexity of hedging instruments requires specialized knowledge and expertise.

- Counterparty risk – the risk that the other party in the hedging contract may default.

Beyond Hedging: Comprehensive Risk Management Strategies

Fuel Efficiency Initiatives: Improving fuel efficiency is a crucial component of a comprehensive risk management strategy.

- Aircraft Technology Upgrades: Investing in newer, more fuel-efficient aircraft is a long-term strategy for reducing fuel consumption.

- Operational Improvements: Optimizing flight routes, improving flight planning, and implementing weight reduction strategies can significantly reduce fuel burn.

- Crew Training: Training pilots and flight crews on fuel-efficient flight techniques can yield substantial savings over time.

Strategic Sourcing and Supplier Relationships: Building strong relationships with fuel suppliers can provide benefits beyond price.

- Negotiating Favorable Fuel Supply Agreements: Securing favorable terms, including volume discounts and price stability, through strong supplier relationships.

- Diversifying Fuel Sources: Reducing dependence on a single supplier helps to mitigate supply chain disruptions and price volatility.

- Building Strong Relationships with Suppliers: Developing partnerships with fuel suppliers can lead to preferential pricing and enhanced supply security.

Financial Risk Management Tools: A holistic approach to risk management extends beyond fuel hedging.

- Diversification of Revenue Streams: Reducing reliance on passenger revenue through cargo operations, ancillary services, or other revenue streams can mitigate risk.

- Financial Modeling and Forecasting: Employing sophisticated financial models to forecast potential scenarios and assess their impact on the airline's financial health.

- Stress Testing Scenarios: Conducting stress tests to analyze how the airline would perform under various extreme scenarios, such as significant fuel price increases or economic downturns.

Conclusion: Mastering Fuel Hedging and Risk Management for Airline Success

Effective fuel hedging and risk management are paramount for airline success in today's volatile market. By thoroughly understanding the factors influencing fuel prices, utilizing a diverse range of hedging strategies, and implementing a comprehensive approach to risk management, airlines can significantly protect their profitability, enhance their financial stability, and ensure long-term sustainability. To develop a tailored fuel hedging and risk management strategy, we recommend seeking expert advice from experienced aviation finance professionals. Don't let fuel price volatility ground your airline's growth; take control of your fuel costs and secure your future through proactive fuel hedging and risk management.

Featured Posts

-

Edinburgh Fringe 2025 Pussy Riots Alyokhina To Stage New Play

May 03, 2025

Edinburgh Fringe 2025 Pussy Riots Alyokhina To Stage New Play

May 03, 2025 -

Inauguration Du Parc De Batteries D Eneco A Au Roeulx Une Nouvelle Etape Pour L Energie En Belgique

May 03, 2025

Inauguration Du Parc De Batteries D Eneco A Au Roeulx Une Nouvelle Etape Pour L Energie En Belgique

May 03, 2025 -

Familys Heartbreaking Tribute To Young Manchester United Fan Poppy

May 03, 2025

Familys Heartbreaking Tribute To Young Manchester United Fan Poppy

May 03, 2025 -

Uk Poll Farage Overtakes Starmer As Preferred Prime Minister In Over Half Of Constituencies

May 03, 2025

Uk Poll Farage Overtakes Starmer As Preferred Prime Minister In Over Half Of Constituencies

May 03, 2025 -

Mental Health Courses Ignou Tiss Nimhans And More

May 03, 2025

Mental Health Courses Ignou Tiss Nimhans And More

May 03, 2025

Latest Posts

-

Directorial Change In Harry Potter Exploring The Absence Of Chris Columbus

May 03, 2025

Directorial Change In Harry Potter Exploring The Absence Of Chris Columbus

May 03, 2025 -

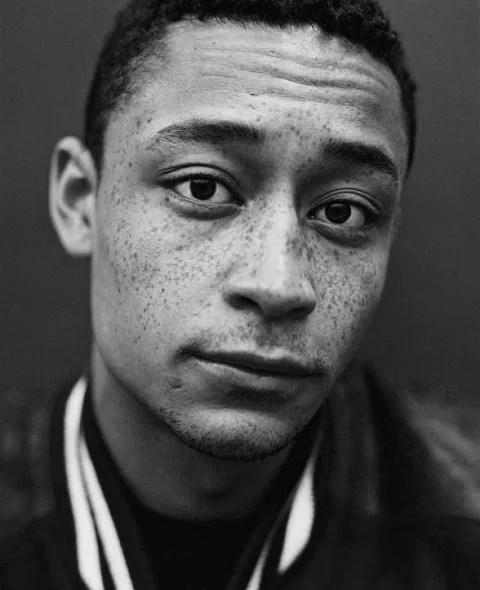

Paired Singles From Loyle Carner All I Need And In My Mind

May 03, 2025

Paired Singles From Loyle Carner All I Need And In My Mind

May 03, 2025 -

Why Chris Columbus Didnt Direct Harry Potter And The Prisoner Of Azkaban

May 03, 2025

Why Chris Columbus Didnt Direct Harry Potter And The Prisoner Of Azkaban

May 03, 2025 -

Loyle Carner Returns With Powerful New Singles All I Need And In My Mind

May 03, 2025

Loyle Carner Returns With Powerful New Singles All I Need And In My Mind

May 03, 2025 -

New Music Loyle Carner Releases All I Need And In My Mind

May 03, 2025

New Music Loyle Carner Releases All I Need And In My Mind

May 03, 2025