Fuji Media Shake-Up: Dalton Partners With Murakami-Affiliated Investment Firm

Table of Contents

Dalton Investments' Strategic Move: A Deep Dive

Dalton Investments, known for its shrewd investments and long-term vision, has made a bold move by partnering with a firm linked to the prominent Japanese investor, Yoshiaki Murakami. Understanding Dalton's investment strategy is crucial to deciphering this partnership. Historically, Dalton has focused on undervalued assets with high growth potential, often targeting companies undergoing restructuring or facing significant market shifts. Their involvement in Fuji Media suggests a belief in the company's potential for substantial transformation and profitability.

The motivations behind this partnership are multifaceted. Dalton likely sees an opportunity to capitalize on Fuji Media's assets, potentially driving significant returns through strategic restructuring and operational improvements. Partnering with a Murakami-affiliated firm offers access to valuable networks and expertise within the Japanese market, streamlining the investment process and mitigating risks.

The financial implications for Dalton are potentially substantial. While the exact terms of the partnership remain undisclosed, a successful restructuring of Fuji Media could yield a considerable return on investment (ROI). However, this venture also carries inherent risks, including potential regulatory hurdles and unforeseen market fluctuations.

- Dalton's previous successful investments in media: Dalton's track record includes successful investments in several international media companies, demonstrating their expertise in navigating the complexities of this sector.

- Potential return on investment (ROI) for Dalton: The potential ROI is substantial, considering Fuji Media's extensive reach and valuable assets, but it's contingent on the success of their strategic initiatives.

- Risk assessment of the Fuji Media investment: Risks include potential regulatory challenges, competitive pressures within the Japanese media market, and the inherent volatility of the media industry.

The Murakami Connection: Influence and Implications

Yoshiaki Murakami is a controversial yet undeniably influential figure in the Japanese financial market. Known for his aggressive investment strategies and shareholder activism, his involvement through an affiliated firm adds a layer of complexity to this partnership. The specific Murakami-affiliated firm involved hasn't been publicly named, adding to the intrigue surrounding this Fuji Media shake-up.

The role of the Murakami-affiliated firm is likely to be pivotal. They will likely provide valuable insights into the Japanese media landscape, facilitating negotiations and navigating regulatory complexities. This partnership could significantly influence Fuji Media's management, potentially leading to changes in leadership and corporate strategy. The possibility of conflicts of interest needs careful consideration.

- Murakami's past successes and controversies: Murakami's career is marked by both significant financial successes and controversies surrounding his activist investment strategies.

- The affiliated firm's investment portfolio and strategies: Understanding their previous investments will shed light on their approach to Fuji Media and their expected role in shaping its future.

- Potential impact on Fuji Media's programming and editorial decisions: This remains a key area of concern. While the partnership's direct impact on programming isn't yet clear, observers will be watching for potential shifts in editorial direction.

Impact on Fuji Media Holdings: Short-Term and Long-Term Effects

The short-term effects of this partnership are already visible in Fuji Media's stock price. While initial reactions were mixed, the partnership could lead to increased market capitalization as investors anticipate positive changes. However, the long-term effects are far more complex and difficult to predict.

Long-term implications could involve significant changes to Fuji Media's programming, content strategy, and overall business model. The partnership may lead to a more aggressive approach to digital media, a shift in programming genres, or even a restructuring of the company's operations. Corporate governance might also see changes, reflecting the influence of the new investors. Consumers might experience shifts in content offerings, with potential benefits or drawbacks depending on the strategic direction Fuji Media takes.

- Stock price fluctuations before and after the partnership announcement: Analyzing these fluctuations reveals investor sentiment and market reaction to the news.

- Potential changes in programming (e.g., increased focus on specific genres): The partnership could lead to shifts in programming to better cater to specific demographic segments.

- Impact on competition within the Japanese media industry: The Fuji Media shake-up has implications for the broader competitive landscape within the Japanese media industry.

Industry Response and Expert Opinions

The Dalton/Murakami partnership has generated considerable buzz within the Japanese media industry. While some analysts express optimism about potential improvements in Fuji Media's performance, others raise concerns about potential conflicts of interest and the implications for journalistic independence. Statements from competing media companies have been largely reserved, though stock market reactions offer some indication of their perspectives.

- Quotes from relevant industry experts: Gathering and presenting expert opinions provides valuable insight into the implications of this partnership.

- Stock market reaction from competitors: Observing competitor stock price movements offers clues about their assessment of the situation.

- Analysis of potential antitrust concerns: This partnership's potential impact on competition warrants a thorough antitrust review.

Conclusion: Analyzing the Fuji Media Shake-Up

The partnership between Dalton Investments and the Murakami-affiliated firm represents a significant turning point for Fuji Media Holdings and the broader Japanese media landscape. The long-term consequences remain to be seen, but the potential for substantial changes in corporate strategy, programming, and even journalistic practices is undeniable. This Fuji Media investment signifies a period of intense transformation, with the ultimate outcome depending on the effectiveness of the partnership's strategic initiatives.

To stay informed on the evolving situation surrounding this Fuji Media shake-up and the impact of Dalton Investments' media strategy, subscribe to our newsletter or follow us on social media for the latest updates on this significant development in the Japanese media industry. Keep an eye out for further developments in Japanese media industry changes and the future of Fuji Media.

Featured Posts

-

Political Motivation Alleged Le Pen Addresses Conviction At Paris Gathering

May 29, 2025

Political Motivation Alleged Le Pen Addresses Conviction At Paris Gathering

May 29, 2025 -

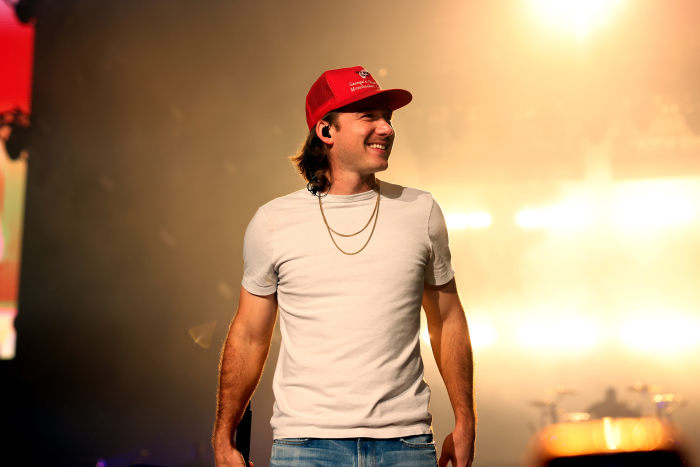

How Morgan Wallens One Thing At A Time Defied Expectations After Recent Scandals

May 29, 2025

How Morgan Wallens One Thing At A Time Defied Expectations After Recent Scandals

May 29, 2025 -

Find The Nike Air Max Dn8 Snakeskin Hv 8476 300 Release Date Here

May 29, 2025

Find The Nike Air Max Dn8 Snakeskin Hv 8476 300 Release Date Here

May 29, 2025 -

Grupo Frontera Controversia Y Respuesta A Las Acusaciones De Apoyar A Trump

May 29, 2025

Grupo Frontera Controversia Y Respuesta A Las Acusaciones De Apoyar A Trump

May 29, 2025 -

Air Jordan Sneaker Releases June 2025 Edition

May 29, 2025

Air Jordan Sneaker Releases June 2025 Edition

May 29, 2025

Latest Posts

-

Italian International Alcarazs Strong Start Dimitrovs Surprise Defeat

May 31, 2025

Italian International Alcarazs Strong Start Dimitrovs Surprise Defeat

May 31, 2025 -

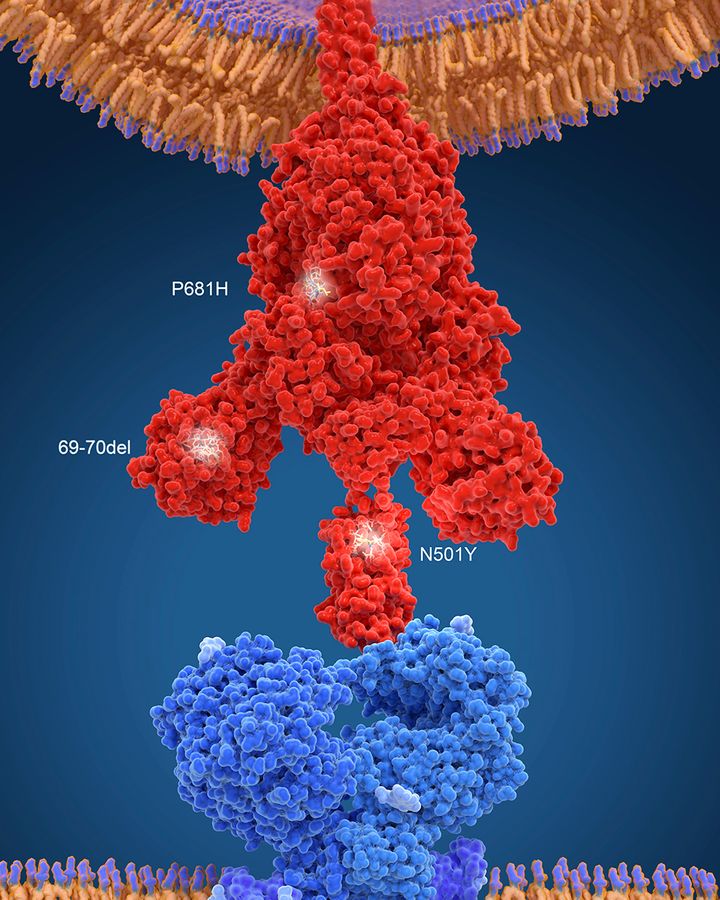

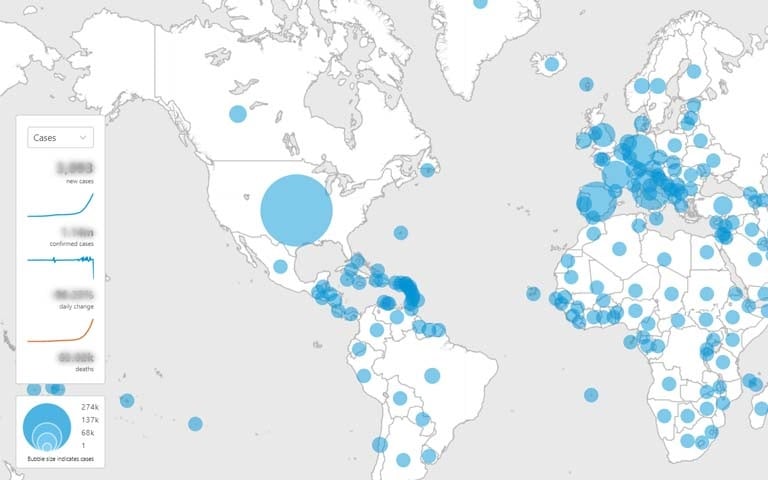

Covid 19 Case Spike Is A New Variant The Cause Who Investigation

May 31, 2025

Covid 19 Case Spike Is A New Variant The Cause Who Investigation

May 31, 2025 -

Alcarazs Rome Triumph And Passaros Upset Key Moments From The Italian International

May 31, 2025

Alcarazs Rome Triumph And Passaros Upset Key Moments From The Italian International

May 31, 2025 -

A New Covid 19 Variant And The Rise In Global Cases A Who Update

May 31, 2025

A New Covid 19 Variant And The Rise In Global Cases A Who Update

May 31, 2025 -

Alcaraz Victorious In Rome Passaro Upsets Dimitrov Italian International Highlights

May 31, 2025

Alcaraz Victorious In Rome Passaro Upsets Dimitrov Italian International Highlights

May 31, 2025