Future Of Microsoft's Activision Deal Uncertain After FTC Appeal

Table of Contents

The FTC's Appeal and its Arguments

The Federal Trade Commission (FTC) filed an appeal to block the Microsoft Activision deal, expressing serious concerns about its potential impact on competition within the video game market. The FTC argues that the acquisition would give Microsoft an unfair advantage, particularly regarding the immensely popular Call of Duty franchise. Their primary argument centers on the potential for Microsoft to leverage its ownership of Activision Blizzard to stifle competition, harming consumers in the long run.

- Key arguments presented by the FTC:

- Reduced competition in the console gaming market: The FTC claims the merger would significantly reduce competition in the console market, potentially leading to higher prices and fewer choices for gamers. The combined entity would control a substantial portion of the market share, diminishing the influence of competitors like Sony and Nintendo.

- Anti-competitive practices related to game distribution and pricing: The FTC worries about Microsoft's ability to manipulate game distribution and pricing, favoring its own Xbox platform and potentially harming other platforms. This could include exclusive deals, higher prices on competing platforms, or delaying releases on rival consoles.

- Concerns about Microsoft's potential to make Call of Duty exclusive to Xbox: This is arguably the FTC's most significant concern. Call of Duty is a massive franchise with a huge player base, and making it exclusive to Xbox would severely disadvantage competitors like PlayStation, giving Microsoft an unfair competitive advantage in the console market. The FTC is heavily referencing the potential impact of such a move on consumer choice.

The FTC's case rests upon established antitrust laws and precedents, aiming to prevent the creation of a gaming monopoly that could harm competition and innovation. The strength of their arguments will be tested during the appeals process.

Microsoft's Defense and Counterarguments

Microsoft has vigorously defended the acquisition, arguing that the deal will ultimately benefit consumers through increased game access, broader innovation, and enhanced competition. They have presented various remedies and concessions to address the FTC's concerns.

- Key arguments presented by Microsoft:

- Benefits to consumers through broader access to games: Microsoft insists that the acquisition will expand game availability across various platforms, including PC, Xbox, and potentially even PlayStation. They highlight the potential for game streaming services to reach a wider audience.

- Commitment to maintaining Call of Duty availability across multiple platforms: This is a crucial aspect of Microsoft's defense. They have repeatedly pledged to continue offering Call of Duty on PlayStation, emphasizing their commitment to maintaining a fair and competitive gaming environment. They've even offered long-term contracts to solidify this commitment.

- Investment in gaming innovation and competition: Microsoft argues that the combined resources of Microsoft and Activision Blizzard will fuel further innovation in gaming technology and development, ultimately benefitting consumers with better games and experiences.

Microsoft's defense relies on demonstrating that the gaming market is dynamic and competitive, with numerous players and platforms vying for consumer attention. They are emphasizing the size and diverse nature of the market to argue against the FTC's claims of a monopoly.

The Role of Other Regulatory Bodies

The Microsoft Activision deal's fate isn't solely determined by the FTC. Other regulatory bodies worldwide have also weighed in, creating a complex global regulatory landscape that adds to the uncertainty.

- Status of approvals/rejections from different regions:

- UK CMA decision and its potential influence: The UK's Competition and Markets Authority (CMA) initially blocked the deal, citing concerns similar to the FTC. This decision significantly impacted the global outlook on the acquisition. However, Microsoft has since appealed, and the matter remains unresolved.

- EU approval status and conditions: The European Union has conditionally approved the deal, highlighting the complexity of regulatory approvals and the varying interpretations of antitrust laws across jurisdictions.

- Impact of global regulatory landscape on the deal's fate: The divergence in opinions across different regulatory bodies underscores the difficulties of navigating the global regulatory landscape when dealing with such a large-scale acquisition. The ultimate success or failure hinges on navigating these international regulatory hurdles.

The differing decisions and approaches taken by various regulatory bodies highlight the intricate nature of antitrust law and its application to the ever-evolving gaming industry.

Potential Outcomes and Market Implications

Several scenarios are possible regarding the Microsoft Activision deal:

- Potential outcomes and their implications:

- Deal completion: If the FTC appeal fails and other regulatory hurdles are cleared, the deal will proceed, potentially reshaping the gaming landscape. Microsoft's market share would increase significantly, influencing game development, pricing, and distribution.

- Deal termination: If the FTC's appeal is successful or if insurmountable regulatory obstacles arise, the deal will be terminated, leaving the gaming industry largely unchanged.

- Significant modifications: A compromise might be reached, involving significant modifications to the original deal to address regulatory concerns. This could include divesting certain assets or making further commitments regarding game availability.

The outcome will significantly impact Xbox's market share and competitiveness, as well as the positions of PlayStation and Nintendo. The long-term consequences will influence game prices, console sales, and the future of game development for years to come.

Conclusion

The future of the Microsoft Activision Deal remains incredibly uncertain. This article has explored the complexities and uncertainties surrounding the FTC's appeal, Microsoft's counterarguments, and the involvement of other global regulatory bodies. The FTC's concerns about reduced competition, anti-competitive practices, and the potential exclusivity of Call of Duty are weighed against Microsoft's claims of consumer benefits and investments in gaming innovation. The ongoing legal battle and the varying regulatory decisions across different jurisdictions highlight the significant challenges in navigating such a massive acquisition in the highly competitive gaming industry.

The future of the Microsoft Activision Deal remains uncertain. Stay informed on this landmark case that will significantly impact the gaming industry by following updates and further analysis on the Microsoft Activision Deal. This ongoing legal battle will shape the future of gaming acquisitions and the competitive landscape for years to come.

Featured Posts

-

Kort Geding Kampen Vs Enexis Weigering Stroomnetaansluiting

May 02, 2025

Kort Geding Kampen Vs Enexis Weigering Stroomnetaansluiting

May 02, 2025 -

Poppy Atkinson Fundraiser In Kendal Surpasses Goal Following Tragedy

May 02, 2025

Poppy Atkinson Fundraiser In Kendal Surpasses Goal Following Tragedy

May 02, 2025 -

Is Donald Trump Mistaking Calibri Font For Ms 13 Tattoos

May 02, 2025

Is Donald Trump Mistaking Calibri Font For Ms 13 Tattoos

May 02, 2025 -

Channel 4 Show Highlights Michael Sheens 1 Million Debt And Net Worth

May 02, 2025

Channel 4 Show Highlights Michael Sheens 1 Million Debt And Net Worth

May 02, 2025 -

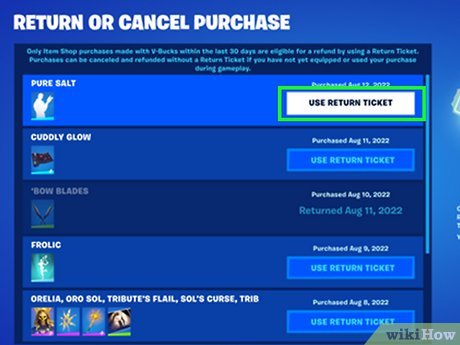

Fortnites Refund Policy Shift What It Means For Cosmetics

May 02, 2025

Fortnites Refund Policy Shift What It Means For Cosmetics

May 02, 2025

Latest Posts

-

Lionesses Match Belgium Vs England Tv Channel Kick Off Time And Viewing Guide

May 02, 2025

Lionesses Match Belgium Vs England Tv Channel Kick Off Time And Viewing Guide

May 02, 2025 -

Chicagos New Harry Potter Shop Everything You Need To Know

May 02, 2025

Chicagos New Harry Potter Shop Everything You Need To Know

May 02, 2025 -

Harry Potter Shop Chicago Now Open A Fans Guide

May 02, 2025

Harry Potter Shop Chicago Now Open A Fans Guide

May 02, 2025 -

England Women Vs Spain Women In Depth Preview And Score Prediction

May 02, 2025

England Women Vs Spain Women In Depth Preview And Score Prediction

May 02, 2025 -

Preview England Women Vs Spain Women Predicted Starting Xis And Outcome

May 02, 2025

Preview England Women Vs Spain Women Predicted Starting Xis And Outcome

May 02, 2025