Gambling On Catastrophe: The Los Angeles Wildfires And The Future Of Betting

Table of Contents

The Rise of Prediction Markets and Disaster Betting

Prediction markets leverage the collective wisdom of crowds to forecast future events. Participants buy and sell contracts based on their beliefs about the likelihood of a specific outcome. While traditionally used for political elections and economic indicators, the concept extends to natural disasters. Although direct betting markets specifically on the severity of the Los Angeles wildfires are currently absent from mainstream platforms, the potential for their emergence is significant.

- Examples of potential platforms: While no established platforms currently offer direct bets on specific wildfire severity, decentralized platforms or niche betting sites could potentially emerge. Existing weather derivative markets offer some parallel, albeit with different focuses.

- Potential for misuse and manipulation: The inherent risk in such markets lies in the potential for manipulation. Insiders with privileged information could significantly influence prices, leading to unfair outcomes and undermining the market's predictive power.

- Data and algorithms: Sophisticated algorithms analyzing historical wildfire data, weather patterns, and environmental factors would be crucial for any accurate prediction market. This would necessitate access to extensive and reliable datasets, including real-time information on fire spread and weather conditions.

Ethical Concerns of Betting on Wildfires

The most significant concern surrounding “Gambling on Catastrophe” is the ethical implication of profiting from the suffering of others. Betting on wildfire severity could be perceived as callous and insensitive, potentially trivializing the human cost of these devastating events.

- Arguments against: Many argue that such markets are morally reprehensible, fostering a detached and exploitative attitude towards disaster. The focus shifts from mitigating risk to speculating on loss, potentially hindering community efforts and emergency responses.

- Exploitation of vulnerable populations: Those most affected by wildfires, often low-income communities and marginalized groups, are least equipped to participate in such markets and could be disproportionately exploited.

- Responsible gambling initiatives: Even if such markets were deemed acceptable, robust responsible gambling initiatives would be crucial to prevent addiction and financial ruin among participants.

The Role of Insurance and Reinsurance in Disaster Risk

Traditional insurance and reinsurance play a crucial role in managing wildfire risk. Insurance companies assess the risk associated with specific properties and charge premiums accordingly. Reinsurance companies then reinsure a portion of the risk for primary insurers, spreading the burden of potentially catastrophic losses.

- Insurance risk assessment: Insurance companies employ sophisticated models to assess wildfire risk, considering factors like vegetation density, proximity to fire-prone areas, and historical fire data.

- Limitations of insurance: Traditional insurance struggles to adequately cover widespread, catastrophic events like major wildfires affecting large areas. The scale of potential losses often exceeds the capacity of even the largest insurers.

- Potential collaboration: Prediction markets could potentially complement insurance and reinsurance, providing additional data and insights to improve risk assessment and pricing models. This could lead to more accurate and equitable insurance premiums.

The Future of Betting on Catastrophic Events

The future of betting on natural disasters is uncertain. While the potential for growth exists, substantial regulatory hurdles and ethical considerations will likely shape its development.

- Regulatory hurdles: Governments will need to grapple with the complex legal and regulatory challenges posed by such markets, balancing the potential benefits with the ethical concerns and the risk of manipulation.

- Technological advancements: Advances in data analytics, artificial intelligence, and remote sensing technologies will significantly improve prediction accuracy, potentially making these markets more viable and attractive.

- Impact of climate change: The increasing frequency and intensity of wildfires, driven by climate change, will likely increase the demand for prediction markets and related financial instruments.

Gambling on Catastrophe: A Call for Responsible Consideration

Betting on catastrophic events like the Los Angeles wildfires presents a complex dilemma. While prediction markets offer potential benefits in risk assessment and financial management, the ethical implications of profiting from human suffering cannot be ignored. Responsible regulation and robust ethical guidelines are essential to ensure fairness, prevent exploitation, and promote responsible behavior. Let's discuss the future of gambling on catastrophe responsibly, ensuring that any such markets prioritize societal well-being and effective disaster preparedness over profit. Further research and engagement with organizations focusing on disaster risk reduction and responsible gambling are crucial steps towards a well-informed and ethical approach to this emerging issue.

Featured Posts

-

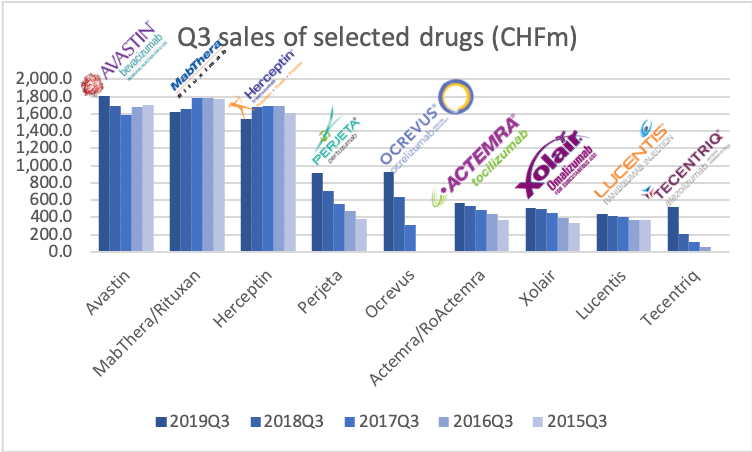

Roche First Quarter Sales Strong Growth And Pipeline Potential

Apr 25, 2025

Roche First Quarter Sales Strong Growth And Pipeline Potential

Apr 25, 2025 -

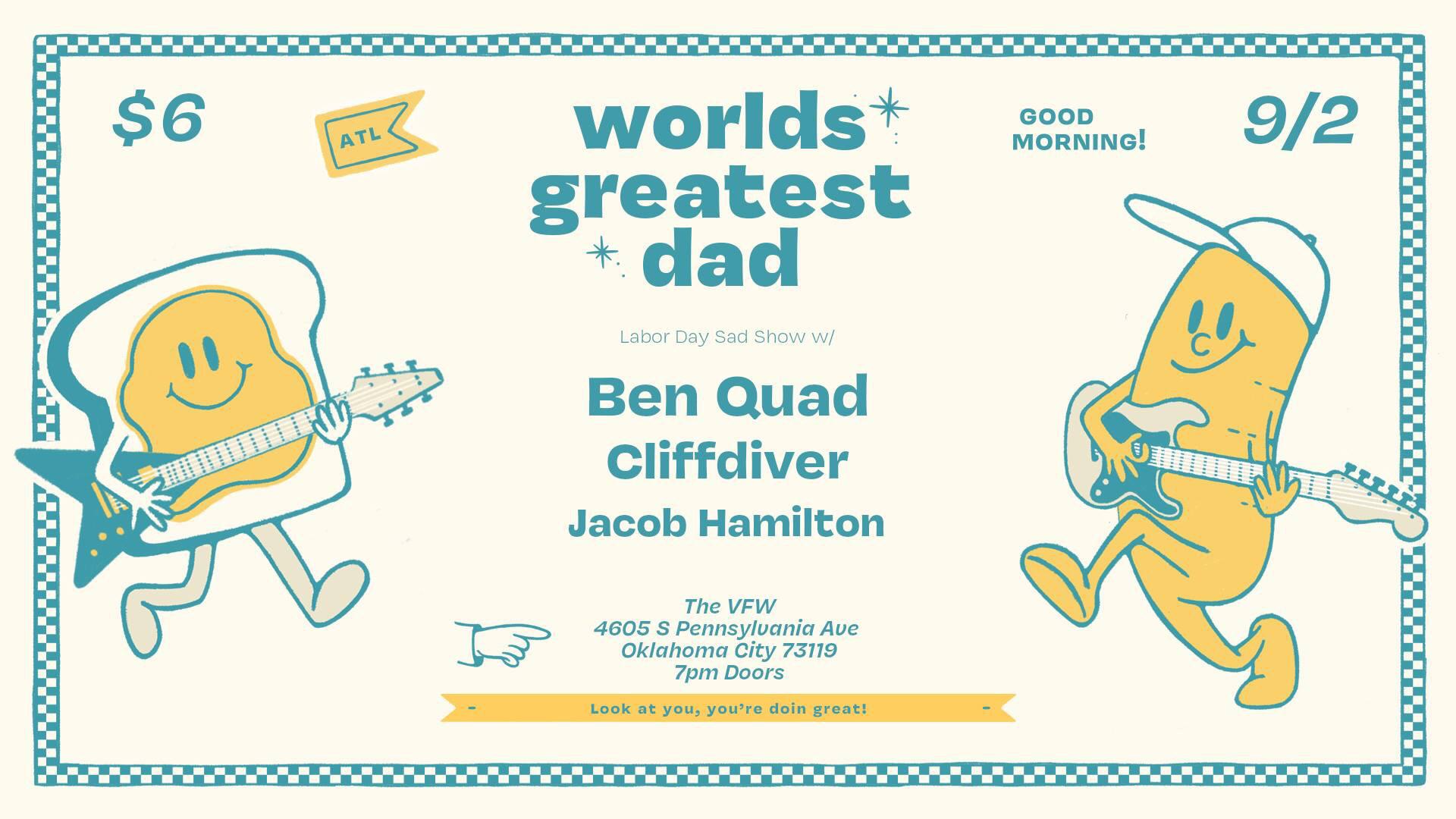

Your Guide To Big Name Concerts In Okc This March

Apr 25, 2025

Your Guide To Big Name Concerts In Okc This March

Apr 25, 2025 -

Trumps Attack On Currency Manipulation Impact On The Krw Usd Exchange Rate

Apr 25, 2025

Trumps Attack On Currency Manipulation Impact On The Krw Usd Exchange Rate

Apr 25, 2025 -

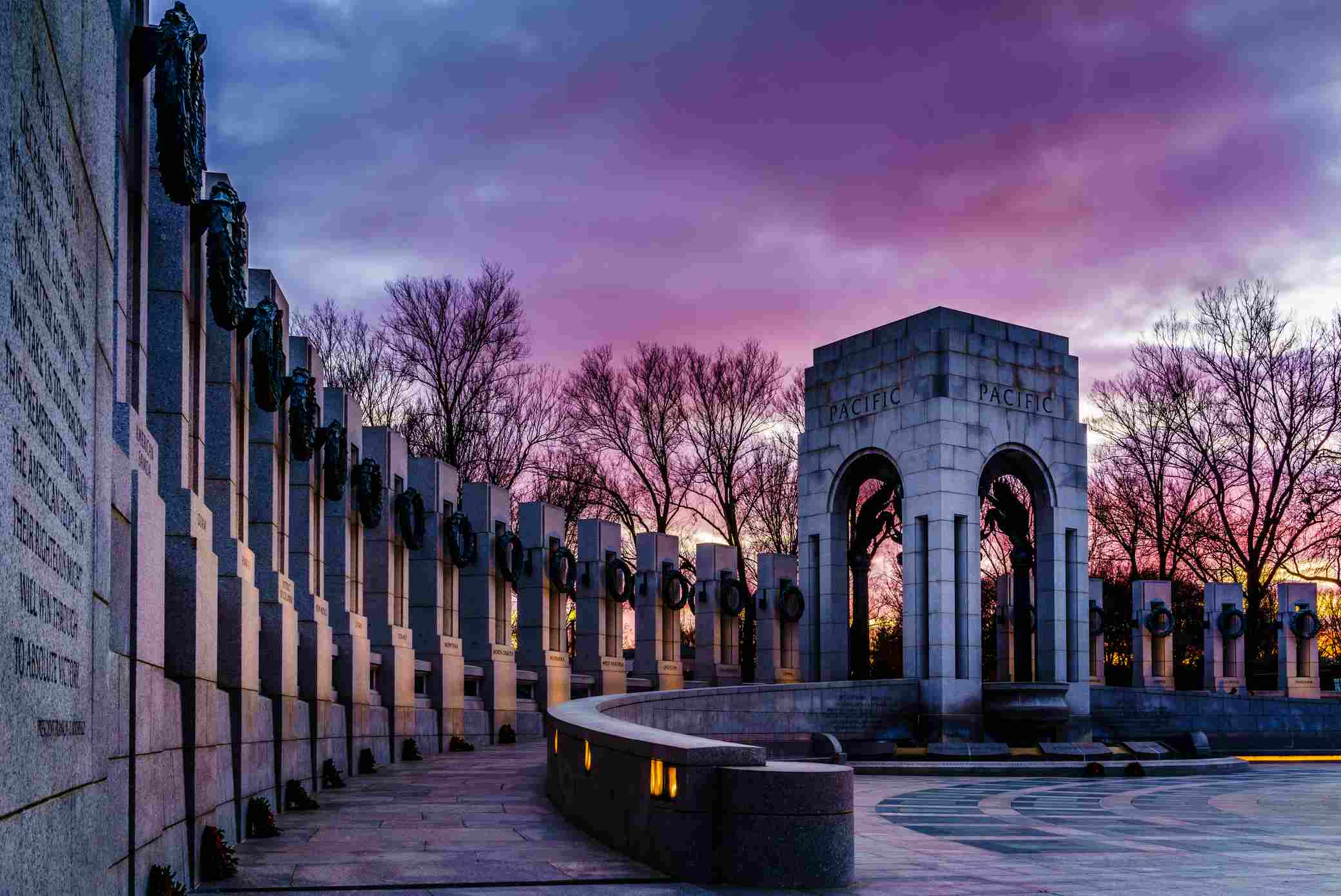

World War Ii Photo Reveals Two Previously Unknown Jewish Resistance Stories

Apr 25, 2025

World War Ii Photo Reveals Two Previously Unknown Jewish Resistance Stories

Apr 25, 2025 -

Anzac Day Observance Sherwood Ridge Primary Schools Policy On Religious And Belief Based Exemptions

Apr 25, 2025

Anzac Day Observance Sherwood Ridge Primary Schools Policy On Religious And Belief Based Exemptions

Apr 25, 2025

Latest Posts

-

Early Birthday Celebrations Announced By The King

Apr 26, 2025

Early Birthday Celebrations Announced By The King

Apr 26, 2025 -

A Kings Birthday Party Plans Unveiled Ahead Of Schedule

Apr 26, 2025

A Kings Birthday Party Plans Unveiled Ahead Of Schedule

Apr 26, 2025 -

Royal Birthday Bash King Starts Festivities Early

Apr 26, 2025

Royal Birthday Bash King Starts Festivities Early

Apr 26, 2025 -

Kings Early Birthday Celebration Plans Revealed

Apr 26, 2025

Kings Early Birthday Celebration Plans Revealed

Apr 26, 2025 -

Climate Change Adaptation And Job Creation In Africas Green Economy

Apr 26, 2025

Climate Change Adaptation And Job Creation In Africas Green Economy

Apr 26, 2025