Gas Prices Fall As Economic Concerns Rise: National Average Under $3

Table of Contents

Factors Contributing to the Decline in Gas Prices

Several interconnected factors contribute to the recent decline in gas prices. Understanding these dynamics is key to grasping the current situation and anticipating future trends. Keywords: Crude oil prices, oil demand, supply and demand, refinery capacity, seasonal gas prices, OPEC, geopolitical factors.

-

Decreased Global Demand for Crude Oil: Slowing economic growth in major global markets, particularly in Europe and China, has significantly reduced the demand for crude oil. Less demand translates directly into lower prices. This is a crucial element in understanding the current falling gas prices.

-

Increased Oil Production by OPEC+: The Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) have recently increased their oil production. This increased supply in the global market puts downward pressure on prices, contributing to the current cheap gas.

-

Seasonal Factors: The decrease in summer travel typically leads to a reduction in gasoline demand. As the peak driving season concludes, fuel consumption naturally declines, influencing prices. This seasonal effect is a regular occurrence, but its impact is amplified in the current economic climate.

-

Improved Refinery Capacity and Efficiency: Increased efficiency and capacity at refineries have enhanced the supply of gasoline. This means more gasoline is available to meet demand, which naturally helps to keep prices down.

-

Geopolitical Factors: Ongoing geopolitical instability, while potentially volatile, has not recently led to major disruptions in oil supply chains, allowing prices to fall. However, any future escalation in geopolitical tensions could swiftly reverse this trend.

-

The Price Breakdown: It's crucial to understand that the price at the pump isn't solely determined by the crude oil price. Refining costs, transportation expenses, and various taxes all contribute to the final price consumers pay. Fluctuations in any of these factors can influence the overall cost of gasoline.

The Economic Context: Recession Fears and Their Impact on Fuel Consumption

The decline in gas prices is closely intertwined with growing economic anxieties. Keywords: Recession, inflation, consumer spending, economic slowdown, interest rates, fuel demand, driving habits

-

Inflation and Interest Rates: Soaring inflation and rising interest rates are significantly impacting consumer spending. With less disposable income, consumers are cutting back on non-essential expenses, including gasoline.

-

Recession Fears: Widespread concerns about an impending recession are causing consumers to become more cautious with their spending. This includes reducing discretionary travel, thereby lowering overall fuel demand.

-

Changing Driving Habits: The rise of remote work and increased adoption of hybrid or electric vehicles have also subtly altered driving habits, further contributing to a decrease in overall gasoline consumption.

-

Recession and Gas Prices: Cause or Effect? The relationship between recessionary fears and lower gasoline prices is complex. Lower fuel costs can be viewed as a symptom of a slowing economy (less demand), but also a potential mitigating factor, lessening the burden on consumers and businesses.

Impact on Consumers and Businesses

The falling gas prices have a significant impact on both consumers and businesses. Keywords: Consumer relief, business costs, inflation impact, economic recovery, savings

-

Consumer Relief: Lower fuel costs provide immediate relief for consumers, freeing up household budgets for other expenses. This can potentially stimulate other sectors of the economy. The savings can be substantial, depending on driving habits and vehicle fuel efficiency. For example, a driver commuting 50 miles daily could save hundreds of dollars annually.

-

Impact on Businesses: Businesses, particularly those in the transportation sector (trucking, delivery, etc.), benefit from reduced fuel costs, lowering their operational expenses. This can potentially improve profitability and competitiveness.

-

Influence on Inflation and Economic Recovery: Lower gasoline prices can act as a deflationary force, helping to alleviate inflationary pressures and potentially boosting economic recovery. However, this effect is dependent on other economic factors.

Looking Ahead: Predicting Future Gas Price Trends

Predicting future gas price trends is inherently challenging due to the volatility of several factors. Keywords: Gas price forecast, oil price prediction, future economic outlook, energy market, uncertainty

-

Uncertainty Reigns: The energy market is influenced by numerous unpredictable variables, including geopolitical events, weather patterns, OPEC+ decisions, and overall economic health. Any of these factors can significantly alter gas prices.

-

Potential Scenarios: Depending on economic growth, geopolitical stability, and oil production levels, gas prices could remain relatively low, increase modestly, or even experience a sharp surge.

-

Expert Opinions: While precise predictions are impossible, keeping abreast of reputable economic forecasts and energy market analyses can help to better understand potential future trends.

-

Factors Leading to Potential Price Increases: Unexpected global events (wars, natural disasters), disruptions in oil production (due to political instability or supply chain issues), and a significant increase in global demand could all lead to a rise in gas prices.

Conclusion

The recent drop in gas prices to below $3 nationally offers temporary respite, but this decline is undeniably linked to growing economic concerns. While decreased fuel costs provide short-term savings for consumers and businesses, the underlying economic uncertainty casts a long shadow over the long-term outlook. Understanding the complex interplay between gas prices and the broader economy is crucial for navigating the current climate. Stay informed about fluctuating gas prices and their economic implications. Continue to monitor this site for updates on falling gas prices and related economic news. Regularly check our website for the latest on national average gas price fluctuations. Learn more about how fuel prices impact your budget and prepare for potential future changes in the gasoline prices market.

Featured Posts

-

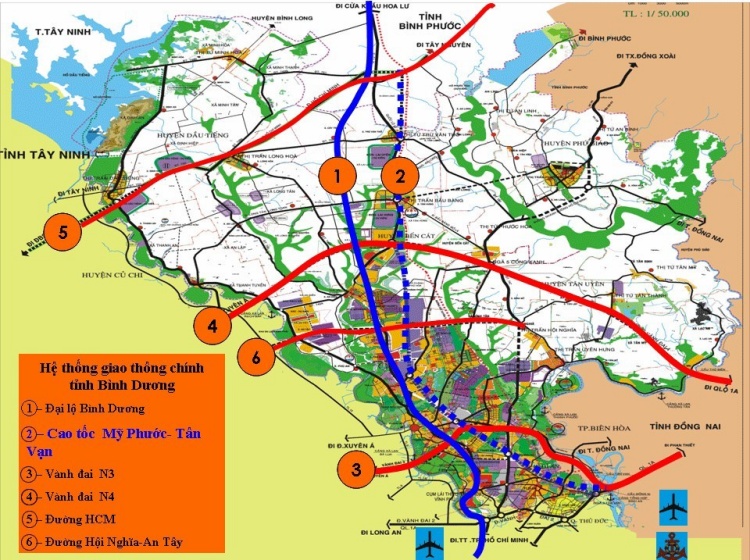

Ha Tang Giao Thong Tp Hcm Binh Duong Nhung Du An Khoi Mo Tiem Nang Phat Trien

May 22, 2025

Ha Tang Giao Thong Tp Hcm Binh Duong Nhung Du An Khoi Mo Tiem Nang Phat Trien

May 22, 2025 -

Zebra Mussel Infestation Discovered On Casper Boat Lift

May 22, 2025

Zebra Mussel Infestation Discovered On Casper Boat Lift

May 22, 2025 -

Effectief Verkoop Van Abn Amro Kamerbrief Certificaten Uw Gids Naar Succes

May 22, 2025

Effectief Verkoop Van Abn Amro Kamerbrief Certificaten Uw Gids Naar Succes

May 22, 2025 -

The Greatest Hot Weather Drink You Ve Never Tried

May 22, 2025

The Greatest Hot Weather Drink You Ve Never Tried

May 22, 2025 -

Nato Ta Ukrayina Chi Ye Vidmova Vid Alyansu Yedino Mozhlivim Variantom

May 22, 2025

Nato Ta Ukrayina Chi Ye Vidmova Vid Alyansu Yedino Mozhlivim Variantom

May 22, 2025

Latest Posts

-

Is Dan Lawrence Englands Next Test Opening Batsman

May 23, 2025

Is Dan Lawrence Englands Next Test Opening Batsman

May 23, 2025 -

Dan Lawrence England Opener Ambitions And Potential

May 23, 2025

Dan Lawrence England Opener Ambitions And Potential

May 23, 2025 -

Sam Cook Englands New Test Bowler For Zimbabwe Series

May 23, 2025

Sam Cook Englands New Test Bowler For Zimbabwe Series

May 23, 2025 -

England Name Sam Cook In Squad For Zimbabwe Test Match

May 23, 2025

England Name Sam Cook In Squad For Zimbabwe Test Match

May 23, 2025 -

The Karate Kid Part Ii Legacy And Impact On Martial Arts Cinema

May 23, 2025

The Karate Kid Part Ii Legacy And Impact On Martial Arts Cinema

May 23, 2025