German Stock Market (Dax): Election And Economic Influences

Table of Contents

The Impact of German Federal Elections on the DAX

German federal elections significantly impact the DAX, introducing periods of both uncertainty and opportunity. The results directly influence government policy, affecting various sectors and investor confidence.

Political Uncertainty and Market Volatility

Elections inherently introduce uncertainty, a key factor affecting investor confidence in the German Stock Market (DAX). The period leading up to and immediately following an election often witnesses increased market volatility. This is largely due to the potential for significant shifts in government policy.

- Potential policy shifts regarding taxation, regulation, and social spending: Changes in tax policies can directly affect corporate profitability, while regulatory changes can impact various industries. Significant alterations to social spending can also influence economic growth and consumer sentiment.

- Uncertainty around coalition negotiations and government formation: The formation of a stable coalition government can take time, prolonging the period of uncertainty and impacting investor decisions regarding the DAX.

- Impact on investor sentiment and foreign investment: Negative investor sentiment can lead to capital flight, while positive sentiment attracts foreign investment, impacting the DAX's performance.

- Historical examples of DAX performance around previous elections: Analyzing past election cycles and their impact on the DAX provides valuable insights for understanding future trends and potential volatility. Studying these historical trends can help investors better anticipate potential market reactions.

Sector-Specific Impacts

Different political parties often present contrasting policy platforms that will differentially impact various sectors. Analyzing the manifestos of competing parties allows for a more informed prediction of potential winners and losers in the post-election economic landscape.

- Automotive industry's sensitivity to environmental regulations: The automotive sector is particularly sensitive to changes in environmental regulations, with stricter emission standards potentially impacting profitability.

- Renewable energy sector's potential boost from green initiatives: Parties with strong green agendas might boost the renewable energy sector through subsidies or other supportive policies, influencing investment in this area and potentially its reflection on the DAX.

- Manufacturing and export-oriented sectors’ response to trade policies: Changes in trade policies can significantly affect export-oriented sectors, influencing their competitiveness and therefore their stock prices in the DAX.

- Impact on the financial sector depending on banking regulations: The financial sector is highly sensitive to banking regulations, with stricter rules potentially affecting profitability and investment decisions within the DAX.

Key Economic Indicators Influencing the DAX

Beyond political factors, several key economic indicators significantly influence the DAX's performance. Understanding these indicators is crucial for assessing the overall health of the German economy and its impact on the stock market.

GDP Growth and Economic Outlook

Strong GDP growth generally correlates with a rising DAX, while economic slowdowns or recessions usually lead to declines. The overall economic outlook, both domestically and globally, significantly influences investor confidence and investment decisions.

- Analysis of Germany's GDP growth trends: Monitoring Germany's GDP growth provides a crucial benchmark for understanding the overall health of the economy and its impact on the DAX.

- Influence of global economic conditions on German growth: Germany's export-oriented economy is highly sensitive to global economic conditions, meaning international factors greatly influence the DAX's performance.

- Impact of inflation and interest rate changes: Inflation and interest rate changes affect corporate profits and investment decisions, which in turn affect the DAX.

- Role of consumer and business confidence: Consumer and business confidence are key indicators that directly influence spending and investment, reflecting their impact on the German Stock Market (DAX).

Inflation and Interest Rates

High inflation erodes purchasing power and can trigger interest rate hikes by the European Central Bank (ECB), impacting corporate profits and stock valuations within the DAX.

- Correlation between inflation rates and DAX performance: Historically, high inflation has often correlated with lower DAX performance, although this relationship is complex and influenced by other factors.

- Impact of ECB monetary policy on the DAX: The ECB's monetary policy decisions, including interest rate changes, directly affect borrowing costs for businesses and investor sentiment.

- Effects of interest rate changes on borrowing costs for businesses: Higher interest rates increase borrowing costs, potentially impacting corporate investment and profitability, thus affecting the DAX.

- Influence of inflation on consumer spending and business investment: High inflation reduces consumer spending and business investment, impacting economic growth and therefore the DAX.

Eurozone Developments

As a core member of the Eurozone, Germany's economy is heavily intertwined with its European partners. Economic turmoil in other Eurozone countries can negatively impact the German economy and, consequently, the DAX.

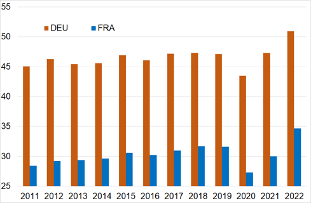

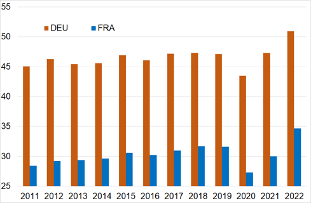

- Influence of other major European economies on the German economy: The interconnectedness of the Eurozone means that economic difficulties in other major European economies can spill over into Germany, affecting the DAX.

- Impact of the Euro's exchange rate on German exports: Fluctuations in the Euro's exchange rate can significantly impact the competitiveness of German exports and thus influence the DAX.

- Effects of the Eurozone debt crisis (and potential future crises): Past crises have demonstrated the interconnectedness of Eurozone economies and how problems in one country can quickly spread, affecting the DAX.

- Importance of Eurozone economic stability on the DAX: The overall economic stability of the Eurozone is a crucial factor for the health of the German economy and, therefore, for the DAX's performance.

Conclusion

The German Stock Market (DAX) is profoundly influenced by both domestic political developments, particularly elections, and broader economic factors. Understanding the potential impacts of government policy changes, economic indicators like GDP growth and inflation, and Eurozone dynamics is crucial for investors seeking to navigate this dynamic market. By analyzing election manifestos, monitoring key economic indicators, and staying informed about Eurozone developments, investors can make more informed decisions regarding their investments in the German Stock Market (DAX). Stay informed and continue to monitor the German Stock Market (DAX) for successful investment strategies. Learn more about navigating the complexities of the German Stock Market (DAX) and develop a robust investment strategy.

Featured Posts

-

Getting Professional Help With Hair And Tattoos Ariana Grandes Bold New Look

Apr 27, 2025

Getting Professional Help With Hair And Tattoos Ariana Grandes Bold New Look

Apr 27, 2025 -

Pne Ag Regulatorische Information Gemaess Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Pne Ag Regulatorische Information Gemaess Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025 -

Top Seeded Pegula Claims Charleston Championship After Collins Match

Apr 27, 2025

Top Seeded Pegula Claims Charleston Championship After Collins Match

Apr 27, 2025 -

High Profile Office365 Hack Results In Millions Of Dollars In Losses

Apr 27, 2025

High Profile Office365 Hack Results In Millions Of Dollars In Losses

Apr 27, 2025 -

Designing For Humanity An Interview With Microsofts Design Chief On Ai

Apr 27, 2025

Designing For Humanity An Interview With Microsofts Design Chief On Ai

Apr 27, 2025

Latest Posts

-

Ariana Grandes New Style Professional Help Behind The Look

Apr 27, 2025

Ariana Grandes New Style Professional Help Behind The Look

Apr 27, 2025 -

The Transformation Of Ariana Grande Professional Hair And Tattoo Work

Apr 27, 2025

The Transformation Of Ariana Grande Professional Hair And Tattoo Work

Apr 27, 2025 -

Ariana Grandes Hair And Tattoo Changes A Professional Analysis

Apr 27, 2025

Ariana Grandes Hair And Tattoo Changes A Professional Analysis

Apr 27, 2025 -

New Look Ariana Grandes Hair And Tattoo Transformation

Apr 27, 2025

New Look Ariana Grandes Hair And Tattoo Transformation

Apr 27, 2025 -

Ariana Grandes Professional Hair And Tattoo Artists A Look At Her New Style

Apr 27, 2025

Ariana Grandes Professional Hair And Tattoo Artists A Look At Her New Style

Apr 27, 2025